The capstone for the week came late Friday, when ratings agency Moody’s downgraded its outlook for US sovereign debt to negative.

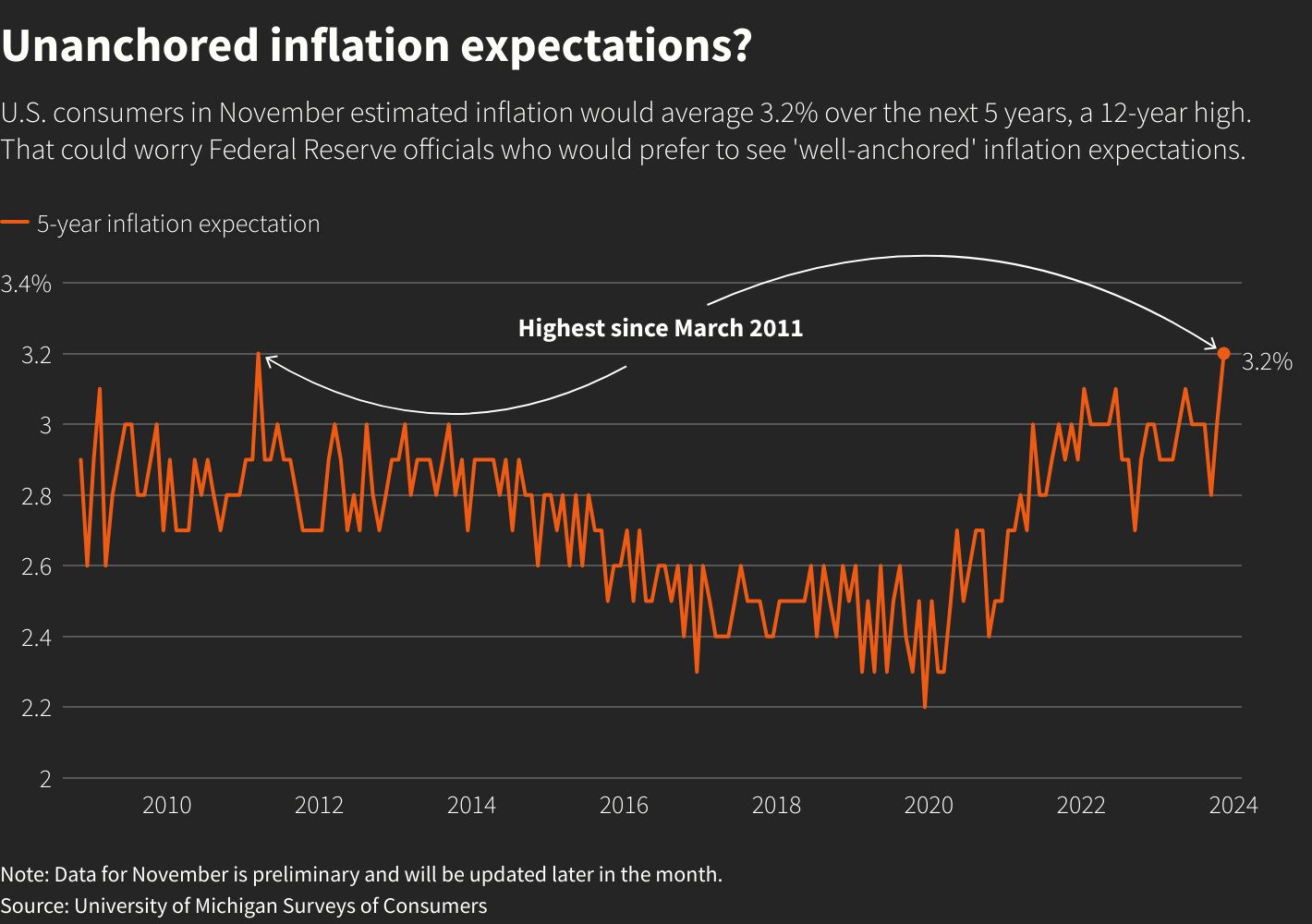

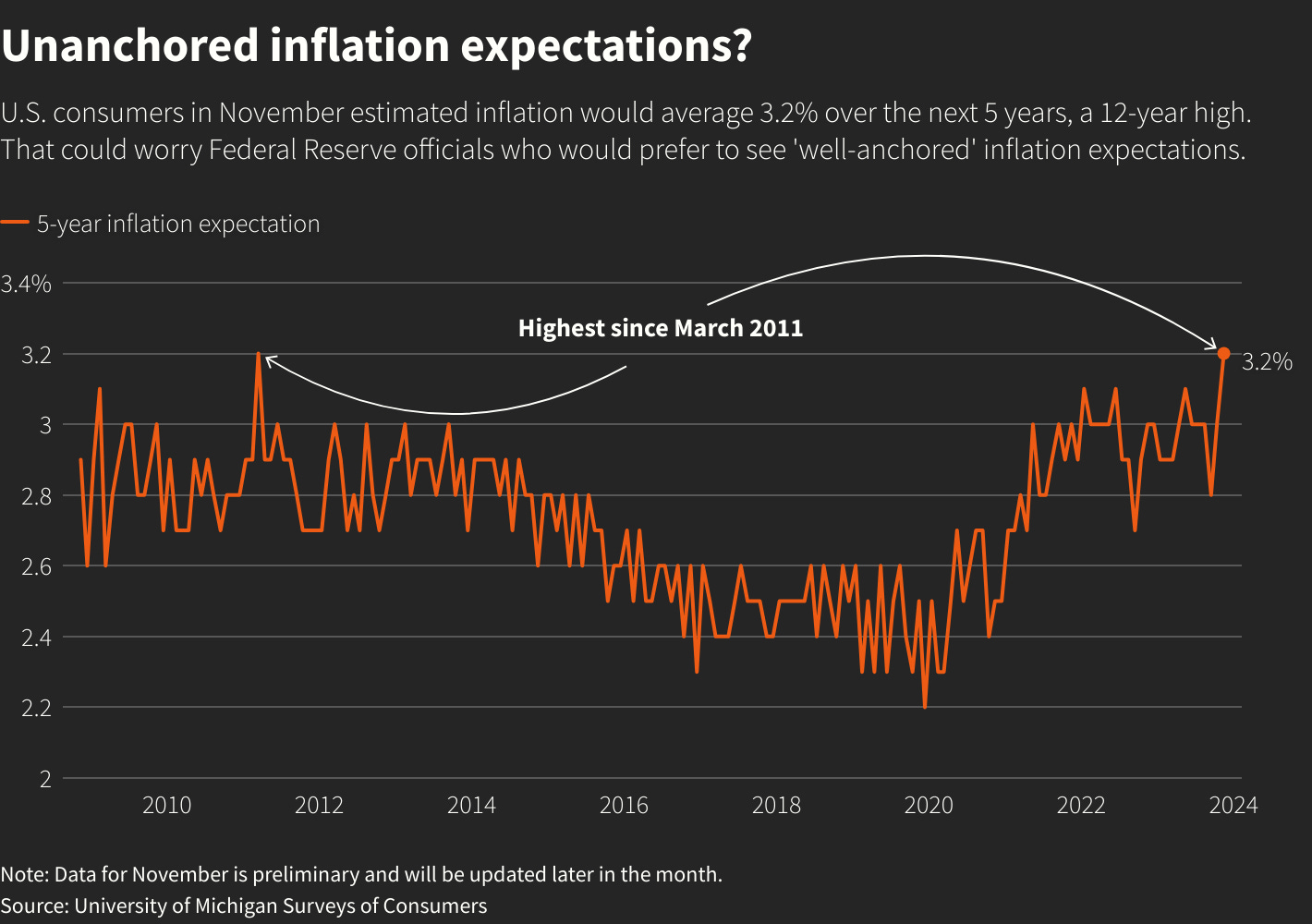

Stocks and bonds broadly sustained their rally from last week despite ongoing signs of deterioration in global financial plumbing. The most notable headline from the week was the US Treasury’s especially weak auction of new 30-year bonds, which resulted in the highest tail for a new issue since 2016 – the mainstream press generally attributed the very soft result to a cyberattack on a major Chinese bank, but we would probably contend that this isn’t exactly a cause for relief even if entirely true. The US commercial real estate backdrop also worsened on the week, with banks’ exposure to delinquent loans making new decade highs before even accounting for the downstream impacts of WeWork’s bankruptcy, which was officially filed this week. Meanwhile, consumer expectations for inflation once again ticked up in the latest benchmark survey data, potentially putting the Fed in an increasingly awkward position, as unanchored inflation expectations will likely move higher if the central bank tries to respond to growing signs of underlying macro stress with some form of easier monetary policy. The capstone for the week came late Friday, when ratings agency Moody’s downgraded its outlook for US sovereign debt to negative.

