Across the United States, a pivotal shift in consumer spending is emerging, transcending demographic boundaries.

Retailers across the spectrum have signaled changing consumer habits. The shift is not limited to a specific demographic; dollar stores report that habitual customers are struggling to afford shopping, while higher-end retailers like Target are restructuring their pricing strategies to cater to budget-conscious consumers.

Target Corporation's introduction of the Deal Worthy brand in February, offering around 400 everyday items at less than a dollar, exemplifies the strategic shift. This move suggests a pivot toward value-focused retailing to attract consumers who are increasingly bargain-hunting.

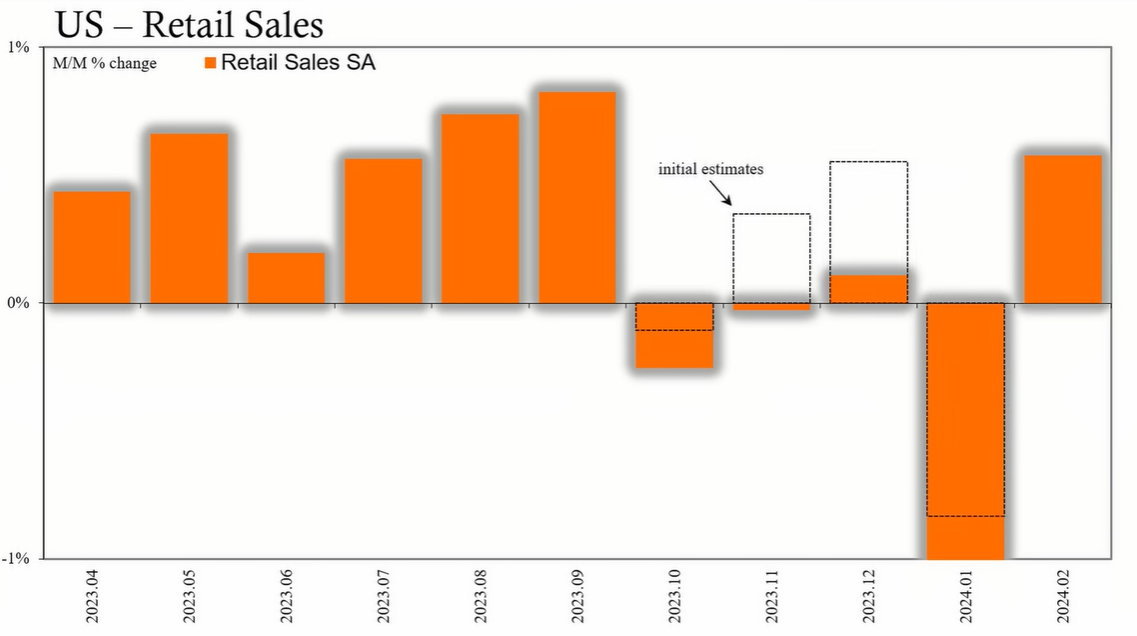

Despite positive indicators from the stock market and Federal Reserve commentary suggesting a healthy economy, retail behavior contradicts this optimism. Government statistics reflect a downturn in retail sales, and Bank of America reports a spending slowdown even among higher-income households.

