Don't sleep on the social dynamics that are beginning to emerge.

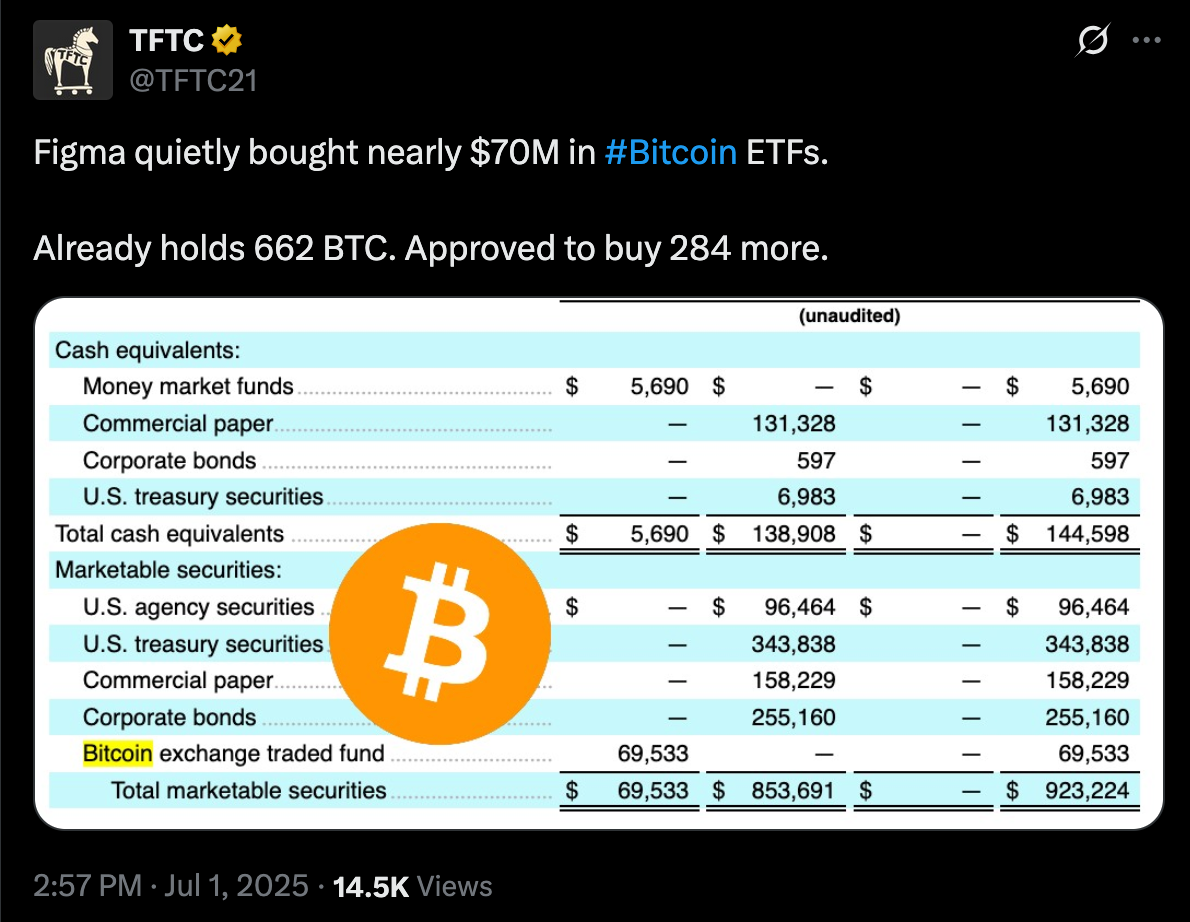

Figma, a collaborative design tool that is universally loved by UI/UX designers across the world, is preparing to go public via IPO. As part of the process of going public, Figma has to disclose their financials to the SEC by filing an S-1. This happened last week and the market has been made aware that Figma is doing very well. The filings boasted:

For those who forget, Figma was set to be acquired by Adobe a few years ago, but the regulators stepped in and prevented that merger from going through. Since then, Figma has had to figure how to produce a monetization event for their founders, employees and investors, and they're doing that by going public. This is a great success story, especially considering the fact that the government stepped in and prevented them from having this monetization event a couple of years ago.

What I really want to focus on in this short letter is the fact that Figma is an incredibly well-run company, one of the darlings of Silicon Valley, and a product that every designer that I know uses in their day-to-day workflow. The fact that the founders of Figma, their board, and their finance team had the foresight to get exposure to bitcoin ETFs and spot bitcoin is an incredibly bullish signal. There are probably a number of these tech firms that are currently private in Silicon Valley and across the world that are run by people who understand bitcoin and are acting accordingly by using their cash flows to stack the hardest money on the planet.

While all eyes are on the publicly traded bitcoin treasury plays at the moment I don't think this disclosure from Figma should go underappreciated. This is the ideal way that companies in the 21st century should be run. You should provide an incredible product that people love, people use, attain scale, reach profitability, and sweep a portion of those profits into bitcoin so that you can increase the equity value of your company over time by riding bitcoin's adoption waves.

I will not be surprised if we come to find that there are others who decide to go public in the next 12 to 18 months that many would not have suspected to have bitcoin exposure that already do. If enough of these companies come to market and disclose their bitcoin holdings, do not discount the social dynamics that will come into play. After a certain amount of these unsuspecting companies reveal that they have bitcoin on their corporate balance sheet, it will become table stakes for everybody else. It will become "unwise" to not have bitcoin on your balance sheet if you're a startup, even if you have nothing to do with bitcoin.

I don't think this is priced in yet.

James Check's analysis reveals a crucial distinction between paper Bitcoin FUD and actual market dynamics. While long-term holders have reduced their selling from peak levels of 40,000 BTC per day to significantly lower amounts, this sell-side pressure still exists - and that's precisely what makes the current price action so bullish. The market is absorbing billions in daily selling pressure while maintaining prices above $107K, demonstrating genuine demand strength rather than manipulation.

"The fact that we've had billions of dollars, tens of billions of dollars a day sometimes of serious sell-side pressure, and the price is $107,000, that is the signal." - James Check

Check emphasizes that while supply tightness is real during certain periods, it shouldn't be anyone's core investment thesis. Instead, focus on the market's ability to digest massive sells at these elevated levels. This absorption capacity, not paper Bitcoin conspiracies, explains our current price consolidation.

Check out the full podcast here for more on treasury company dynamics, the next bear market structure and Bitcoin lending strategies.

Tech Elite Back New Bank for Bitcoin and AI - via X

Bitcoin ETF Out-earns BlackRock's S&P 500 Fund - via X

Trump Announces Vietnam Trade Deal with 20% Tariffs - via X

Get our new STACK SATS hat - via tftcmerch.io

It’s time to build a long-term strategy and declare your financial independence. Unchained’s Financial Freedom Bundle is designed to help serious bitcoin holders secure their future by taking control of their generational wealth.

Request the bundle to get:

First 100 to request a bundle receive a physical copy of Foundations.

Request your bundle here.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I need to catch more sunrises.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: