Real estate is a shitcoin.

The guy who runs a 46,000-member DFW real estate investment Facebook group has figured out #bitcoin as unit of account and has started telling everyone the bad news 😂😂😂 pic.twitter.com/yiV7aS9Ggs

— Stephen Hall (@stephenjhall) June 7, 2024

One of the beauties of bitcoin is that it has the luxury of being patient. Time is on bitcoin's side. As more time passes more blocks are produced. These blocks are filled with transactions that are being settled in a peer-to-peer fashion with no trusted third parties. The network of distributed nodes and miners are passing along these transactions, organizing them and settling them on the network. The consensus rules are protecting the 21,000,000 supply cap, which gives individuals confidence that they are storing their value in an asset that cannot be debased. As more individuals wake up to the reality of these dynamics they, too, will decide to store their wealth in bitcoin and Econ 101 supply + demand dynamics come into play. Inevitably pushing the price higher as more people compete for a very scarce amount of bitcoin.

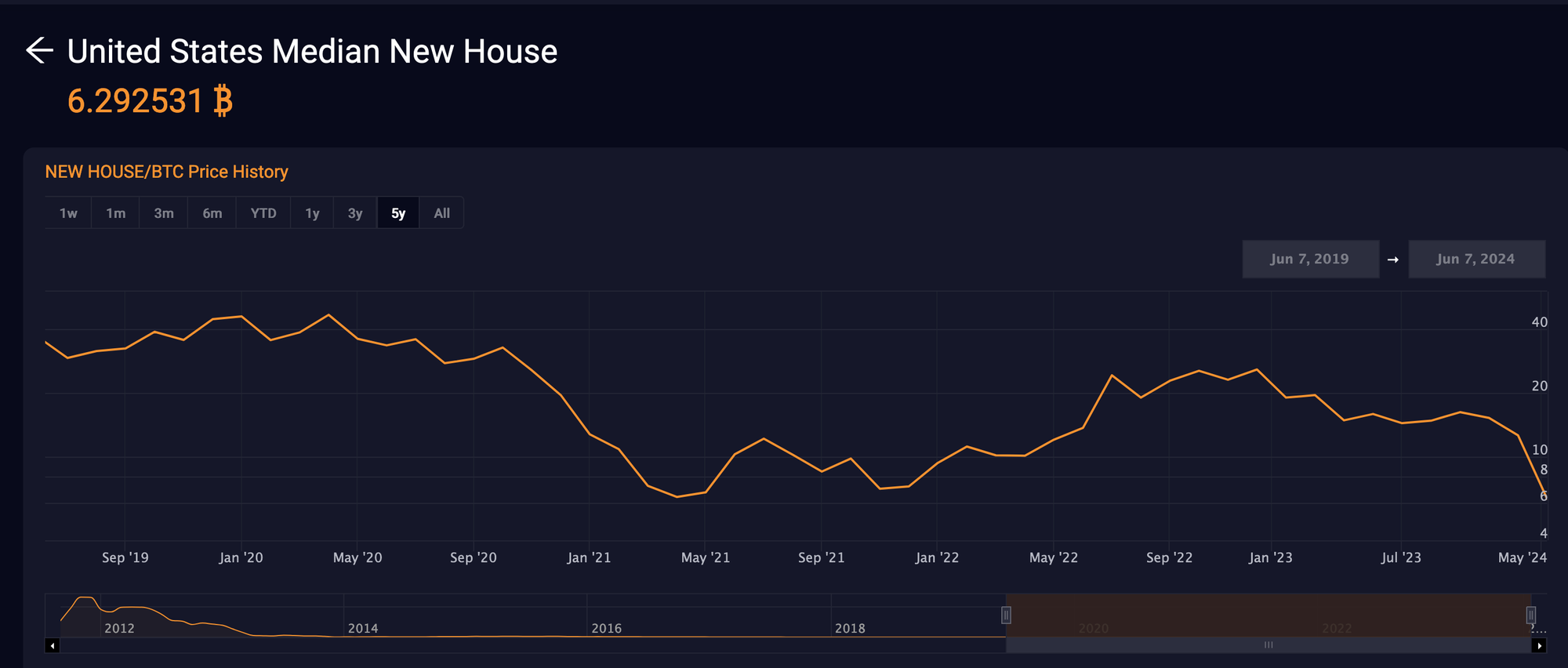

More blocks being produced as more time passes and the price continues to drift higher means that there is a mountain of historical data piling up that individuals can use to make more informed decisions about bitcoin. It seems that Jawad Dashti, a real estate investor who runs a large real estate focused Facebook group in the Dallas-Fort Worth area, has come to the hard conclusion that if you look at real estate investment objectively they are absolutely plummeting in bitcoin terms.

It’s hard to put my entire career and reputation at risk.