While bankers around the world rushed to complete Treasury auctions with thumb drives, the Ten31 team was spending the week at Nostrville, a multi-day summit at Nashville’s Bitcoin Park devoted to the organic explosion of development taking place in the Nostr ecosystem. This decentralized communications protocol is still nascent, but the pace and volume of innovation on display for a protocol that only really took off late last year is staggering. We expect to continue closely following and supporting the ecosystem as it matures and becomes a more critical pillar in the freedom tech stack.

Mempool.space is the leading explorer and analytics platform for the bitcoin ecosystem. The platform provides extensive data and tools for real-time analysis of the multi-layer bitcoin network, including granular information on the bitcoin blockchain, the lightning network, and a mining dashboard, all presented in an intuitive and sleek UI. The platform’s suite of tools allow users to easily estimate forecasted transaction fees, drill into in-depth data on both historical and forecasted blocks, explore the liquidity and connectivity of nodes across the lightning network, and much more. Users can either query data directly through the mempool.space site or choose to self-host an instance of the platform on their own hardware to eliminate third-party dependencies. In addition, mempool.space will soon launch a Mining Accelerator product that will help users more easily and predictably manage bitcoin’s volatile blockspace fee market.

River launched its first app for Android devices:

Start9 rolled out its latest version of StartOS, which offers substantial performance and stability enhancements:

Fold added sats-back gift card options for all Kroger grocery store brands:

Unchained Co-Founder and CSO Dhruv Bansal published a new piece on Unchained’s vision for the long-term development of dynamic markets for collaborative custody key agents.

Parker Lewis, Zaprite’s Head of Business Development and an Advisor to Ten31, wrote a new essay expanding on his view of the progression toward widespread merchant use and acceptance of bitcoin.

Parker also took some newly-released audience Q&A as part of his popular talk “Bitcoin Is Not a Hedge” from last month.

Samourai published a piece highlighting that close to 90% of users are not relying on the company’s node to engage in Whirlpool collaborative transactions, a testament to the resiliency of the project.

A week after the Federal Reserve maintained its benchmark federal funds rate at 5.25-5.5%, Fed Chairman Jerome Powell said in prepared remarks this week that the central bank is “not confident” it has done enough to sustainably lower price inflation.

Despite some relief in the bond complex since the US 10-year yield broke 5% two weeks ago, Treasury market liquidity continued to sputter this week, with one gauge reaching stress levels not seen since March 2020.

This concerning liquidity backdrop was exacerbated on Thursday, when the US Treasury conducted an historically weak auction of 30-year issues. The results of the auction caused yields to briefly spike, though bonds largely retraced those moves on Friday when the auction results were blamed on a cyberattack against China’s largest bank.

Following the drama around the auction, ratings agency Moody’s downgraded its credit outlook for US sovereign debt to negative (though kept its ratings unchanged at a pristine Aaa).

New data released this week showed that the total volume of delinquent commercial real estate loans held by US banks jumped 30% last quarter to reach its highest level in a decade. Meanwhile, use of the Fed’s BTFP facility rose to a new high this week after several months of largely unchanged volume.

The latest data from the University of Michigan’s closely watched Consumer Sentiment Index showed inflation expectations once again ticking higher, with US consumers now forecasting 1-year inflation of 4.4% (a seven month high) and 5-year inflation of 3.2% (the highest since March 2011).

Overseas, economic data continued to show challenges, as the Eurozone PMI indices for October slumped substantially M/M to levels not registered since 2012.

Bitcoin transaction fees briefly spiked to a multi-month peak of over 200 sats/vB on the back of both heightened exchange activity and renewed interest in ordinal inscriptions. Fee pressure has since subsided and settled back into a range of ~30 sats/vB as of this writing, illustrating once again the dynamism of bitcoin’s transaction fee market.

In order to comply with the so-called “Travel Rule” proposed by the Financial Action Task Force (FATF), crypto exchange Gemini’s UK arm will no longer permit outbound transfers to any entity not registered as an approved virtual asset service provider (VASP).

Fintech giant PayPal reported that it had received a subpoena from the SEC regarding its recently launched USD stablecoin.

Augustin Carstens, head of the Bank of International Settlements, again reiterated his view that CBDCs will “sit at the core of the future financial system,” whether in wholesale (i.e. inter-bank) or retail form.

The New York Times ran a feature story this week on the growing problem of arbitrary and unexplained bank account closures in the US, often a result of onerous fraud and money laundering regulations and yet another signpost for the importance of counterparty-free money.

This was originally published on Ten31 Timestamp