The Chinese yuan is teetering on the brink of exceeding its government-imposed trading band, a first in its history, amid global market volatility.

The Chinese currency, the yuan, is on the cusp of a historic milestone. For the first time, it is threatening to breach the government-imposed trading band. This situation has unfolded amidst volatile currency market activity, and now, China embarks on a two-day holiday, leaving global markets in suspense.

The core of the issue is a classic battle between market forces and central bank controls. China maintains a managed float for the yuan, where the People's Bank of China (PBoC) sets a daily midpoint – the central parity – and permits trading within a 2% range above or below that point. When market pressures skew the yuan too strong or too weak, the PBoC typically intervenes by selling or buying yuan to maintain balance.

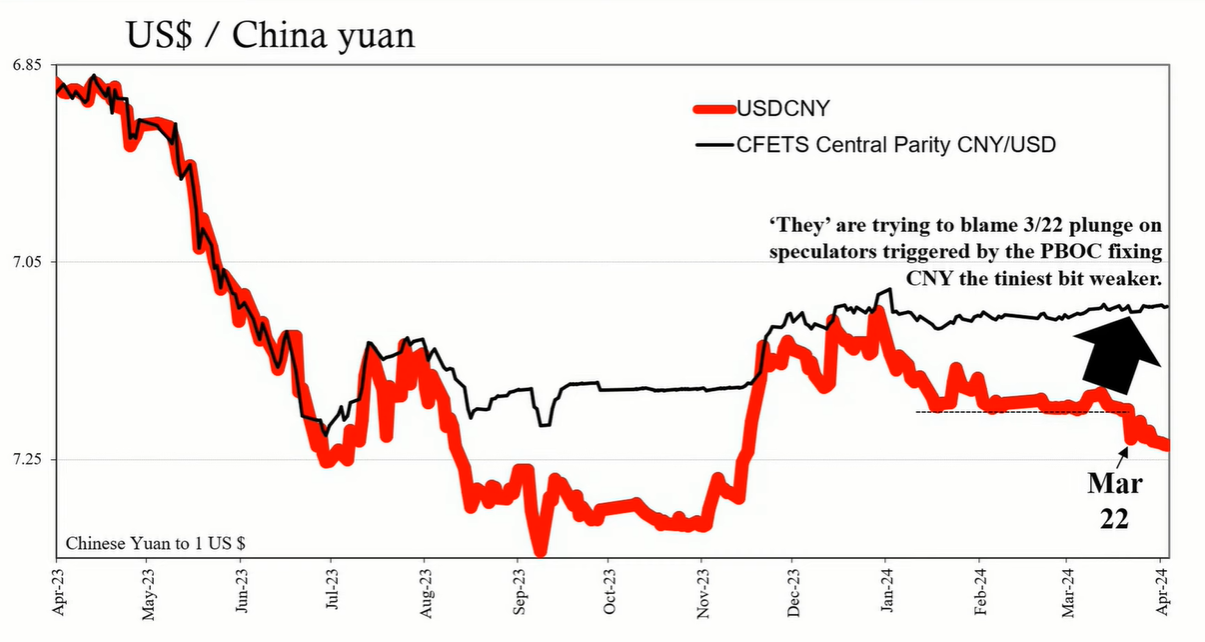

In recent events, March 22, 2023, marked a significant shift when the yuan experienced a sharp decline, echoing similar trends in the yen and Indian rupee. Contrary to media reports attributing this movement to a minor weakening of the midpoint by the PBoC, the yuan's weakness persisted despite attempts to strengthen it through central parity adjustments.

Traditionally, if the yuan's market value approaches the 2% lower limit, Chinese banks act on behalf of the PBoC, selling dollars and buying yuan. The effectiveness of these interventions has been inconsistent, often prompting the PBoC to adjust the midpoint to avoid breaching the threshold – a scenario that could expose the limitations of the bank's influence.

