It's the money, stupid.

The tweet I quoted by Nikita Bier was making the rounds on Twitter last week. He was perplexed by the notion that bitcoin and gold prices have been rallying as individuals and institutions alike move their capital in preparation for a multi-polar world that will bring with it higher rates of inflation as governments and central banks turn to printing money and high fiscal deficits to paper over the problems they've created over the last five decades. How can bitcoin and gold buyers not see that AI is here, it's going to take over the world and it's going to be deflationary?!

The irony of the tweet is mind boggling when you consider the fact that a good portion of the stimulus and fiscal deficits described above will be driven by the desire to win the global AI arms race. Governments are going to issue debt, monetize existing debt, and subsidize the build out of grid infrastructure, data centers and on-shoring critical manufacturing capabilities. All of this will be inflationary. The end result may be that we can ping an LLM to do some deep research on a relatively complex subject and it will provide us with an extremely detailed report in minutes for a few cents. And yes, in the long-run, if these AI models continue to live up to the hype, may ultimately replace white collar jobs that cost companies hundreds of thousands of dollars a year. However, the additional productivity gains will be soundly overwhelmed by the amount of money printing that enables them in the first place.

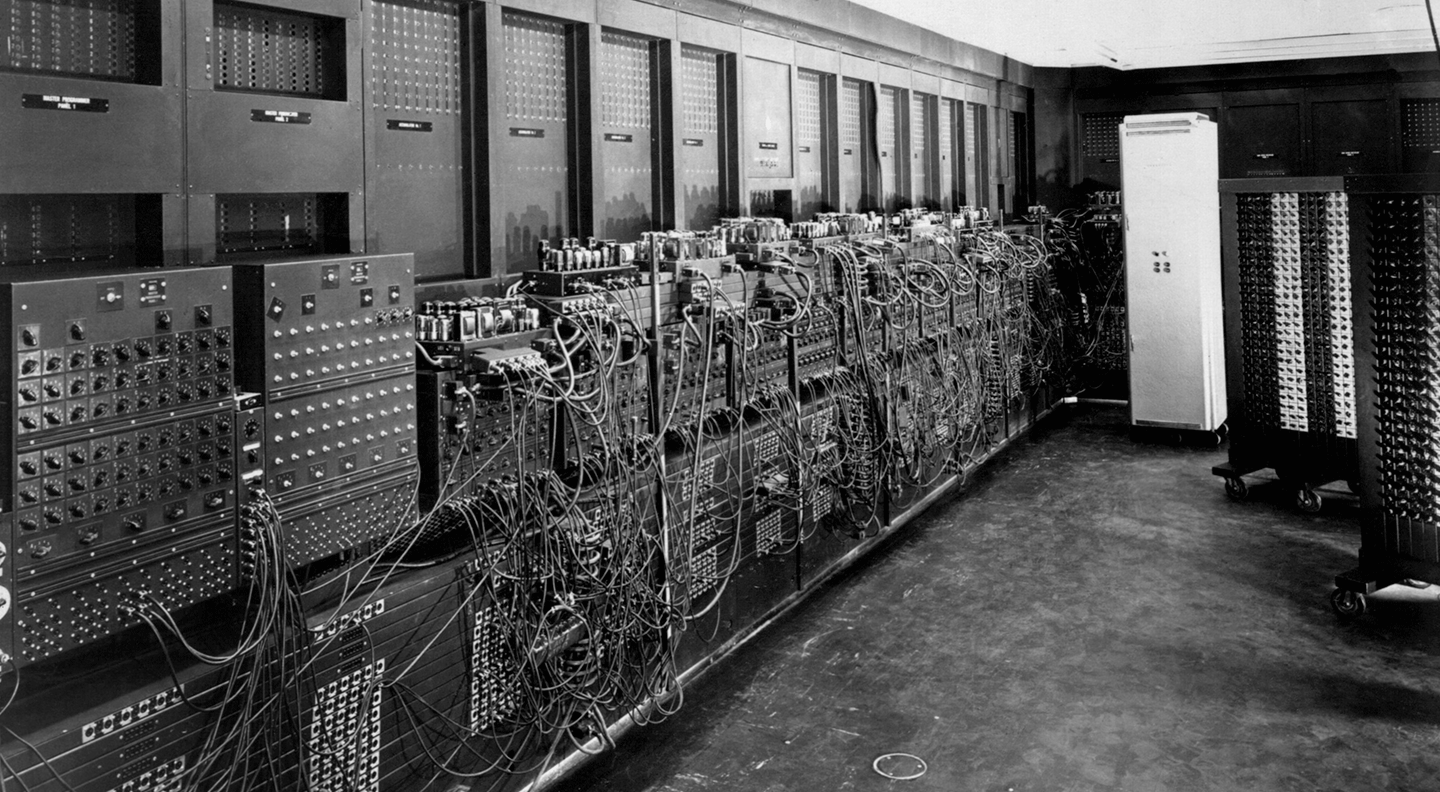

How do I know this is the case? Because it has always been the case. The other ironic thing about Nikita's tweet is that he seems to be completely oblivious to the fact that tech has always been deflationary and we have witnessed awe inspiring levels of tech deflation over the course of centuries. Here's a picture of the first ever computer that was built by the US Army.

