Germany's industry faces a bleak economic outlook and the prospect of relocating operations abroad due to its dependency on expensive energy imports.

Germany's industry is facing significant headwinds, according to recent statements by Markus Krebber, the CEO of RWE, one of Germany's top energy companies. Krebber has expressed concern that the German industry is at a "disadvantage" due to high gas prices resulting from reliance on imported liquefied natural gas (LNG).

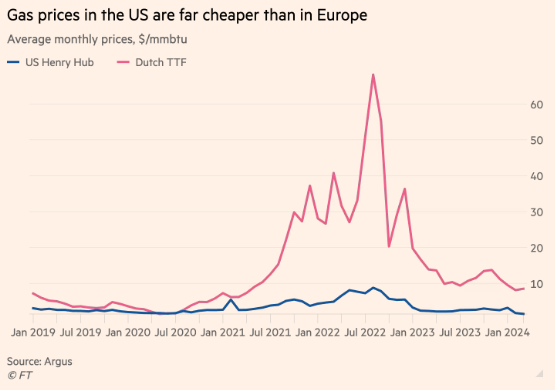

Despite a dramatic 90 percent drop in European gas prices from their 2022 peak, prices remain nearly two-thirds higher than in 2019, as reported by commodities pricing agency Argus. Germany’s pivot away from Russian natural gas has left the nation dependent on costly LNG imports.

Criticism has been aimed at Germany's past energy policies, especially the 2011 decision to phase out nuclear power which Krebber labeled a "mistake". He underscored the need for immediate action when transitioning away from established energy sources. Some observers, including Krebber, believe that the German industry may not fully recover, and that there will be "significant structural demand destruction" in energy-intensive sectors.

Amidst these challenges, Germany's economic outlook appears bleak. The country's leading economic research institutes have downgraded growth forecasts to a mere 0.1 percent increase in GDP for the year, citing a decline in exports. Berlin's investment in transitioning to a 'carbon-neutral' economy, have heightened concerns about the impact of stringent green policies on manufacturing.

The German industrial stagnation has become a politically charged issue, with critiques from the BDI, Germany's industrial lobby, about the dogmatic environmental regulations affecting manufacturers. Goldman Sachs' head of natural gas research, Samantha Dart, predicts permanent reductions in European industrial capacity, with a complete return to pre-crisis conditions being a significant hurdle.

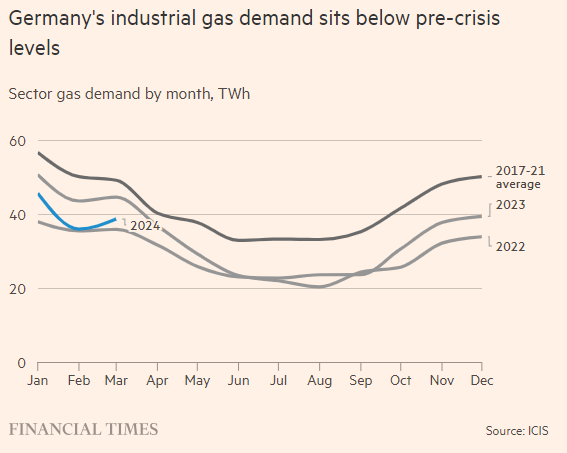

According to S&P Global Commodity Insights, Europe's industrial gas demand was down 24 percent in 2022 from 2019, and it is estimated that 6 to 10 percent of gas consumption may be permanently lost due to demand destruction. As a result, many manufacturers are looking towards the United States, which offers attractive policies for revitalization of manufacturing.

A survey by the German Chamber of Commerce and Industry found that nearly half of large industrial firms in Germany are considering relocating operations abroad, with the U.S. being the preferred destination. This is driven by lower energy prices, one-sixth of those in Europe.

The current situation underscores the need for robust policies to secure the competitive edge of Germany’s industry in a challenging global market. The future implications of these developments remain to be seen, as Germany and other European countries grapple with the shifting landscape of energy supply and the consequences of climate policies.