Speculative attack, accelerate.

In 2018 Cash App enabled their users to easily buy and sell bitcoin within the popular consumer finance app. At the time this was a massive validation and endorsement for bitcoin when it was less than a decade old. Having the backing and buy-in from a mainstream fintech player like Block (Square, at the time) was a signal to the world that bitcoin is something to take seriously. Jack Dorsey and team sticking their necks out to recognize bitcoin as a legitimate value added product to their suite will be recognized as a pivotal point in bitcoin's history.

It's been more than seven years since Cash App launched buy/sell bitcoin and Block has launched:

To say the least, Block really cares about pushing bitcoin forward and has backed that up with heavy investments in businesses that support different parts of the bitcoin market.

With all of that being said, the number one question Block has been asked since they unleashed bitcoin to Cash App users seven years ago is, "Wen bitcoin in Square terminals?!"

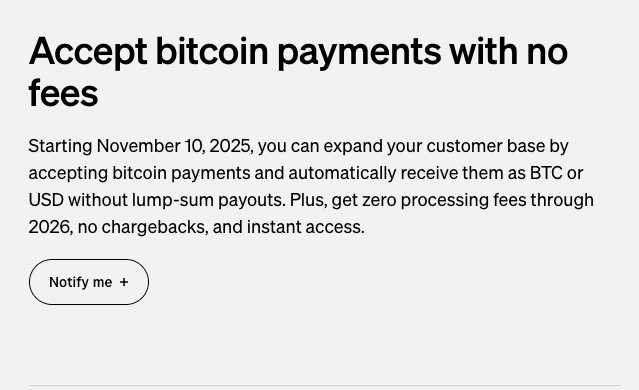

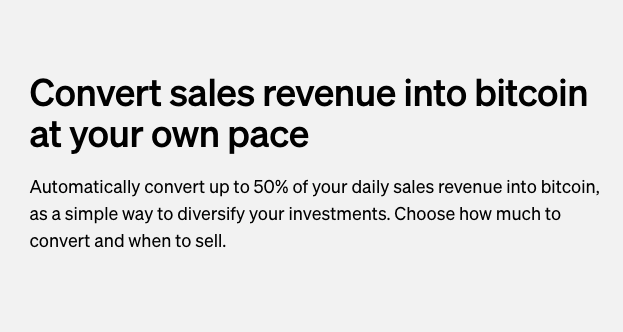

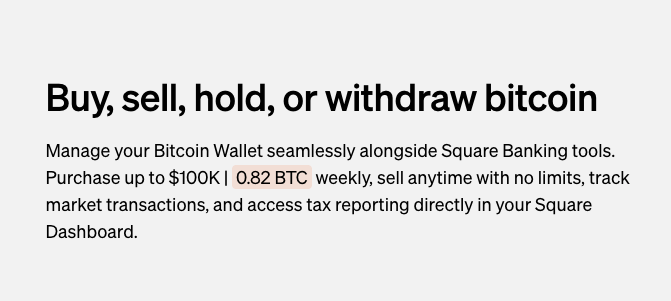

Well, as of today, the wait is officially over. Earlier this afternoon, Square announced that all of their merchants will immediately be able to convert a portion of their card sales to bitcoin, buy/sell/hold/withdraw bitcoin via their business portals and on November 10th they will also be able to accept bitcoin via Square terminals as well.

This. This right here is massive. As it stands today, Square supports over 4,000,000 merchants across the United States and every single one of them will be able to log into their Square business accounts tomorrow and decide to automatically convert a portion of their cash flow into bitcoin. If 10% of their US customer base enables this feature that will produce 400,000 new small, medium and large businesses that are using bitcoin as a treasury asset that enables them to help grow their businesses. Don't take it from me, take it from Glenn Charles, who has been part of Square's beta test of this product for the last two years.

This is the type of "corporate" bitcoin adoption you love to see. Bitcoin is an asset that can help small businesses in ways that most people cannot even fathom. I know from experience, this small (but mighty) media company has benefited massively from our bitcoin treasury, our ability to accept bitcoin for payment and our ability to pay employees and contractors in bitcoin. Opening this up to 4,000,000 businesses overnight cannot be overstated. Most importantly because Square is making bitcoin a first-class citizen throughout the experience, where other payment processors and point-of-sale systems make it hard for their customers to integrate bitcoin throughout the business stack.

Once bitcoin payments are enabled in a little over a month merchants will be able to receive bitcoin and either convert it immediately to cash or hold it in bitcoin. Bitcoiners who live on a bitcoin standard will be able to spend their sats at many more merchants in meat space. THE bitcoin standard becomes more tangible.

The next thing to check off the list is getting a de minimis tax exemption for bitcoin payments. It looks like Jack is putting the pressure on.

In our latest episode, we delved into the current state of the Bitcoin market for 2025, which has been marked by a phase of consolidation with notably low volatility. This 'chop-solidation' phase, as my guest James Check described, suggests a market that is maturing and becoming more sophisticated. The discussion highlighted how this period of stability might be setting the stage for a significant future movement in the market, indicating a strategic patience among investors.

The market is showing signs of a sophisticated structure, preparing for something big. - James Check

This optimistic outlook was shared by both myself and James, suggesting that the current market dynamics could lead to substantial opportunities for those who remain patient and vigilant. The low volatility phase is not just a lull but potentially a precursor to a major shift, making this an exciting time for Bitcoin enthusiasts and investors alike.

Check out the full podcast here for more with one of the most accurate price prediction and market structure experts we have on the show.

Tokyo firm invests $3.3M in Bitcoin

Bitcoin payments via WhatsApp demoed

Bitcoin addresses over 100 BTC hit ATH

Square introduces zero-fee Bitcoin wallet

Loosening conditions fuel Bitcoin bull run

Bitcoin's floor at $95k, target $150k

You know the story of bitcoin’s market cycles... euphoric blow-offs, brutal crashes. Maybe not anymore. The Bitcoin Checkpoint takes a deep look at how the 2023–2025 cycle has rewritten market structure and why these changes could be permanent.

Inside, you’ll find analysis of record-low volatility, ETF flows absorbing billions monthly, and why long-term holders remain in control with $1.3T in unrealized profit. Plus, download now for automatic access to the event where James Check took a deep dive into the report himself.

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

Created by Carl Dong (former Bitcoin Core contributor), unlike other VPNs, it can’t log your activity by design, delivering verifiable privacy you can trust.

Outsmarts internet censorship: works even on the most restrictive Wi-Fi networks where other VPNs fail.

Pay with bitcoin over Lightning: better privacy and low fees.

No email required: accounts are generated like bitcoin wallets.

No trade-offs: browse freely with fast, reliable speeds.

Exclusive Deal for TFTC Listeners:

Sign up at obscura.net and use code TFTC25 for 25% off your first 12 months.

Now available on macOS, iOS, and WireGuard, with more platforms coming soon — so your privacy travels with you wherever you go.

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Let's go Phils!

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: