When you compare the activity happening at bitcoin's base layer to Fedwire you'll notice that bitcoin is scaling just fine.

In this insightful episode of the Stephan Livera podcast, guest Ben Carman from Mutiny Wallet explores the complex landscape of Bitcoin's protocol development, addressing the challenges of scaling while maintaining the network's decentralized ethos.

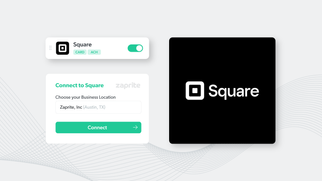

Coinbase Commerce's decision to remove native bitcoin support could significantly impact Coinbase Commerce's market share, driving merchants towards more flexible alternatives like Zaprite or BTC Pay Server.

Mark Goodwin's 'The Bitcoin-Dollar' delves deep into the evolving nexus between Bitcoin and the US dollar, challenging conventional perspectives.

In an unexpected twist, Senator Elizabeth Warren, previously a vocal critic of Bitcoin, has seemingly honored its creator, Satoshi Nakamoto, with a flag flown over the US Capitol.

As Bitcoin reaches a significant price milestone of over $52,000, this article provides an in-depth analysis of the factors driving its ascent.

If the price keeps pumping, how will that affect the bitcoin mining industry heading into the next block subsidy halving?

When you compare the activity happening at bitcoin's base layer to Fedwire you'll notice that bitcoin is scaling just fine.

In this insightful episode of the Stephan Livera podcast, guest Ben Carman from Mutiny Wallet explores the complex landscape of Bitcoin's protocol development, addressing the challenges of scaling while maintaining the network's decentralized ethos.

Coinbase Commerce's decision to remove native bitcoin support could significantly impact Coinbase Commerce's market share, driving merchants towards more flexible alternatives like Zaprite or BTC Pay Server.

Mark Goodwin's 'The Bitcoin-Dollar' delves deep into the evolving nexus between Bitcoin and the US dollar, challenging conventional perspectives.

In an unexpected twist, Senator Elizabeth Warren, previously a vocal critic of Bitcoin, has seemingly honored its creator, Satoshi Nakamoto, with a flag flown over the US Capitol.

As Bitcoin reaches a significant price milestone of over $52,000, this article provides an in-depth analysis of the factors driving its ascent.

If the price keeps pumping, how will that affect the bitcoin mining industry heading into the next block subsidy halving?

In this guide, we'll explore how to pair your Coldcard wallet with a mobile device using virtual disk mode and integrate it with Nunchuck Wallet. This setup allows you to manage your Bitcoin with added security and mobility.

The Finance and Expenditure Committee of the New Zealand government held a meeting with the nation's central bank governors yesterday during which the country's central bankers admitted two things.

Now, businesses with Square merchant accounts can accept bitcoin (on-chain and lightning) side-by-side with fiat payment methods through Zaprite. Zaprite is never in the flow of fiat funds, which process and settle through Square’s existing merchant rails.

Bitcoin, as a decentralized digital currency, has established itself as a form of "unstoppable money." Unlike traditional currencies, it operates without the need for a central authority.

At what point do tax paying American citizens begin to push back against this overt theft and money laundering into unproductive endeavors by the government?