The US economy is experiencing a 'Recession Light,' with decreased economic activity but stable employment levels, defying typical recession patterns.

Recent data on the US economy indicates signs of a "recession light," characterized by a downturn in various economic indicators while notably lacking widespread job cuts. This raises questions about the state of the labor market and what could potentially trigger more severe consequences, such as significant layoffs.

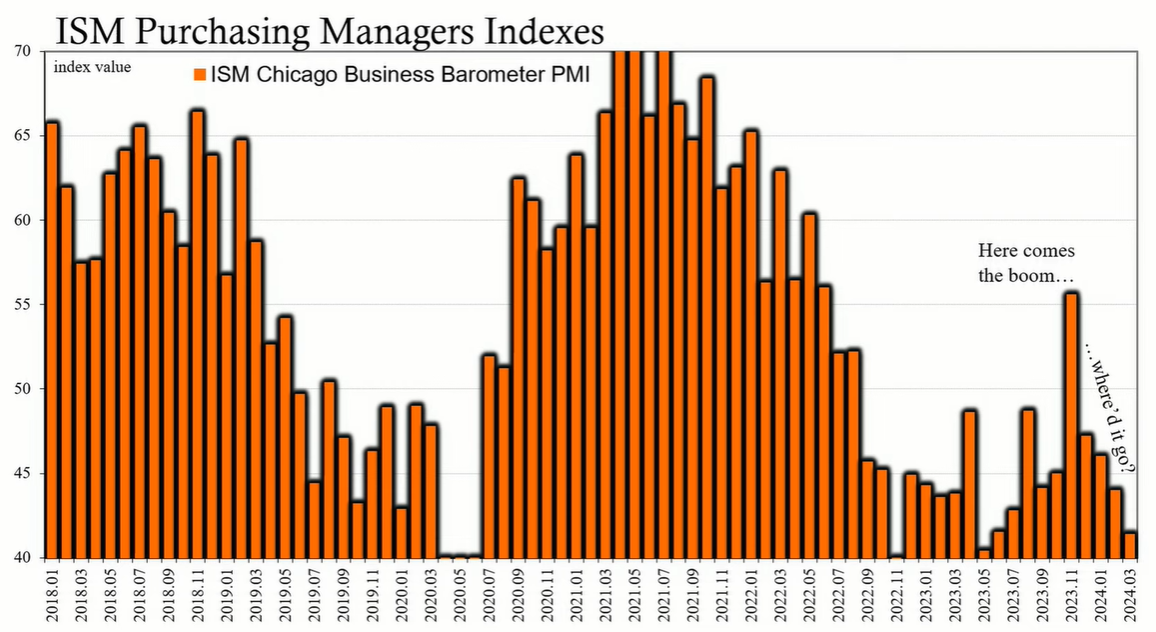

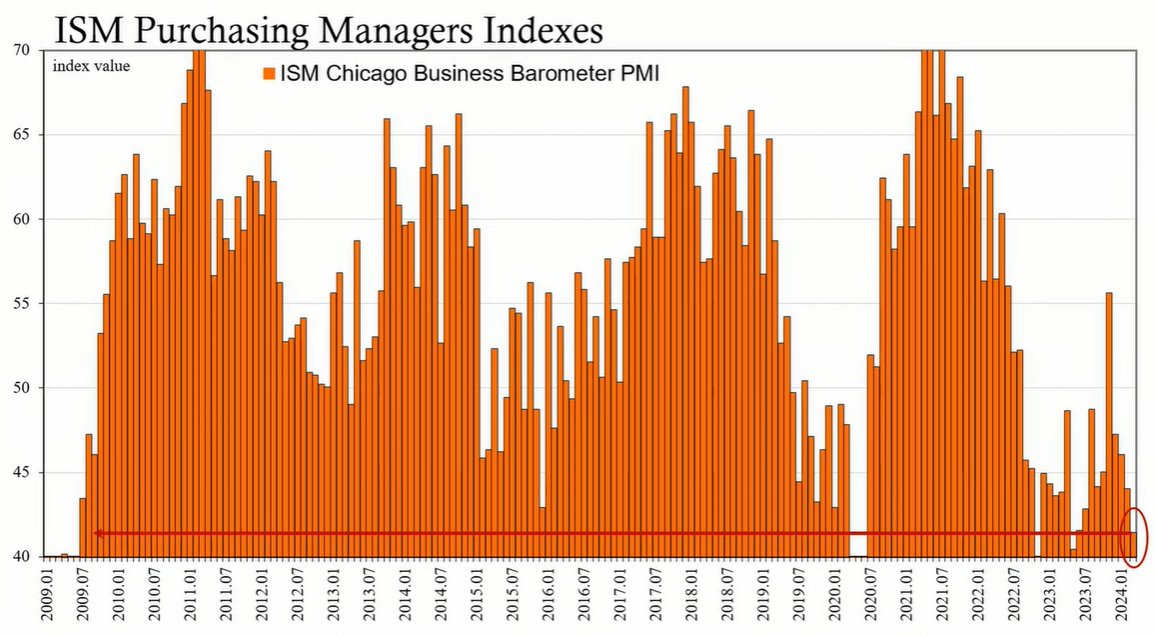

The soft survey data, which reflects business sentiment, shows a decline in economic activity. The Chicago business barometer from the ISM dropped to 41.4 in March, signaling contraction. New orders are down, and backlogs have significantly contracted, hinting at future challenges for businesses in managing costs and labor force.

Hard data such as industrial production and factory orders support the sentiment expressed in the soft data, indicating a downturn consistent with prior recessions. Historical analysis demonstrates that these soft sentiments often precede the tangible effects seen in the hard data, such as lower production numbers.

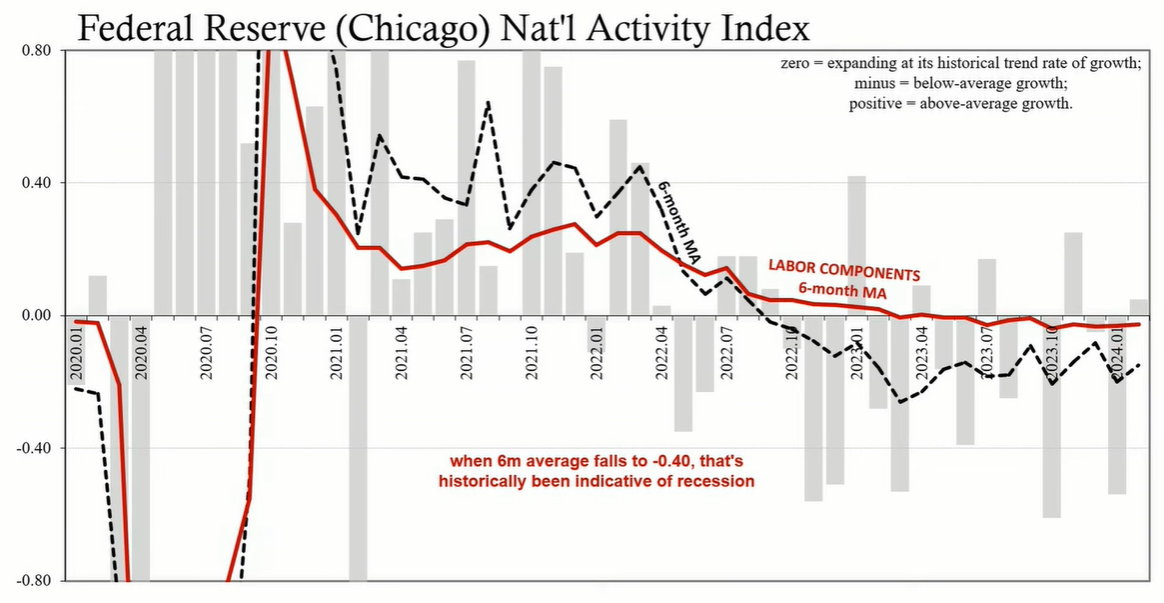

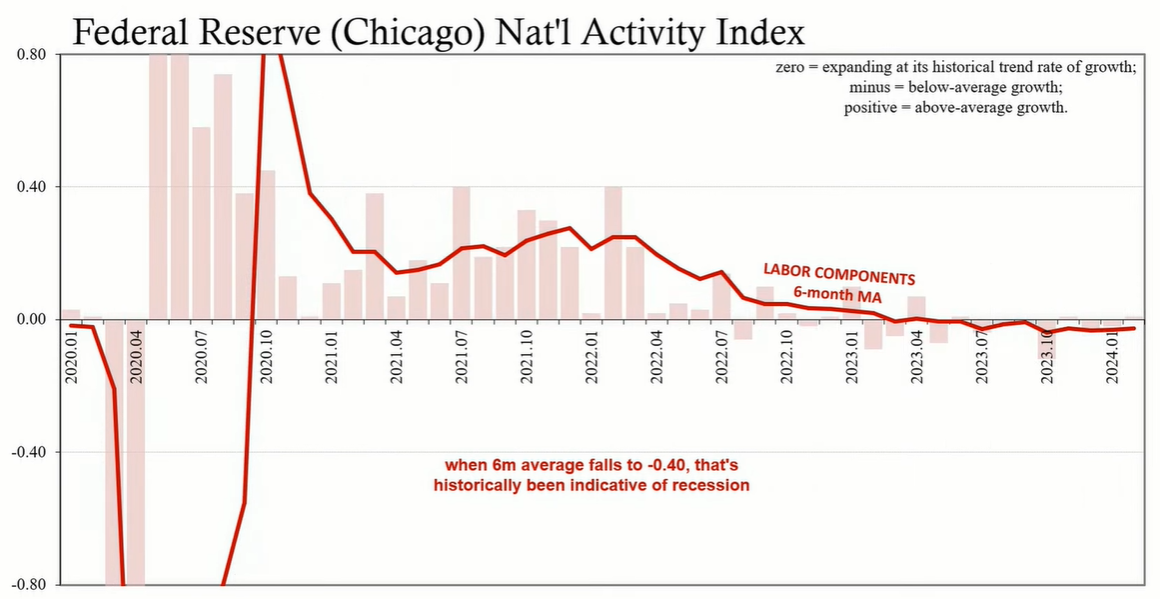

While the soft and hard data suggest a recessionary trend, the labor market has not yet exhibited the significant job cuts typically associated with a recession. The Chicago Fed's National Activity index shows a modest negative trend, but labor components like employment and hours worked remain relatively stable.

One reason for the absence of job cuts is labor hoarding, where businesses retain employees even in times of economic downturn, anticipating a future upswing. This behavior has been reinforced by recent economic uncertainties.

A deeper analysis reveals that the current labor market trends are part of a broader "silent depression" where businesses have been consistently cautious in their hiring practices since the early 2000s. The lack of optimism and a shift in business behaviors have led to fewer spare workers available for layoffs during downturns.

The current situation poses a risk that if economic conditions deteriorate further, businesses may be forced into layoffs, transitioning from a recession light to a full-blown recession. The labor market's resilience, despite other economic downturn indicators, suggests that any shifts in employment trends could have significant implications.

The US economy is in a unique position, experiencing recessionary indicators without the expected job cuts. Factors such as labor hoarding and long-term shifts in business hiring practices have contributed to this anomaly. As the economy continues to navigate these uncertain times, the potential for job cuts looms as a serious concern for the future health of the labor market and the overall economy.