Get on the ship before it's too late!

Traditional finance teaches the importance of diversification of an investment portfolio. The goal is to construct a portfolio that reflects the individual's risk appetite and investment objectives and select investments that will maximize their risk-adjusted return. Despite understanding the notion of diversification from my undergraduate education and TradFi experience, which can be summarized as "don't put all your eggs in one basket," I've done the opposite. Why is that?

Each year since my initial touch point with bitcoin in 2017, my conviction and position in the asset has grown. It's become more than an investment to me, but for this essay, I’ll focus strictly on the investment case and why I've put all my eggs in one basket (well, not all, but most).

Of course, I don't recommend that anyone reading this do the same unless it makes sense for you. Each individual has to manage their finances according to their needs and life goals. I am 27, my risk appetite high, my time horizon long.

The main reason why I've decided to ignore "Modern Portfolio Theory" is because my analysis of the macroeconomic landscape has led me to construct a thesis that every investment at this stage of an empire/long-term debt cycle is all one trade. Harry Markowitz, the pioneer of the MPT, which has been used since the 1950s, did not construct a framework for preserving and growing wealth at the end of a long-term debt cycle. And that's where we (the world) are at today.

As cited in previous articles and frequently on Finance Twitter (FinTwit):

Since 1800, 51 out of 52 countries with gross government debt greater than 130% have defaulted, either through restructuring, devaluation, high inflation or outright default. - Hirschmann Capital

I’ve written exhaustively in other pieces, such as “Central Bank Credibility: The Next Bubble to Burst” and “Bondholders Beware!” about my views of the macro landscape and why I’ve concluded that governments globally are running Ponzi Schemes. These governments are now faced with an election: continue the scheme or collapse the entire house of cards

Fundamental analysis of equity cash flows and the idea of a risk-free rate go out the window when the issuing entity of the risk-free rate is insolvent, and all assets, including equities, act as a harder form of money to protect purchasing power against the inevitable debasement of the currency. MPT had its day. Now the goal for investors should be understanding larger cycles at play and studying the history of other empires that have debauched their currencies, such as Rome.

That’s where most investors and savers get it wrong. No fault of their own. They grew up during a time when MPT was a sound framework to follow. The other issue I’ve found with Wall Street and Traditional Finance is that investment horizons are often focused on quarters or years, not decades or centuries. TradFi asset managers want to beat their benchmark for a quarter or year; that’s why people invest in their mutual fund or hedge fund. But, when one tide pulls all ships, it’s vital to understand the gravity of said tide and how to allocate capital.

The tide that I'm referring to is money printing. The monetary and fiscal policies of bodies such as the Federal Reserve and the US Government are steering the ships of equities, fixed income, real estate, real assets, cryptocurrencies, and bitcoin. I believe this dynamic began in earnest in 1971 with the abandonment of the gold standard, at which time the USG defaulted on its obligation to peg its spending and currency to gold.

The impact of monetary and fiscal policy on asset class performance accelerated post-2008 Financial Crisis when the Fed, effectively the world's central bank, set the precedent of zero interest rate policy (ZIRP) and began asset purchase programs such as Quantitative Easing (QE). The manipulation of interest rates to 0% and the Fed’s creation of money from nothing to purchase assets has distorted the reality of financial markets. While these were intended to be “emergency measures,” the policies remained in place far longer than most expected and essentially became standard policies for central banks and governments.

Interest rates are a crucial pricing mechanism for all asset classes. The decision by central planners to hold interest rates artificially low at 0% for over a decade has created an “everything bubble” and simultaneously allowed governments to stockpile massive amounts of debts at a low-interest expense.

