There is a movement to directly register the float of an entire company. But the numbers appear to be stalling- is the DTCC complicit?

A few months ago, I wrote a piece on the Gamestop phenomenon, outlining how it happened, what occurred during the run-up, and the groundbreaking SEC revelation that the whole January 2021 price spike and subsequent turning-off of the buy button was NOT a short squeeze- they never closed their positions.

After the events of January 2021, the reddit boards were still abuzz, with hundreds of thousands of retail investors logging in daily to discuss the stock and hypothesize about what would happen next. Much of the content were the usual memes and shitposts, but among the crowd emerged several authors, people who were educated in the realms of finance and mathematics and who posted intelligent, well thought out due diligence (DD) reports on different aspects of the Gamestop story.

One such author was Atobitt, who came out with his seminal House of Cards piece. In this manifesto, many things were revealed, but chief among them was the discovery that retail investors do not own their shares- instead, all shares are held at the DTCC and it’s subsidiary, Cede and Co, is the legal owner. We are all beneficial owners of stock, meaning we can enjoy the benefits of share ownership (capital gains, dividends, voting rights) but legally we DO NOT actually own the shares.

This was a shocking revelation to the community- could this be the reason why naked shorting seemed so prevalent in $GME before the runup, contributing to the 226% short interest in the stock. However, some data feeds, like FINRA’s, at one point had the stock at 313% short! As the new announcement reverberated throughout the community, many began looking into other stocks that were shorted into oblivion- quite a few interesting names came up, including GlobalLinks, Overstock, and CMKM Diamonds. Many more were discovered, including cancer research companies and biotech firms.

The online investigatory force soon found a method to fight back against this massive naked shorting scheme: The Direct Registration System, or DRS.

Around the 1970s, the financial services industry began considering the concept of individual book-entry ownership for corporate securities. This approach was already in practice for municipal bonds, as they transitioned to being book-entry only. Similarly, US Treasuries were also available exclusively through book-entry systems. However, in the 1990s, a proposal supported by the Securities Transfer Association emerged, aiming to allow shareholders to maintain book-entry accounts directly on the records of issuers.

The transfer agent, employed by the company, is responsible for maintaining records of shareholders. Typically, the transfer agent charges the company a monthly fee, along with additional fees such as per transfer and per certificate fees. However, as brokers observed certificates becoming obsolete due to mandates, they witnessed a decline in their revenue stream. They fought back- but were ultimately unsuccessful.

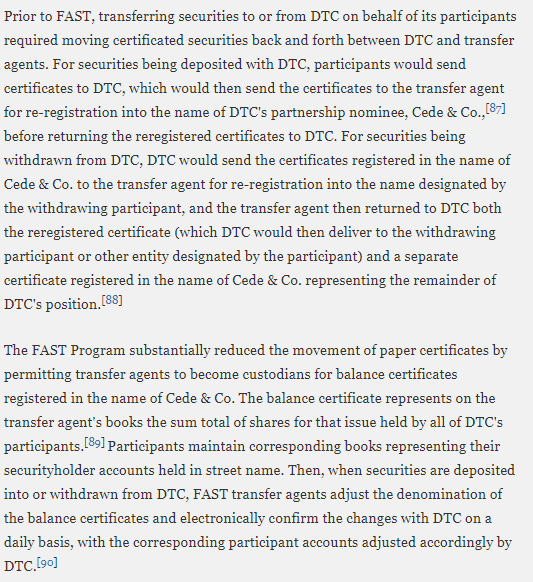

Anyways, by the late 1990s the DRS system (also known as DWAC) was put in place, and allowed a direct line from DTC to the transfer agent, allowing shares to be withdrawn from the DTC’s subsidiary Cede & Co which is where basically all certificates are held.

Here’s how the DTC itself describes it:

The Direct Registration System (DRS) enables investors to elect to hold their assets in book entry form directly with the issuer by leveraging DTC’s connectivity with FAST transfer agents. Through DTC’s DRS Service, assets can be electronically transferred to and from the transfer agent and broker/dealer to easily move shares in and out of DRS.

DRS provides investors with an alternative to holding their securities in certificate or “street” form. Under DRS, investors can elect to have their securities registered directly on the issuer’s records in book-entry form. With DRS, the investor does not receive a physical certificate, instead receiving periodic account statements (at least yearly) from the transfer agent or issuer evidencing holdings. Dividend/interest payments, proxy materials, annual reports, etc., are mailed from the issuer or its transfer agent directly to the investor.

This was first discussed on the reddit boards on February 2nd, 2021 but was buried underneath all the price action. However, in the months afterwards, discussion on DRS began re-emerging and eventually a concerted movement began to directly register the entire float of Gamestop.

Purple circles started emerging, with investors sharing screenshots of DRS’d shares through Gamestop’s transfer agent, ComputerShare, and a bot was coded to track how many shares were being registered through the Superstonk subreddit.

The movement began in May of 2021, and quickly picked up steam. Through the whole year, people DRS’d en masse and volume on the exchange slowly dwindled. In October 2021, 20,800,000 shares (post-split) were directly registered and by March of 2022, there were 125,543 record holders. Throughout 2022, the number steadily climbed as word spread and the purple circles became a meme. We hit 50,800,000 in Q1, then 71,300,000 by Q2 and soaring to 76,000,000 in the 10K that year.

However, the growth started to stall!

This began to perplex many investors, including myself- how could consistent buy volume, and DRS transfer images, which we saw on Reddit, not be showing up in the reports? Soon a theory emerged by u/6days1week as to what could be going on.

6days was holding a DRS book share of Nordstrom, and right before a cash dividend was scheduled to be paid on Nordstrom stock on March 29, he purchased two new plan shares plus a fractional. He was testing if he would receive cash for his book share and dividend reinvestment for his plan shares.

A shocking revelation came soon enough- ALL shares received dividend reinvestment. By buying a single plan share, it enrolled the entire account into the plan and thus even DRS book shares became plan shares.

There is a categorical difference between book and plan shares; both are held in computershare, but plan shares are held portionally at the DTC. The plan shares are moved in and out of DTC for “operational efficiency” which basically means liquidity needs.

Retail investors commonly believed that "DRS book shares" referred to what Computershare identifies as "pure DRS." However, this belief is wrong. "Pure DRS" represents a specific way of holding shares. DRS book shares, unless they are part of the DirectStock plan highlighted in green, fall under the "Pure DRS book" category. Meanwhile, DRS book shares enrolled in the plan do not qualify as "pure" according to Computershare's definition, as indicated in the yellow and orange sections above.

As 6days lays out, if you own 1000.1 shares, it implies ownership of 1000.1 DSPP shares. A fraction of all these shares is stored at DTC for operational streamlining. A video update on May 2, 2023, disclosed that Computershare typically reserves 10% to 20% of all DSPP shares at DTC. Therefore, in the hypothetical scenario mentioned, by holding the 0.1 share, you enable a segment of the remaining 1000 shares to be transferred to DTC for operational efficiency purposes.

However, this 10-20% number is for a typical stock. Gamestop is not typical.

He laid out his Heat Lamp Theory in December 2022, and soon after, the DRS record dates began moving. Prior to this, the record date was always the last Saturday of the fiscal quarter, so the date was predictable and volume spikes occurred independently of this date. Furthermore, the 10Q/K filings described the shares as being “directly registered”, pointing to pure book DRS shares.

Heat lamps are used to keep food warm in restaurants or food-service establishments, typically for relatively short durations. They prove particularly beneficial in quick-service restaurants like McDonalds, where food can be prepared and stored in advance of customer demand.

Here’s how 6days describes it:

If you’re the burger maker (Computershare), you just fill demand as it comes in. You don’t ask a lot of questions as you’re technically working for someone else (GameStop). If you make a mistake, as long as you’re following procedure, you didn’t do anything wrong. If no one is in the restaurant, you’ve been told not to cook the burgers nor put anything under the lamp (with the exception of one single burger just in case someone walks in). However, if a 50 passenger bus (short hedge funds) showed up at your restaurant, the burger maker (Computershare) would start making a lot of burgers.

When 50 passengers walk in, you’ve been told to have 40 burgers ready so that you can serve them all in under a minute each. When it turns out that the bus was full of vegetarians, and the driver just needed to use the restroom, the burgers under the heat lamp didn’t need to be there which means the demand that pulled inventory was artificially false. The burger maker (Computershare) didn’t do anything wrong. They actually did everything right (according to policy). They were just following training protocol that said that when walk-in customer volume is high, make a predetermined amount of burgers and get them under the heat lamp so that operations will flow efficiently.

Essentially, what 6days is getting at here is that market makers, or hedge funds, are spiking volume in order to trigger the Plan Share algorithm to transfer more shares out of computershare and into the DTC for a few days. Like we covered in the DRS Record Dates slide above, starting in December 2022 massive spikes of volume coincided with the record date. This was shortly after the publication of the first HeatLamp DD, which was likely seen by the Gamestop team or relayed to them by a redditor.

Anyways, as Lawson and 6days had hypothesized on my Youtube video, these hedgefunds are using volume pumps to pull a large portion of shares out in order to satisfy FTD obligations. There are other anomalies as well during these dates, including millions of shares to borrow just appearing and then disappearing as well as huge share blocks being traded in after hours.

Basically, Gamestop is trying to highlight this by moving the record date around so that we can see which days should be investigated.

The other theory, which I find less plausible, is the rug-pull theory. Essentially what this entails is hedgefunds DRSing shares all quarter and then pulling them out during a record date, which means higher volume as a byproduct but also reducing the DRS share count and throwing off our prediction models. This would be an expensive and lengthy process, and seems much harder than just using volume spikes to draw out shares to satisfy FTD obligations and then putting them back in Computershare.

There are thus two main theories as to why the DRS numbers are stalling. The first is that the push for Plan shares across social media (dividend reinvestment on, fractional shares, limit orders set) has been successful, and most investors are unwittingly putting more and more shares into Plan. The institutions are able to use the high volume days to pull out shares, let’s say 10M or so, and as a result the numbers are staying the same. These firms may even have an incentive to keep the number flat to frustrate retail and make it seem as if they are not making any progress when in fact, they are. They increase the amount of shares pulled out of plan every single quarter to compensate for the growth in overall count. For example, last year there were 21M shares in DirectStock (Plan) that are able to be accessed via this mechanism.

The other theory, and the one that probably most investors do not want to hear, is that buy pressure has simply died down. A silent recession has hit, with hundreds of thousands of layoffs and inflation still remains stubbornly high. Psyops on reddit and twitter have “been successful” in dissuading people from DRSing their shares and they have simply given up. The other alternative is that there are still a strong cohort of retail buyers DRSing but they are being offset by another segment which is selling. Both are potentially true.

This quarter, the same result replayed; the 10K showed 75.3M shares held by registered holders, and a later amendment to the 10K displayed 194,270 record holders of Class A common stock.

The truth is, these markets are so complex and opaque that no one has the full picture. Regulators are asleep at the wheel, institutions abuse and manipulate the system how they like, and most retail investors are fed misinformation about what’s going on. On the plus side, Gamestop is now net income positive and has more than enough cash on hand to pay off debt. They are not going bankrupt anytime soon, and the playbook to short $GME into the ground as it came up on a large bond maturity in March 2021 backfired.

We’ll keep digging to find the truth about #DRS.

Originally published on The Dollar Endgame