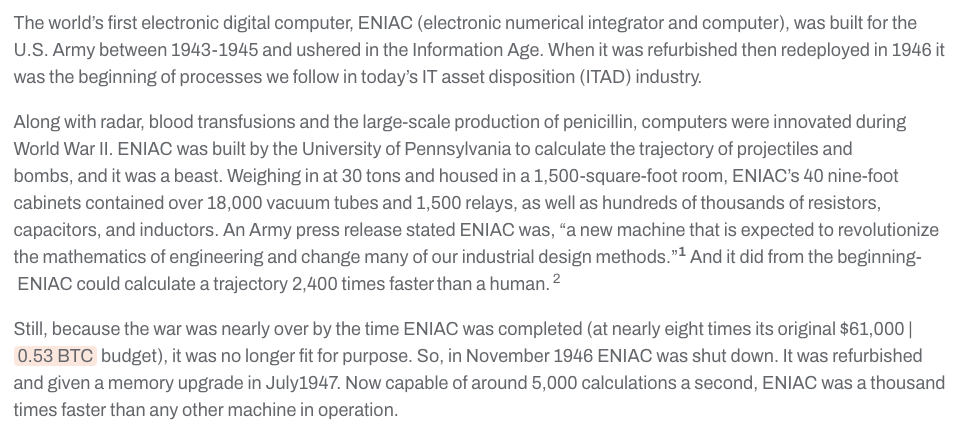

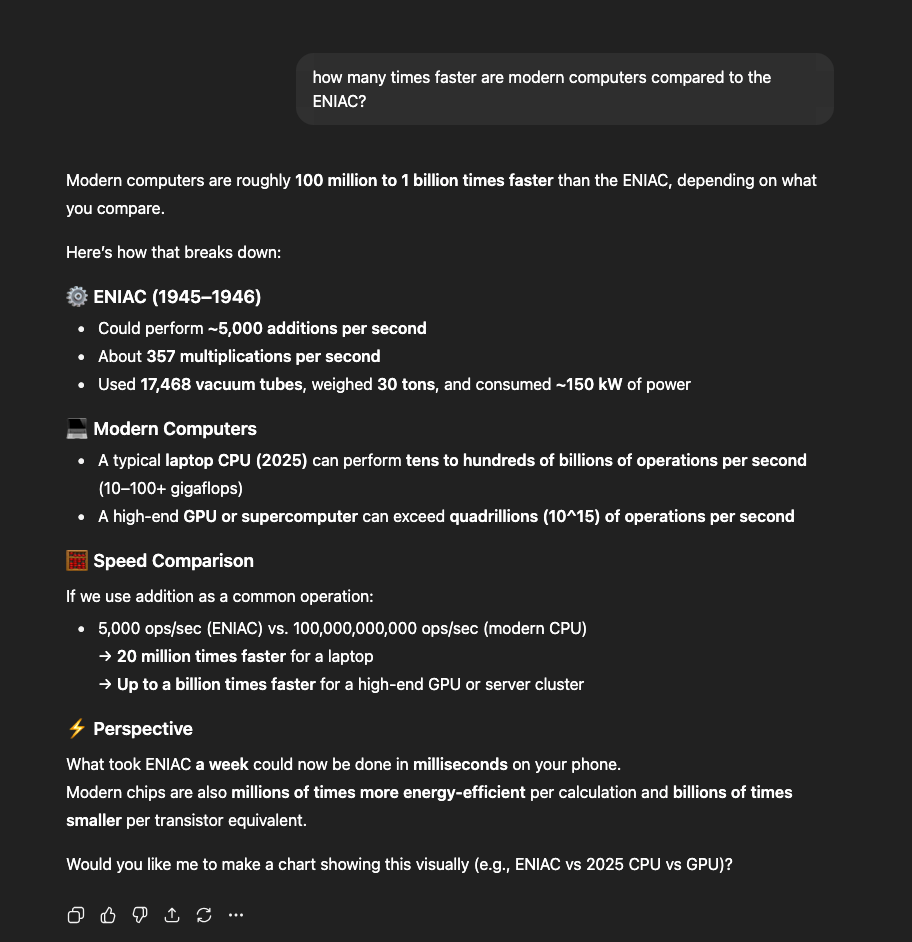

And here's some information about how big it was, how much computation it could handle, and how much it cost to make.

In today's inflation-adjusted dollars, it cost the US Army ~$8,000,000 to build this absolute unity in 1946. The ENIAC wouldn't be recognized as a computer by people living today. It would seem too dumb because computers have the luxury of using computers that are checks notes 100 million to 1 billion times faster than the ENIAC.