— Jawad Dashti CRE ⚡️ (@TheJawadDashti) June 7, 2024

But it is undeniable.

The value of a home only goes up from the debasement of the dollar.

When using bitcoin it plummets.

Residential real estate is crashing https://t.co/h1uzCPNYfv

This is a massive signal in your Uncle Marty's opinion. Having real estate investors wake up to the fact that their investments have only appreciated in dollar terms because of the debasement of the US dollar and the fact that people have been taught to view homes as a store of value for their wealth is an unlock that will inevitably lead to a flood of capital away from real estate investments and into bitcoin. The opportunity cost of piling your investment dollars or savings into real estate as opposed to bitcoin is simply too high.

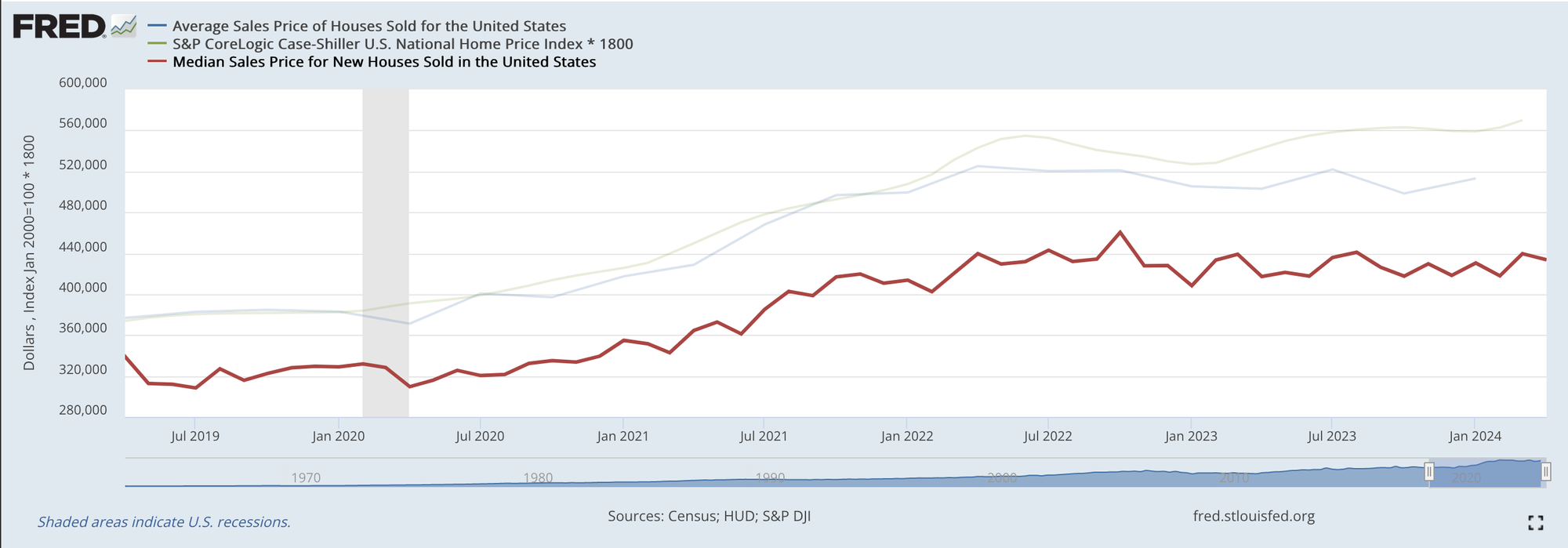

Over the last five years the cost of a median new house in bitcoin terms has fallen from ~35 bitcoin to 6.29 bitcoin or -82%, yet the price of a home in dollar terms is up ~33% over the same period (if you believe the numbers from FRED).

To contrast, bitcoin is up over 762% over the same period.

The undeniable nature of this data is beginning to set in for some real estate investors. As is evidenced by Jawad's post to his Facebook group. The question that remains is how quickly do real estate investors begin to either dump their real estate for bitcoin or realize that it should be at least partly collateralized with bitcoin?

When you take the time to sit down and think about it the reasons for storing you wealth in bitcoin as opposed to housing become glaringly obvious. Real estate is a consumption good that comes with maintenance costs and property taxes. It is extremely illiquid. The value can fluctuate due to external supply factors (people building more homes in your area). Neighborhoods can change from favorable to unfavorable. All of this creates an atmosphere of relative uncertainty that makes real estate, on a long enough timeline, a risky place to store value.

Compare this to bitcoin. It is global, trades 24/7/365, is the most scarce asset on the planet, granularly divisible, easy to transport, and, most importantly, unable to be manipulated by central planners who would degrade those assurances if they were given the chance.

It's a no brainer and even the people who have built careers in the real estate investment industry are beginning to recognize this.

Final thought...

Optimism is going to be crucial in the years ahead. Stay positive, freaks.

Enjoy your weekend!