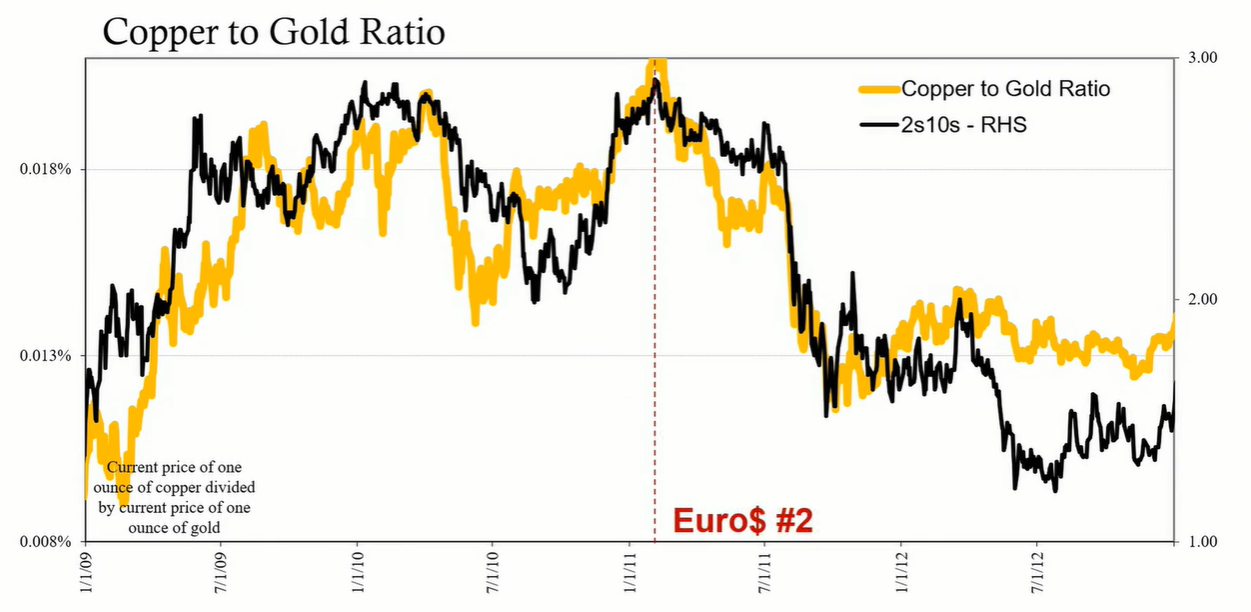

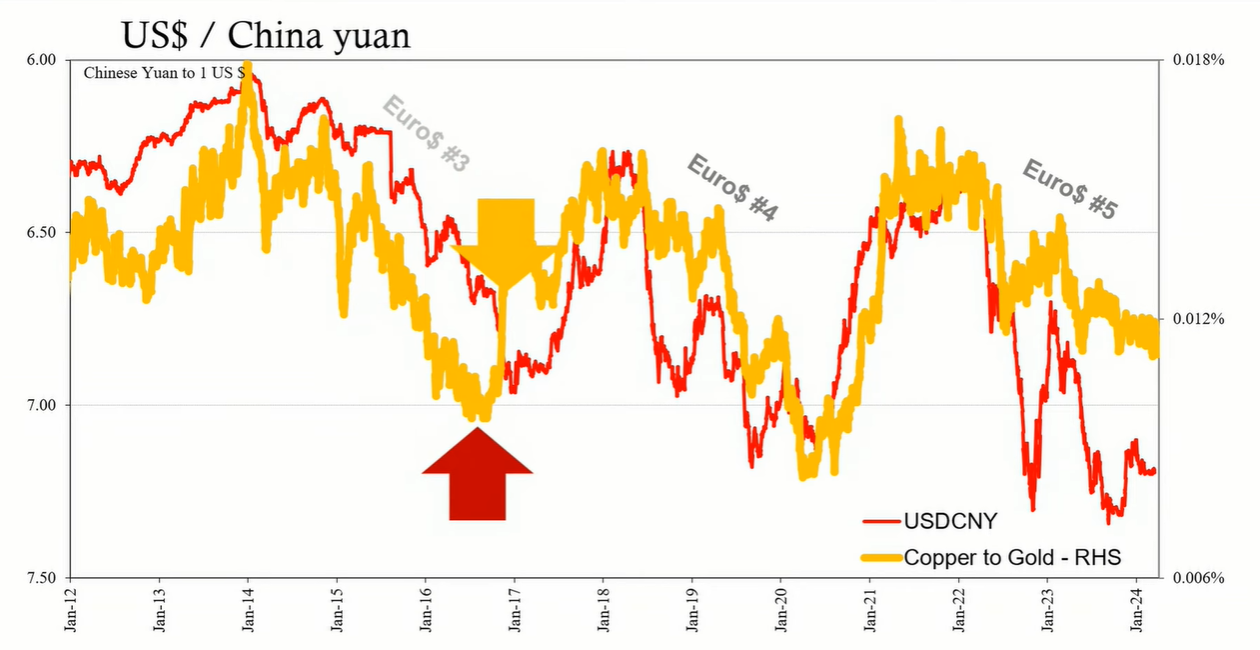

The yuan's movements are not isolated but reflect broader economic sentiments. Past trends highlight the yuan's correlation with global indicators like the copper to gold ratio and U.S. dollar interest rate swap spreads. For instance, during the 2017 globally synchronized growth, the yuan strengthened against the dollar, suggesting ample global dollar liquidity. Conversely, in periods like euro dollar number three beginning in 2014, and the recent downturn since March 2022, yuan weakness indicated tightening liquidity and growing risks.

The yuan's exchange rate is more than a number; it signifies the health of the global economy, with implications far beyond China's borders. A declining yuan typically signals broader economic distress, aligning with negative shifts in other financial metrics.

As China enters its holiday, the question looms whether the PBoC will maintain its stance or adjust the midpoint to prevent the yuan from crossing the 2% limit. The resolution of this tension could have significant repercussions. A continued downward trajectory of the yuan would reinforce concerns about economic stability, both within China and globally.

The yuan's flirtation with the 2% boundary is not simply a technical matter but a symptom of underlying economic vulnerabilities. As the world awaits China's next move post-holiday, the stakes are high. The yuan's direction will offer critical insights into the state of the global economy and the efficacy of central bank interventions in an increasingly interconnected financial world.