Recent data reveals a steep drop in consumer confidence, driven by growing unemployment fears and signaling economic instability.

Recent data indicates a significant downturn in consumer confidence, marking one of the sharpest declines on record. This decline is attributed to growing concerns about the labor market, particularly the fear of unemployment, which has seen the most significant increase in over a decade.

The University of Michigan's consumer confidence index dropped from 77.2 in April to 67.4 in May, a much steeper decline than expected. This decrease reflects the largest miss to expectations in the survey's history. The change in consumer sentiment is consistent across demographics, including age, income, and education groups. The index drop signals a pervasive worry among consumers about inflation, unemployment, and rising interest rates.

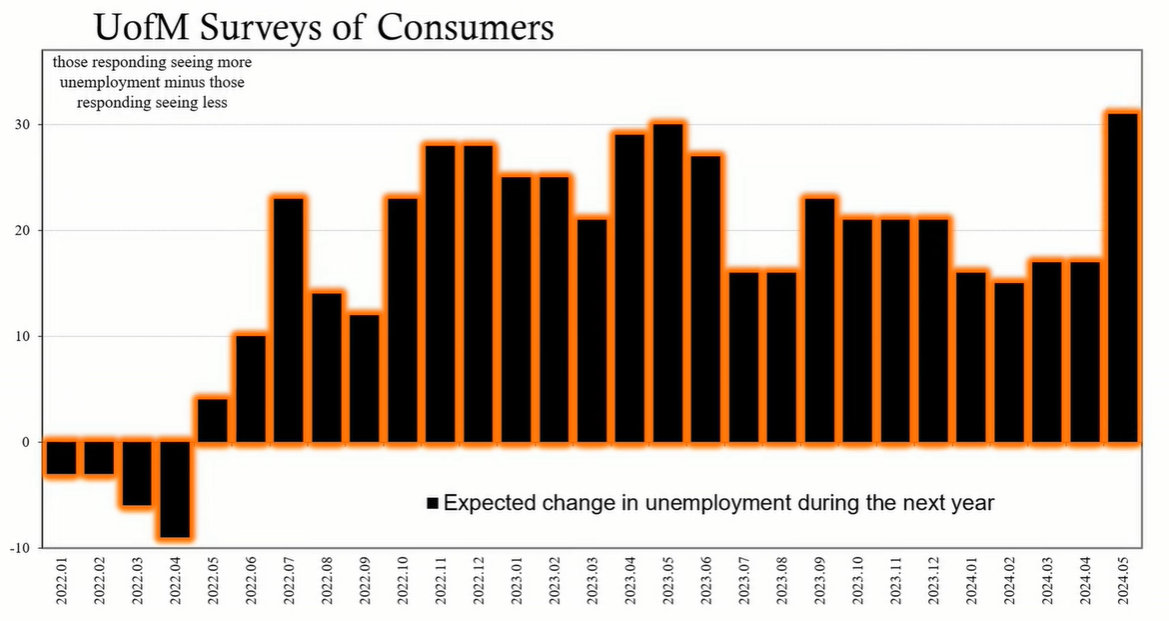

Unemployment fears are at the forefront of consumer concerns. The University of Michigan survey revealed a net 31 percentage points more respondents expecting higher unemployment in the next year, the most significant disparity since 2011. This trend aligns with reports from companies about the necessity to reduce their workforce, signaling a potential shift towards a more challenging economic period.

