This analysis delves into the recent surge in global equity markets, propelled significantly by Nvidia's impressive earnings report, and the Federal Reserves current monetary stance.

Equity markets around the world have experienced a notable surge, with major indexes reaching record highs. A significant event contributing to this trend was the earnings release from Nvidia. The semiconductor company, known for its graphics processing units (GPUs), has seen its stock price dramatically increase. The anticipation around Nvidia's performance was high, given the ongoing AI boom from which Nvidia is profiting.

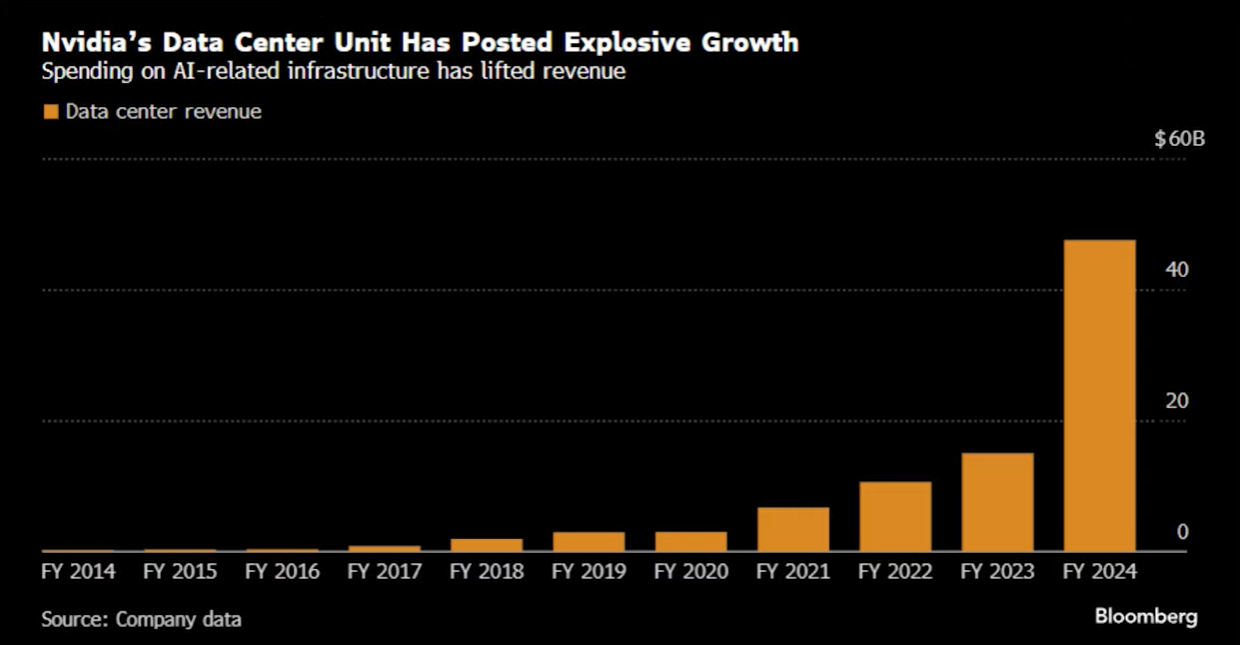

An analysis of Nvidia's earnings report reveals a thriving data center business, with revenues growing substantially. This success reflects a broader industry trend where tech giants are investing in AI technologies, which, in turn, necessitates purchasing hardware like Nvidia's GPUs. Following the earnings announcement, Nvidia's stock price soared by over 10%, positively impacting major equity indexes.

Moreover, global markets are also showing bullish signs. Japan's Nikkei index has reached new all-time highs, breaking a record from the 1980s, while Europe's Euro Stoxx has similarly charted new territory.

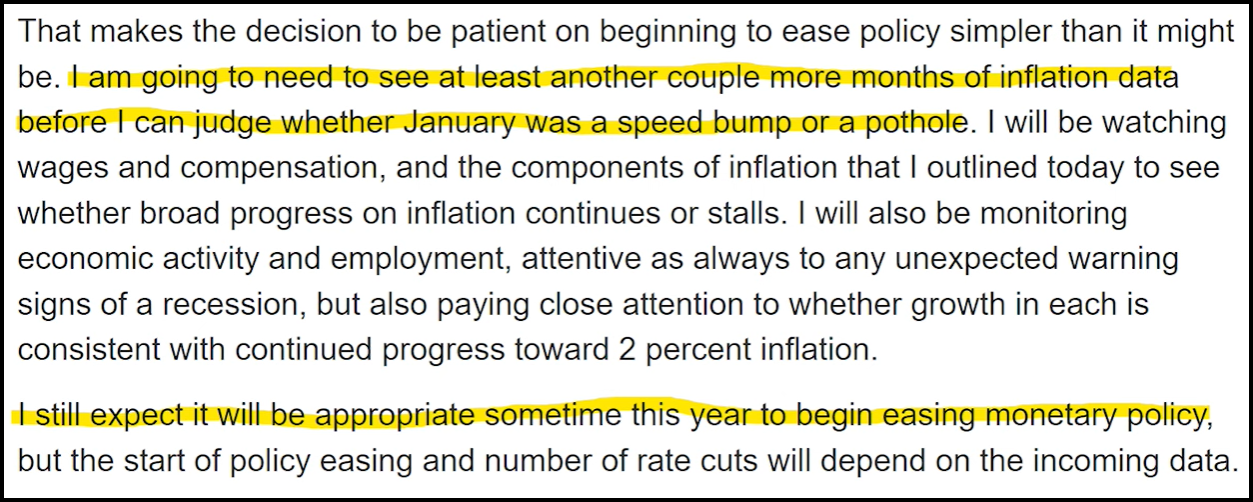

Recent communications from the Federal Reserve indicate a marginally more hawkish stance on monetary policy. Despite this, the expectation is that the Fed will still reduce interest rates within the year. Data suggests inflation has been hotter than anticipated which has led to a loosening of financial conditions. This includes narrowing credit spreads and robust equity market performance.

Federal Reserve Governor Waller's speech suggested a pause in rate cuts to observe further economic data, particularly inflation trends. New York Fed President John Williams also echoed the sentiment that rate hikes are not the current base case. The market has adjusted its expectations, now aligning more closely with the Fed's guidance, anticipating around three rate cuts for the year.

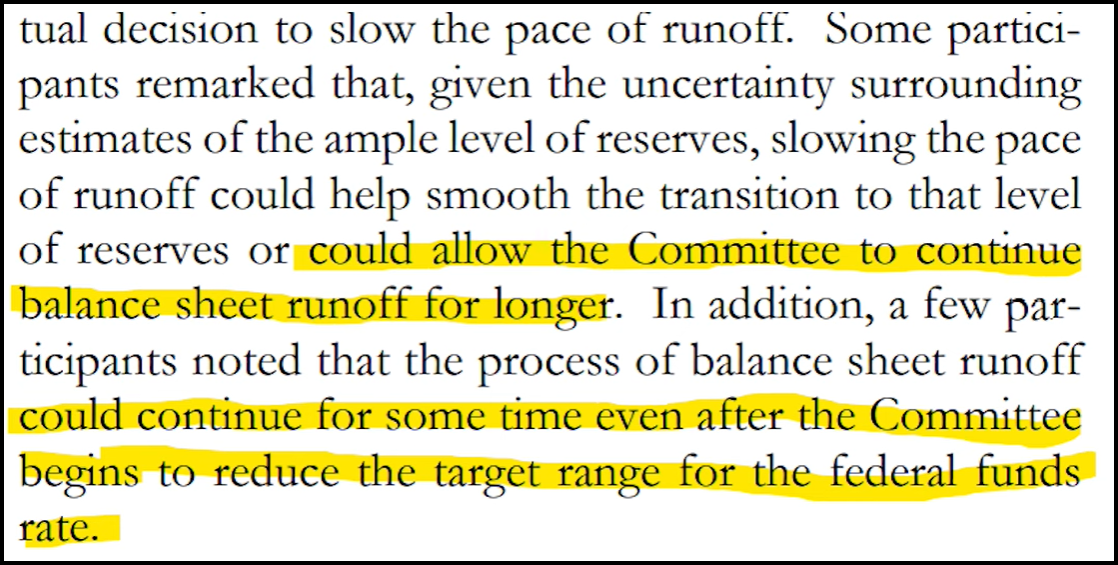

The Fed's meeting minutes also hinted at the continuation of quantitative tightening (QT) for a longer period, albeit potentially at a slower pace. This suggests that QT tapering might commence in the fourth quarter and could extend into 2025.

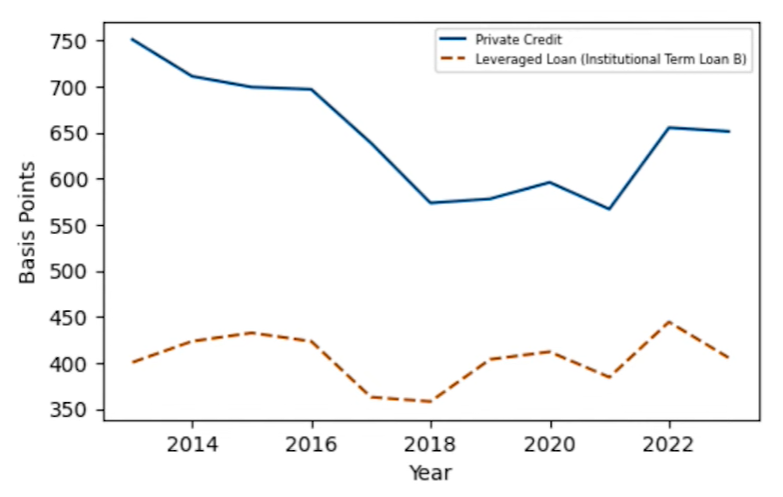

The Federal Reserve has published research on the private credit market, an increasingly significant but opaque sector. Private credit has grown to about $1.7 trillion, offering an alternative to traditional bank loans or capital markets for companies seeking funds. Often, these loans are bilateral agreements between a large investment fund and the borrowing company, allowing for customized and expedited lending arrangements.

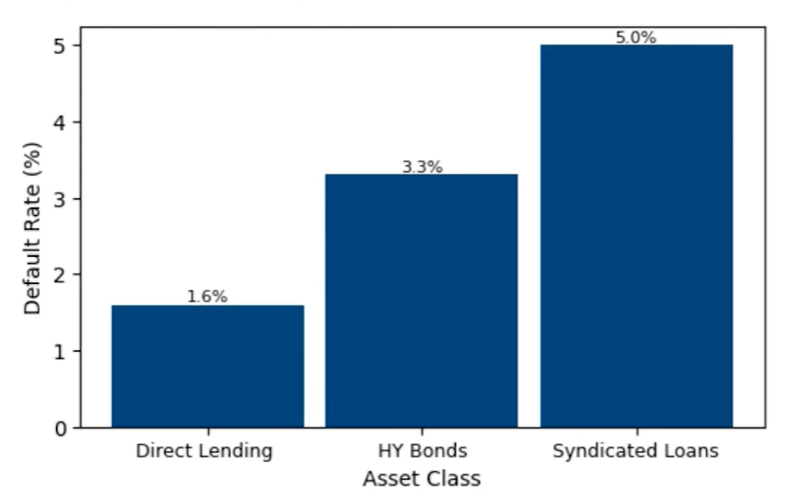

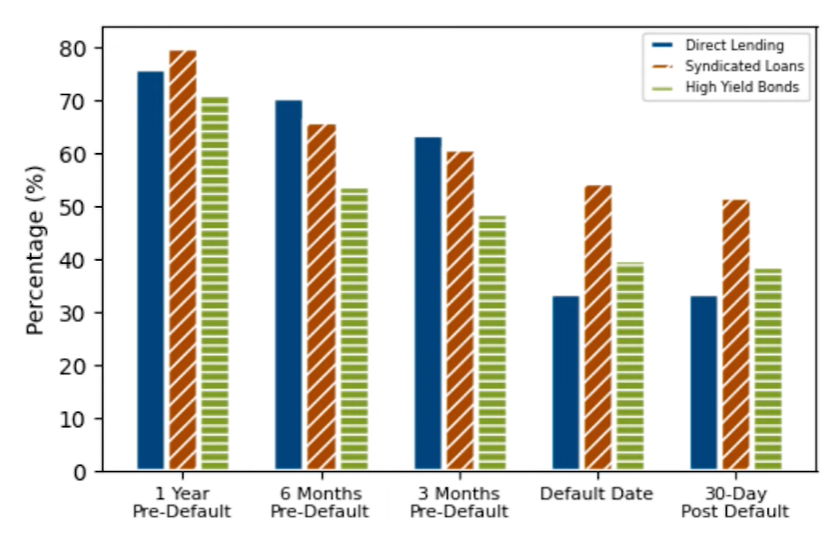

Private credit has attracted investors due to higher interest rates compared to other investment opportunities, as well as the absence of mark-to-market valuation, which can shield investors from market volatility. The Fed's study notes that private credit has generally lower default rates than leveraged loans, likely due to the ease of renegotiating terms. However, recoveries on defaulted loans are often lower because collateral tends to be intangible assets with uncertain market value.

Most private credit loans have floating interest rates, which have caused interest coverage ratios to deteriorate as the Fed has raised rates. Nevertheless, the anticipated rate cuts later in the year may provide relief to borrowers in this sector.

In summary, equity markets worldwide are showing strong performance, bolstered by tech companies like Nvidia that are capitalizing on the AI revolution. The Federal Reserve remains "cautious" but indicates rate cuts may occur, with inflation still being a concern.