Our pets' heads are falling off!

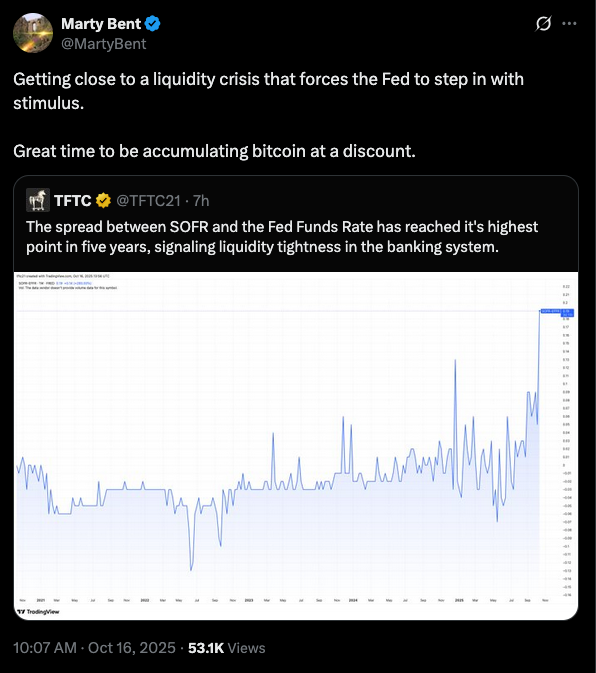

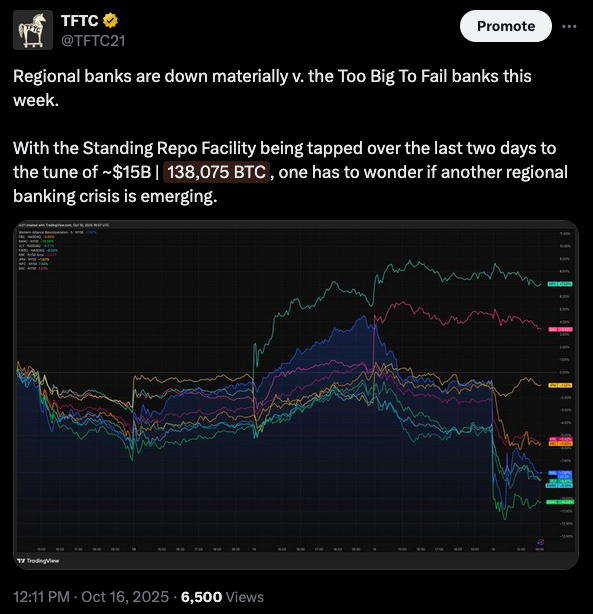

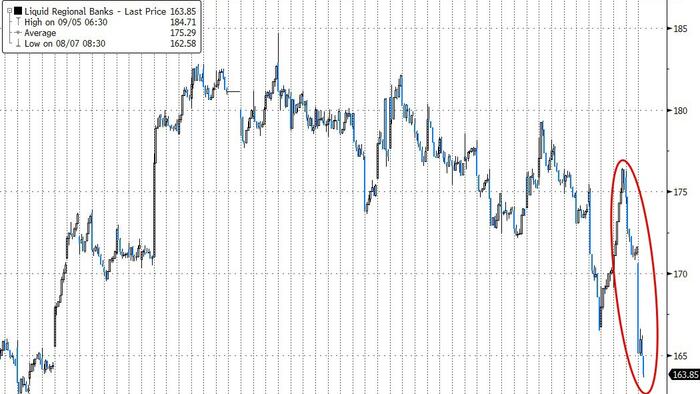

Woo doggie. That was the most active day in markets since the "Tariff Tantrum" earlier this year. The spread between SOFR and the Fed Funds Rate blew out to it's highest point since the COVID crisis. Leaving many to speculate that there is an emerging liquidity crisis in the banking sector. Many are speculating that it's coming out of the regional banks after looking at their stock performance today in relation to the Too Big To Fail banks.

It seems that there are also knock on effects of the Tricolor auto lending implosion last month that are beginning to emerge.

Apparently Tricolor wasn't the only lender exhibiting extremely relaxed underwriting practices and handing out loans to anyone with a pulse. To make matters worse, it seems that many banks lapsed on the due diligence of their counterparts who were giving out these loans. Leading to a domino effect that has forced a number of banks, including JP Morgan, to right-off nine figure loans.

I'm not sure if this is directly related to the budding credit crisis, but the Standing Repo Facility is being tapped for the first time in many years, which signals a desperate dash for liquidity for at least some banks. To get a better understanding of the repo markets, I highly recommend you check out this explainer from Nik Bhatia from The Bitcoin Layer.

Lastly, gold is still the hottest chick in the room. It is currently sitting at $4,331 per ounce and the chart is awe inspiring.

It looks like a bitcoin chart, but over the course of 100 years.

Something is definitely happening with gold. This price action is extremely abnormal and it signals to me that it is very geopolitical in nature. I'll reiterate what I said early this week while summarizing my conversation with Vince Lanci on TFTC, I would not be surprised if China is making the big move to make an alternative settlement network backed by gold and is forcing central banks and governments into the market to bid for as much of the pet rock as they can get their hands on. With this in mind, there are many out there who are disappointed that bitcoin isn't moving in lock step with gold right now. To those people I say, zoom out.

Bitcoin has performed exceptionally well so far this decade and will continue to do so.

Gold is having its day because governments are falling back to what they know as the dollar reserve system comes into question.

China is setting up a parallel settlement network using gold and it's using gold because it's been reliable for millennia and, more importantly, has the liquidity profile to settle the size they need to settle if they're going to compete with treasuries.

This does not change the fact that bitcoin is superior in every way to gold. It's a harder money that's more easily divisible, easier to send, easier to verify and easier to custody.

Bitcoin still has many trillions of dollars of market cap to add before it can compete with gold from a liquidity perspective.

I am more optimistic than ever that bitcoin will reach this point because more people are learning these facts every day and the infrastructure around the protocol is advancing at a faster pace than I've ever seen.

Square's release this week is the latest example of this. 4,000,000 merchants across the United States are currently being forced to ask the question, "Should I accept and hold bitcoin?"

How many do you think will take the plunge? How many more products will come to market that make it easier to use bitcoin? How many more tradfi spasms will there be? How many more inflationary bouts will there be? How many more authoritarian crack downs on financial rails will there be?

If the answer to any of the above questions is > 1 than you can guarantee that more people are coming to bitcoin over time.

It's absolute chaos out there. Take advantage of the cheap sats while the sale lasts. And, on that note, look for the Fed and the Treasury to step in as soon as things look like they're getting dire. They will plug the holes with so much liquidity you'll feel like you're at a water park while looking at your Robinhood account.

Vince Lanci laid out a compelling case for why gold will never face meaningful tariffs, despite Trump's occasional threats. He explained that gold serves as an "unintentional loophole" in the global financial system—it's classified as a good rather than money, allowing nations to circumvent sanctions through barter arrangements. This isn't exploitation; it's an "honor among thieves" understanding that all major powers utilize. Lanci pointed to Japan's practice of buying American gold to satisfy trade deficit requirements, essentially using it as a monetary laundromat that keeps both parties happy.

"You cannot tariff gold because gold is the intentional, unintentional loophole to avoid sanctions. Everyone does it."- Vince Lanci

The mercantilism principle is straightforward, as Vince noted: you tariff what you make, not what you need. With the US now repatriating gold for its own strategic purposes—likely related to competing with China's gold-backed BRICS initiatives—tariffing gold would be counterproductive. When Trump floated gold tariffs, the market's immediate negative reaction forced a quick reversal. The message is clear: gold's role as a sanctions workaround is too valuable to disrupt.

Check out the full podcast here for more on China's gold-backed currency system, Bitcoin ETF manipulation, and the coming 1970s-style crisis.

Japan Plans Bitcoin Insider Trading Ban

Jason Critiques Saylor After Long Hiatus

Downing Introduces Bitcoin 401(k) Bill

MicroStrategy Stock Returns to 2025 Start

Created by Carl Dong (former Bitcoin Core contributor), unlike other VPNs, it can’t log your activity by design, delivering verifiable privacy you can trust.

Outsmarts internet censorship: works even on the most restrictive Wi-Fi networks where other VPNs fail.

Pay with bitcoin over Lightning: better privacy and low fees.

No email required: accounts are generated like bitcoin wallets.

No trade-offs: browse freely with fast, reliable speeds.

Exclusive Deal for TFTC Listeners:

Sign up at obscura.net and use code TFTC25 for 25% off your first 12 months.

Now available on macOS, iOS, and WireGuard, with more platforms coming soon — so your privacy travels with you wherever you go.

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

You know the story of bitcoin’s market cycles... euphoric blow-offs, brutal crashes. Maybe not anymore. The Bitcoin Checkpoint takes a deep look at how the 2023–2025 cycle has rewritten market structure and why these changes could be permanent.

Inside, you’ll find analysis of record-low volatility, ETF flows absorbing billions monthly, and why long-term holders remain in control with $1.3T in unrealized profit. Plus, download now for automatic access to the event where James Check took a deep dive into the report himself.

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Early RHR tomorrow. Need to set an alarm.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: