This week marks a pivotal moment for the global economy, as central banks worldwide convene to determine their next moves amidst fluctuating economic signals.

As the world's central banks convene for a pivotal week of policy meetings, the global financial community is on alert for signals that might chart the course of economic stability and market health. The spotlight is on how these institutions will address the delicate balance between countering inflation and acknowledging the emerging signs of economic weakness, possibly verging on recession.

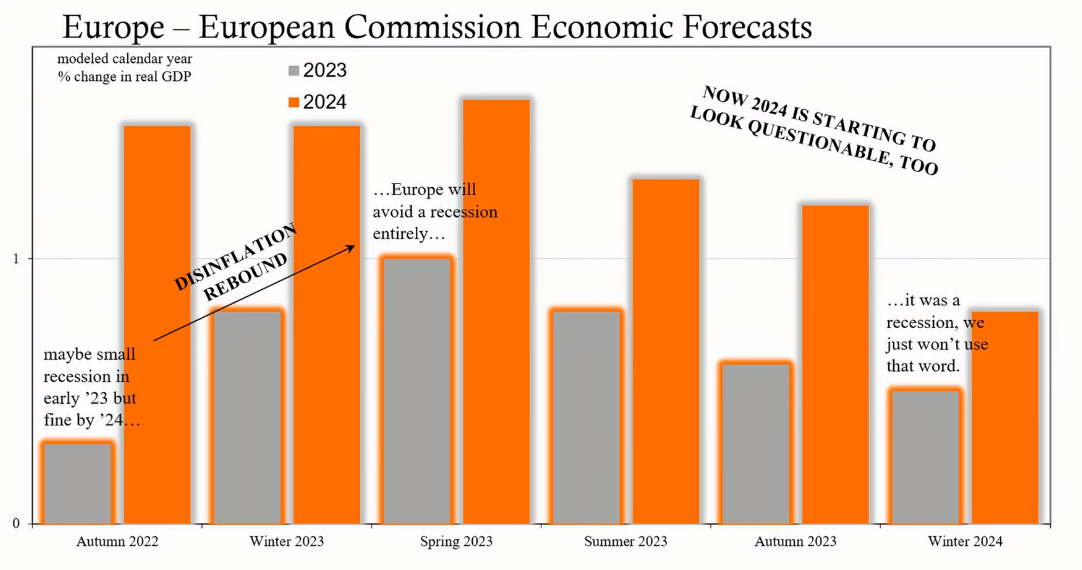

The European Central Bank (ECB) set a cautious tone, tempering its consumer price forecast and signaling a potentially stagnant economy in 2024 akin to the recessionary climate of 2023. Attention now turns to the Bank of Japan, which has implemented its first rate hike since 2007, a move that would signal confidence in overcoming its long-standing deflationary woes.

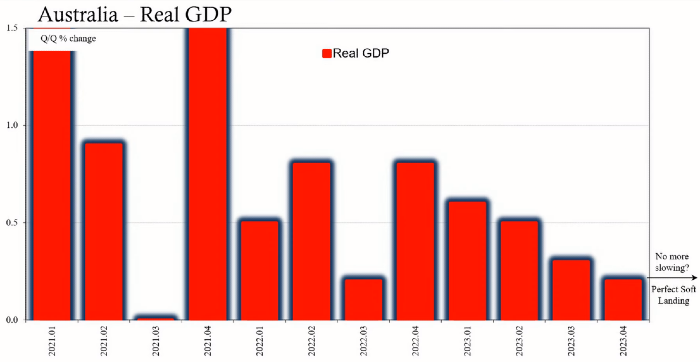

The U.S. Federal Reserve is not expected to adjust rates; however, its dot plot will be scrutinized for hints of future policy shifts. Australia's central bank is also under the microscope as it grapples with the economic fallout from China's slowdown, while Brazil's aggressive rate-cutting strategy acknowledges the perils of an economy in limbo.

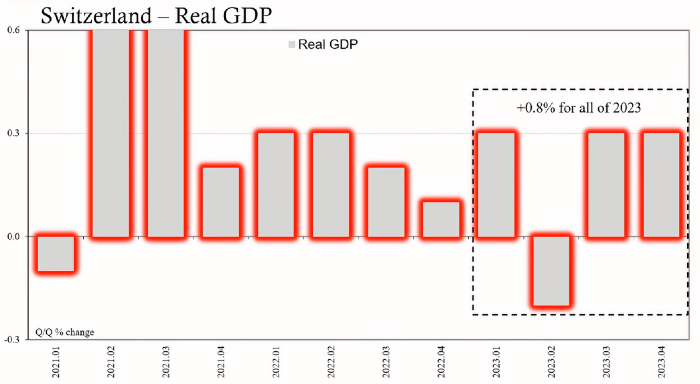

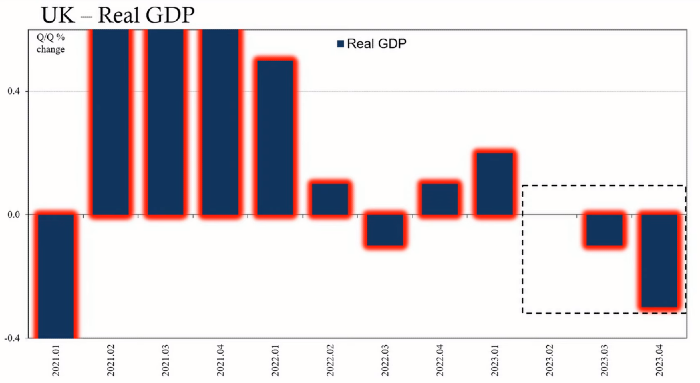

The Swiss National Bank and the Bank of England are both contending with their own economic challenges, with the latter weighing recessionary pressures against persistent inflation. Mexico, amidst an industrial slowdown, may signal a shift in policy to address economic weakness, reflecting a global trend of central banks prioritizing growth concerns.

The Federal Reserve's stance remains critical, with recent labor market data suggesting a more pronounced consideration of economic fragility. As the world's financial stewards navigate these complex dynamics, their decisions will reveal much about the global economy's health and the potential policy trajectory in 2024.