The conversations this week covered everything from Bitcoin ETF adoption to geopolitical tensions and their market implications.

The conversations this week covered everything from Bitcoin ETF adoption to geopolitical tensions and their market implications. Here are the three most significant predictions that emerged from recent episodes.

Matthew Sigel from VanEck laid out a compelling case for Bitcoin reaching $180,000 during this cycle, representing a 10x move from the previous bottom. He noted that the "previous smallest cycle ever for Bitcoin was 20X from the trough to the peak," making a 10x move to $180,000 seem feasible given Bitcoin's maturing market dynamics. What makes this prediction particularly noteworthy is the massive corporate buying power now entering the market.

Sigel revealed that "MSTR plus CEP plus ASST plus Semler plus NACA plus DJT is $76 billion in capital raising ability to buy Bitcoin right now" - representing 56% of the AUM of all Bitcoin ETFs and 169% of their net inflows over the past 16 months. He expects the traditional four-year cycle to hold, with the second half of this year being "very positive as long as inflation continues to come in light." However, he also warned that many of these treasury companies currently trading at premiums to their Bitcoin holdings may face compression, with some potentially forced to sell if they can't sustain those premiums.

Tom Luongo presented a detailed thesis that Europe is approaching a sovereign debt crisis that will manifest in the coming months, potentially by Labor Day. He observed that "the markets are starting to push back that capital starting to fall back into the United States," noting specific indicators like the DAX rolling over, the euro topping out, and stress appearing in European T-bill markets. "There's seizure happening in the one month market over there," Luongo explained, with the Hong Kong dollar pegged at the top of its range for 10 days - something he hadn't seen in years.

His prediction centers on Jerome Powell's strategy of maintaining higher US rates while European central banks cut, creating a dollar shortage overseas. "Powell has been very effective in upsetting the offshore dollar markets exactly as I've been talking about for years and we might be at that inflection point where something's about the crack." This crisis, according to Luongo, will force capital to flee Europe for the safety of US markets and treasuries, potentially setting up what Trump could claim as an economic victory heading into midterm elections.

NVK outlined a compelling vision for how AI will reshape the workforce over the next five years, predicting that "30, 40% of the middle of the curve" will be replaced by AI automation. His framework focuses on what he calls the "middle of the bell curve" - Excel jockeys, middle management, and administrative roles that are neither highly specialized nor cheap manual labor. "The people who are on the right of the curve, the high IQ, those things are very hard to replace. It's very hard to do the last 10% of the knowledge of the specialty," he explained.

On the other end, cheap manual labor remains "cheaper to do by people than to do by machine." NVK sees this playing out like historical labor disputes: companies temporarily raise wages to meet union demands, then "slowly automate whatever makes economical sense." He pointed to McDonald's as a preview - "there is one person serving 100 people. It's just screens now." However, he remains optimistic about the net impact, arguing that "everything gets better" as these tools democratize access to expertise and enable people to build new businesses with minimal capital.

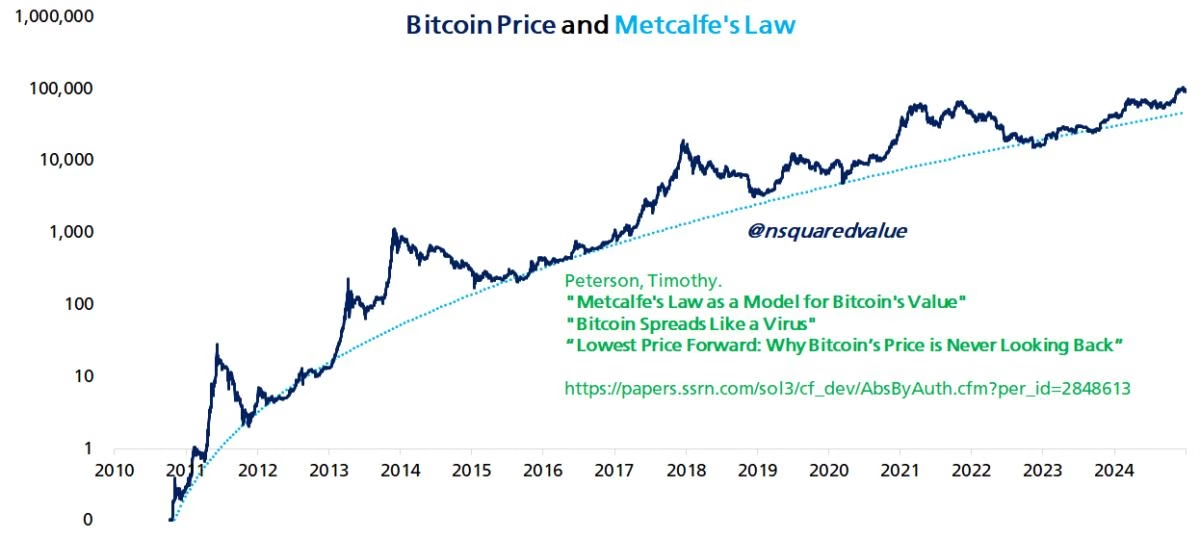

Every Bitcoin cycle spawns viral price prediction models claiming to crack the code. They all eventually break.

