From the launch of transformative Bitcoin ETFs to the impact of the Bitcoin halving and inflationary pressures, we dissect the elements contributing to Bitcoin's tripling in price and potential to exceed $100,000.

The recent surge in Bitcoin's value has captured the attention of both seasoned investors and novices alike. Within the past year, Bitcoin has seen its price triple, reaching an all-time high of nearly $69,000, a value that humorously aligns with the whims of tech magnate Elon Musk. More impressively, Bitcoin's valuation has skyrocketed twentyfold since the onset of the pandemic, outpacing the traditional inflation hedge, gold, which has nearly doubled in price, enabling gold enthusiasts like Peter Schiff to upgrade their wardrobe substantially.

So, what exactly is fueling this unprecedented Bitcoin boom? Three primary catalysts can be identified: the advent of Bitcoin ETFs, the Bitcoin halving event, and the persistent specter of inflation.

Firstly, Bitcoin ETFs have been a game-changer, funneling over $15 billion into the asset. These instruments allow investors to buy into Bitcoin akin to owning a share of a treasure-laden bag, without the complexities of direct ownership. While this introduces the risk of relying on a custodian, such as BlackRock, to safeguard the assets, it simplifies the investment process for those unfamiliar with the intricacies of self-custody. Companies like Unchained.com have emerged, offering an alternative that provides investors with the ability to retain control over their Bitcoin while enabling trading and leveraging options.

The second factor is the halving, a designed feature of Bitcoin's protocol that slashes the daily production of new coins by half every four years, akin to a sudden and permanent closure of half the world's gold mines. Historically, this scarcity-driven event has led to substantial price increases, suggesting that if past trends continue, Bitcoin could potentially breach the $100,000 mark in the future.

Lastly, inflation is playing a significant role in Bitcoin's ascendancy. Created by the enigmatic programmer Satoshi Nakamoto, Bitcoin was designed to mimic gold's attributes as a form of money: decentralization, limited supply, and a safe haven against failing government-issued currencies. In times of inflation, Bitcoin behaves like an amplified version of gold, with more pronounced price fluctuations. Its 20-fold increase compared to gold's doubling is a testament to its heightened sensitivity to inflationary pressures.

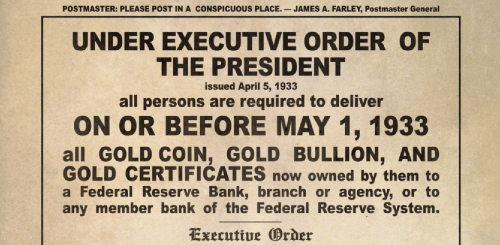

Looking ahead, the fundamental question remains: To what extent will Bitcoin challenge traditional paper money? While gold boasts a storied history, it is also vulnerable to government seizure, as evidenced in 1933 under President Franklin D. Roosevelt. In contrast, Bitcoin's decentralized nature renders it impervious to confiscation and offers the ease of electronic transferability.

For newcomers to Bitcoin, a cautious approach is advised. Starting with a nominal investment allows for a learning curve to navigate the volatility of the currency without the risk of premature sell-offs. As for seasoned investors, diversifying with both gold and Bitcoin could be a prudent strategy in anticipation of the eventual decline of fiat currencies.