The acceleration of U.S. inflation in March challenges the Fed's purported plans for imminent rate cuts.

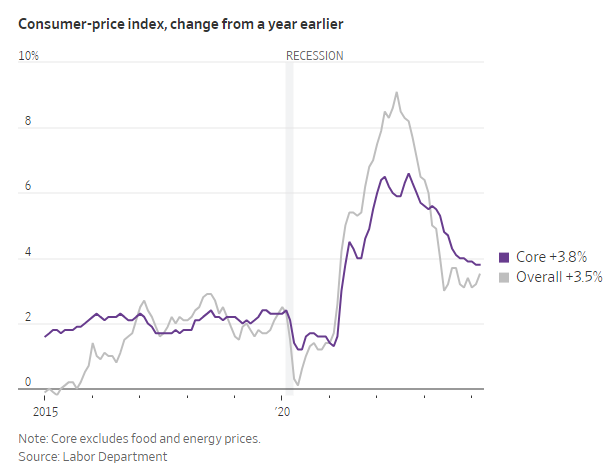

The U.S. inflation rate accelerated in March, challenging the Federal Reserve's ability to reduce interest rates soon. According to the Labor Department's Bureau of Labor Statistics, the consumer price index (CPI) rose by 0.4% in March. This increase brought the annual inflation rate to 3.5%, up from 3.2% in February, surpassing the forecasts of economists surveyed by Dow Jones who expected a 0.3% monthly gain and a 3.4% year-over-year rise.

Core CPI, which excludes food and energy, also saw an uptick of 0.4% month-over-month, with an annual increase of 3.8%, again exceeding the anticipated figures of 0.3% and 3.7% respectively. The report, released on Wednesday, led to a decline in stock prices and a spike in Treasury yields as the market digested the implications for monetary policy.

Energy and shelter costs were significant contributors to the rise in the all-items index, with energy prices increasing by 1.1% and shelter costs, accounting for around a third of the CPI weighting, rising by 0.4% for the month and 5.7% year-over-year.

Certain food categories experienced notable price hikes, such as a 0.9% rise in the cost of meat, fish, poultry, and eggs, driven by a 4.6% surge in egg prices. Conversely, there was a 5% decrease in butter prices and a 0.9% drop in cereal and bakery products. Food away from home edged up by 0.3%.

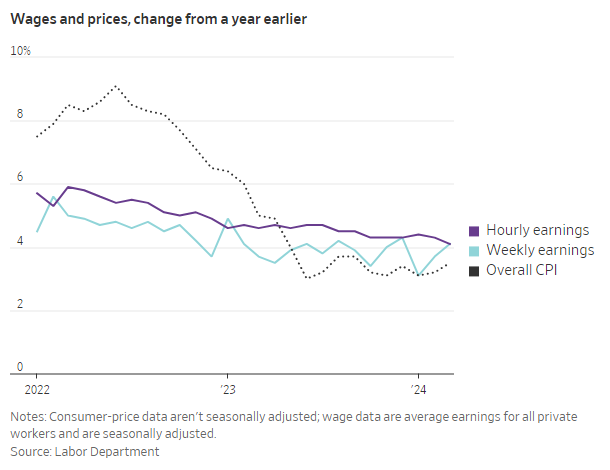

The inflationary pressure also negatively impacted workers, with real average hourly earnings remaining flat for the month and showing a mere 0.6% increase over the past year, as reported by a separate BLS release.

Liz Ann Sonders, chief investment strategist at Charles Schwab, commented on the outlook for the Fed's interest rate policy, saying, "There’s not much you can point to that this is going to result in a shift away from the hawkish bent from Fed officials. June to me is definitively off the table."

The Fed also anticipates a decline in services inflation throughout the year, but the services index, excluding energy, rose by 0.5% in March, reaching a 5.4% annual rate, which is inconsistent with the Fed's target.

Seema Shah, chief global strategist at Principal Asset Management, reflected on the inflation trend, stating, "This marks the third consecutive strong reading and means that the stalled disinflationary narrative can no longer be called a blip. In fact, even if inflation were to cool next month to a more comfortable reading, there is likely sufficient caution within the Fed now to mean that a July cut may also be a stretch, by which point the US election will begin to intrude with Fed decision making."