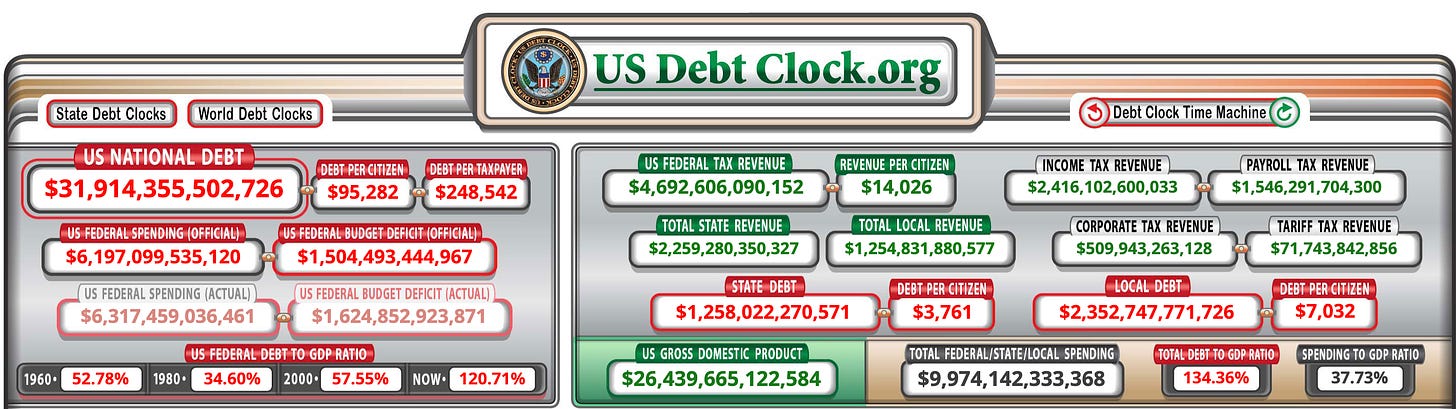

Now it’s 2023, fifteen years following the Great Financial Crisis. While last year the Fed reversed their easy money policy by hiking rates at the fastest rate in history, the reality is that the financial system is a house of cards priced on the aforementioned easy monetary policies (ZIRP and QE) and now, with Debt-to-GDP at 130% the only option is to continue on the path of money printing or face Great Depression II.

That’s why studying history and understanding human behavior, incentives, and interests is important. As President George Washington stated, "The only permanent interest is self-interest." It's in the self-interest of politicians and bureaucrats to keep the easy money flowing to avoid collapse during their time in office.

The tide is becoming stronger. In 2008 when the TARP bill was announced, a $750 billion bailout package was astronomically high. Yet, in 2020 and 2021, the United States created over $6 TRILLION of new money to stave off a financial crisis.

Well, guess what? The tide on the horizon is a tsunami. A monetary tsunami is coming. We don’t know when, but it’s inevitable. It’s the nature of the tide of a debt-based monetary system that must continue to issue more and more debts (currencies) to avoid a default. A decade from now, the $6 TRILLION will be overshadowed by the 10s of trillions that will be needed to keep the fiat ship afloat.

Think of all asset classes as ships. Some are more resilient and prepared to weather the tsunami than others. Some, such as bonds, are structurally unsound for the storm of exponential debt issuance and currency debasement. Equities and real assets such as real estate, precious metals, and farmland can serve as a vessel to protect wealth through the storm, but bitcoin is the most pristine ship, built for the tsunami.

Bitcoin’s native monetary properties, such as the 21 million hard cap and its increasing scarcity, which

Jesse Myers has written so eloquently in his piece “Bitcoin’s Value Appreciation Engine: Increasing Scarcity” will protect and grow wealth despite the rough seas. Every four years, the amount of bitcoin issued gets cut in half, commonly referred to as the “halving.” While all fiat currencies and debts must be destroyed in terms of purchasing power as time passes, bitcoin’s scarcity is increasing, acting as a vehicle to grow wealth.

We’re in the early stages of investors understanding the circumstances on the horizon. Bitcoin is a $500 billion asset class in a fleet of $900 trillion of global asset value, but as other captains understand the need to weather the storm, capital will shift rapidly to the lifeboat. When asset performance is steered by monetary and fiscal policy, which must continue the course of easy money, hard money (meaning hard to make more of) protects and grows purchasing power during times of inflation.

Originally published on "The Fiat Cave".