What would America look like it we return to the gold standard? Would we return to the stone age, would innovation end as Wall Street bankers and government’s paid economists claim? It's easy to talk about the catastrophes unleashed on humanity by paper money. The permanent inflation,

What would America look like it we return to the gold standard? Would we return to the stone age, would innovation end as Wall Street bankers and government’s paid economists claim?

It's easy to talk about the catastrophes unleashed on humanity by paper money. The permanent inflation, the endless parade of recessions, the exploding debt. The progressive impovertization and the predatory governments who don't care if the people starve or the cities collapse since, after all, the bureaucrats will still feast.

What's harder for people to imagine is what a hard money world looks like. In other words, what are we fighting for?

Fortunately, for most of human history -- up until just 50 years ago -- we lived in a hard money world. Until Nixon broke it.

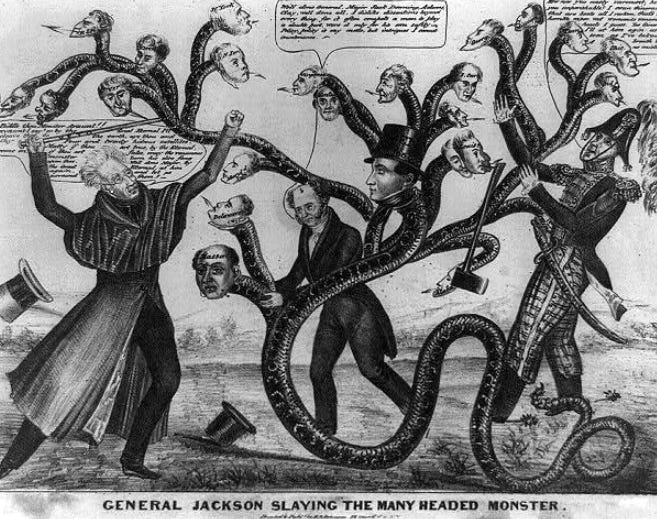

In fact, for the first 150 years of the Republic, we didn't even have a central bank — Andrew Jackson killed the last one.

So hard money without a central banks isn't science fiction. It's normal.

What’s weird is today’s fiat world, combining worldwide inflationary central banks and worldwide inflationary paper money. We have never tried that. Meaning, yes, this is an experiment. We are the guinea pigs.

Which should probably keep us up at night.

So what did the world look like under gold? For that, we go back to the late 19th century, the period between 1879 and 1913.

1879 was the re-establishment of the gold standard in reaction to Lincoln's disastrous hyperinflation.

And 1913 was when it ended with the founding of the Federal Reserve. Which actually destroyed the world surprisingly fast -- within a year most of the world was shooting each other in the trenches of France. All financed by the Federal Reserve.

In short, that period from 1879 to 1913 was the greatest golden age, not just for America, but literally for humanity.

Essentially the entire modern world was invented in just 35 short years.

A partial list includes: Electricity, automobiles, telegraph and telephone, airplanes, steam turbines, video, wireless communications, broadcasting, plastics, stainless steel, even the first computer. Every sci-fi miracle Elon Musk springs on an unsuspecting public is built on that Golden Age: electric cars (1890), solar panels (1888), rockets (1903), mobile phones (1908), undersea tunnels (1875) and even subways running in pneumatic tubes (1870).

We went from whale oil to gas stoves in 30 years. From Pony Express and horse-drawn carriages to radio, telephone, and traffic jams. From candles and coal to walls of light splashed across Broadway and central heating warming town-sized skycrapers. All in a single generation.

It was the birth of science fiction, of Jules Verne and HG Wells. Because anything was possible. Today we laugh at their optimism: their flying cars, their George Jetson robots, the passenger ships to Mars. We laugh because it’s so long gone we can’t even imagine it anymore.

The gold standard era gave us a tiny government — roughly 10 times smaller than today. Partly because without a central bank the federal government couldn’t print unlimited money like today.

That smaller government meant the amazing inventions of the Golden Age translated directly into widespread prosperity. Rather than being taxed, or regulated, to oblivion.

Murray Rothbard estimates that in the era’s peak deflationary stretch, America had annual GDP growth of about 6.8% per year. That’s about 3 to 5 times faster than today. And it means children would be between 4 and 6 times richer than their parents.

Unfortunately, we squandered it. Well, the voters of 1913 squandered it, with a toxic policy mix that delivered enough government to mortally wound the golden goose. Specifically, the income tax, the central bank, and the century of wars that come from both, from a government that can take — and print — anything it wants.

Over the following century, our Golden Era, our Tophat Singularity, went into exile. Muscled aside for the welfare-warfare state that funded military spending, galloping socialism, and endless inflation and depression.

To illustrate, compare today to that Golden Era. In the last 35 years — since 1988 — the only completely novel invention was, ironically, Bitcoin. It’s true that regulators finally let us use the internet, which is based on the 19th century telegraph and was fully developed by the 1950’s. And we finally mass-produced some of the bigger Golden Era inventions like mobile phones. Otherwise we've been like medieval tinkerers, improving on mysterious Roman inventions we stumble across in old books.

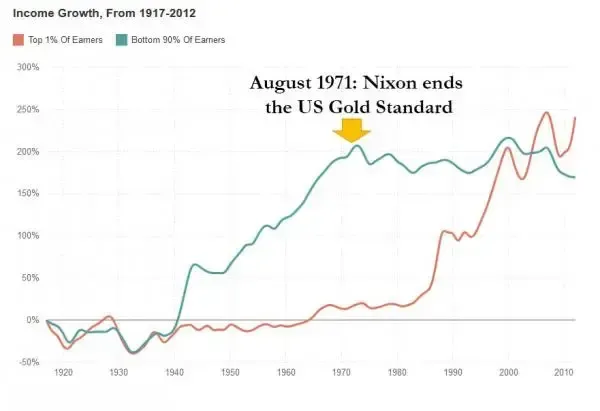

More important, consider incomes. Today the young look with envy on the boomers — their grandparents — while we debate whether we’ve actually gotten poorer these past 35 years.

Compared to the 4 to 6 fold rise in incomes every generation in the Golden Age. We can only imagine a world if prosperity had continued: six-figures for a barista, the working class retired in their 40’s to explore the world.

Looking back, it’s hard not to be angry at what we’ve lost.

We know what happens under hard money because we have the receipts: Prosperity flourishes, innovation soars, and with both freedom rises.

Unfortunately, the prosperity and freedom may be part of the problem. Because hard money robs the state of its ability to arbitrarily seize the entirety of humanity's wealth via the money printer, it robs it of its chief means of financing the crises that grow leviathan itself. The boom-bust cycle that feeds its cronies on the bailout treadmill while sacrificing enough human shields to leave the masses begging for bread.

In other words, hard money lets the people rise, but it clips the wings of governments. To the extent government makes the rules, they will therefore fight it with everything they’ve got.

At this point, whether it comes in gold, silver, or Bitcoin, a return to hard money promises us an epoch-forming transformation. To smaller government, to fewer crises and paper-financed wars. It brings a world of more human freedom, more innovation, more hope for the future. In contrast to the creeping feeling of doom many of us have in today’s fiat world.

If that’s not worth fighting for, not much is.

Sign up to my free email list to get weekly posts on the economy and freedom. Choose the $5 option if you’d like to support the videos and articles.

Also check out the weekly podcast rounding up all the week’s videos in a single 30 minute podcast.

This was originally published on profstonge.com