The Fed turns dovish. The Federal Government keeps spending. And Bitcoin keeps ticking.

The financial world held its breath once again this week for the bi-monthly ritual of a dozen central planners handing down their latest pronouncements on the global price of money. The world’s most powerful attorney Jerome Powell surprised many traders – who had been taking an increasingly bearish view of near-term rate cuts on the back of recent upward reversals in reported inflation metrics – with news that the Federal Reserve still expects three rate cuts this year, with a tapering of the central bank’s “Quantitative Tightening” program to begin soon. Markets reacted positively to the news and equity indices ripped to new all-time highs once again as investors assessed the prospect for easier monetary policy even in the face of headline inflation metrics that remain stuck well above the Fed’s nominal policy target, the latest data point in a string of updates pointing to increasing fiscal dominance in the US. As if right on cue, the US House of Representatives closed out the week by passing a $1.2 trillion omnibus bill to avoid the latest government shutdown with an incremental slug of federal debt to tack onto the existing $34.6 trillion pile (which is already up over $3 trillion since the last shutdown stalemate nine months ago).

Meanwhile, bitcoin’s price continued to cool this week as the spot bitcoin ETF complex flipped to net outflows for several days in a row, but total network hashrate continued to follow the path of parabolically global debt, as the metric reached 600 EH/s for the first time only a few months after first surpassing 500 EH/s. Despite the less favorable price action, the week brought several headlines indicating ongoing sovereign and institutional interest in bitcoin, including constructive announcements from Japan’s $1.5 trillion government pension fund and BlackRock’s Head of Digital Assets. Bitcoin doesn’t need official endorsement from any of these institutions to continue doing exactly what it was designed to do, but with monetary easing apparently getting closer despite entrenched inflation and global debt continuing to ramp with seemingly no ceiling, we expect both network hashrate and interest from legacy players to continue moving up and to the right this year and beyond.

Giga Energy is a bitcoin miner and infrastructure provider focusing on stranded energy and waste gas opportunities. The company helps oil and gas producers use bitcoin mining to optimize production and monetize gas resources that would otherwise be wasted, through both proprietary mining deployments and the provision and operation of tailored power generation equipment including generators, data centers, and electrical infrastructure. Giga sits at the forefront of the convergence of the energy production and bitcoin mining industries, a trend we expect to gain significant momentum over the coming decade.

Strike announced the rollout of Strike BLACK, a suite of tools for developers and businesses in need of plug and play integrations for bitcoin, lightning, and more:

Samourai launched the first phase of its decentralized Whirlpool coordinator infrastructure:

Unchained rolled out a preview of its new app for Signature clients, coming soon to all Unchained accounts:

Zaprite’s Head of Product Will Cole and Head of Business Development Parker Lewis (also a Ten31 Advisor) joined The Investor’s Podcast to discuss bitcoin’s recent momentum and the future of bitcoin payments.

Parker also published a blog post highlighting some of Zaprite’s recent feature upgrades.

Coinkite Co-Founder and CEO Rodolfo Novak appeared on the TFTC podcast with Ten31 Managing Partner Marty Bent to discuss a range of topics from open source AI to the new Coldcard Q signing device.

Unchained VP of Enterprise Sales Trey Sellers joined the Gary Cardone show for an overview of the future of bitcoin custody.

Unchained Senior Software Engineer Buck Perley published an essay on Unchained’s “Braid Model” for infrastructure development, a companion to his video on the topic from several weeks ago.

Ten31 Managing Partner Matt Odell appeared on the Bitcoin Veterans podcast.

Ten31 Managing Partner Marty Bent joined the Melanion Capital podcast to discuss Ten31’s thesis, strategy, and expectations for bitcoin adoption.

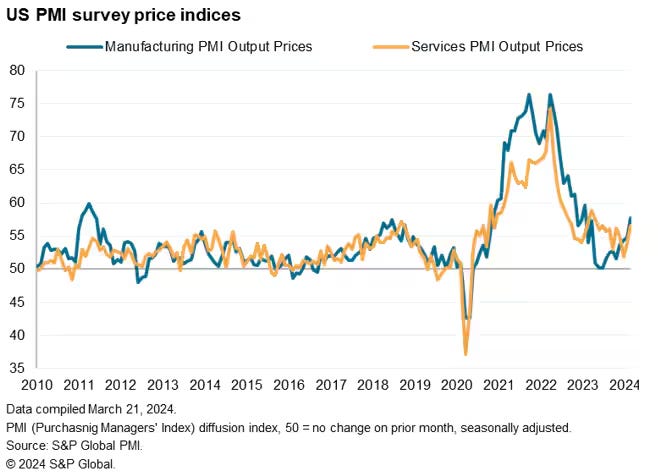

The latest FOMC meeting was the pivot point for markets this week. The committee held its benchmark Federal Funds Rate steady at 5.25-5.5%, but Fed Chairman Jerome Powell positively surprised investors by indicating the central bank is still planning on three interest rate cuts this year, despite recent signs of entrenched inflation including a March PMI update that showed notable acceleration in services and manufacturing input cost growth.

Notably, Powell also suggested that tapering the pace of the bank’s Quantitative Tightening program – which has drawn down the Fed’s balance sheet by ~17% off its highs but still leaves it nearly 100% above pre-COVID levels – “will be appropriate soon.”

Major stock indices spiked on the unexpectedly dovish commentary, with the S&P 500, Nasdaq, and Dow Jones all hitting new lifetime highs once again.

The day after the Fed’s update, the Swiss National Bank also tilted toward an easier stance, surprising the market with a 25bps cut to its key policy rate. This move makes the SNB the first major central bank to cut rates since the global tightening cycle began over two years ago.

Elsewhere in central banking, the Bank of Japan abandoned its longstanding yield curve control policy and eliminated the world’s last remaining negative interest rate while also ditching special facilities to directly sop up shares of Nikkei ETFs and Japanese REITs.

At the same time, the BOJ suggested it is not contemplating significant rate hikes and anticipates “accommodative financial conditions” in the near term.

Bitcoin’s price momentum continued to stall this week, as the spot bitcoin ETF complex saw its first string of net outflow days in several weeks, including a record day of outflows on Tuesday on the back of reaccelerated GBTC selling.

Despite the selloff, several major institutions indicated growing interest in bitcoin this week. Japan’s main government pension fund – which manages over $1.5 trillion in assets and is the largest pension manager in the world – announced it is exploring an allocation to bitcoin (among other assets including gold and farmland).

Meanwhile, BlackRock’s Head of Digital Assets indicated bitcoin is “overwhelmingly” the main priority for the firm’s clients within the “crypto” ecosystem. The bitcoin ETFs have now accounted for more than half of the total net YTD ETF flows posted by BlackRock and Fidelity.

While bitcoin’s price chopped this week, global bitcoin network hashrate continued to pump, breaking 600 EH/s for the first time just a few months after first eclipsing the 500 EH/s level late last year.

The mining ecosystem also saw another milestone this week with the release of version 1.0.0 of the StratumV2 reference implementation, which includes several updates and functionality that could shore up bitcoin mining’s long-term censorship resistance.

The US pitched the G7 on a $50 billion bond for Ukraine backed by assets seized from the Russian central bank in February 2022, the latest manifestation of the Biden Administration’s attempts to mobilize nearly $300 billion in frozen Russian central bank assets and a move that would likely further threaten the dollar’s credibility as a neutral international settlement asset.

The European Union passed new legislation specifying tighter KYC/AML thresholds, including an outright ban on anonymous payments in cryptocurrencies and a cap for anonymous cash payments.

The Ethereum Foundation is under investigation by an unnamed “state authority,” with some reports this week indicating the SEC is “waging an energetic legal campaign to classify Ethereum as a security.” Bitcoin’s Board of Directors could not be reached for comment.

US Congressman Tom Emmer released an internal Federal Reserve memo suggesting the central bank views the development of a CBDC as a key priority.

A major Indian political party alleged that the incumbent government had frozen its bank accounts ahead of the country’s general election next month, highlighting once again the vulnerability of permissioned, centralized payment systems.

Bloomberg ran a feature highlighting that interest in bitcoin as a means of escaping price inflation has been skyrocketing among Argentines in the past few months, with local exchanges seeing volumes near two-year highs (though it’s admittedly difficult to disentangle this volume from more general worldwide interest in bitcoin on the back of the recent bull run).

OpenSats announced a new long-term support grant for developer Bruno Garcia. The Human Rights Foundation also announced $500,000 in grants to 14 bitcoin projects, including one for Chaumian e-cash developer Calle, whom Ten31 supported with a grant earlier this year.

Learn more about Ten31, our investment thesis, portfolio companies, and funds by visiting our website.