In Q1 2024, U.S. GDP growth decelerated to 1.6%, significantly below expectations and marking a two-year low, raising concerns of stagflation.

The U.S. economy expanded at a significantly slower pace than anticipated in the first quarter of 2024, with the Gross Domestic Product (GDP) growing at an annualized rate of 1.6 percent. This figure, reported by the Bureau of Economic Analysis (BEA), fell short of the expectations of analysts who had forecasted a 2.5 percent rise. It also marks a substantial decrease from the revised 3.4 percent growth rate in the fourth quarter of the previous year.

The slower growth has disrupted market predictions, which had previously been leaning towards the possibility of interest rate cuts by the Federal Reserve. The shockingly weak GDP data has also impacted the dollar's strength and has had a negative effect on equities around the globe.

As the U.S. heads towards the November election, President Joe Biden is relying on the strength of the economy to gain an edge over his Republican counterpart, Donald Trump. Nonetheless, borrowing costs are at their highest in 23 years, prompting traders to reassess the likelihood of rate cuts by the Fed due to persistent inflationary pressures.

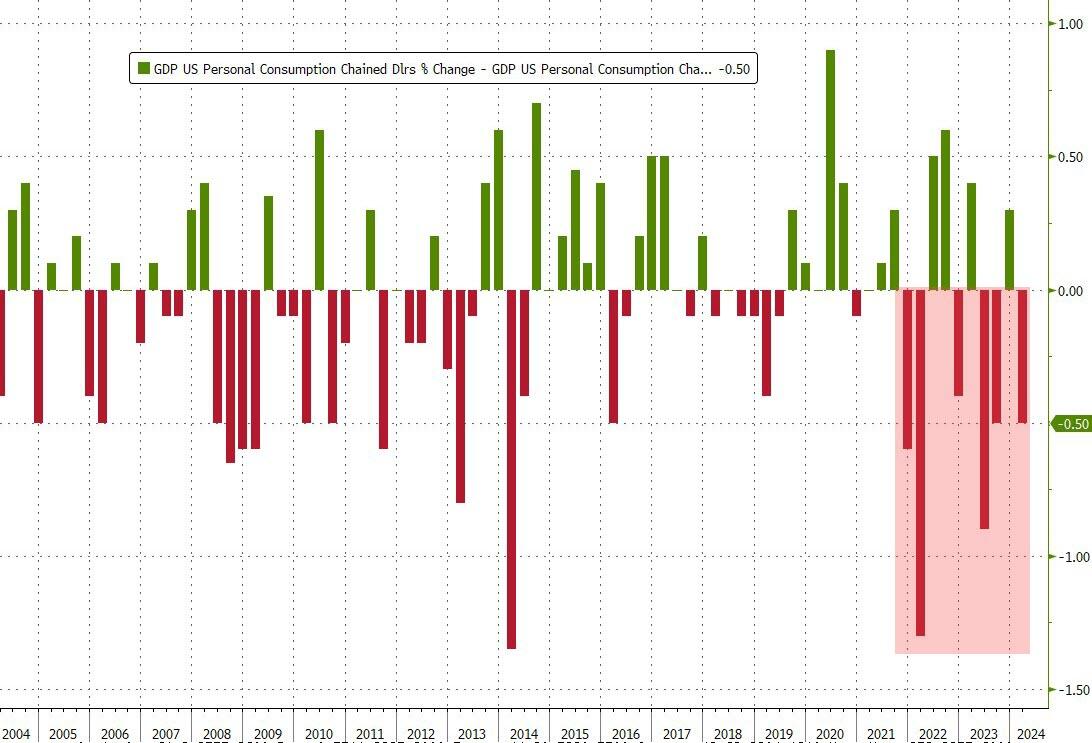

The BEA's report also indicated a rise in the GDP deflator, a measure of inflation, to 3.1 percent, exceeding the expected 3.0 percent and raising from the 1.6 percent in the previous quarter. Core Personal Consumption Expenditures (PCE), excluding food and energy, saw a significant jump from 2.0 percent to 3.7 percent, surpassing estimates and suggesting mounting inflationary pressures.

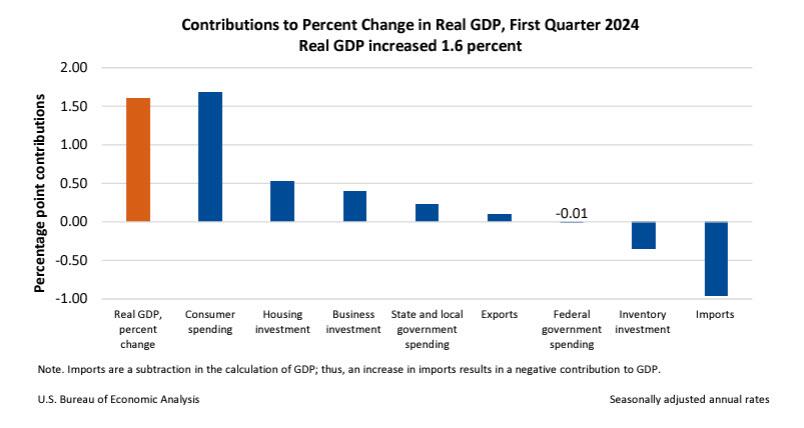

Analyzing the components of the GDP, the BEA noted that the increase in Q1 was primarily driven by consumer spending, particularly in services such as health care and financial services, and housing investments. However, these gains were partly offset by decreases in inventory investment, particularly in wholesale trade and manufacturing. Additionally, there was a deceleration in consumer spending, exports, and government spending, with imports showing an acceleration.

The data further reveals that personal consumption, while still contributing positively to the GDP, has declined compared to the previous quarter. Fixed investment saw a modest rise, while changes in private inventories continued to detract from overall GDP. Net trade also had a negative impact on GDP growth for the quarter.

The report's inflation data, represented by the increase in PCE price index, suggests that the U.S. could be facing a risk of stagflation—a combination of stagnant growth and high inflation. This complex economic scenario poses a challenge for the Federal Reserve in determining the appropriate monetary policy response.

Fitch economist Olu Sonola commented on the report, emphasizing that "the hot inflation print is the real story in this report." With growth slowing and inflation potentially accelerating, expectations for a Fed rate cut in 2024 seem increasingly uncertain.