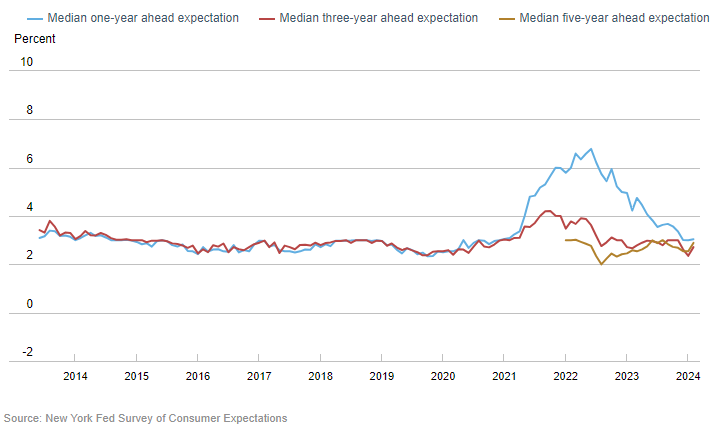

The New York Federal Reserve's latest survey highlights a significant shift in consumer inflation expectations, disrupting the Federal Reserve's supposed inflation control efforts.

A recent survey conducted by the New York Federal Reserve has revealed that consumers' long-term inflation expectations have increased, potentially complicating the Federal Reserve's efforts to control inflation. The survey, reported on March 11, 2024, shows that at the three-year range, expectations have risen by 0.3 percentage points to 2.7%, and at the five-year outlook by 0.4 percentage points to 2.9%. These figures surpass the Fed's target of 2% for 12-month inflation, suggesting that tighter monetary policy may be necessary for an extended period.

As consumers navigate rising costs, the survey indicates a growing skepticism over the Federal Reserve's ability to rein in inflation to its benchmark goal. "Longer-term inflation expectations appear to have remained well anchored, as reflected by a broad range of surveys of households, businesses, and forecasters, as well as measures from financial markets," Fed Chair Jerome Powell commented during a Capitol Hill testimony last week. He reiterated the Fed's goal of reducing inflation to the 2% target.

The expected increase in rent costs over the next year declined to 6.1%, marking the lowest projection since December 2020. This is a significant observation as housing costs have been a persistent contributor to inflation. Federal Reserve officials are "optimistic" that shelter expenses will moderate as the year progresses and lease renewals take place.

Other findings from the survey include a slight increase in the one-year outlook for gasoline prices to 4.3%, a significant drop in expectations for medical care cost increases to 6.8%, and stability in food price expectations at 4.9%. Additionally, respondents anticipate a 5.2% rise in household spending over the next year.

The survey also sheds light on job market concerns, with an increased perceived probability of job loss in the coming year, now at 14.5%.

In the face of these mixed signals, the Federal Reserve is expected to maintain current interest rates at its next meeting, with market predictions suggesting a potential rate cut in June, followed by additional cuts later in the year. This forecast is based on the CME Group's analysis of futures markets.

In conclusion the survey from the New York Federal Reserve underscores the uphill battle of maintaining the central bank's inflation targets. As the Fed navigates these complexities, the outlook for rent, healthcare, and other essential costs will be critical in shaping future monetary policy decisions.