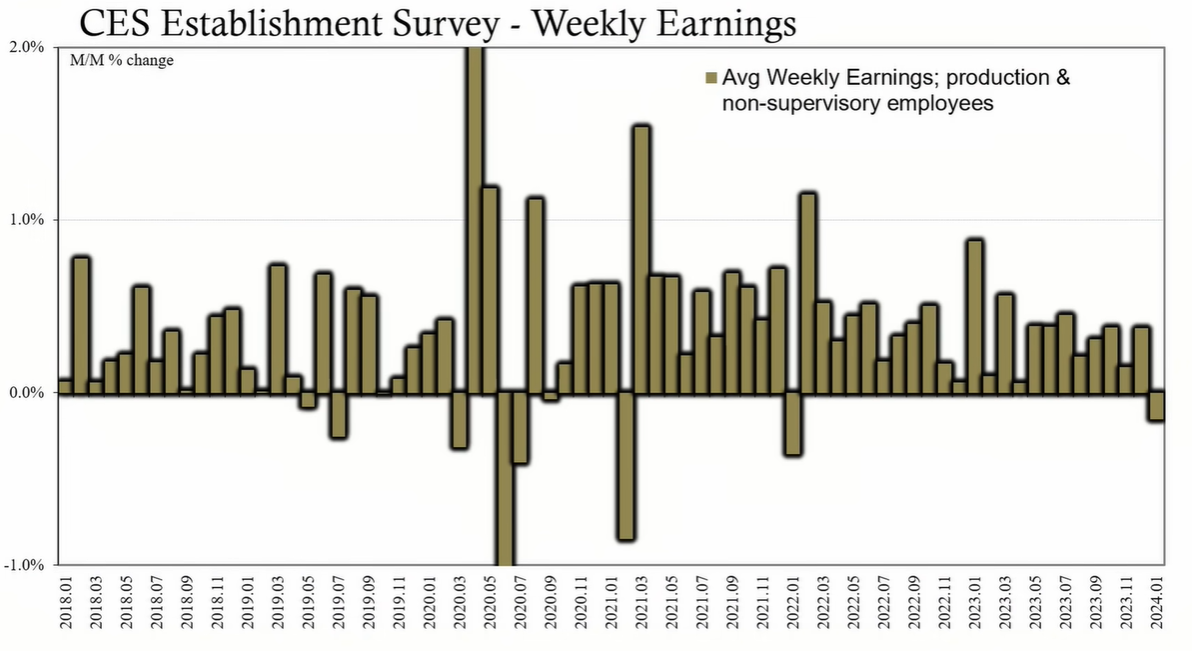

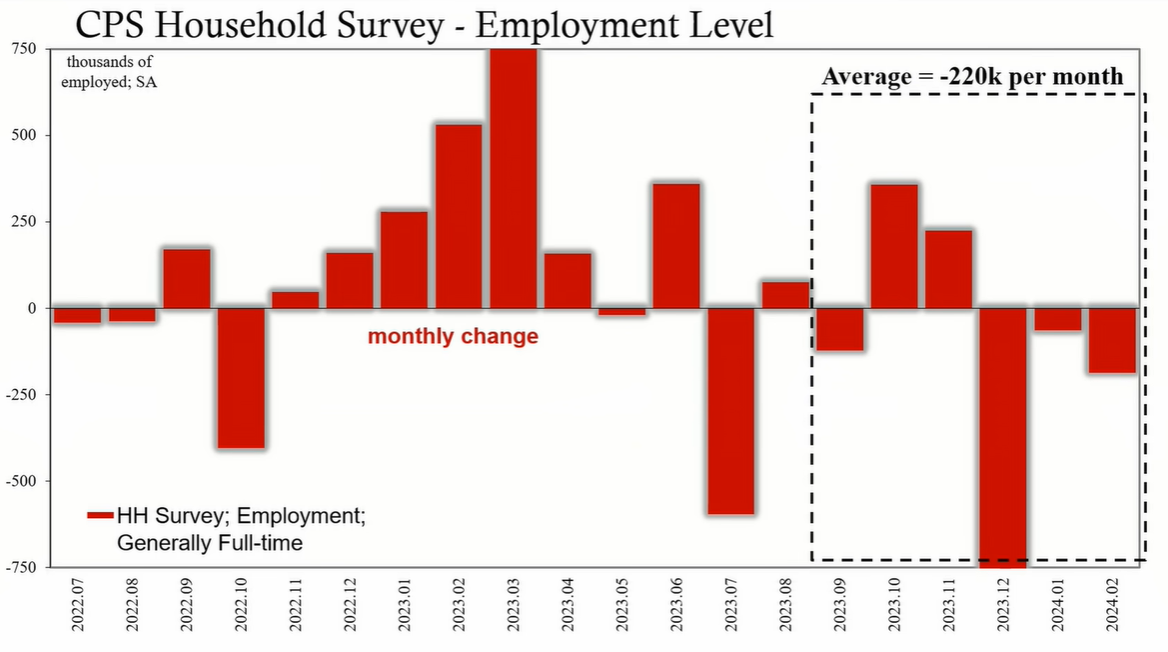

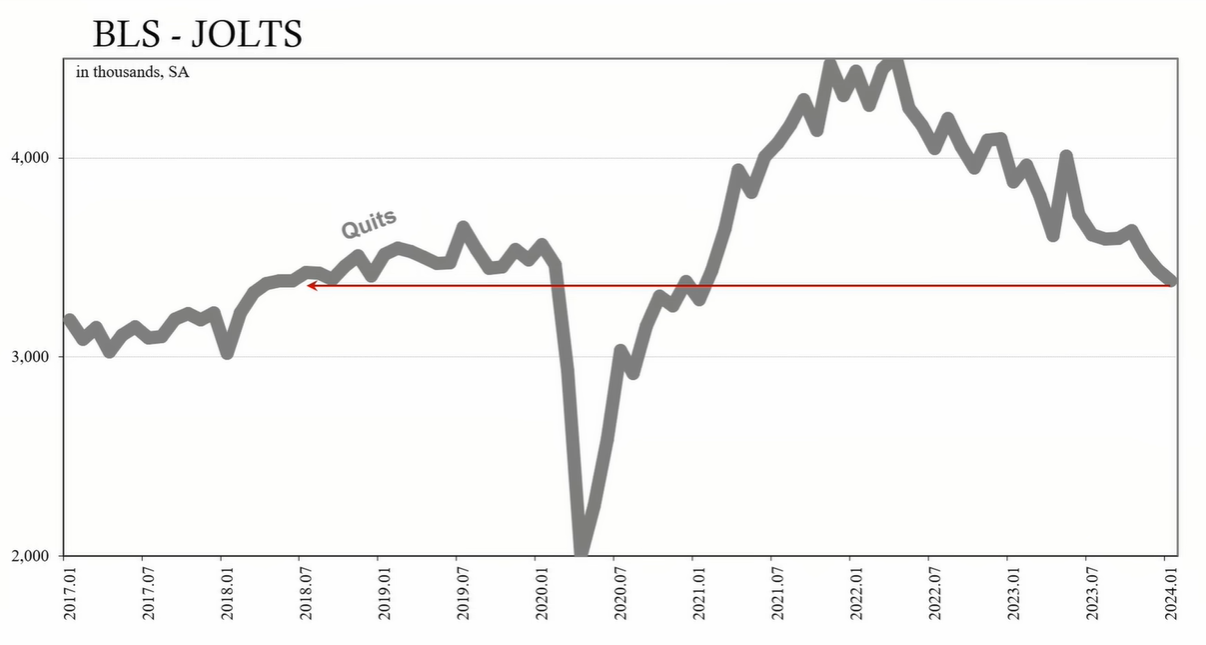

While official figures tout wage growth, the labor market reveals a less rosy picture. A decline in hours worked has resulted in lower incomes for many. The lack of robust demand for U.S. labor has led to employers reducing hours, signaling a potential economic downturn.

Consumer credit availability and the psychological impact of an uncertain job market are influencing spending behaviors. Concerns about reduced hours or job loss can lead to a tightening of household budgets, further affecting retail sales.

The concept of disinflation has been misunderstood. Prices are unlikely to return to pre-2020 levels, and the resulting income pressure, especially on middle-income individuals, has led to a conservative approach to spending. Business owners witnessing a revenue decline respond by cutting costs, including reducing employee hours.