I bought a Mac Book a few weeks ago and it cost $1,000, or 0.0125% the cost of the ENIAC. That's insanely deflationary. And despite this incredible tech deflation, the cost of living has consistently risen over the course of my life and has been accelerating in recent years. The money printer is orders of magnitude stronger than the forces of tech-driven deflation. AI is not going to change that.

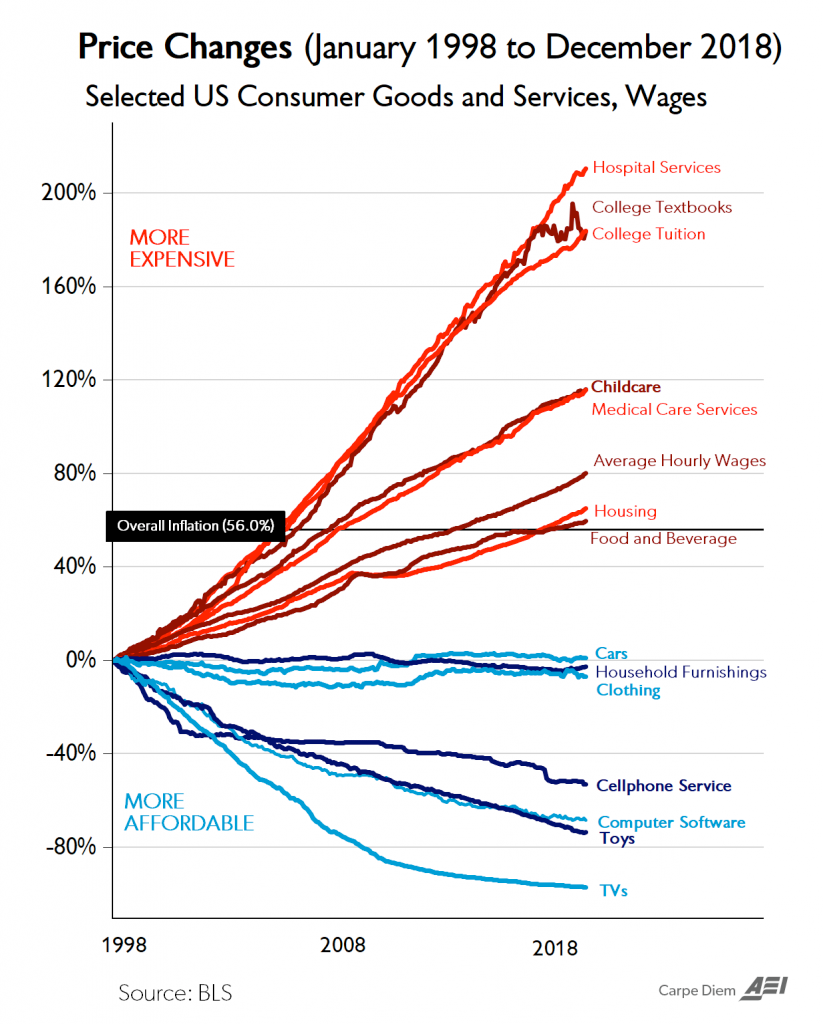

This chart was popular many years ago and it really drives home the problem. (I'd love to see this chart updated through the COVID years. I imagine it looks much worse.)

