Marty's Bent Sup, freaks? Let’s talk about the Coinbase Super Bowl ad and, more importantly, the reaction to it from the millions of regular people watching the game last night. It highlights exactly why we at TFTC and Ten31 believe you should focus on Bitcoin, and why

Sup, freaks? Let’s talk about the Coinbase Super Bowl ad and, more importantly, the reaction to it from the millions of regular people watching the game last night. It highlights exactly why we at TFTC and Ten31 believe you should focus on Bitcoin, and why actors like Coinbase have done Bitcoin a massive disservice.

— julia (@julia_fiedler5) February 9, 2026

People were giving Coinbase the finger. A visceral, immediate reaction.

Retail does not like Coinbase. They got tricked into a karaoke activity during the Super Bowl with a Backstreet Boys flashback, only to be rugged by Coinbase yet again. Many people feel Coinbase and crypto is a scam because they put money in throughout the years, particularly in 2017 and later, and lost most of it. Coinbase is nothing more than a casino these days. They just want to launch as many tokens as possible, get people to speculate on them, and reap fees as people trade.

Crypto and tokenization will be a great equalizer, giving billions a level playing field to pursue wealth creation.

— Brian Armstrong (@brian_armstrong) February 9, 2026

Equality of opportunity is worth pursuing. Equality of outcomes leads to very dark places.

This is one of the rhetorical tricks Brian Armstrong and the Coinbase team use. They say something blatantly obvious and true, then try to equate what they're doing to that thing. Equality of opportunity versus equality of outcomes is a real and important distinction. But then Armstrong takes that obvious truth and slaps it on crypto. It's really just economic illiteracy brought to the market and packaged in a way that makes it seem good.

And this gets at what I think is the core misunderstanding. One of the biggest misconceptions in broader crypto is the belief that these tokens compete on tech features. People think it's a tech revolution. It's not. It's a monetary revolution. Armstrong and others think better smart contracting, faster settlements, and DeFi protocols are what's going to drive value.

Bitcoin is certainly a tech innovation. The combination of proof of work with a difficulty adjustment, distributed consensus, and a hard cap supply is incredibly innovative and enabled by a novel combination of disparate technologies, but what it enables is a superior monetary good for the Digital Age. Once you have a free market for monetary goods, they compete on monetary properties, not tech properties. Bitcoin is relatively slow, simple, and boring, and that's because it needs to be. It limits the attack surface and increases social scalability so it can affect billions of people in a positive way.

Bitcoin's beauty is found in its simplicity. That simplicity makes its monetary properties ironclad. Millions of tokens have come and gone over 17 years, and none have come close to Bitcoin's success.

And I think the market is finally catching on. People have been burned. The greater fools of crypto scams are not going to be as plentiful as they were in cycles past. The knowledge has been distributed that these things are scams. Despite all of this, Bitcoin is sitting at a $1.4 trillion market cap, trading above $70,300. Bitcoin is still the king. Though, it has unfortunately been tainted with the stench of the rotting corpses of crypto scams that have died along the way.

“Blockchains” exist to enable digital money for the digital age. It doesn't make sense to spin up a token to monetize YouTube or podcast content. The whole Base and Farcaster craze is a great example of that meme falling flat on its face. For these particular use cases of content monetization you don’t need a token for every creator, piece of content and “digital good”. What you need is distributed content mechanisms like RSS feeds combined with sound digital money like Bitcoin. Podcasting 2.0 does this beautifully. Put a Lightning address in your RSS feed and people can stream sats to a creator directly. You don't need a Marty token or a TFTC token.

As AJC (Averaged Joe's Crypto) put it: the Coinbase ad took something universally loved, slapped crypto on it, and prayed that the emotional hijacking would work. Classic bait and switch. Yet another rug pull.

The Coinbase ad was a perfect microcosm of why everyone hates crypto.

— AJC (@AvgJoesCrypto) February 9, 2026

It took something universally loved, slapped “crypto” on it, and prayed the emotional hijacking would work.