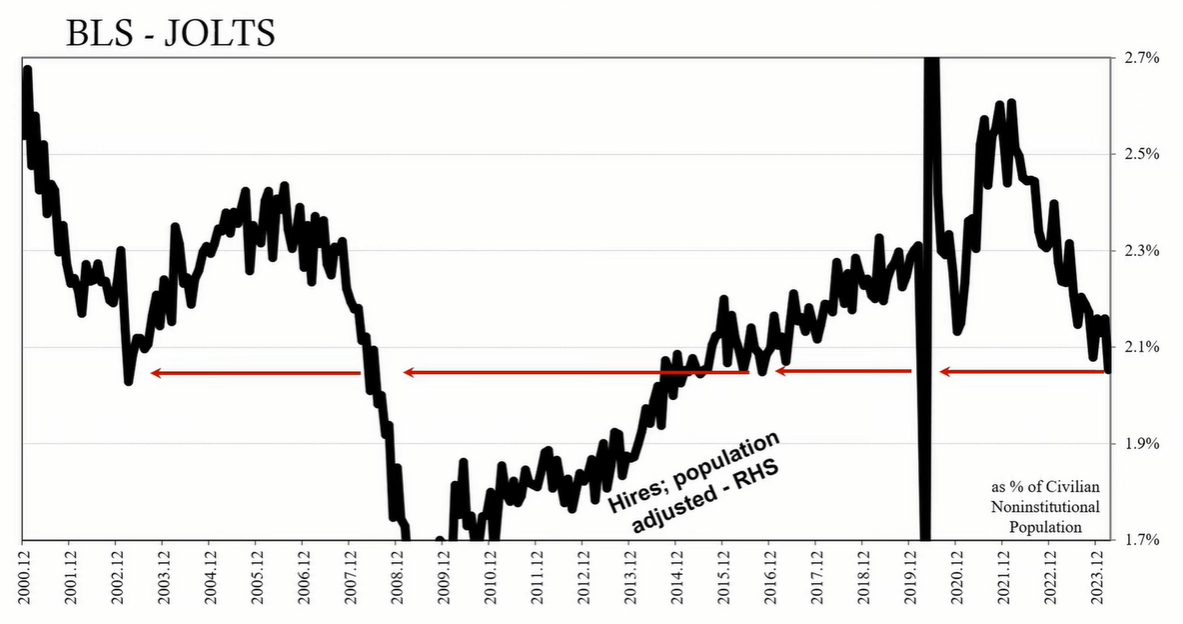

There is a growing body of evidence suggesting that the economy has been experiencing a partial recession for some time, with an increasing likelihood of transitioning to a full recession. Hiring rates have significantly decreased, and the general economic conditions do not reflect the inflationary pressures suggested by consumer price indices. This disconnect between consumer prices and the broader economy is becoming more apparent.

