The 4 paths to choose from in digital assets

Your intuition is right, something really big is happening here. We are living through the Digital Revolution. The first half was the digitization of information — the Internet. The second half is the complementary digitization of value.

If this is true, then it is the financial opportunity of a lifetime. A chance to stake your claim on the frontier of digital assets before 99%+ of the world has figured out what is happening.

In other words, yes, you can become rich by getting into crypto. But here’s the catch: if you make poor decisions, you will not only end up worse off, but you’ll also squander the biggest financial opportunity of your lifetime. The stakes could not be higher.

What’s more, there are thousands of ways you could screw this up. It’s extremely daunting, especially because these pitfalls are hard to spot for greenhorns new to this asset class. So let’s make it simple. Here are the diverging paths that beckon to you, and what you will find if you venture down them:

The four paths before you in crypto:

I have been down each of these paths, and I have spoken with hundreds of people about their experiences in crypto. That makes me something of a salty veteran, with the scars to show it. Here’s what awaits on each of these paths:

Most people are on this path — after all, it’s the default. In the age of cryptocurrencies, people only participate by opting in. Until they opt in, they remain on the “do nothing” path. Interestingly, this is the “right” path for a majority of the time. In the crypto market, bullish rallies are short and explosive; slow and painful downtrends make up the balance.

But being “right” the majority of the time has been a losing strategy overall for the last 15 years. People who remain in the “do nothing” camp are forced to watch from the sidelines as a major bull market delivers shocking performance once every four years, on average.

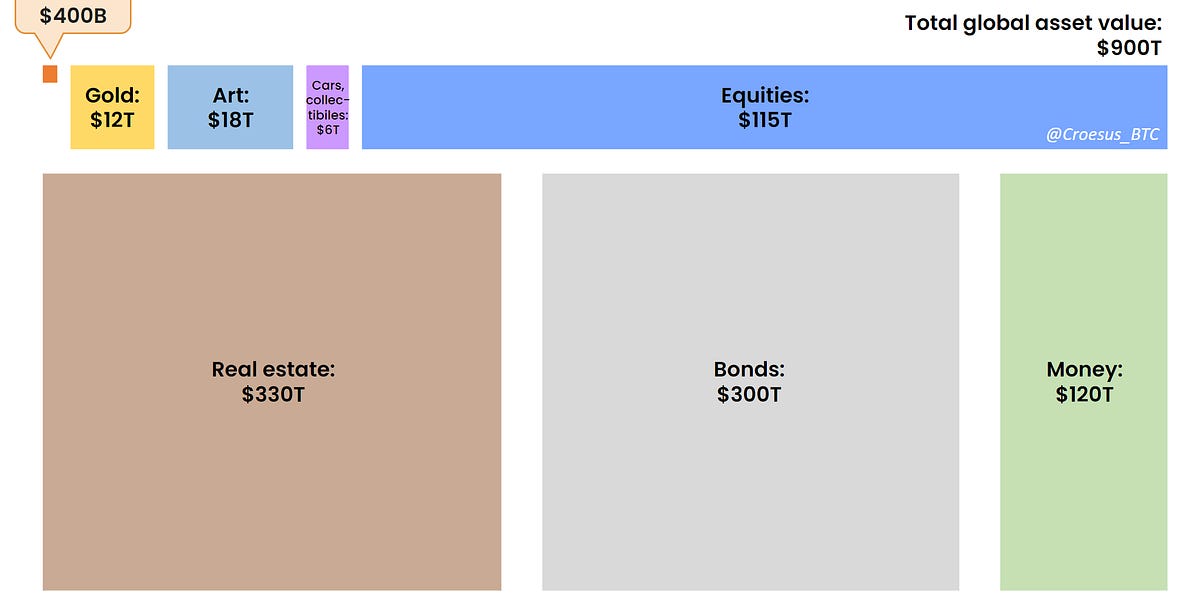

Importantly, this dynamic may continue for the next few decades. It’s easy to think of the crypto market as something that has already developed, but if this new asset class is the digitization of value, then it has only just begun. The total value of all crypto assets today is ~$1T, which remains a tiny bucket in a $900T sea of global asset value. It’s impossible to say how large “digital value” can become in the digital age, but it stands to reason that it will be much more than 0.1% of total global asset value.

What most people do when they first transition from the default “do nothing” approach to digital assets is to adopt an open-minded and explorative philosophy. There are 30,000 crypto projects, and the landscape is rapidly evolving. Surely, the latest and greatest new projects offer the best opportunity to get in on the next big wave?

Well, that’s certainly the narrative that all of these new crypto projects tap into. And they do that because this logic resonates with us. I believe this is because we have lived through the Internet revolution, and we have collectively learned the lessons of technology investing over the last few decades. Fundamentally, the core takeaway has been: find the handful of new companies that will be the big winners each decade. In tech investing, fortunes were made by betting on Microsoft, Apple, Google, Amazon, Facebook, Uber, Netflix, Tesla, and so on. Culturally, we’ve synthesized this economic reality into an investing philosophy: invest like a Silicon Valley VC.

When we dabble in crypto, we unconsciously bring this same philosophical approach to technology investing with us. We can’t help it — we don’t even realize that we’re doing it.

The result is that everyone tends to seek out exciting upstarts and builds a “diversified” portfolio of crypto holdings. This mental model is the “multicoin” thesis:

Surely there will be many winners in crypto, just as there have been on the Internet.

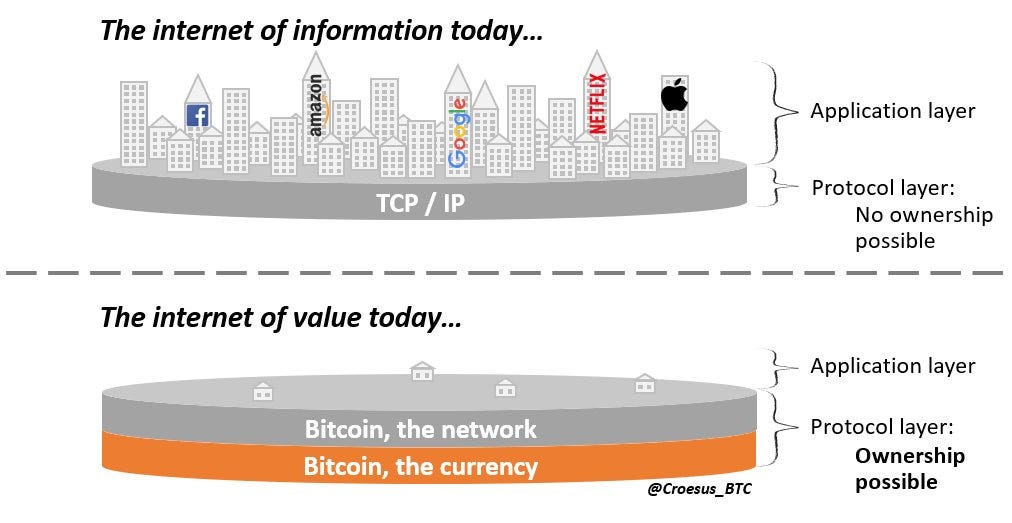

The fundamental mistake that everyone makes here is assuming that the landscape of Internet companies is the appropriate analogue to compare the landscape of cryptocurrencies to. The Internet is built on open-source protocols for how computers can exchange information — TCP/IP, specifically. But it’s not possible to own this kind of open-source information protocol. As a result, the only way you can invest in the Internet is by investing in the companies built on top of this protocol.

However, cryptocurrencies are fundamentally protocols for storing and exchanging value. The landscape of 30,000 competing cryptocurrencies may remind us of the landscape of Internet startups, but they are actually competing protocols. Competing versions of TCP/IP.

And yet, we know from the Internet what happens when open-source protocols compete… eventually a dominant network effect emerges and that protocol becomes the standard that people and companies adopt and build on (like TCP/IP).

The result of all this is that crypto investors who “invest in the new” tend to underperform the single cryptocurrency that is emerging as the dominant network effect and value protocol standard, akin to TCP/IP.

Interestingly, individuals who manage to briefly outperform by investing in a variety of selected crypto projects (this was me from 2016-2018) tend to grow more confident that their thesis is correct. As a result, they will cling to it longer and endure more pain before coming around to the reality that this is a competition for a singular protocol standard for digital value, and that everything else is gambling and noise.

Inevitably, many people are drawn to crypto because they want to get rich quick. Crypto may be a rising tide and picking the flash-in-the-pan Cinderella darlings for each bull market (in 2021, Solana, Doge, and Shiba Inu) can amplify this performance tremendously, but actively trading can amplify performance even more. If a person can jump from one winning trade to another, they can turn a few thousand dollars into a fortune.

What people don’t realize is that they might as well be entering the World Series of Poker tournament as a total novice. Trading in markets is a zero-sum game. You either take money from other market participants or they take money from you.

You can get lucky for a while. But eventually, you’ll find yourself nursing a dwindling pile of chips wondering why people around you seem to be getting rich.

Traders want you to believe that anyone can be a winning trader with a little discipline, creativity, and luck. But they don’t tell you that they spent a decade learning their craft from veteran traders on Wall Street. And they certainly don’t tell you that they rely on a steady flow of novice traders to harvest money from.

You can play their game, but you will almost surely lose.

Investing in promising crypto projects (#2) and trading to glory (#3) can still be profitable in dollar terms. The problem is that the longer people pursue these paths, the more likely it becomes that their overall portfolio begins to lag behind in Bitcoin terms. (Remember, if a singular dominant digital value protocol is emerging… all others underperform by comparison.)

Invariably, these people who have been working hard chasing crypto performance eventually run a simple calculation: how much Bitcoin could I buy now? For most, this number is less than they could have had if they just bought and held Bitcoin from the beginning.

And in a rush of revelation and regret, the case for holding Bitcoin suddenly makes sense. We are all searching for investment exposure to the future of digital assets. While we may have originally presumed that this future included a variety of different cryptocurrencies, the simplicity of the Bitcoin-only thesis becomes painfully obvious.

Money is the mother of all network effects & tends to one. Bitcoin is the original & increasingly dominant protocol for digital value storage and exchange. For those of us who have been focused full-time on digital assets for 6 years, it’s increasingly clear that Bitcoin is emerging as the TCP/IP for value — and yet, most of the world still has no idea that this is happening.

And if this is the case, why hold any other digital asset? You’re early to the biggest investment megatrend for the 21st century, focus on that!

It’s no exaggeration to say that most people you encounter online who loudly advocate for Bitcoin and Bitcoin only… are full of regret for not arriving at this conclusion sooner themselves. Myself included. I would have much more Bitcoin if I had graduated from “crypto” to Bitcoin-only even just a few months before I ultimately did.

That inevitable conclusion was painful. It involved accepting that I had screwed up, that I had been wrong, and that I would never have as much Bitcoin as I could have had just a few months earlier. I had to swallow my pride and shift my attitude from frustration to gratitude and enthusiasm.

Why gratitude? Because it is still so early for Bitcoin, and that is an essential bit of perspective. If this is the emergence of the dominant store-of-value asset for the digital age, the scale of what this asset can become is enormous. ($10m/Bitcoin, in today’s dollars, based on my analysis.)

In that sense, the fact that you are here now and able to recognize the potential opportunity before you is a tremendous gift — quite possibly, the greatest financial opportunity of your life.

To put this into perspective, it’s helpful to remember that there will only ever be 21M Bitcoin. Since there are 8B people on Earth, that means ~0.0025 BTC/person. Right now, an entire human’s worth of the emerging monetary standard for the digital age can be acquired for just $100.

If you’re looking to get rich in crypto, perhaps the best path is right in front of you.

Did you find that Bitcoin analysis informative? You have a choice now:

Originally published on Once in a Species