Block out the noise. There's a ton of it out there right now.

If you've been hanging out on "bitcoin Twitter" recently, you're probably under the impression that the bitcoin price isn't going up fast enough. Many are even surmising that there has to be some sort of price manipulation going on because "it just doesn't make sense" that bitcoin is sitting at $109,000. I understand these feeling, I've had them myself before.

However, it is always important to keep things in perspective by zooming out, understanding that our emotions are often volatile and irrational in the short-term, taking a deep breath, and re-orienting ourselves to the long-term trend. Bitcoin is a decentralized peer-to-peer digital cash system that was launched by a pseudo anonymous developer in January of 2009 and went from a fringe internet "project" to see if this form of digital cash could catch on to a digital cash system that is currently being used by tens of millions of people around the world and has amassed a $2.17 TRILLION market cap. That is an incredible feat.

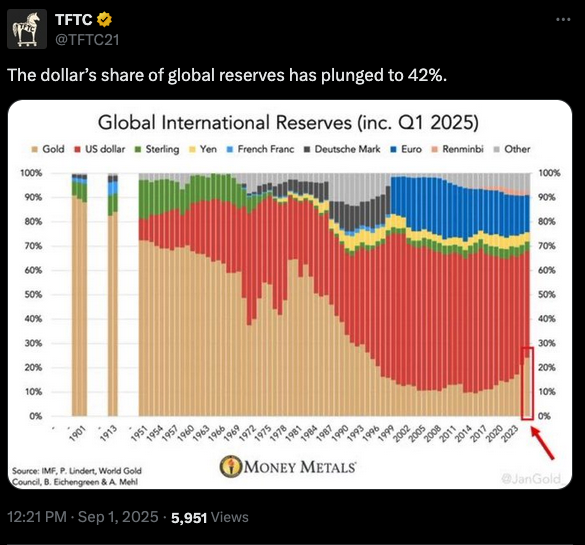

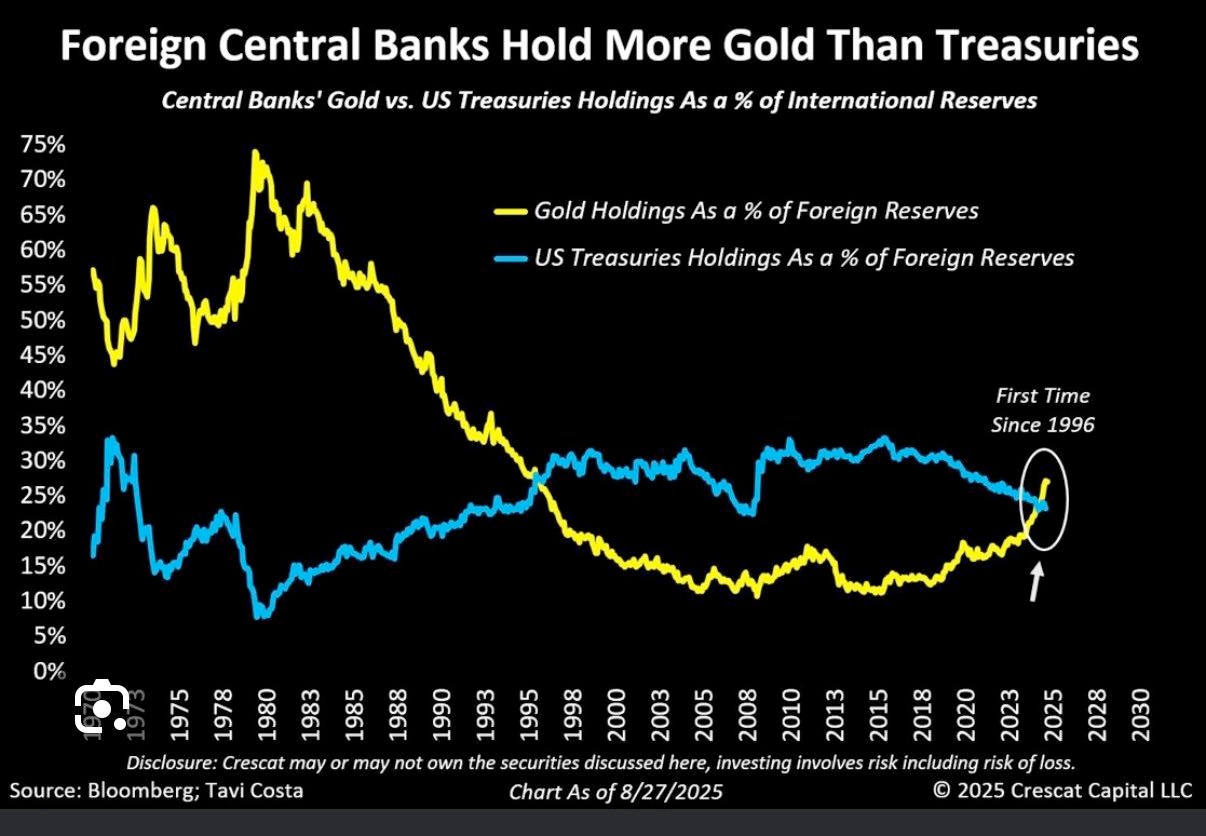

Meanwhile, bitcoin's largest competitor, the US dollar, has seen its influence wane over the last decade as the US government has accelerated its drunken debt binge and weaponized the dollar system by freezing the treasury assets of its adversaries. The mismanagement of the dollar system has led to those who, for a long time, found safety in US treasuries to seek out alternatives. Up to this point, the alternative of choice has been the most reliable neutral reserve asset for millennia; gold. This is evidenced by the charts below:

