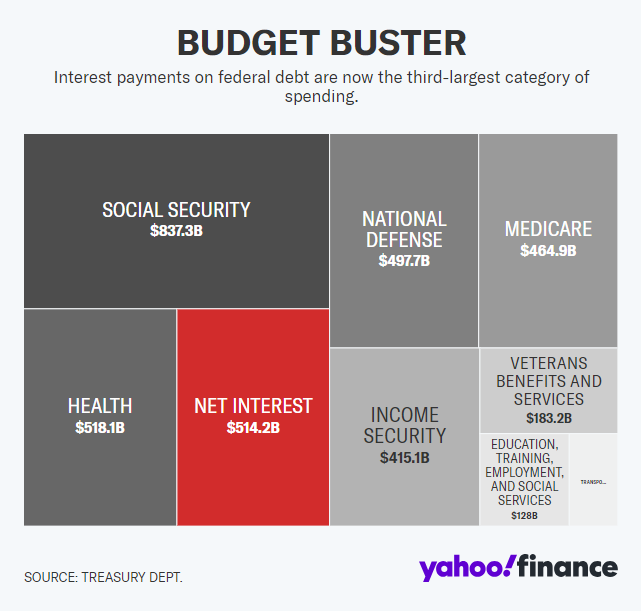

U.S. interest payments on the national debt surpassed defense spending, totaling $514 billion in the first seven months.

The United States is now spending more on interest payments for its national debt than on its defense budget. For the first seven months of fiscal year 2024, net interest payments have reached a staggering $514 billion, surpassing defense spending by $20 billion.

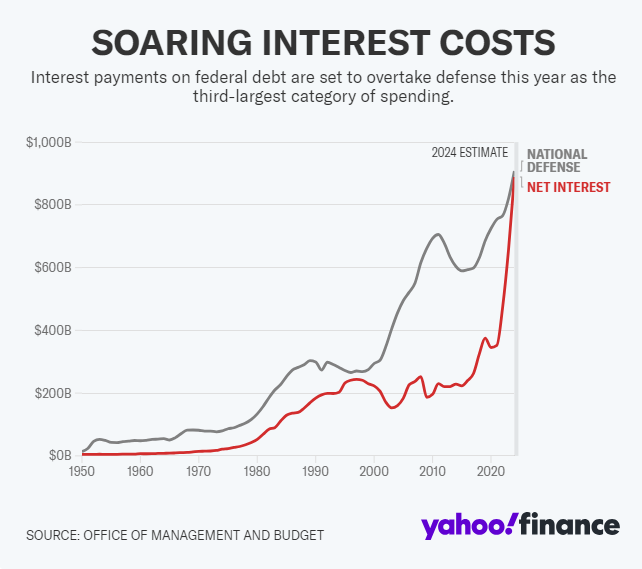

Two years prior, interest payments ranked as the seventh-largest federal spending category. However, they have now surged to become the third-largest, trailing only Social Security and health programs excluding Medicare. This substantial increase in interest expenses, which are 41% higher than in 2023, stems from two main factors: the burgeoning national debt and rising interest rates.

The national debt has ballooned to $34.6 trillion, a 156% increase since the end of 2010. Annual deficits have soared, particularly due to COVID-related spending in 2020 and 2021, with the annual deficit swelling to $2.24 trillion and projected at $1.5 trillion for 2024. The deficit as a percentage of GDP has nearly doubled in a decade, from 2.8% in 2014 to an estimated 5.3% in 2024.

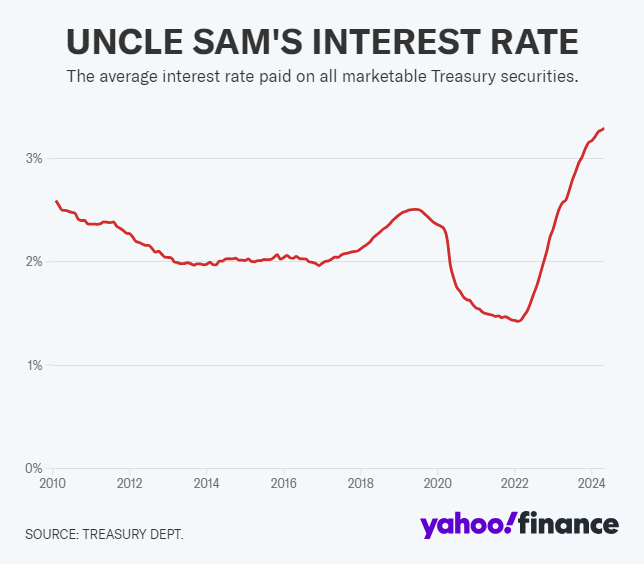

Contributing to the rising cost of these interest payments is the hike in interest rates implemented by the Federal Reserve in 2022. The average interest rate paid by the government on Treasury securities has increased from 2.1% between 2010 and 2021 to 3.3% currently.

Amidst this fiscal scenario, neither President Joe Biden nor former President Donald Trump, leading candidates in the upcoming presidential race, are emphasizing deficit reduction in their campaigns. President Biden proposes tax hikes on businesses and the wealthy to reduce annual deficits, though his plans for increased social spending may negate potential savings. On the other hand, Trump suggests that increased oil and natural gas drilling could generate significant tax revenue to reduce the debt, though the effectiveness of this plan remains unclear.

Both administrations have seen the national debt rise significantly under their tenure – $7.8 trillion during Trump’s presidency and $6.8 trillion during Biden's first three years and four months.