In a revealing financial report by the U.S. Treasury, an alarming $175 trillion shortfall in Social Security and Medicare funding poses a dire threat to America's retirement future.

As Americans look towards their future, a sobering revelation from the U.S. Treasury Secretary, Janet Yellen, casts long shadows over the prospect of a secure retirement. According to the latest financial report released by the United States government, Social Security and Medicare face a staggering underfunding of $175 trillion. To put that into perspective, that amounts to approximately $1.4 million per household, dwarfing the median household net worth in the U.S., which stands at a mere fraction of this figure.

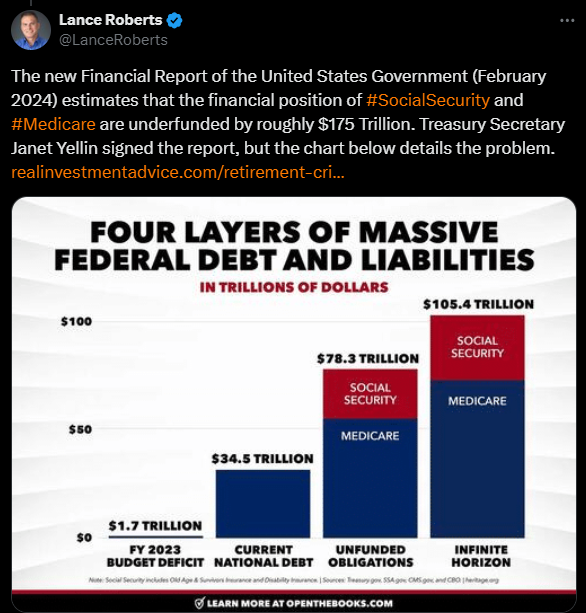

This 254-page document not only outlines the fiscal challenges but also includes a chart that starkly illustrates the scale of the problem. While the actual deficit hovers around $2 trillion and the national debt has reached a colossal $35 trillion, the real concern arises from the unfunded obligations of Social Security and Medicare.

The root of this financial quagmire, it seems, lies in the mismanagement of funds by politicians who, instead of safeguarding the money poured into these programs, have effectively replaced it with IOUs—government bonds that are as substantial as the proverbial bag of sand in place of treasure. This misappropriation is significant, given that Social Security and Medicare constitute over a third of federal revenue through a 15.3% payroll tax, half of which is deceptively borne by employers.

Apart from the inherent inefficiencies of such government-run programs, which bleed billions in fraudulent claims annually, the fundamental flaw in their design echoes that of a Ponzi scheme: collect substantial funds from a large, contributing workforce to support a smaller, older population, with the promise of future benefits that are spent in the present.

The looming crisis is imminent, with projections indicating that Medicare funds will be depleted by 2031 and Social Security by 2033. To address this grim forecast, three potential solutions have been posited. First, reducing the number of beneficiaries, which would entail raising the retirement age— a politically charged and unpopular move. Second, increasing payroll taxes, which would be equally contentious given the flat nature of the tax. Lastly, the path of least resistance: cutting benefits.

Analysts expect a 23% reduction in benefits within the next decade, which will inevitably extend beyond the affluent to the middle class, as the number of wealthy individuals is insufficient to shoulder the shortfall. The outcome will force millions of Americans to rely increasingly on personal savings, which are already being eroded at an alarming rate.

As the nation grapples with this impending financial debacle, the question remains: how will Congress navigate these turbulent waters? The path they choose will not only impact the fiscal health of the country but will also determine the financial security of countless Americans in their twilight years.