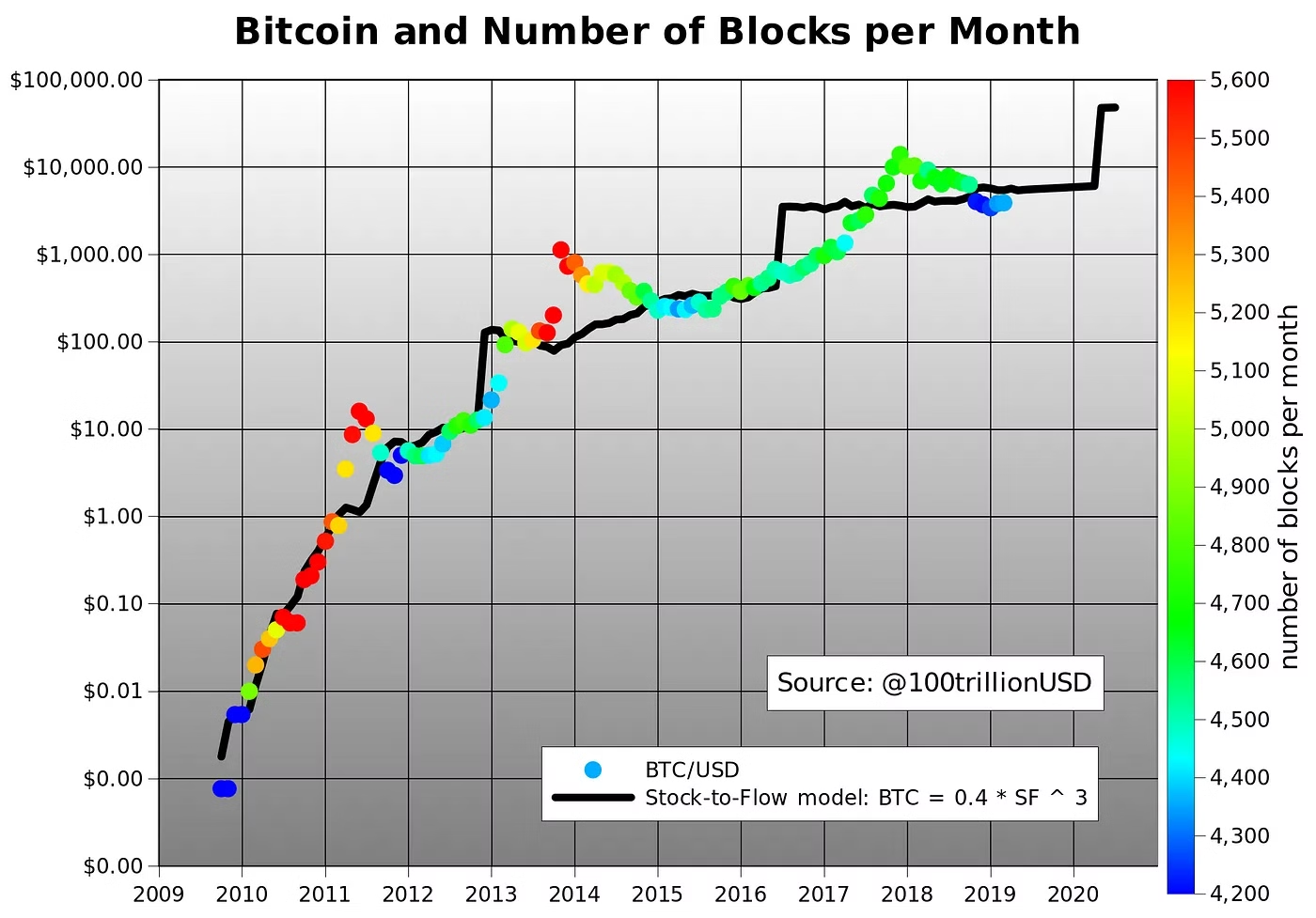

Stock-to-Flow's spectacular failure: PlanB's scarcity-based model predicted $100,000 BTC by 2021. Reality: Bitcoin stalled at $70,000, then crashed 80% below projections. Despite revisions targeting $500,000-$1,000,000 by 2025, the model ignores demand shocks and assumes halvings aren't priced in.

Other broken frameworks:

The next narrative: "Institutional Structured Bid" theory suggests ETF inflows and corporate treasuries will replace violent 80% crashes with "water torture" – prolonged sideways chops. Plan C predicts smaller drawdowns as institutions refuse to panic-sell and use derivatives for hedging.

Bottom line: As PlanB admits, "All models are wrong, but some are useful." The key insight? Bitcoin defies traditional valuation frameworks. For investors, this means patience matters more than position sizing in the new institutional era.

Subscribe to them here (seriously, you should): https://newsletter.blockspacemedia.com/

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

STACK SATS hat: https://tftcmerch.io/

Subscribe to our YouTube channels and follow us on Nostr and X: