Leo Zhang gives an ELI5 of Hashpower.

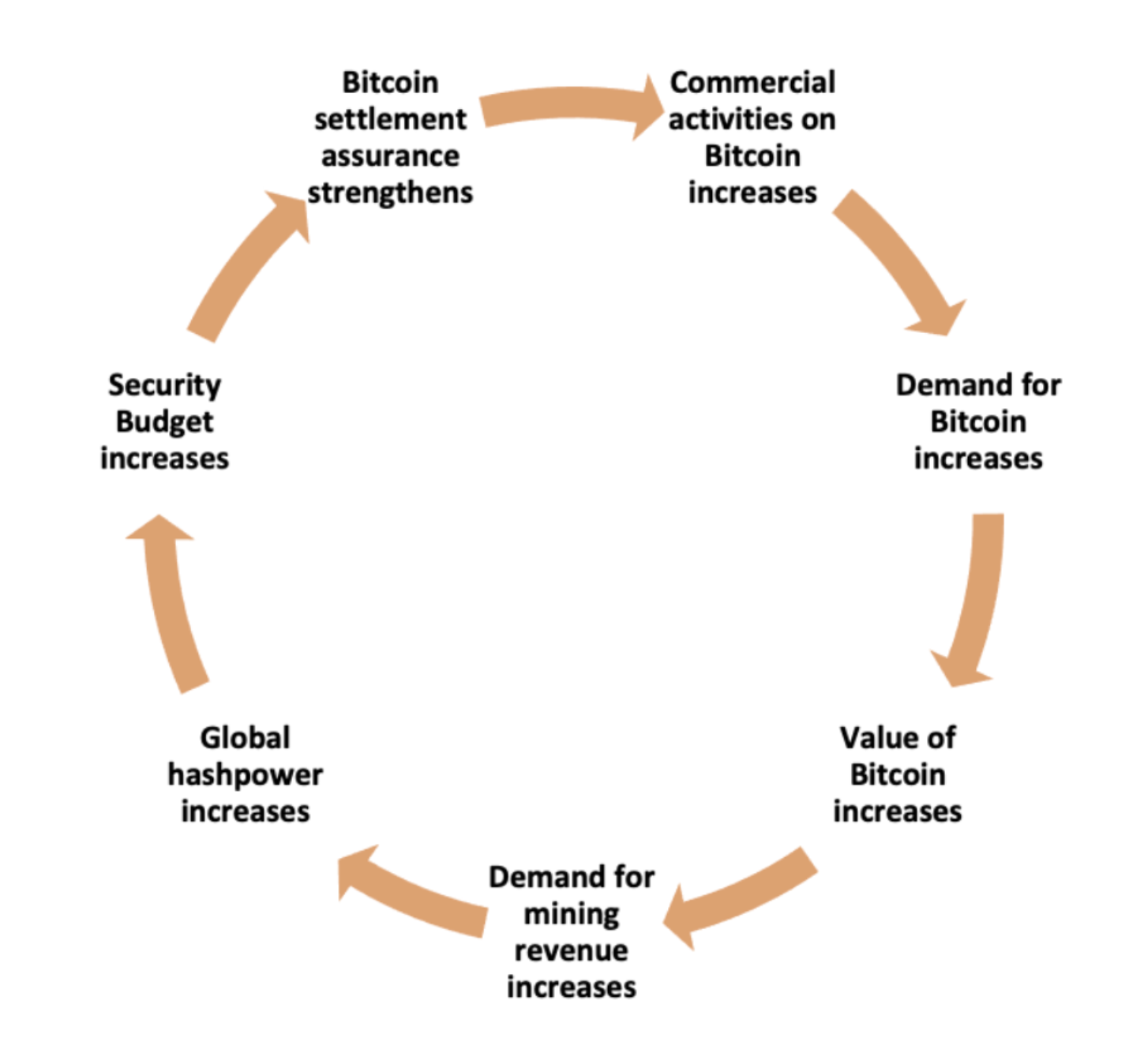

Here's another great piece from our friend Leo Zhang that dives into the intricacies of the market for hashpower. In it, Leo describes the dynamics at play between the market for ASICs, the value of hashpower at any given point in time, and the derivatives products that are available to miners and outside speculators who want exposure to the Bitcoin mining industry. If you're interested in learning more about the mining industry, I highly recommend you peep this piece today.