Even affluent consumers are exercising caution, as evidenced by brands like Lululemon acknowledging a shift in U.S. consumer behavior. This challenges the expectation that wealthier individuals would exhibit increased spending in line with their net worth.

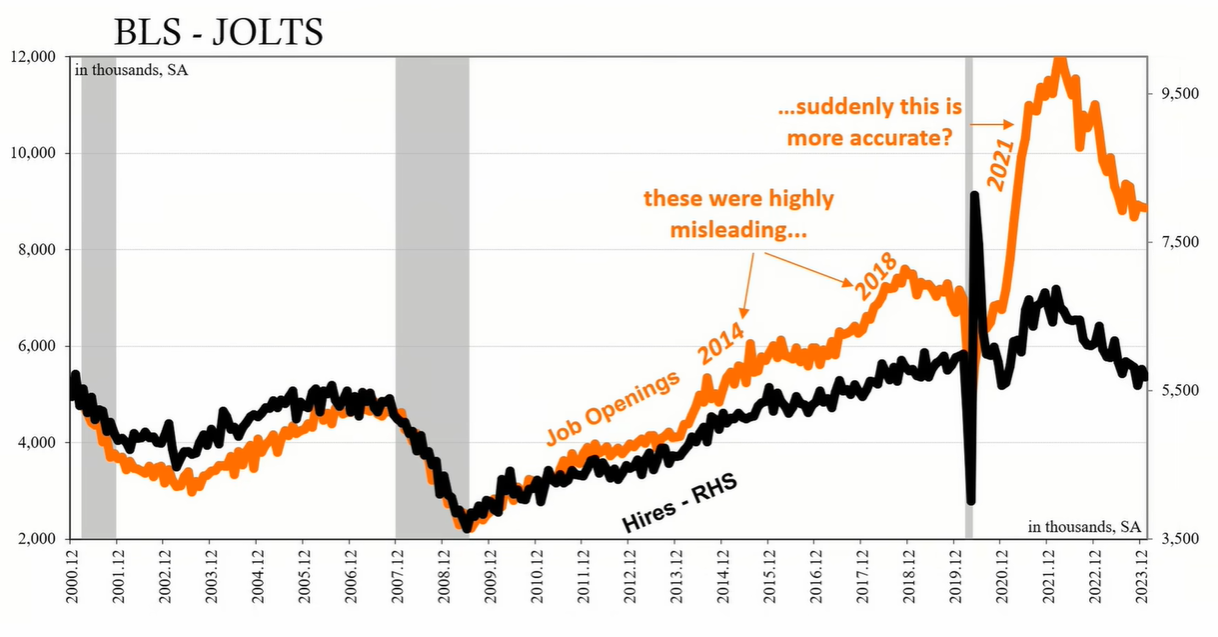

The Job Openings and Labor Turnover Survey (JOLTS) suggests a plethora of job openings, yet the reality of hiring rates paints a different picture. The mismatch between reported job vacancies and the actual hiring trend indicates a weakening demand for labor.

The evidence from retailers and the labor market indicates that U.S. consumers, irrespective of income level, are experiencing a shift in spending due to various economic pressures. Despite optimistic market narratives, the reality for many Americans is a more cautious approach to their finances, suggestive of underlying economic fragility.