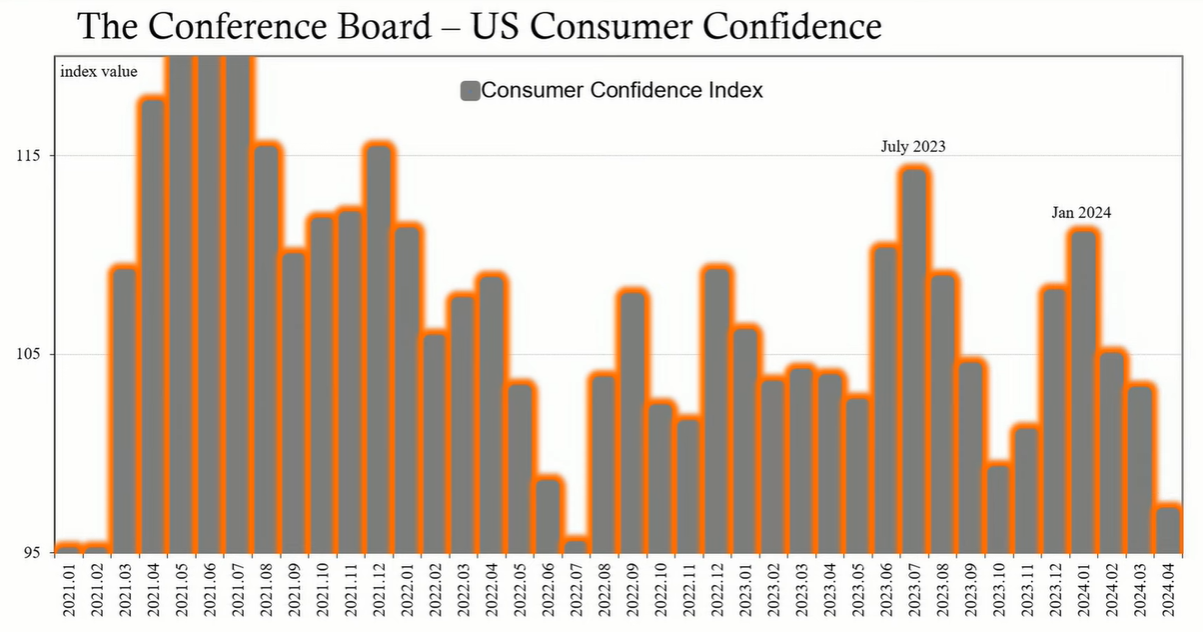

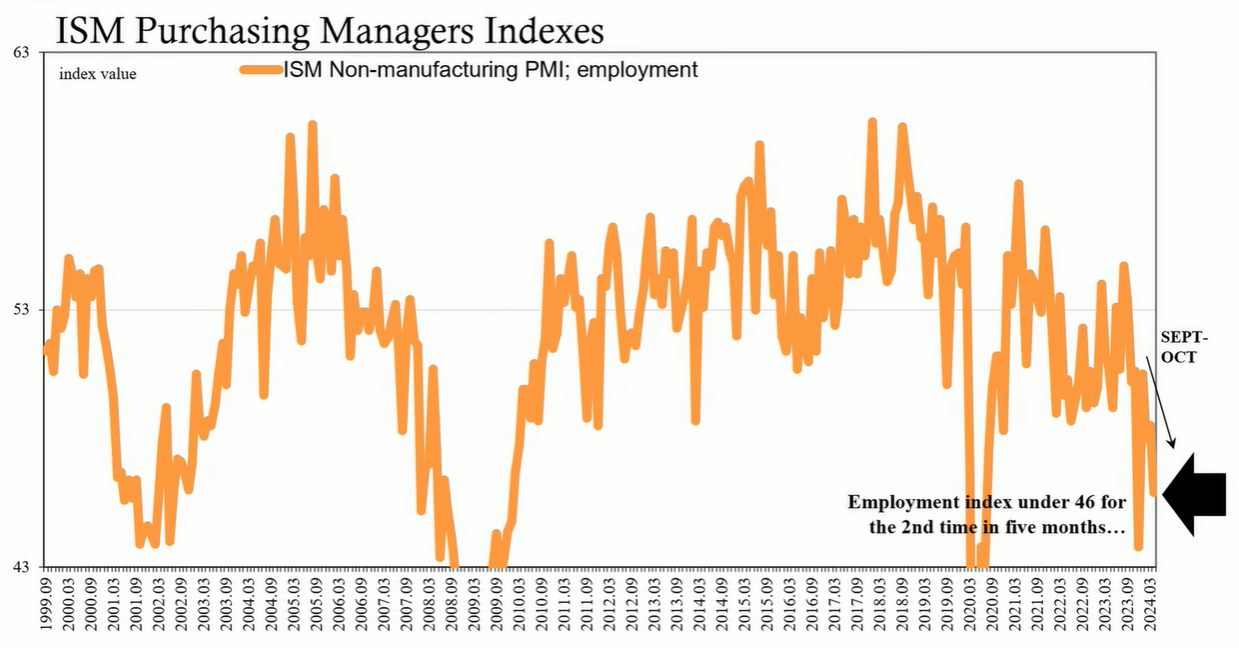

Falling consumer confidence has implications beyond individual spending; it affects businesses' decisions on labor and investment. Notably, the Conference Board's consumer confidence index also reported a decline, citing concerns over the current labor market and future business conditions. Similarly, the ISM services index, a gauge for the non-manufacturing sector, showed a drop below the critical 50-point mark, indicating contraction.

The Federal Reserve's response to inflation, primarily through interest rate hikes, has been a key factor in shaping the current economic landscape. However, the disconnect between the Fed's focus on CPI and the weakening economy could lead to a reassessment of interest rate policies if the trend towards a full recession continues.

The confluence of consumer sentiment data and labor market indicators paints a picture of an economy in transition, moving away from the perception of a robust recovery to grappling with the realities of a potential recession. This transition is accompanied by a shift in the narrative from an inflation-dominated economy to concerns over stagflation and, ultimately, the possibility of a more persistent economic downturn. The situation warrants close monitoring as it unfolds, with particular attention to labor market dynamics, consumer spending patterns, and the Fed's monetary policy decisions.