The collapse of Republic First Bank, marked by aggressive expansion and financial missteps, signals potential systemic vulnerabilities in the banking sector that could herald a broader crisis.

On Friday, after the closure of financial markets, the US Federal Deposit Insurance Corporation (FDIC) announced the failure of a Philadelphia-based bank. This incident has reignited concerns over the potential for a resurgence in the banking crisis. Republic First, operating under the name Republic First, was seized by state regulators in Pennsylvania, resulting in significant taxpayer expense.

Pennsylvania's Department of Banking and Securities took action to seize Republic First, prompting the FDIC to act as receiver. The FDIC arranged for Fulton Bank, National Association, to take over almost all deposits and assets of Republic First Bank. As of January 31, 2024, Republic First had approximately $6 billion in total assets and $4 billion in total deposits. The estimated cost to the Deposit Insurance Fund due to Republic First's failure is $667 million.

Republic First's failure can be attributed to aggressive expansion during the uncertain periods of 2020 and 2021, fueled by government stimulus and an assumption of continued economic heat. This expansion, however, was based on bubble-like behavior, which became unsustainable as the economy began to correct post-pandemic imbalances.

Republic First had not filed any financial statements with the SEC since the third quarter of 2022, raising red flags about its condition. The bank had aggressively grown its assets from $3.3 billion in 2019 to $6.16 billion in the first quarter of 2023, nearly doubling in size during the pandemic. Its asset portfolio included a significant amount of available-for-sale securities, which had depreciated in value, exacerbating the bank's vulnerabilities.

The bank's aggressive growth was not matched with stable deposit funding, leading to a reliance on significant borrowing. Republic First had secured a $35 million capital infusion, but the deal was later terminated, leaving the bank exposed. The bank's liability side showed a dramatic increase in senior debt, growing from $81 million in 2021 to over $1 billion by the first quarter of 2023.

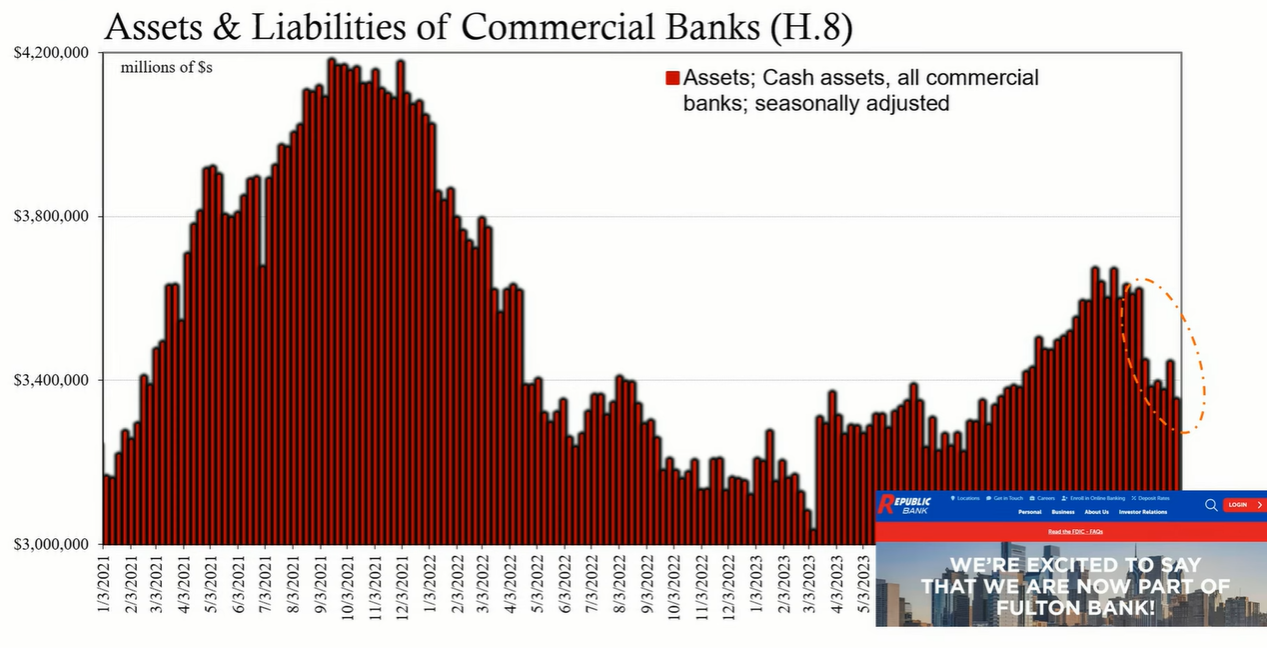

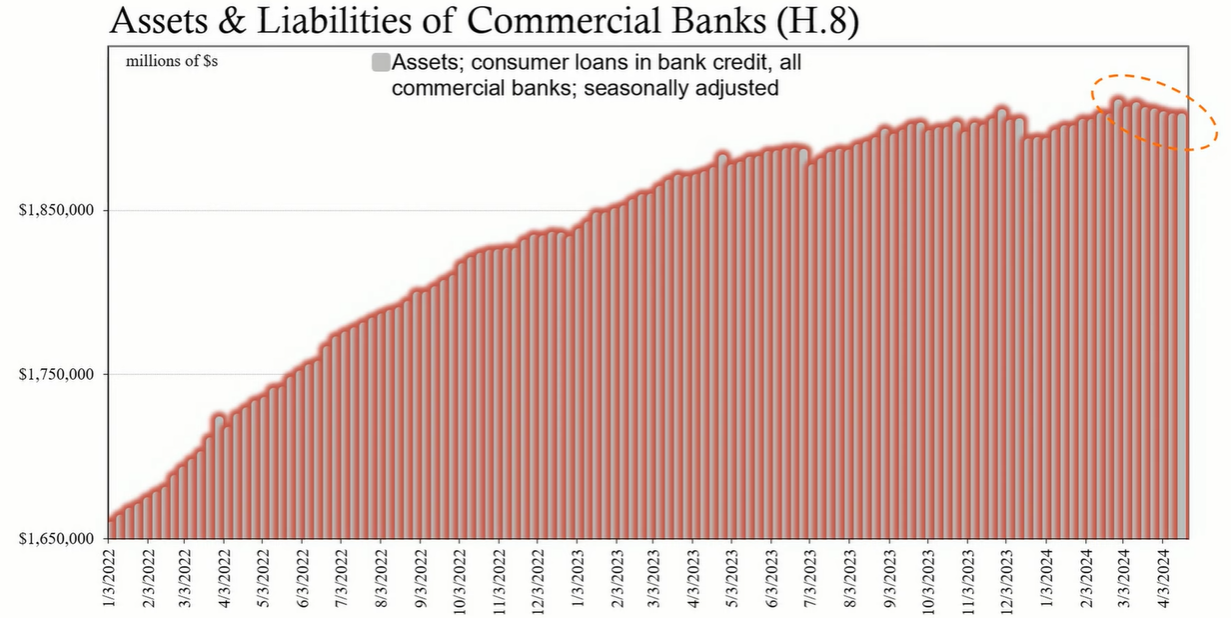

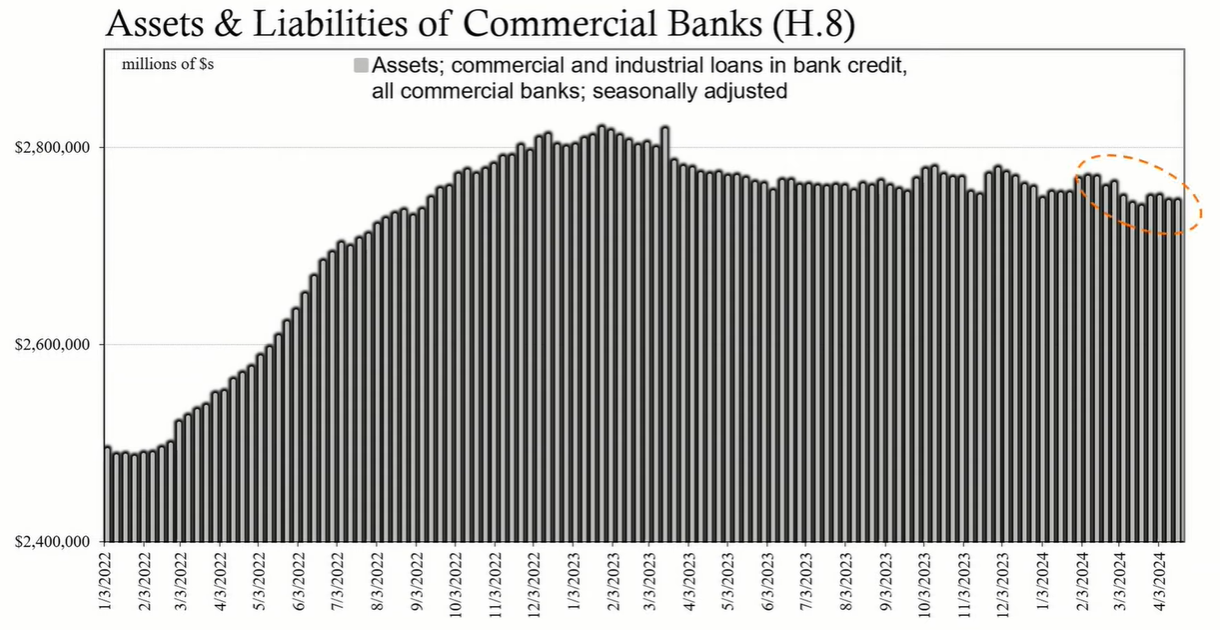

The failure of Republic First raises broader concerns about similar vulnerabilities across the banking sector. There are indications of wider deposit withdrawals and cash strains among commercial banks, along with risk-averse lending behavior. This suggests a lack of confidence in the economic outlook and possible preparation for further corrective measures.

The collapse of Republic First does not solely reflect the downfall of a single institution, but rather points to a pattern of behavior that pervades the banking industry and the broader economy. The aggressive expansion based on now-challenged assumptions has left many banks susceptible to the current correction process. The banking sector's response to these challenges, including unwinding bubble-era mistakes, will shape the trajectory of the purported second chapter of the banking crisis.