The March 2024 CPI data disrupts the inflation narrative, indicating a surprising rise amid a broader trend of fluctuating perceptions and ongoing disinflation.

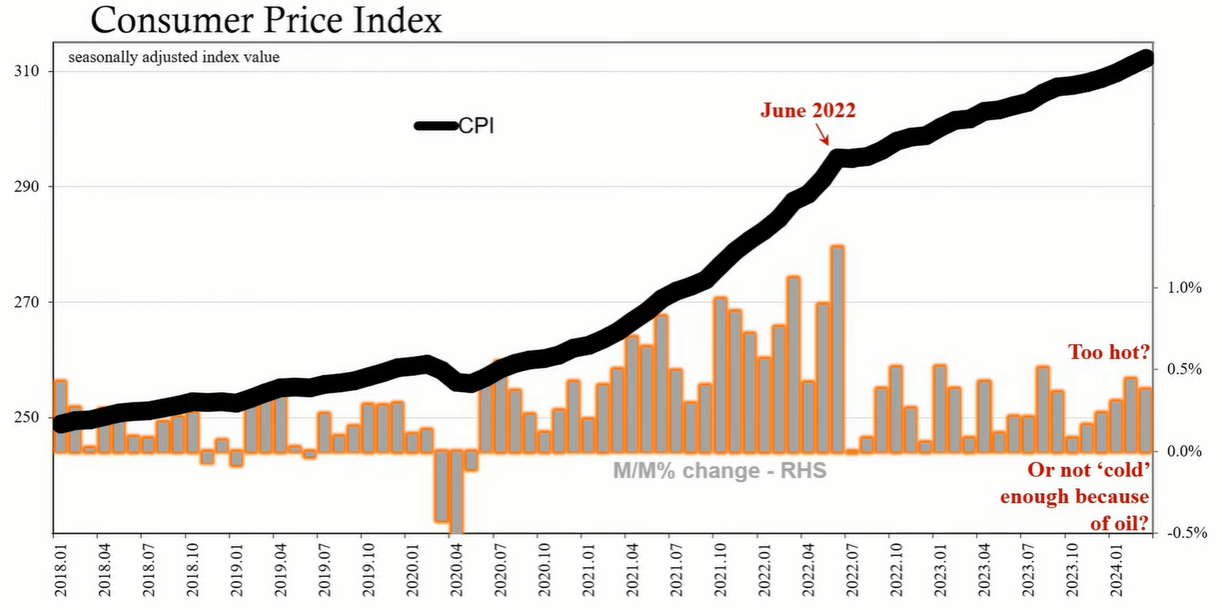

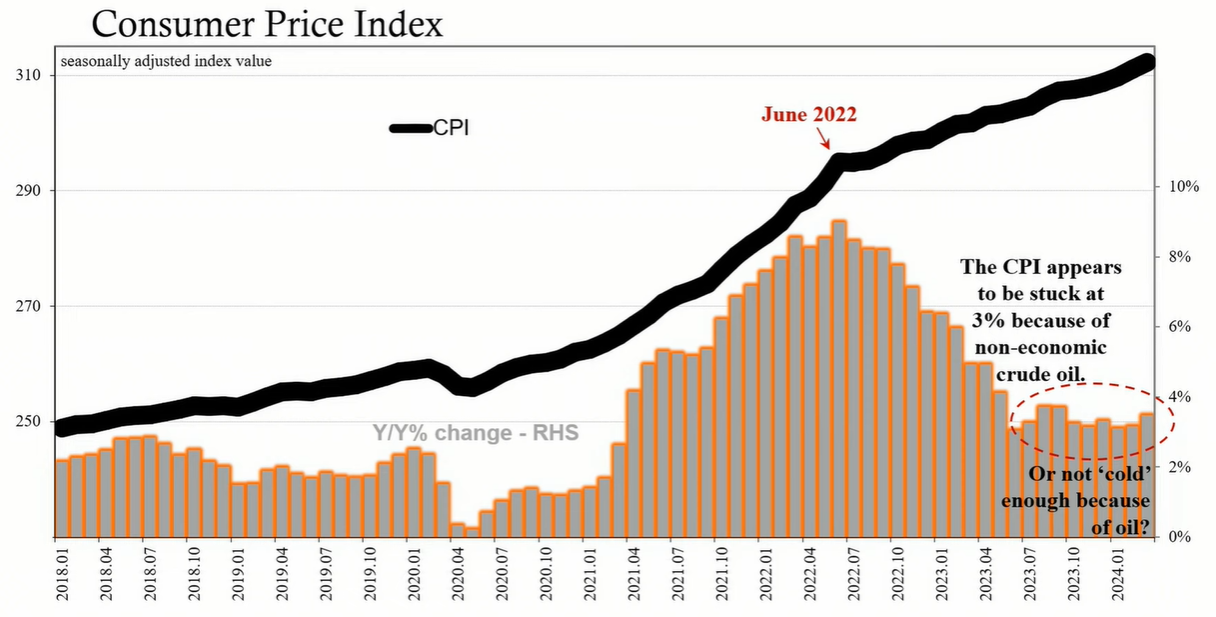

The US Consumer Price Index (CPI) for March 2024 exceeded expectations, continuing a pattern of fluctuating perceptions around inflation. While disinflation seemed to take hold in mid-2022, the CPI has since prompted reinflation concerns multiple times. March 2024 marks the latest point where such concerns have resurfaced, raising questions about the persistence of inflation.

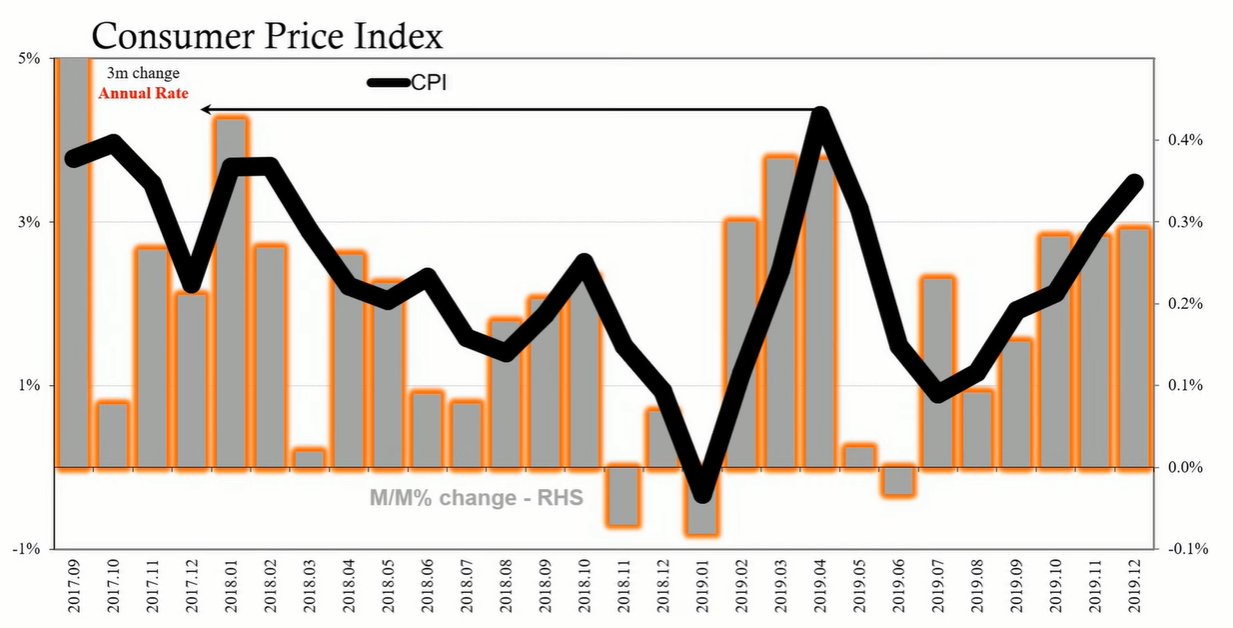

Looking back, a similar scenario unfolded during the transition from 2018 to 2019. Initially, the Federal Reserve had raised interest rates to combat perceived inflation risks. However, as the economy showed signs of weakening, the CPI decelerated, and the Fed considered pausing rate hikes. Despite a temporary acceleration in consumer prices, the Fed eventually opted for rate cuts as disinflation resumed.

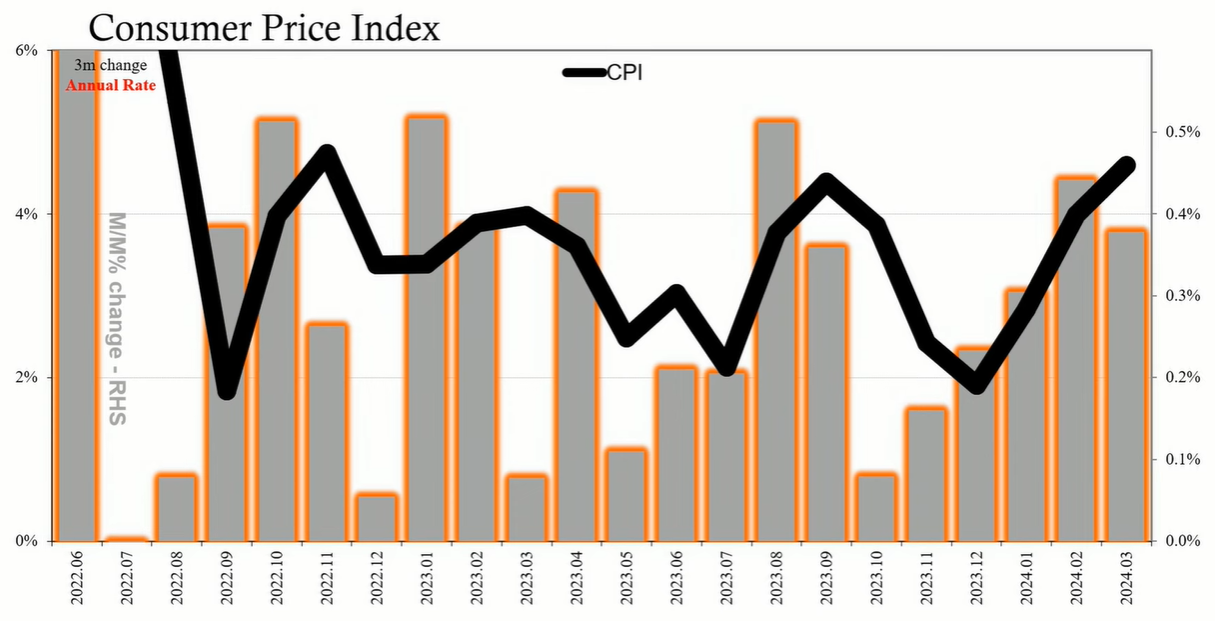

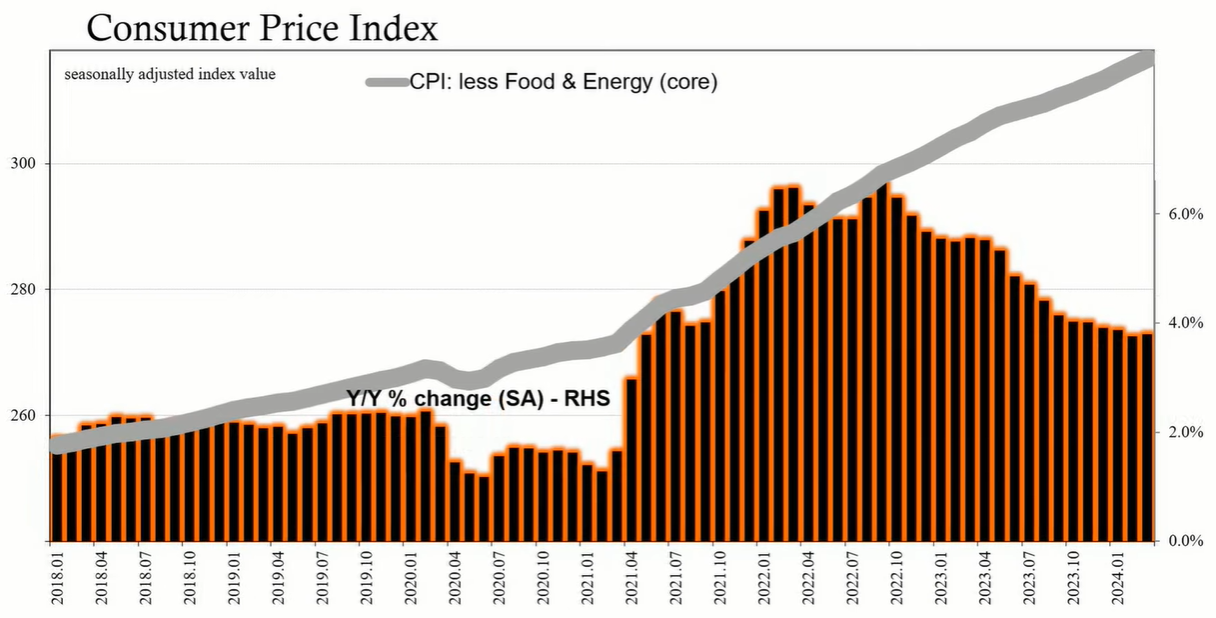

In mid-2022, the CPI's three-month rate of change declined to a 1.8% annual rate, suggesting the onset of disinflation. However, the rate rebounded later in the year and slowed again in early 2023. External factors, such as oil price surges due to OPEC decisions, led to intermittent CPI increases. By December 2023, the three-month rate of change had fallen to 1.9%. Yet, the start of 2024 has seen a rise back to a 4.65% annual rate.

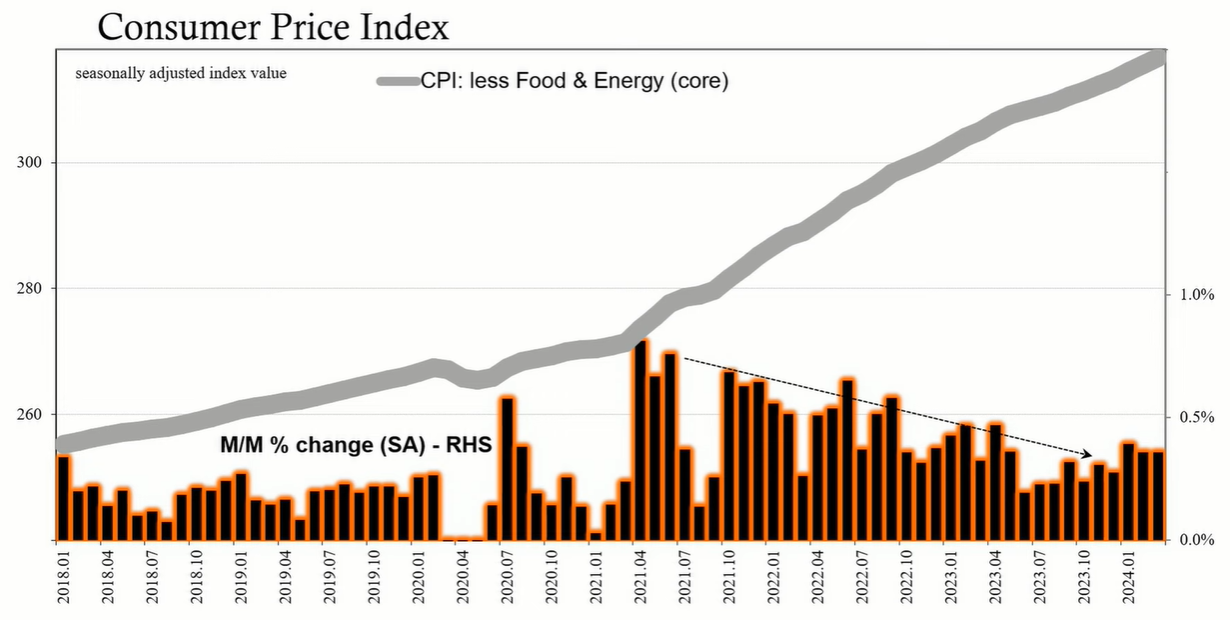

For March 2024, the month-over-month change in CPI was 0.38%, a slight decrease from February's 0.44%. Despite this, the annual rate of change increased to 3.48% in March from 3.15% in February, fueling inflationary concerns.

Core CPI, which excludes food and energy prices, remained unchanged month-over-month at 0.36%. The year-over-year change in the core rate stands around 3.8%. This stability in the core rate, particularly with respect to shelter prices, suggests underlying inflationary pressures that are less influenced by energy prices.

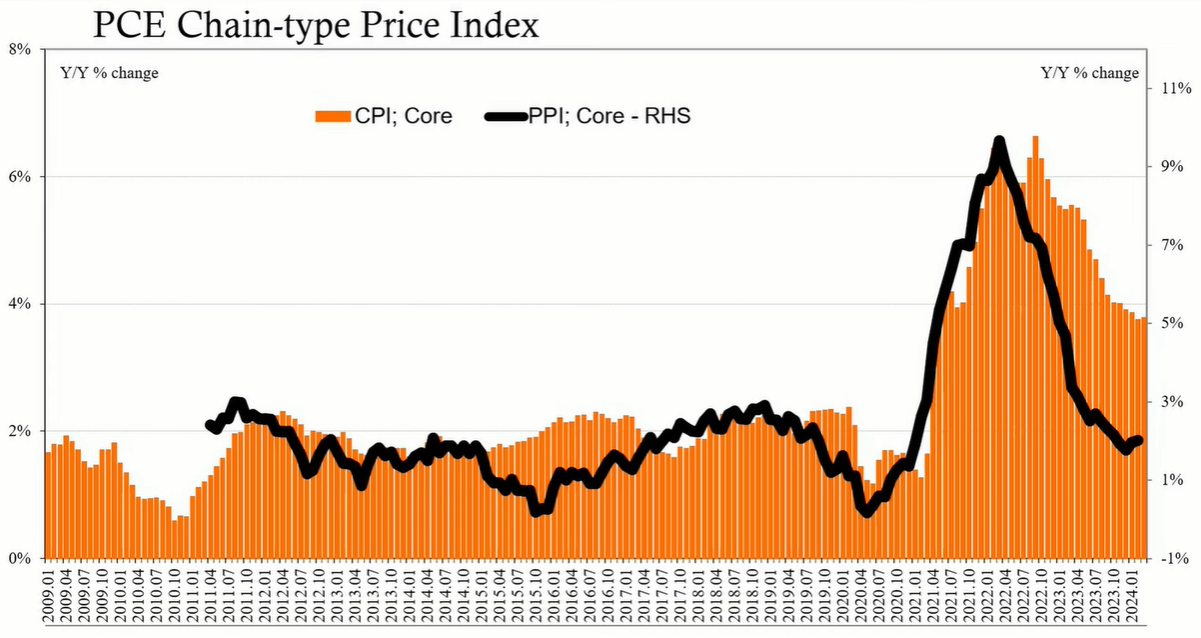

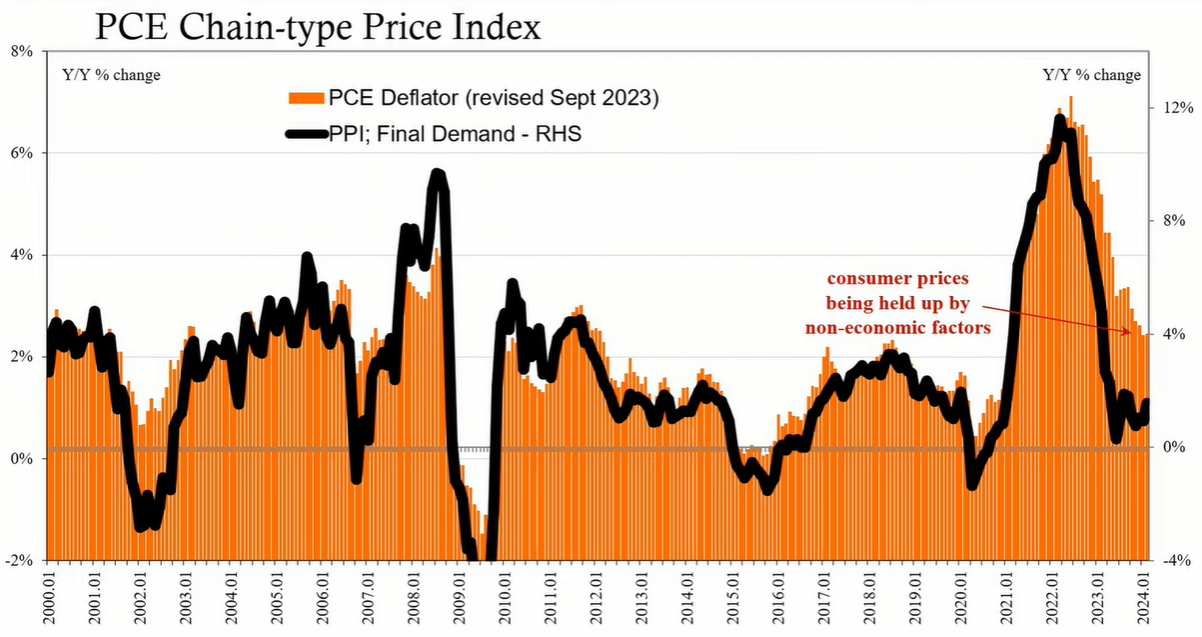

Producer Price Index (PPI) data often serves as a leading indicator for CPI trends. Current PPI data indicates a more disinflationary environment than the CPI reflects, hinting that the supply shock factors that initially drove inflation are subsiding.

The March 2024 US CPI data presents another instance of inflationary alarm that fits into a pattern of recurring short-term spikes in consumer prices. Historical precedents and the current global economic environment suggest that these are variations within an overall disinflationary trend.