A few things to pay attention to while you stay humble and stack sats.

Today was the big "rate cut" day and Jerome Powell and the FOMC came out and cut their target rate by 25bps. Considering the recent jobs reports, revisions, inflation data and the abysmal housing starts data that was published today, many analysts and pundits viewed the 25bps cut as insufficient. Many are claiming that the current environment coupled with the recent 911k downward revision to 2024 jobs numbers warranted a 50bps cut. This was also explicitly expressed by the newest Federal Reserve Board Governor Stephen Miran, who was the only dissenter of this month's meeting.

Speaking of Miran, it seems that he is also keen on pushing the idea of a "third mandate" within the Fed to pursue "moderate long-term interest rates", which is something that has been choreographed by the Trump administration throughout the year. A pursuit of "moderate long-term interest rates" is also referred to as yield curve control and when governments and central banks commit to yield curve control it represents a point of no return from a policy perspective. Once you start, it is extremely hard to stop. It signals that there is waning demand for your long-term debt and the only way to fix it is to have the central bank step in and buy it to drive down yields. Unless a fiscal miracle occurs and the US federal government is able to meaningfully reduce it's debt burden it's hard to see why many would come back to the market outside of forced allocations.

If and when this is implemented, it will be a massive phase shift in how the Federal Reserve has operated since its inception in 1913. It will be imperative to save your wealth in a hard asset like bitcoin. Especially when you consider the fact that yield curve control may be entering the equation when parts of the economy are beginning to turn over. Powell admitted today and during his speech in Jackson Hole last month that it has become obvious to him that the focus should turn from inflation to the jobs market after the big revision and continued weakness in recent jobs reports. Today's housing data is also signaling that the real estate market is continuing to slow at an accelerating pace, with new permits being down for the fifth month in a row.

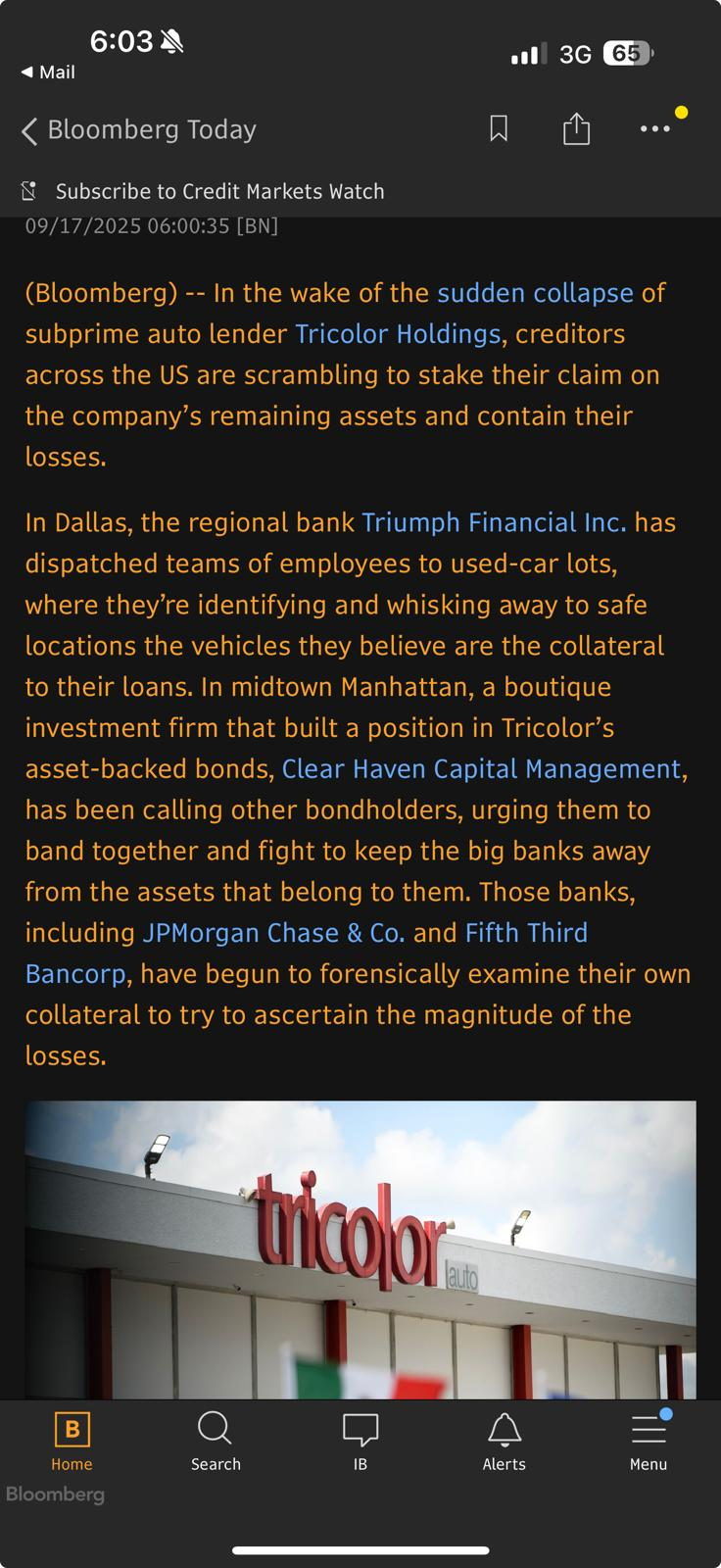

To make the outlook for the Fed even worse, it seems like we may be in the early stages of a credit crisis as is evident by the collapse of the subprime auto lender Tricolor.

I sat down and had a wide ranging conversation with Ed Dowd today during which we discussed Tricolor's collapse and its potential knock on effects. In short, Ed believes that this is a symptom of the Trump administration's immigration policy which has resulted in deportations by ICE and self-deportations being driven by subsidies for illegal immigrants that have been axed by the administration. Tricolor's largest customer base were these immigrants and their sudden departure from the country has left Tricolor holding a steaming bag of shit in the form of subprime loans. As you can see from the excerpt above there are a number of banks and credit funds who are scrambling to figure out how large of a write down they're going to have to eat. I have a feeling Tricolor is just the first of many lenders to suffer this fate. With rates still relatively elevated and the economy turning it isn't hard to see how this can cascade rather quickly. Maybe Jerome should have cut by 50bps.

Who knows exactly how this will all play out. The Fed and the Federal government have perfected one thing; kicking the can down the road and extending the lifecycle of irrational markets. And don't let the pundits fool you, the market seems pretty irrational right now when you consider where the stock market is and where forward looking PE ratios sit (above dot com bubble levels) juxtaposed to the economic data and credit stress that has been making headlines in recent months.

I wouldn't be the least bit surprised if we see a massive correction in the short to medium term. The question on my mind is how will bitcoin react? Will it play the roll of "liquidity hedge", which we wrote about earlier this year, and be the first asset that people dump to bolster their cash positions? Or will it "decouple" and act as a true "risk-off safe haven" that acts as a safety net during times of deleveraging and repricing? Time will tell, but I am inclined to remind you all of the argument our friend Matthew Mežinskis has been making for years; monetary policy and macroeconomics only account for 5% of bitcoin price movements despite what everyone likes to think. The other 95% is driven by simple network adoption trends that have been observed in other network goods throughout history.

If we do see a decoupling, I would argue that it very well could be driven by the fact that we've simply reached the point in the bitcoin network's lifecycle where we've passed an adoption tipping point. Stay frosty out there, freaks.

Melody Wright presented compelling evidence that America's housing crisis has surpassed 2008 levels despite massive government intervention. She highlighted that Google searches for "help with mortgage" have reached March 2009 peaks, even after unprecedented COVID-era forbearances and loan modifications. Wright noted that property taxes and insurance have doubled many mortgage payments, while the median age of new homebuyers hit a record 56 years old.

"We've had intervention that far outweighs what we saw after the last housing crisis. And yet people need help with their mortgage."- Melody Wright

Wright emphasized that first-time homebuyers are at their lowest level since the 1980s, while record numbers work multiple part-time jobs. She argued that despite payment deferrals and partial claims that allowed borrowers to push missed payments to the end of their loans, the affordability crisis has only deepened, suggesting these interventions merely delayed rather than solved the underlying problems.

Check out the full podcast here for more on commercial real estate collapse, Bitcoin as housing solution and local community revitalization.

SEC Approves Generic ETF Standards - via X

Golden Trump Bitcoin Statue in DC - via X

Saylor Predicts Metaplanet Tops Japan - via X

Federal Reserve Cuts Rates 25bps - via X

Money Markets to Fuel Bitcoin Rally - via X

This extended $75k–$110k range has caused some to wonder if the bull run is exhausted. But what if the on-chain evidence tells a totally different story? Join James Check (Checkmate of Checkonchain) and Connor Dolan for a data-driven discussion on what a maturing bitcoin market means for the road ahead.

James will break down:

On-chain metrics show bitcoin has crossed the Rubicon—from a nascent store of value into a true institutional-grade asset class. This session will help you understand what that means for this bull market and beyond—and how you might position yourself appropriately.

Tuesday, September 30th at 3PM CT — online, free to attend.

Register now for early access to a new on-chain metrics report from Unchained and Checkonchain: https://unchnd.co/3Ve67mv

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Ready for bed.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: