The Bitcoin fear and greed index hit 9. Blue Owl Capital permanently froze investor redemptions. The Fed flagged private credit vulnerabilities. Something is breaking beneath the surface, and the on-chain data says smart money is accumulating.

Sup, freaks? The Bitcoin fear and greed index is sitting at 9. Single digits. Historically, if the fear and greed index is in single digits, it's a great time to buy. However, there's a lot going on in the broader markets right now and I don't feel confident coming out and saying, "Everything's fine!" because it may not be. Something seems to be breaking behind the scenes, and the Fed just quietly acknowledged it.

Bitcoin Fear and Greed Index is 9 — Extreme Fear

— Bitcoin Fear and Greed Index (@BitcoinFear) February 19, 2026

Current price: $66,606 pic.twitter.com/R9lvTKd1Nh

The FOMC meeting minutes from last month came out this week, and there's an acknowledgment of something they're worried about. Several participants highlighted vulnerabilities associated with the private credit sector and its provision of credit to riskier borrowers, including risks related to interconnections with other types of non-bank financial institutions like insurance companies and banks.

The big news in the tradfi world: Blue Owl Capital has permanently halted investor redemptions from its retail private credit fund OBDC II, reversing its earlier plan to reopen withdrawals.

PRIVATE CREDIT IS FLASHING A WARNING SIGN NOT SEEN SINCE THE GREAT FINANCIAL CRISIS:

— First Squawk (@FirstSquawk) February 19, 2026

BLUE OWL CAPITAL HAS PERMANENTLY HALTED INVESTOR REDEMPTIONS AT ITS RETAIL PRIVATE CREDIT FUND, OBDC II, REVERSING ITS EARLIER PLAN TO REOPEN WITHDRAWALS.

This is the culmination of a slow motion bank run that started in mid 2025. Blue Owl manages five business development companies, two public and three private. The private funds promised quarterly liquidity at net asset value subject to a 5% gate. The problem? The public BDC started trading at 20% plus discounts to NAV, creating an obvious arbitrage. Why hold the private fund at 100 cents when you can redeem and buy the exact same portfolio on the public market at 80 cents?

Instead of reopening redemptions as promised, they permanently locked the door. If you put money into this fund, you cannot get your money out. Many people are comparing this to the Countrywide situation in early 2007. In 2025, there were $145 billion in real estate originations from private credit funds. Hard asset lenders reduced collateral requirements from a 40% LTV to 90%. You used to have to put down two and a half times the loan amount at 12% to 13% interest. Now it's basically a dollar ten to get a dollar with single digit rates. A lot of that liquidity flowed into illiquid investments, particularly real estate. And those markets are not doing well.

Oof. Pending home sales fell to an all-time low in January pic.twitter.com/xOtqgIu0Bk

— Kevin Gordon (@KevRGordon) February 19, 2026

Pending home sales in the United States fell to an all-time low in January. Interest rates are high, housing prices are elevated, younger generations aren't finding well paying jobs, and inflation is crushing everyone. Boomers are sitting on houses at elevated valuations refusing to sell at a loss while younger generations can't afford to buy. Something's got to give. On top of that, 60+ day delinquency rates on US subprime auto loans hit a record 6.9%. The 2008 crisis high was 5%.

BREAKING: The 60+ day delinquency rate on US subprime auto loans is up to a record 6.9%.

— The Kobeissi Letter (@KobeissiLetter) February 18, 2026

Serious delinquency rates have more than DOUBLED since 2021.

This exceeds the 1996 peak by 0.9 percentage points.

For context, the 2008 Financial Crisis high was 5.0%.

Meanwhile, total… pic.twitter.com/FOz86zTj9z

Then there's the jobs market. US job numbers were revised down by 1,029,000 jobs in 2025, the largest annual revision in at least 20 years. This follows downward revisions of 818,000 in 2024 and 306,000 in 2023. In total, 2,153,000 jobs have been revised out of initially reported data over the last three years. Since 2019, 2.5 million jobs have been erased from official data with negative revisions in six of the last seven years. By comparison, 2009 and 2010 combined downward revisions were roughly 1.2 million. The jobs data is not being reported appropriately no matter what administration is at the helm.

BREAKING: US job numbers were revised down by -1,029,000 jobs in 2025, the largest annual revision in at least 20 years.

— The Kobeissi Letter (@KobeissiLetter) February 15, 2026

This follows downward revisions of -818,000 in 2024 and -306,000 in 2023.

In total, -2,153,000 jobs have been revised out of initially reported data over the… pic.twitter.com/CLDvMNLLse

So what does all of this mean for Bitcoin? Looking at the chart right now, we're down 24.26% year to date, down 31.67% since this time last year, and 47% below the all-time high of $126,160. We tapped $59,000 a couple weeks ago and are sitting at $67,216 right now.

With all of that in mind, I'd like to highlight a point that Jack Mallers, CEO of Strike, made a couple days ago. Bitcoin has been labeled weak since it diverged from NASDAQ, but what if it's a smoke alarm? The only truly free market left. If an AI driven credit shock is coming, what if Bitcoin detected it first? Maybe it's telling us what centrally planned markets can't.

Bitcoin (orange) has been labeled "weak" since it diverged from the Nasdaq (white).

— Jack Mallers (@jackmallers) February 18, 2026

What if it’s the smoke alarm, the only truly free market left? If an AI-driven credit shock is coming, would Bitcoin detect it first?

Maybe it’s telling us what centrally planned markets can’t. pic.twitter.com/zSvJPHRiiJ

This is something we've been saying in this rag for years. Bitcoin is the liquidity alarm bell. When institutional investors sniff out tremors on the horizon, they sell their most liquid assets first. Bitcoin's role as a liquidity alarm bell doesn't feel good when the price is going down, but it's actually one of its strongest attributes. Having almost instantaneous access to liquidity of a hard asset is hard to come by. The fact that anyone in the world can sell bitcoin at a moment's notice to access needed liquidity is a God send. This is a feature that an asset like real estate or gold can never replicate. And if there is a liquidity crisis, the Federal Reserve and Treasury will step in, which means the next round of money printing is right around the corner. Bitcoin will likely sniff that out early too.

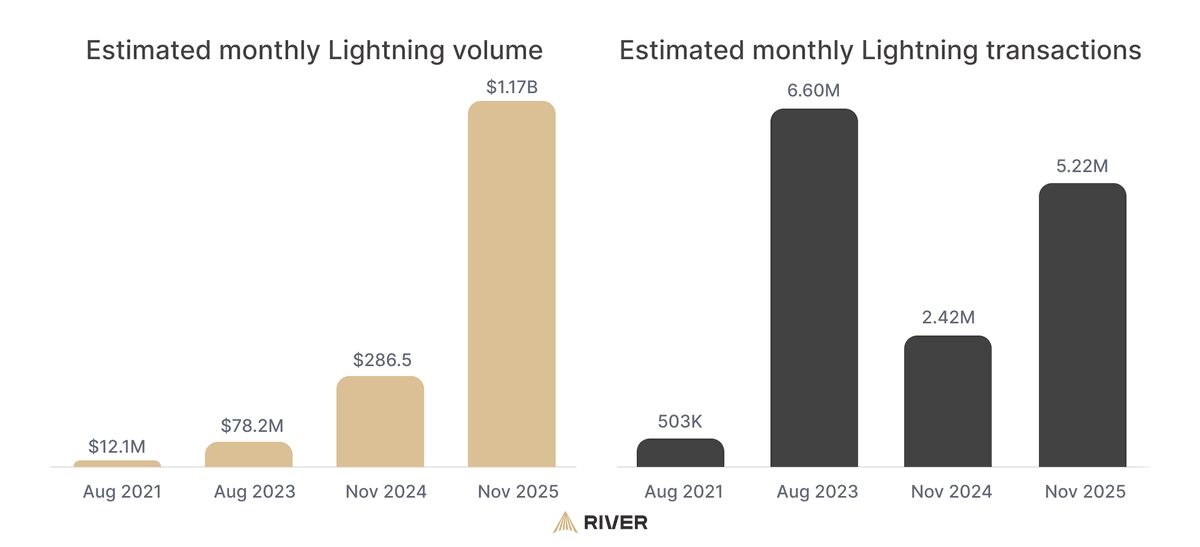

Now for some bullish fundamental news to close on. River came out with their 2025 Lightning Network retrospective today. Lightning volume grew 400% in 2025 and exceeded $1 billion in monthly volume. The average Lightning transaction size went from $118 in 2024 to $223 in 2025. The list of exchanges with Lightning enabled is growing year on year.

The fundamentals of Bitcoin are stronger than ever despite all of the chaos and noise. Think of Bitcoin as a liquidity alarm bell, a great leading indicator for trouble in the system, which certainly seems to be emerging. From here, the price could go up, or it could go down. I'm not here to be your TA guru. I focus on fundamentals. And the fundamentals are bullish.

Jesse Shrader presented a compelling vision for Bitcoin's role in revolutionizing global currency exchange during our latest conversation. He argued that as sovereign currencies become increasingly tokenized as stablecoins, Bitcoin and the Lightning Network are uniquely positioned to capture a significant portion of the massive $9.7 trillion daily foreign exchange market. Shrader emphasized that Lightning's instant settlement capabilities and low fees make it the ideal infrastructure layer for facilitating these cross-border transactions.

"The Lightning Network becomes the settlement rail for all of these tokenized currencies, and Bitcoin becomes the reserve asset backing this entire system" - Jesse Shrader

This transformation represents more than just technological advancement. Shrader outlined how this shift could fundamentally restructure global finance, eliminating the inefficiencies of traditional correspondent banking while maintaining the sovereignty of national currencies through tokenization. The implications extend far beyond simple currency exchange, potentially creating a more inclusive and efficient global financial system built on Bitcoin's foundation.

Check out the full podcast here for more on stablecoin adoption, Lightning infrastructure, and global payment rails.

White House Urges Bankers to Allow Stablecoin Rewards for Crypto Bill

White House Pushes March 1 Deadline for Stablecoin Yield Compromise

Bitcoin Crypto Market Structure Bill Odds Surge to 83%

CME Group to Launch 24/7 Crypto Futures Trading on May 29

Lightning Monthly Volume Crossed $1.17 Billion in November 2025

Ledn Completes First Bitcoin-Backed Securities Deal Raising $188M

Do you know what they did with your collateral while it was falling? Do you know if it's still there?

Celsius customers didn't know either. Neither did BlockFi's. Or FTX's.

Lygos built something different.

Non-custodial bitcoin lending where YOUR bitcoin never leaves YOUR control. It sits in a multisig on Bitcoin's base layer, verifiable on-chain, impossible to rehypothecate.

Already have a loan with a custodial lender? Lygos handles the refinance. 0% origination fees, competitive rates, and your bitcoin moves to non-custodial custody. They handle the entire buyout.

No custodians to trust, no withdrawals to freeze. Just cryptographic certainty. Refinance before the next Celsius.

Bitkey is an easy, secure way to move your bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

RIP Mac Miller. Gone too soon.

Download our free browser extension, Opportunity Cost:

https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

|

|