This is the fiat world "sending it".

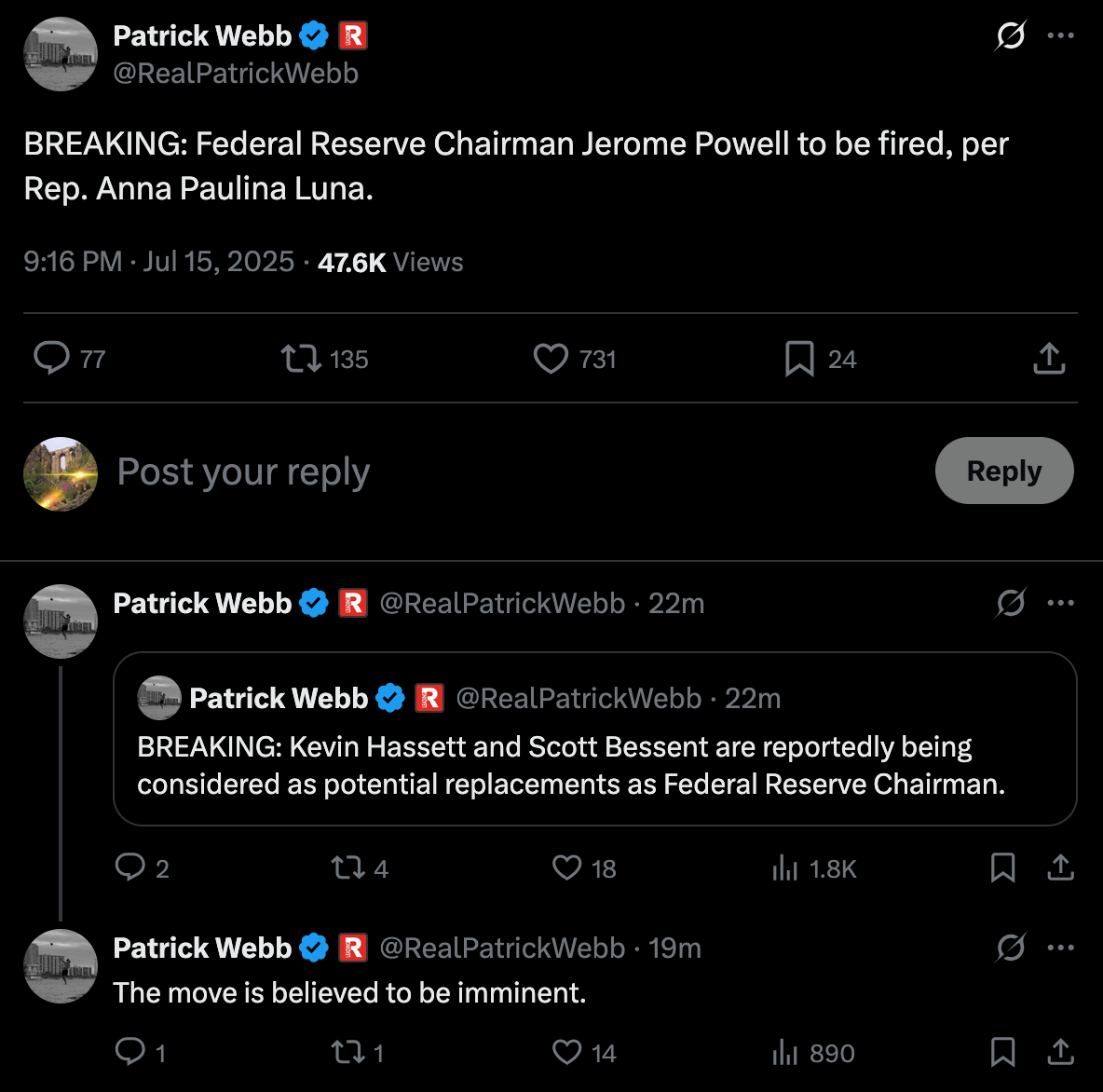

Federal Reserve Chairman Jerome Powell has been subjected to a public flogging by Donald Trump, members of his administration and many Senators and Congressmen for the better part of a month. President Trump has been very vocal about is disapproval of the Fed's interest rate policy decision since before he even stepped into office, but the escalation we've witnessed over the last month has been monumental. So monumental that it seems that - if we believe the rumor being spread by Rep. Anna Paulina Luna - Jerome is about to get seen the door.

The justification being put forth for the ousting of the sitting Fed Chair is the fact that inflation has fallen considerably and the Fed Funds rate needs to come down so that the long end of the treasury yield curve can come down so that we can refinance trillions in debt at lower rates and ensure that the interest expense on the debt that is being rolled over is lower as a result.

However, if you look beneath the hood of the headline CPI print of +2.7% (which is already woefully understated) and discard falling gasoline and electronics prices, things are still running pretty hot. Shelter, medical service, transportation, food, and electricity prices are all up anywhere from 3.5-6% year-over-year. These are material increases that were built on the higher base created during the aftermath of COVID stimulus.

| What the CPI shows | What the author highlights |

|---|---|

| Headline CPI: +2.7 % YoY – kept low by an ‑8 % plunge in gasoline prices. | Ex‑gas, core living costs remain hot: • Shelter + 4 % • Medical services & transportation + 3.5 % • Food at home & away + 4–5 % • Electricity + ~6 % |

| Falling prices in TVs, smartphones, apparel. | These discretionary items are dropping despite tariffs, undercutting the claim that tariffs are driving inflation. |

| Bottom line | Essentials keep climbing while non‑essentials fall, freezing real household purchasing power. |

Info sourced via the Coastal Journal

On top of this, as I've said many times over the last couple of months, I don't think it's a foregone conclusion that a drop in the Fed Funds Rate would result in the long end of the yield curve coming down. We learned that the opposite can happen last September when Powell lowered rates for the first time since 2022. To guarantee the long end would come down you'd have to pair rate cuts with stimulus in the form of the Fed stepping in and purchasing treasuries in size, which I would not expect Jerome Powell to do unless there was an obvious liquidity crunch in the banking system.

This brings us to the "what it means" part of this letter. What seems pretty obvious to me, if you're able to read the implicit signaling coming out of DC over the last month, is that the Trump Administration would like to merge the Fed and the Treasury to ensure that it can enact Japanese-style yield curve control so that they can go about turning everything on turbo without having to worry about an independent Fed Chair. Nothing made this clearer than Scott Bessent's appearance on CNBC on July 3rd.

This was an incredible display of admission via omission. Now, whether or not Scott Bessent is the one who actually replaces Jerome Powell is yet to be determined, but it doesn't really matter. The signaling is pretty clear, whether it's Bessent, Warsh or Hassett - who are the three front runners as of right now - they will effectuate the plan that Scott Bessent and President Trump have in mind.

When you put all of this together, things become very clear. Risk assets are about to scream. Inflation is likely to drift higher. And you're going to want to find safety in sats. The economic policy of this administration is bold and aggressive and they need liquidity to try to re-build the American industrial economy and lean into the explosive growth being exhibited by AI. The optimistic take on this plan is that it's a double edged sword that leads to a revitalization of Amercia's energy infrastructure, manufacturing capacity, rare earth metals mining capacity, and increased asset prices while also bringing back inflation. The hope is that the aggressive economic plans can stoke enough growth, job creation and wage increases that the inflation isn't as impactful on the American consumer as it was in 2022.

While I would like to think we can thread that needle, the rationalist in me is screaming that this is likely wishful thinking and the best decision anyone can make right now is to funnel their wealth into the hardest asset on the planet; bitcoin.

Becca Rubenfeld laid out a compelling case for why Bitcoin's custody landscape is about to experience a seismic shift. She revealed that major custodians like Coinbase and Fidelity offer effectively no insurance coverage, with even ETF prospectuses explicitly stating holdings are uninsured with no recourse if lost. As Anchor Watch achieves qualified custodian status this fall, fiduciaries will face an uncomfortable truth: they're paying basis points for what amounts to an uninsured honeypot vulnerable to insider threats.

"If you're a fiduciary responsible for your client's funds, it just doesn't make sense." - Becca Rubenfeld

The implications are profound. Once insured custody options become available from qualified custodians, fiduciary duty itself will mandate the switch. No responsible treasury manager or fund administrator can justify choosing uninsured custody when insured alternatives exist at comparable costs. This "fiduciary flight" could reshape the entire institutional Bitcoin custody market within the next 12-24 months.

Check out the full podcast here for more on wrench attack insurance, Bitcoin inheritance solutions and custody insurance for lending.

Trump Imposes 50% Copper Tariff for National Security - via X

Grok 4 Unveiled: xAI's Leap in AI Innovation - via X

Apple Approves First iOS Game with Bitcoin Payments - via X

Get our new STACK SATS hat - via tftcmerch.io

At $118,000 bitcoin, the boom is still just beginning. Are you positioned for a

decade-long rush? Join Tuur Demeester and Unchained for a high-signal briefing on where bitcoin’s macro momentum is coming from—and how to act on it. Institutions are accumulating. Onchain metrics point to growing bullish momentum, the Fed’s role in the current political climate is in flux.

Featuring a macro update from Tuur and a clinic on self-custody from Unchained’s Tyler Campbell, this is your chance to align your bitcoin strategy with what’s next.

🗓 Tuesday, July 22 at 1PM CT

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

It’s pretty cool watching a brotherly bond grow stronger in real time.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: