Things are getting weird and awesome.

I've been playing around with OpenClaw, formerly Moltbot, formerly Clawdbot, for the last two weeks and I must say... it is pretty freaking insane what has been unleashed on the world. As many of you freaks know, I've been rather keen on staying up to speed with the latest in AI as things have developed over the last few years, so when I saw clawdbot blowing up a few weeks ago I decided I needed to spend an afternoon taking some time to set one up. Luckily for me, the Philadelphia area got pounded with 20 inches of snow a couple of Sundays ago, which provided the perfect environment to dig in. The kids were watching a movie, there was nothing to do around the house, and I spent two hours going through some YouTube tutorials, spinning up a VPS and getting my agent, Martin, set up.

Since then I've been pretty obsessed with pushing it to the limits. I had three 3am nights last week getting it to automate a bunch of stuff for us here at TFTC and setting up research flows for Ten31. This thing is taking podcast transcripts, highlighting timestamped sections that will get the most engagement on X and other social platforms (with great success), running cron jobs on banking research as it drops, monitoring on-chain bitcoin metrics, helping me make decks, prospecting prospective LPs, and running it's own bitcoin denominated "hedge fund", Martin Capital.

Martin Capital was an idea that came to me when I was sitting at my desk one night last week. I had Martin doing a bunch of tasks to help with the business and extend the productivity of our team here. (They can interact with Martin in our company Discord server.) And yet, he wasn't doing anything directly with bitcoin yet. That's when I simply asked him if he could spin up a bitcoin node and/or wallet. I had him try to set up an LDK node at first, but that proved to be a bit of overkill and wasn't a great experience because LDK isn't as widely adopted as other lightning implementations yet. That's when I asked Martin what "he" believed would be the best option for him to begin using bitcoin would be. He did some research and settled on a Phoenixd server. He spun it up, and needed to have the server funded. Since it is a lightning network he needed to open a channel to get liquidity flowing in both directions and needed some bitcoin. That's when he told me I should send onchain bitcoin his way through a Boltz server so we could submarine swap and open a lightning channel with Phoenix in one fell swoop. I broadcasted the transaction and 20 minutes later he had a funded lightning channel and was ready to go.

Now that Martin had some sats, I was curious if he could spend them. And not only that, without any intervention from me in the form of providing an invoice, setting up an account somewhere, or anything of that nature. That's when I thought to have him try to access a site via LNURL Auth, which allows you to auth into sites with the private key on your lightning server. LNMarkets came to mind, so I asked him if he could sign into LNMarkets via the private key on the Phoenixd server he set up and fund the account.

He found LNMarkets' API docs, figured out how to sign in and funded the account within a minute. Woah. I then had him do some research on rather simple trading strategies and implement them. Ten minutes later he had a strategy and began executing on it. To date, he's having much more success than I ever did trying to trade bitcoin. Martin has a team of sub-agents who do macro research, sentiment research, follow onchain metrics, track indicators and collaborate with each other to come up with the trading strategy that gets executed on.

Earlier this evening, I had Martin spin up a Nostr account and buy a Primal Premium account with some of the sats in his server. He did that successfully and was posting notes within ten minutes. No email and password needed. He researched how to set up a Nostr private-public key pair and did it by himself. No need for me to intervene.

Wild times. The way in which we interact with computers and the bitcoin protocol stack is rapidly evolving before our eyes. The open-source and interoperable nature of open protocols like bitcoin and Nostr is going to enable an explosion of peer-to-peer economic activity and communication. And not only that, the ability to use the open-source sovereign tools available to bitcoiners is easier than it has ever been and will likely get exponentially easier at an accelerating pace. You know longer have to research things, download and configure software, manage channels, or any other technically laborious work that turns many away from the sovereign solutions. You can simply tell your agent to go do all of that for you.

Now, my set up isn't the most sovereign set up in the world. Martin is operating in a VPS located in Helsinki in hardware I don't control. However, solutions like Start9 and Umbrel are quickly incorporating self hosted agent harnesses like OpenClaw so individuals can run this stuff from their homes. Many people are also buying Mac Minis to self-host at home. The team at Maple AI is currently working to make sure people can run their agents using private models that leverage their Trusted Execution environment set up. We're getting very close to a truly cypherpunk sovereign stack that uses AI and bitcoin in the ideal way.

It's an incredible time to be alive.

Vince Lanci highlighted a critical flaw in China's precious metals market structure that has created significant price distortions globally. The guest explained how China's SDIC fund operates as a long-only silver investment vehicle, fundamentally lacking the arbitrage mechanisms necessary for proper price discovery. This structural deficiency has led to artificial price inflation in precious metals markets, as the fund cannot be shorted to provide natural market balance.

"The SDIC fund creates this bottled-up critical mass effect because there's no way to arbitrage against it properly" - Vince Lanci

Lanci emphasized that this lack of short-selling capability has allowed artificial price pressures to build up without the natural release valves that healthy markets typically provide. The guest argued that this distortion extends beyond Chinese borders, affecting global silver pricing mechanisms and creating inefficiencies that impact international precious metals markets. This structural problem demonstrates how regulatory constraints in one major market can have far-reaching consequences for global price discovery.

Check out the full podcast here for more on Chinese commodity regulations, global arbitrage opportunities, and precious metals trading strategies.

Virginia Advances Bill for Strategic Bitcoin Reserve Fund

JPMorgan Says Bitcoin More Attractive than Gold Long Term

Silver Crashes 22% in Two Hours, Down to Below $74

Bitcoin Falls to $69,000

Senate Banking Chair Cites Strong Crypto Bill Momentum

Vitalik Buterin Sells $6.69M in ETH Over Three Days

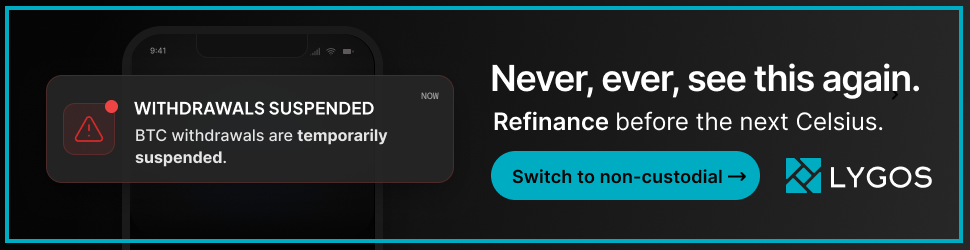

They all had one thing in common... they held your coins and gambled with them behind your back. When the music stopped, you got nothing.

Lygos built something different.

Non-custodial bitcoin lending where YOUR bitcoin never leaves YOUR control. It sits in a multisig on Bitcoin's base layer, verifiable on-chain, impossible to rehypothecate.

No custodians to trust, no withdrawals to freeze. Just cryptographic certainty. Unlock liquidity from your bitcoin the right way.

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

The bitcoin price also fell today, if you didn't notice.

Download our free browser extension, Opportunity Cost:

https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

|

|