A classic bait-and-switch, exactly what retail has come to expect from crypto.

People are suffering out there. In cycles past, they turned to speculation on crypto to escape the permanent underclass by taking big risks on meme coins, NFTs, and other ephemeral crypto fads. Most people who speculated found it made them financially worse off. And with AI increasingly threatening job disruption, people are particularly skeptical and hostile toward the tech industry at the moment.

This is why I focus on bitcoin. It's the best money that's ever existed. It's not going away. We are in the early innings of adoption. If you understand that bitcoin is a long-term game and begin saving some of the fruits of your labor every paycheck, you'll see massive benefits as adoption increases. There are only 21 million bitcoin, and that scarcity is going to push up the purchasing power of individual units over time.

Brian Armstrong and Coinbase are pied pipers leading the retail masses astray. The retail masses have caught on, which is why they reacted so negatively to that Super Bowl commercial last night. The sooner people in crypto put all of their effort behind bitcoin, something that is provably scarce, provably decentralized, with the most hash rate and the most individual holders of any digital asset, the sooner we can actually solve the hard problems as they pertain to money and financial stress.

Crypto is a scam. Everybody knows it now.

The current Bitcoin bear market presents a clear decision point for investors, according to on-chain analyst James Check. He argues that if you fundamentally believe Bitcoin isn't dead, then this bear market will inevitably have an end. The data supports this optimistic outlook, with Check pointing out that we're currently sitting in the bottom 20% of long-term mean reversion models, indicating significant progress has been made toward establishing a market bottom.

"Unless your fundamental assessment is that Bitcoin is dead and going to zero, then this bear market is a process that will eventually conclude." - James Check

This analytical framework simplifies the complex emotions surrounding prolonged downturns into a straightforward assessment. Check's thesis suggests that the mathematical models and historical patterns are aligning to indicate we've already done much of the heavy lifting required for a market cycle bottom. For those maintaining conviction in Bitcoin's long-term viability, the current environment represents process rather than permanent decline.

Check out the full podcast here for more on on-chain metrics, market cycles, and portfolio allocation strategies.

House Democrats Seek to Overturn Trump's Canada Tariffs

Chinese Regulators Urge Banks to Cut US Treasury Holdings

Discord Requires Facial Scan or ID to Escape Teen Mode

Fed Governor Waller Says Bitcoin Volatility Part of the Game

MrBeast Acquires Banking App Step

Anonymous Whale Sends $181K Bitcoin to Satoshi's Wallet

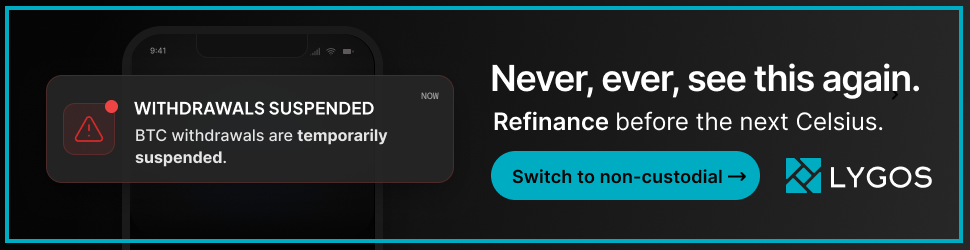

Do you know what they did with your collateral while it was falling? Do you know if it's still there?

Celsius customers didn't know either. Neither did BlockFi's. Or FTX's.

Lygos built something different.

Non-custodial bitcoin lending where YOUR bitcoin never leaves YOUR control. It sits in a multisig on Bitcoin's base layer, verifiable on-chain, impossible to rehypothecate.

Already have a loan with a custodial lender? Lygos handles the refinance. 0% origination fees, competitive rates, and your bitcoin moves to non-custodial custody. They handle the entire buyout.

No custodians to trust, no withdrawals to freeze. Just cryptographic certainty. Refinance before the next Celsius.

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Solid Monday. Highly productive.

Download our free browser extension, Opportunity Cost:

https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

|

|