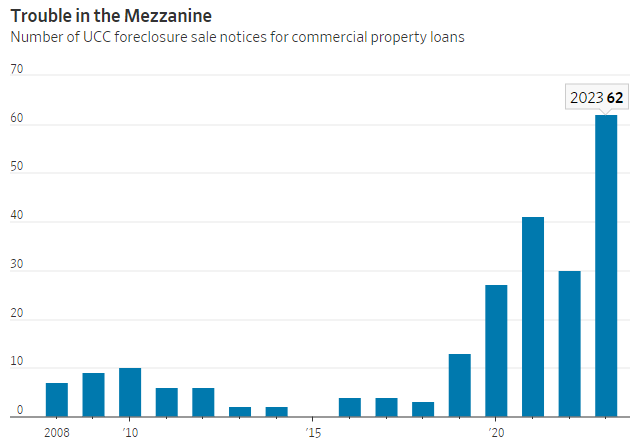

The US economic picture continues to look precarious, as leading indicators extended their record-long streak of sequential declines and existing home sales cratered to new 13-year lows – but as the Wall Street Journal suggests, you can always consider selling your kidney if times get tight.

The exchange is mandated to enhance its anti-money laundering safeguards and rectify lapses in its Know Your Customer (KYC) protocols, alongside its withdrawal from the U.S. market.

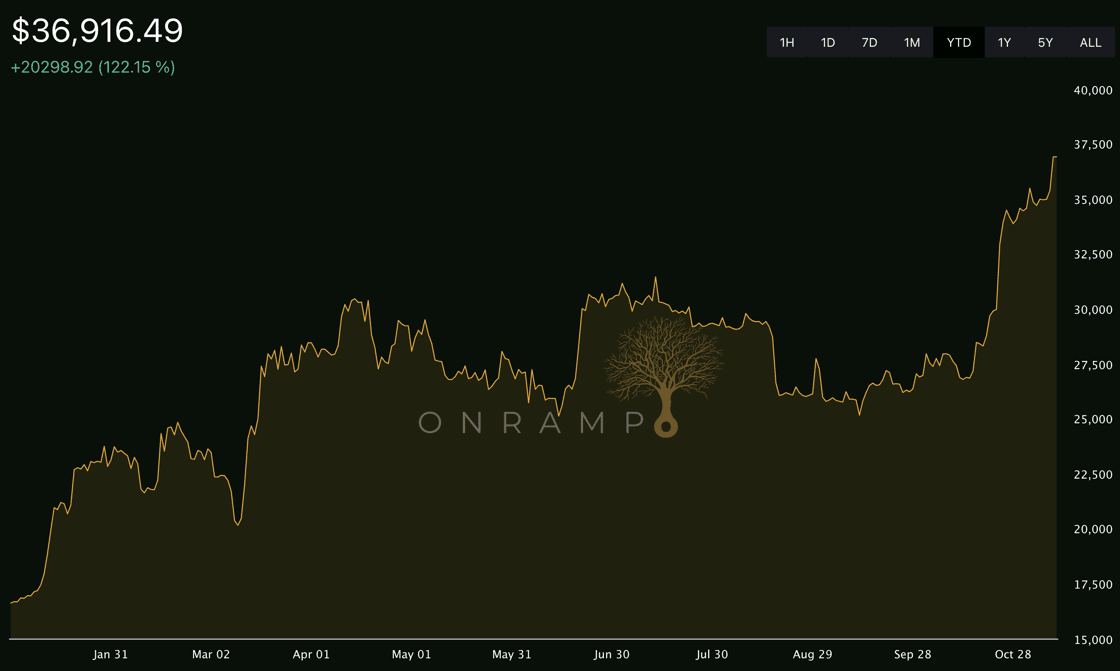

Things are heating up and the most bullish scenario I can envision for bitcoin is playing out.

Markets decisively reversed course from mid-October woes this week, as the latest CPI reading ignited a short squeeze that sent stock indices back near YTD highs.

It is safe to assume that the government is overtly lying about the true level of price inflation throughout the economy.

The 4 paths to choose from in digital assets

I'm not going to lie, freaks. Uncle Marty currently has his tinfoil hat firmly settled on his head.

Why every business will decide to receive bitcoin payments. Someone-is-going-next logic. If not you, then who.

The Fed has broken the Financial Matrix.

This week's signal in bitcoin and markets.

Baby boomers on fixed incomes who rented their entire lives and planned to do so in retirement are now facing rental prices for which they never budgeted.

Hard times are coming, but it's beautiful on the other side.

The market needs a monetary system whose cost of capital is determined by that market at any given point in time and not a small group of men in boardrooms at the member Federal Reserve banks.