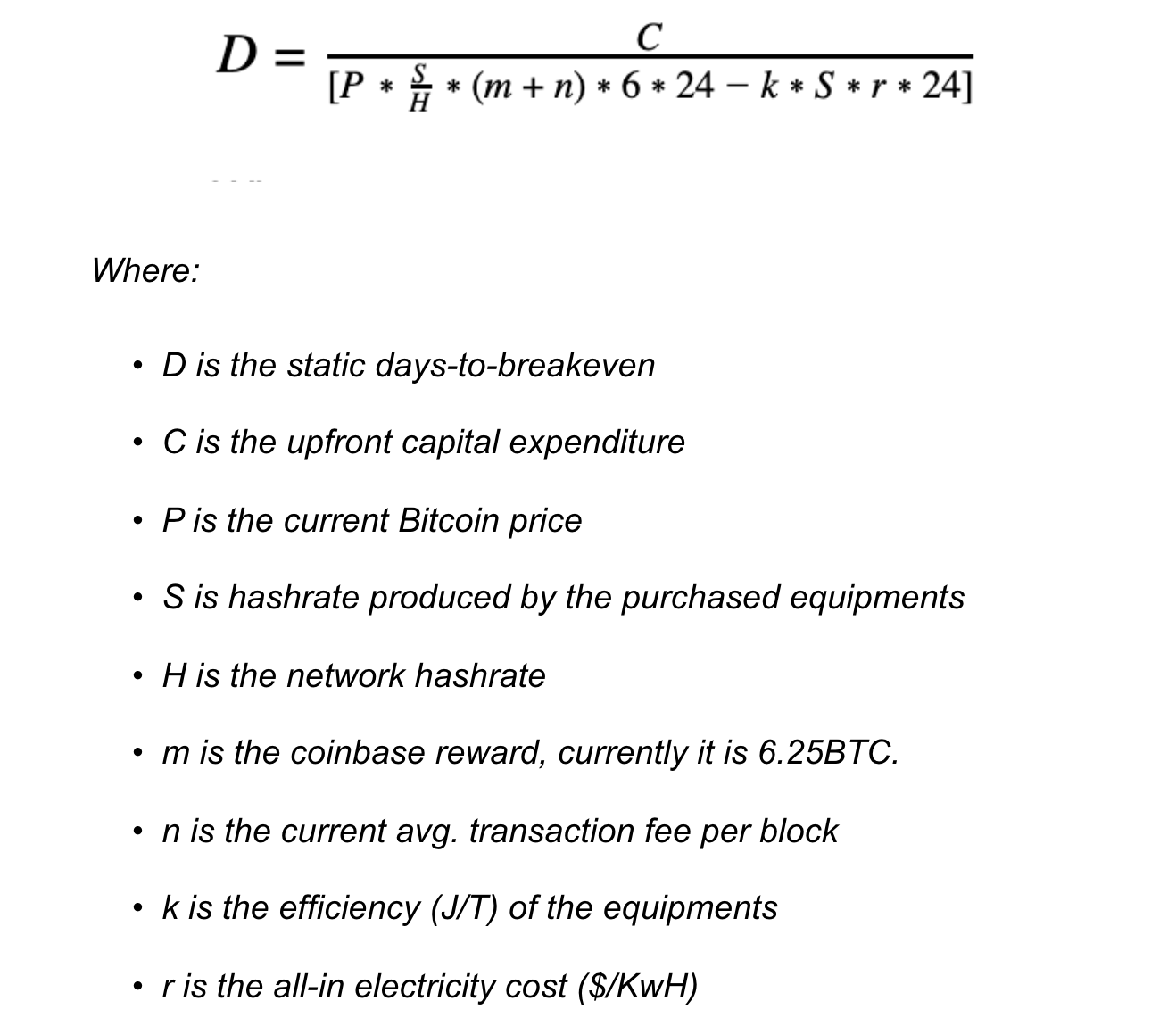

A couple of things I liked particularly are the formulas Leo included which can help anyone who is interested in running a profitable mining operation in making some critical decisions and the different hedging products + strategies that can be employed by miners.

Included above is the formula for days-to-breakeven that miners can use to help gauge whether or not and at what point they can reach profitability while taking the price of bitcoin, the block reward (subsidy + fees), and network hashrate at any given point in time into consideration. This formula highlights the importance of picking the correct machines and buying them at the correct time. Due to the reflexive nature of the market for ASICs, which tracks movements in the price of bitcoin closely, a miner hoping to be profitable in the long-run has to play a timing game and attempt to deploy capital to acquire miners when they are cheap. Usually during times of low BTC price volatility. This may seem obvious to anyone reading this rag, but in practice this timing game is much harder.

As time goes on, weighing these risks will become much easier as ASICs become more commodified and, more importantly, as the ability to hedge your risk with derivatives. Right now, the breadth and maturity of derivatives markets catered to bitcoin miners is nowhere near where it needs to be. However, these markets are being actively developed and we should see this area mature significantly during this mining epoch. Off the bat, hashrate forwards contracts seem like a great product for miners. For example, it would allow us at Great American Mining to sell future hash production for cash today so that we could expand our operations or build a cash reserve to deploy in the future or hedge some operational risks. At the moment, this market is very manual and the order book liquidity is very low. It will be interesting to see who is able to crack the code and create the most efficient/liquid markets for the individuals who want to sell or buy hashpower.

Make sure you follow Leo if you aren't already. He will be dropping more fire content on this subject in the future.

Final thought...

I think I'm a "Sunday beach cigar" guy now.