These charts were floating around X over the weekend and gold surpassed $3,500 an ounce earlier tonight. As should be expected, the gold bugs have been taking well deserved victory laps. And, if I'm being honest, I'm happy for our gold brethren. At the end of the day, gold bugs and bitcoiners are on the same team; team sound money whose control is out of the hands of central banks and governments. However, I think they're victory lapping around bitcoin is misguided and will eventually make them look foolish. Whether they like it or not, bitcoin is a superior store of value for the digital age. It's scarcer, easier to divide, easier to verify, easier to transfer, easier to secure and the process of bitcoin production has positive externalities that strengthen our energy systems.

Gold is certainly having its moment now, but if we're being objective bitcoin is going to be the winning horse in the race of monetary assets in the 21st century. This will be a product of the superior attributes listed above coupled with the fact that bitcoin is still in the infancy of its monetization phase. Gold has been monetizing for millennia and even though it will certainly continue to hit new all time highs, it won't have the purchasing power appreciation potential that bitcoin has.

To both the gold bugs and bitcoiners who think that the recent unimpressive price action is a sign that bitcoin is losing favor I will just say; stop being high time preference goobers. Bitcoin hit a new all time high *checks notes* 18-days ago. Sure, we're not seeing the post-halving/four year cycle blow off tops that many have come to expect if they've been observing bitcoin's price action over it's short 16-year history, but the trend is undeniably "up and to the right".

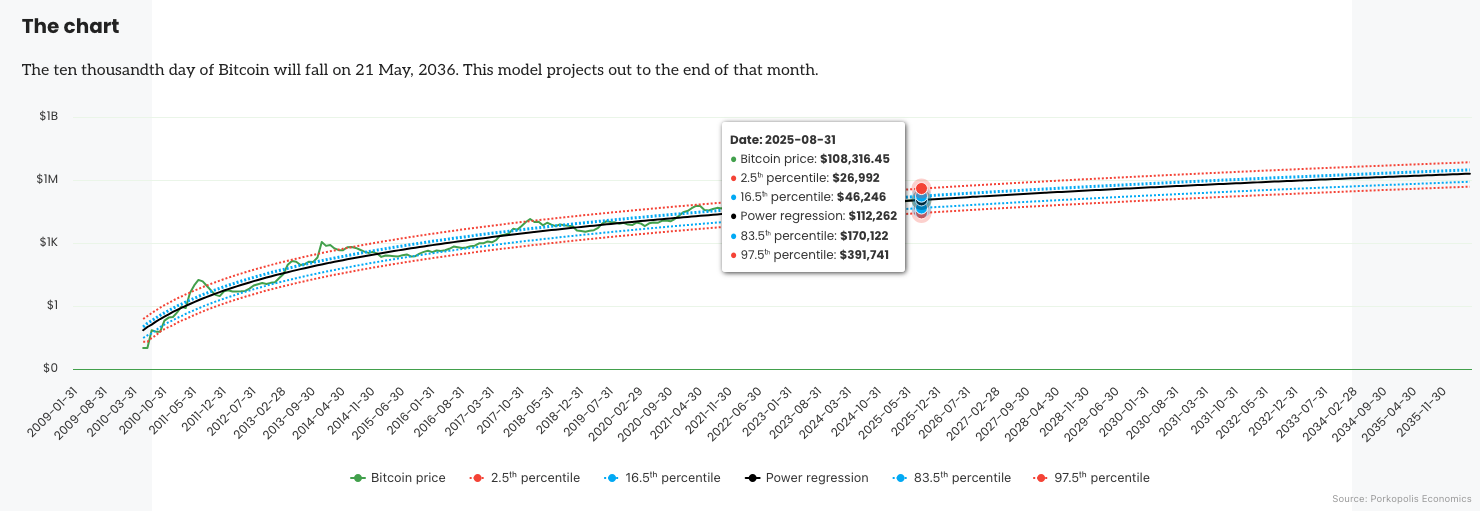

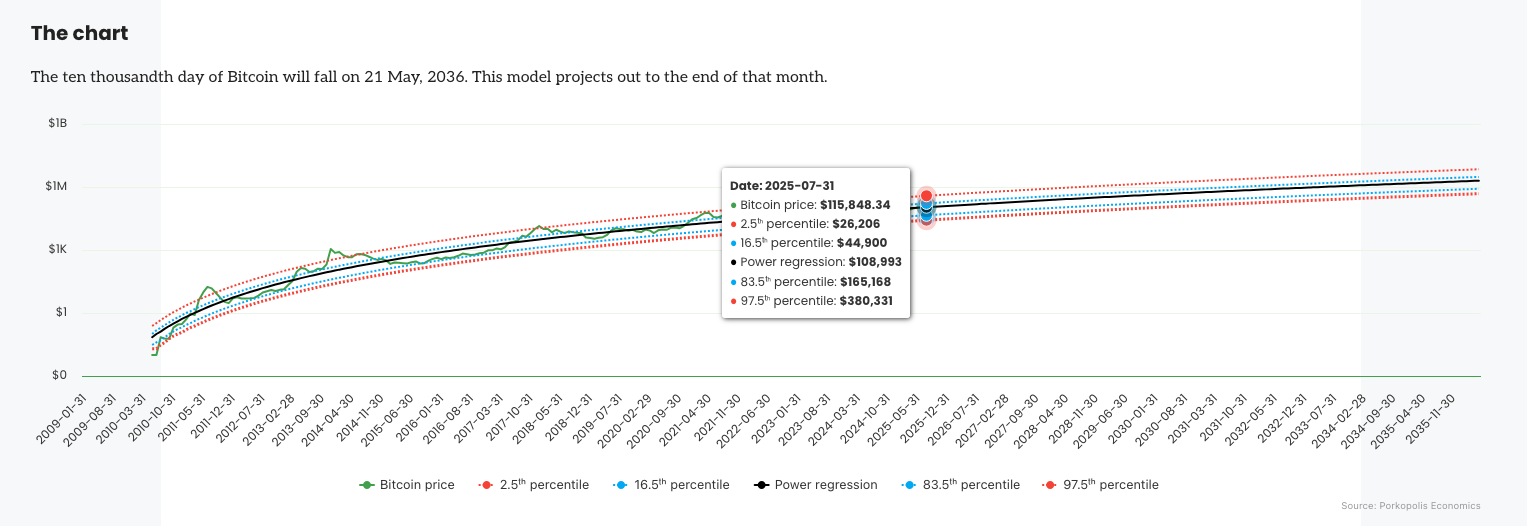

As many of you know, I am a fan of the thesis that bitcoin is experiencing power trend adoption and price appreciation, which is what we typically see with adoption trends around networks outside of bitcoin. If we look at the power law trend chart produced by our friend Matthew Mežinskis at Porkopolis Economics you'll see that all is well.

As of yesterday, the power trend model says that the bitcoin price should be $112,262. As I write, we are sitting at $109,555, or ~2.5% below trend. Which is nothing abnormal with this model.

If you zoom back to the end of July, the model stated that the price should be at $108,983 and the price of bitcoin ended the month at $115,848, or 6.2% above trend.

If you believe there is any validity to the power law trend model of bitcoin adoption, which I do, then the bitcoin price is in a very good spot.

Outside of price charts and trend models, the fundamentals have never been stronger (this seems to be something that will be true if uttered at any point in the future, the longer bitcoin survives the stronger it gets). Bond yields are blowing out in Japan and the UK. They're still elevated in the US. And France is apparently on the brink of crawling to the IMF hat in hand to ask for a sovereign bail out. Civil unrest and nationalism are on the rise in the West, stock markets are trading at PE multiples that are higher than the dot com bubble, consumers have been absolutely hammered by inflation, and credit stress is surpassing 2008 levels.

If a material correction in broader markets manifests this Fall it could mean that the bitcoin price takes a hit as investors dump liquid assets for cash, as has been the case during times of financial system uncertainty since bitcoin launched. This could also be the crisis that finally moves in bitcoin's favor as people wake up to the fact that fleeing to a cash system controlled by the people creating the crises in the first place is an irrational move. We'll see how the dominoes fall if a financial crisis does materialize.

However, in the long-run the trend is very clear and it is your friend. The fiat monetary system is buckling globally, people are losing faith in currencies that are being constantly debased and the debt issued by the governments debasing those currencies. The world needs an alternative. Currently, central banks and governments looking to flee the dollar reserve system are running to something very familiar to them; gold. Over time, bitcoin has benefited and will continue to benefit from these trends of trust degradation. As the distribution of bitcoin knowledge increases, more people come to understand and intuit the superior properties bitcoin has to other monetary goods, and the infrastructure around the protocol becomes more mature - bitcoin adoption will increase.

The beauty of bitcoin is that any increase in demand isn't met with a commensurate increase in supply. The supply distribution was predetermined when Satoshi hit "launch". That demand will be met with the most inelastic supply side response of any asset on the planet, which will force buyers to bid the price up.

Don't get distracted by the monotony, boredom and noise that currently exist in this market. Take a step back and recognize that the trend is very much on your side.

Tom Honzik has helped 1,000+ people secure more than 5,000 BTC. Now, TFTC and Unchained are teaming up for a live online session on bitcoin custody.What you’ll learn:

Stick around for the AMA to ask Tom Honzik and Marty Bent anything—from privacy considerations to the tradeoffs of different multisig quorums.

Created by Carl Dong (former Bitcoin Core contributor), unlike other VPNs, it can’t log your activity by design, delivering verifiable privacy you can trust.

Outsmarts internet censorship: works even on the most restrictive Wi-Fi networks where other VPNs fail.

Pay with bitcoin over Lightning: better privacy and low fees.

No email required: accounts are generated like bitcoin wallets.

No trade-offs: browse freely with fast, reliable speeds.

Exclusive Deal for TFTC Listeners:

Sign up at obscura.net and use code TFTC25 for 25% off your first 12 months.

Now available on macOS, iOS, and WireGuard, with more platforms coming soon — so your privacy travels with you wherever you go.

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I can't believe my oldest is going to Kindergarten.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: