You can't trust the shitcoiners on Capitol Hill.

Well it looks like Capitol Hill is thinking about making one of the more objectively idiotic and transparently corrupt decisions related to bitcoin and "crypto" in recent years. As Conner Brown reports, there has been an ongoing back-and-forth behind the scenes about whether or not there will be de minimis tax exemption for bitcoin transactions. Apparently, the crypto lobby has been pushing for a "narrowing" of the rules that would exclude bitcoin from a de minimis tax exemption and designate that it only be extended to stablecoins, which are explicitly designed to not fluctuate in value. If a stablecoin drifts to far from its peg of $1, it is in deep trouble.

As it currently stands, there is a discussion draft for this bill on the floor that has been presented by Reps Miller and Horsford of Ohio and Nevada, respectively.

This is patently absurd and would be a massive blunder if a bill like this gets passed. The only people who would benefit from this are high-frequency traders looking to arb the fraction-of-a-penny difference that may exists from one stablecoin to another trading on different exchanges. If passed in its currently form, this bill would be a slap in the face to the bitcoiners who pulled weight to help get Trump across the line during the 2024 presidential election.

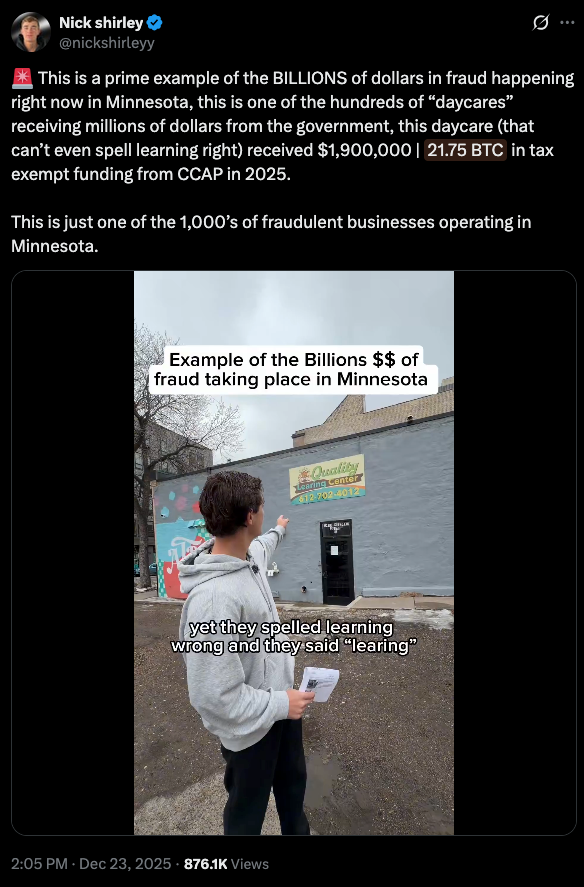

Not only that, it would be counterproductive to President Trump's economic agenda, which is looking to accelerate growth as quickly as possible. If you want to unleash a material wealth effect on the country a de minimis tax exemption on bitcoin transactions up to $600, which is what Senator Lummis has proposed, is a great way to do that. I, personally, think $600 is a very low threshold, but I would take anything at this point. The fact that capital gains taxes exist in the first place is an abomination. They're essentially a savings tax that punishes people who allocated their money wisely with an onerous and material clip that is handed over to the taxman. A taxman that is taking that money and literally enabling fraud on a scale that would make Bernie Madoff blush.

But I digress, a de minimis tax exemption on bitcoin transactions, no matter how minuscule, would likely have a material wealth effect throughout the country. Instead of saving to avoid having to pay capital gains taxes by spending or selling their bitcoin, bitcoiners would be able to tap into their bitcoin savings to purchase goods and services throughout the economy. This would bolster the businesses they spend their bitcoin (or cashed out bitcoin) at.

The biggest problem with this bill isn't the politicians who "drafted" it, it's the crypto lobbying groups who have thrown insane amounts of money around on the hill to influence policy in an attempt to develop a regulatory moat. Even though a de minimis tax exemption for stablecoin transactions won't have any benefit at all outside of the HFT firms arbing the fractions-of-a-penny arbitrage opportunities that exist, it will be seen as implicit support and preference for stablecoin usage in the United States and a deterrence of bitcoin usage.

These crypto lobbying groups have a ton of money, have garnered a significant amount of influence, and they are corrupting legislation and setting back the American economy as a result. All so that they can force CBDCs-by-another-name-that-they-can-control-and-monetize on the market while simultaneously kneecapping bitcoin adoption and its proliferation as a medium of exchange. The crypto lobby is a disease that needs to be fought vigorously.

If we're being honest, these crypto lobbyists deserve a tip of the cap. They know how to play the game and they are putting their ill-gotten riches to work in an act of self-preservation via regulatory moats. This is why it's critically important to support organizations like the Bitcoin Policy Institute, which is staffed with principled bitcoiners who know what's at stake, know needs to be done and know what they're talking about. They are currently out-gunned by a wide margin. Supporting them and other organizations like them should be a high priority in 2026.

While mainstream media continues to fuel fears about artificial intelligence eliminating jobs, a more optimistic perspective emerged during our recent discussion. The argument was made that AI won't destroy employment opportunities but will fundamentally transform the nature of work itself. Rather than viewing AI as a threat to traditional employment, we should see it as the great democratizer of entrepreneurship, enabling ordinary people to compete with large corporations by making previously expensive and specialized tasks accessible to everyone.

AI democratizes creation by making previously expensive and time-consuming tasks accessible to average people, allowing them to pursue their dream projects and become their own boss. - Stella

This transformation represents a shift from the traditional employee-employer model toward a future where more individuals can pursue their entrepreneurial dreams. AI tools are already enabling people to create products, services, and content that would have required entire teams and substantial capital investment just a few years ago. The result isn't fewer jobs, but rather a fundamental change in how value is created and captured in the economy.

Check out the full podcast here for more on automation trends, digital sovereignty, and decentralized work models.

Tether Leads $8M Strategic Investment in Lightning Firm Speed

Trump Set to Interview Christopher Waller for Fed Chair

UK Finance Ministry to Begin Regulating Bitcoin in October 2027

Japan Greenlights $118B Debt-fueled Stimulus Package

Bitwise Predicts Bitcoin Will Break 4-year Cycle in 2026

MetaMask Now Supports Bitcoin with 100M+ Users

As billions of people compete for a fixed supply of 21 million coins while fiat currency supplies continue to expand, bitcoin’s risk-reward profile stands apart.

On January 7 at 10 AM CT, join Unchained and Parker Lewis for an online video premiere exploring the forces shaping bitcoin’s opportunity today and what current market and policy conditions may mean going forward.

A talk originally given on December 10th at the Old Parkland debate chamber in Dallas, Parker covers:

If you want a clearer framework for thinking about bitcoin’s opportunity and the risks of overlooking it, this is the talk to share with friends and family.

Tuesday, January 7 at 10 AM CT — online, free to attend.

Register now: https://unchnd.co/4s7JbEw

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

Created by Carl Dong (former Bitcoin Core contributor), unlike other VPNs, it can't log your activity by design, delivering verifiable privacy you can trust.

Outsmarts internet censorship: works even on the most restrictive Wi-Fi networks where other VPNs fail. Pay with bitcoin over Lightning: better privacy and low fees. No email required: accounts are generated like bitcoin wallets. No trade-offs: browse freely with fast, reliable speeds.

Exclusive Deal for TFTC Listeners: Sign up at obscura.net and use code TFTC25 for 25% off your first 12 months.

Now available on macOS, iOS, and WireGuard, with more platforms coming soon — so your privacy travels with you wherever you go.

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I love Bobby, our Elf on the Shelf.

Download our free browser extension, Opportunity Cost:

https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

|

|