Money printing perturbs capital allocation. When money is printed, it has to go somewhere. As you can see from the chart, the last 27 years has seen a flow of money from the monetary spigots into the market, which has driven up the costs for things that are deemed essential to life in 2025. Medical care, housing, education, food, and childcare. Saving some money on your big screen TV, smartphone and video games is nice, but it doesn't save you enough to be able to weather the forces of price increases in the highest ticket items that are essential to maintaining a life of dignity.

Tech deflation is certainly real, and it is certainly incredible for humanity. Unfortunately, humanity is not able to reap the full benefits of tech deflation because people are forced to fight the powerful forces of monetary inflation. If we want to live in a society where everyone has an exponentially higher chance of leading an extremely high quality life in which they can reap the full benefits offered by advances in technology, tech deflation needs to be paired with a deflationary money like bitcoin. As technology makes us more productive, expands the spectrum of potential goods and services that can be brought to the market relatively cheaply and pushes humanity forward, people should be able to buy more for less and save their excess productivity in a money that works for them, not against them.

Until then, all of the tech deflation we see in the market will be bitter sweet. We're advancing tremendously, but not everyone sees their quality of life advancing. They experience the exact opposite.

For some reason, it seems that most people in Silicon Valley do not understand this simple truth.

James Check raised a sobering observation about this market cycle: retail investors may not return with the fervor we saw in 2017 and 2021. The simple reality is that everyday Americans don't have the capital anymore. While institutions quietly accumulate Bitcoin through ETFs and sophisticated derivatives, regular people are drowning in rising costs. Health insurance premiums are spiking 25-60% across the country during this enrollment period. Germany just announced plans to raise retirement age to 72, with similar discussions happening here at 67. The quality of life for those without financial assets has deteriorated dramatically as real costs explode while wages stagnate.

"I don't think retail has the money. I don't think they have the money to come." - James Check

This cycle is fundamentally different. The mania phase driven by retail FOMO may not materialize because retail simply lacks disposable income for speculative investments. Instead, we're witnessing something more profound: institutional recognition of Bitcoin's role in the debasement trade. While this may feel less exciting than previous cycles, it represents Bitcoin's maturation into a legitimate macro asset that doesn't need retail enthusiasm to appreciate.

Check out the full podcast here for more on treasury company dynamics, iBit options explosion, and the $95K floor thesis.

Mara Holdings Buys 400 Bitcoin for $46.3M

Dubai Ruler Hails Leading Virtual Assets Market

BlackRock CEO Views Bitcoin Like Gold Alternative

Gold Reaches New All-Time High at $4,075

Lagarde Admits Bitcoin Disrupting Financial System

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

Created by Carl Dong (former Bitcoin Core contributor), unlike other VPNs, it can’t log your activity by design, delivering verifiable privacy you can trust.

Outsmarts internet censorship: works even on the most restrictive Wi-Fi networks where other VPNs fail.

Pay with bitcoin over Lightning: better privacy and low fees.

No email required: accounts are generated like bitcoin wallets.

No trade-offs: browse freely with fast, reliable speeds.

Exclusive Deal for TFTC Listeners:

Sign up at obscura.net and use code TFTC25 for 25% off your first 12 months.

Now available on macOS, iOS, and WireGuard, with more platforms coming soon — so your privacy travels with you wherever you go.

You know the story of bitcoin’s market cycles... euphoric blow-offs, brutal crashes. Maybe not anymore. The Bitcoin Checkpoint takes a deep look at how the 2023–2025 cycle has rewritten market structure and why these changes could be permanent.

Inside, you’ll find analysis of record-low volatility, ETF flows absorbing billions monthly, and why long-term holders remain in control with $1.3T in unrealized profit. Plus, download now for automatic access to the event where James Check took a deep dive into the report himself.

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Ready for my forever home.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: