Recent data reveals concerning signs in the labor market, questioning the economy's resilience amid a looming crisis.

Recent data has revealed signs of a weakening labor market, challenging the narrative of a resilient economy. Indicators such as the treasury rally and downward employment revisions suggest the possibility of an impending recession.

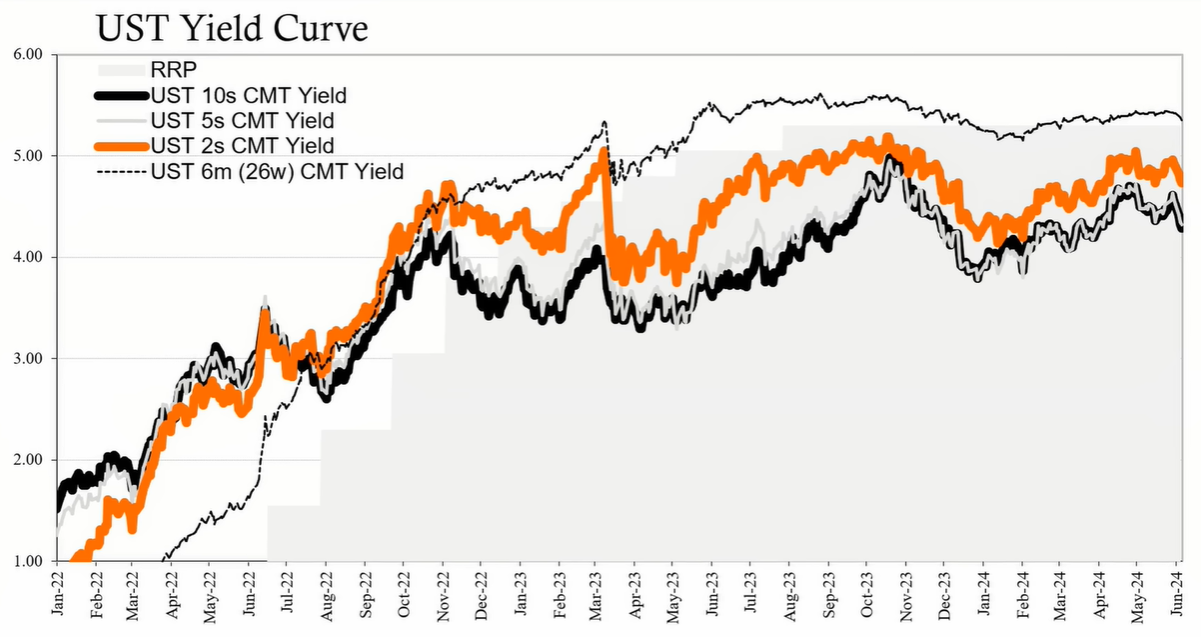

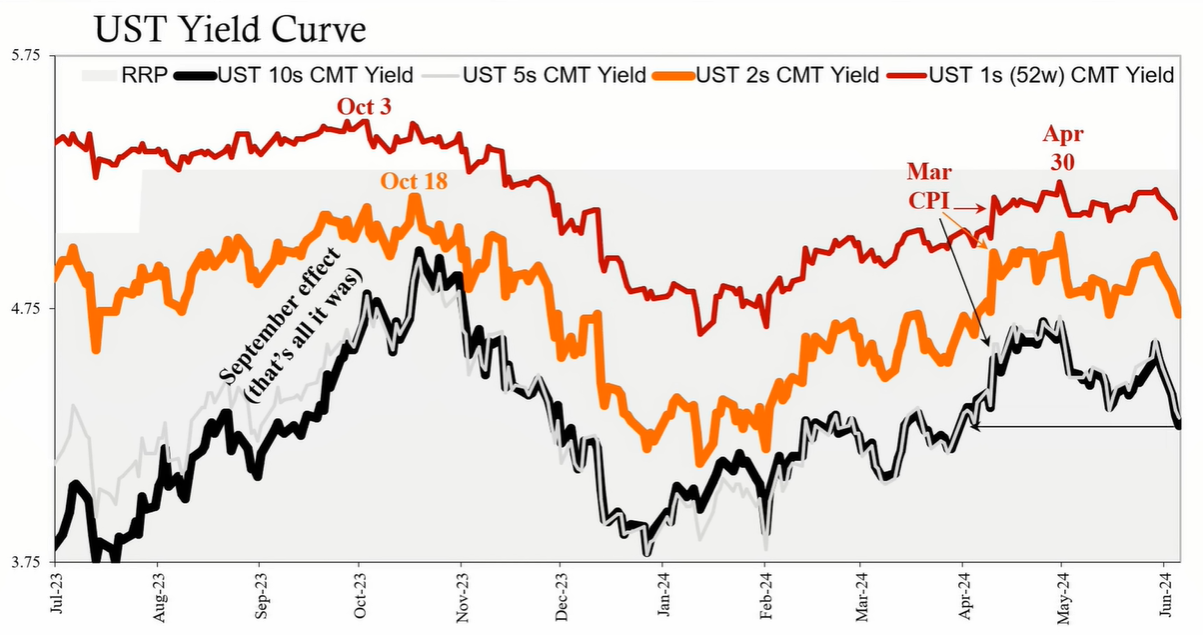

The yield on the ten-year treasury has fallen back into the 420s, despite a better-than-expected ISM non-manufacturing index. This indicates that the market is pricing in potential labor market weaknesses and adjusting expectations for future interest rates. Furthermore, the two-year treasury yield stands at 474, reflecting market speculation on the Federal Reserve's response to consumer price numbers and real economy indicators.

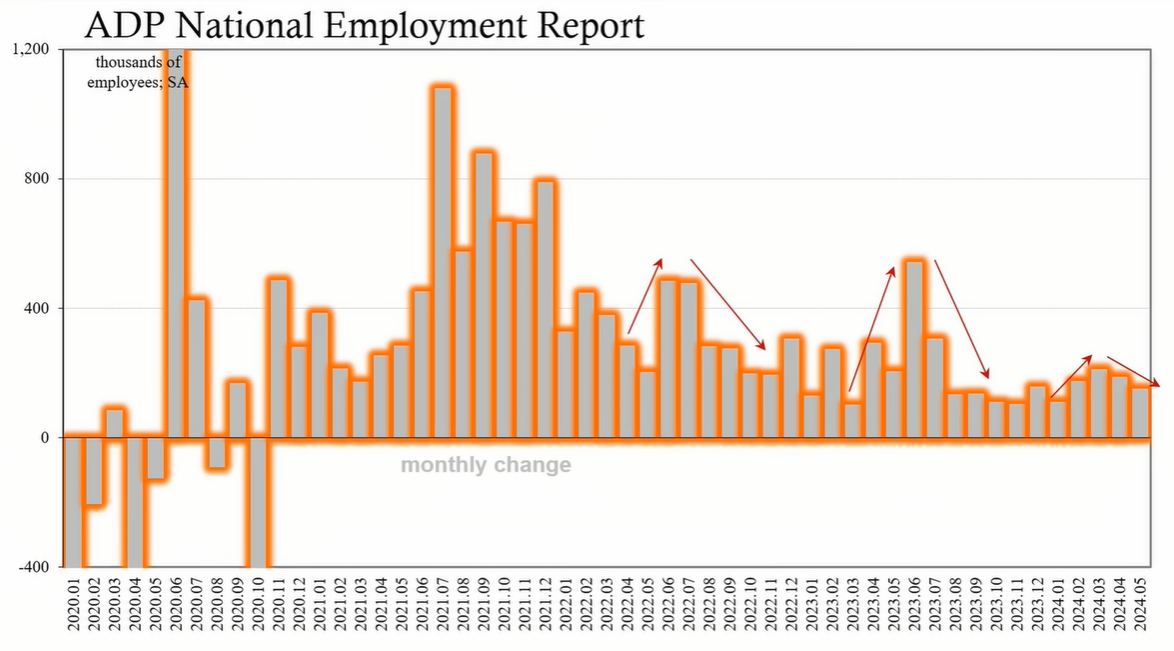

The ADP employment report showed an addition of 152,000 jobs in May, marking the lowest gain this year and suggesting a downward employment trend post-March. The report highlights that while education and healthcare sectors remain stable, other industries such as trade, transportation, and utilities may see a decline. Additionally, losses in sectors like manufacturing and professional business services offer a cyclical warning, while a gain in construction jobs raises questions given contradicting data.

Wage statistics from ADP indicate a slowdown in pay growth, a trend that concerns policymakers as it could imply a reduction in consumer spending power. The Federal Reserve, which often correlates wage growth with inflation rates, may adjust its policy stance if labor market conditions weaken unexpectedly.

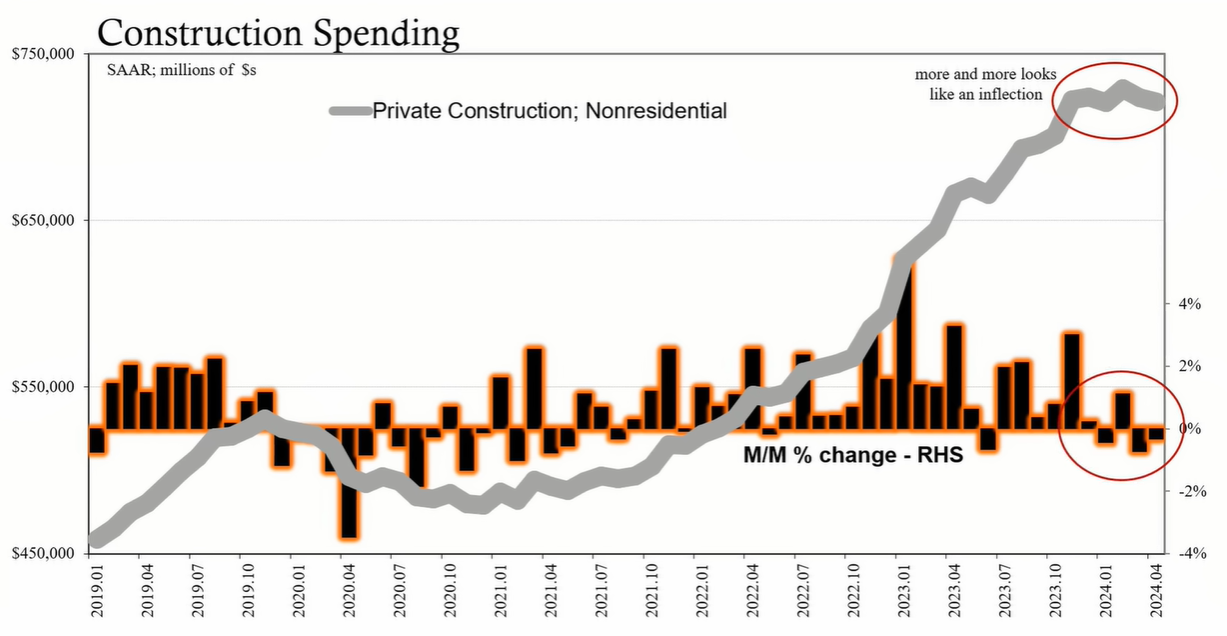

Data from the Bureau of Labor Statistics (BLS) suggests consistent growth in construction jobs, conflicting with other indicators that point to a slowdown in the sector. Non-residential construction spending, for example, has been flat or declining for five months, a pattern observed before previous recessions.

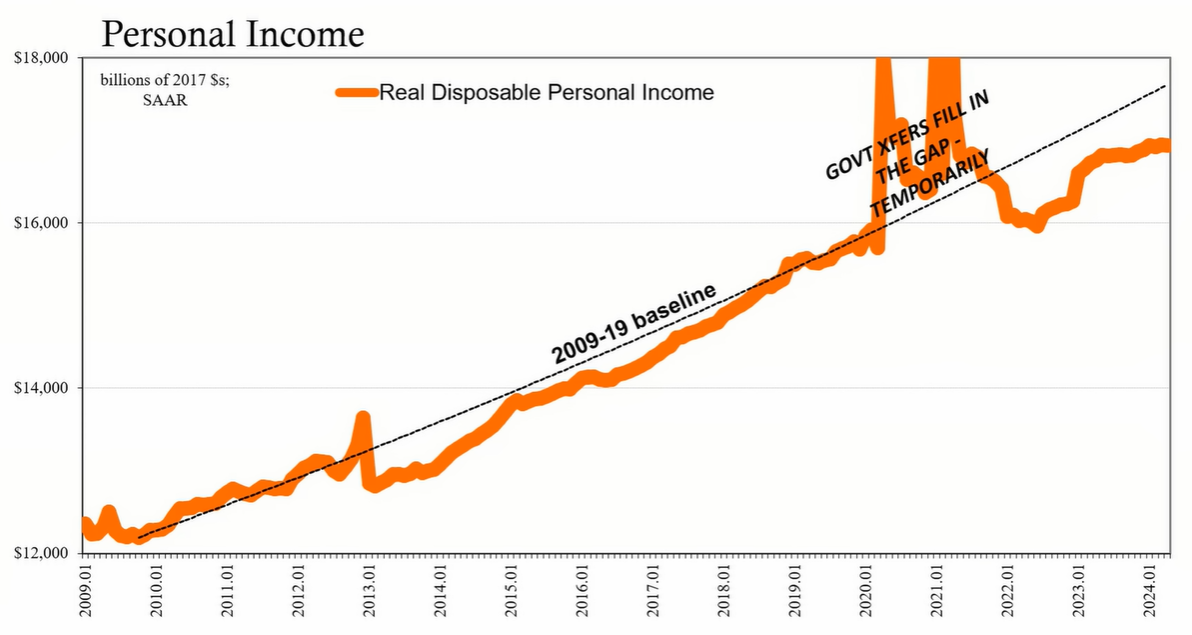

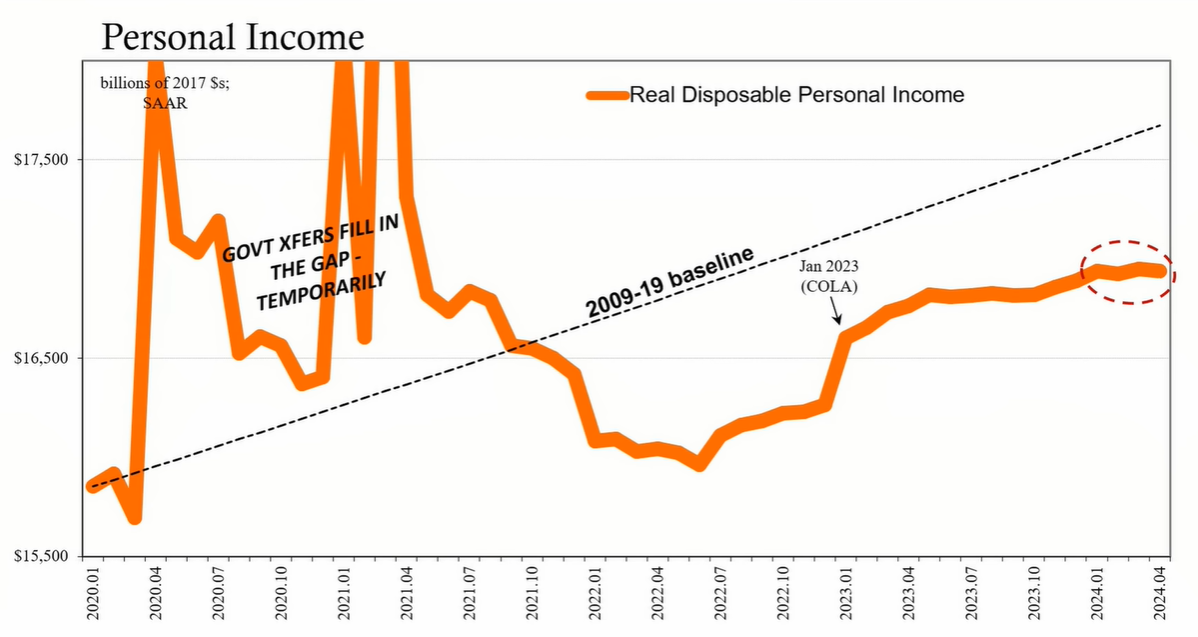

The lag in income growth relative to price changes during the supply shock has not been recovered, potentially leading to a weaker labor market and overall economic downturn. Many Americans perceive that their incomes are not catching up, which has broader implications for economic stability.

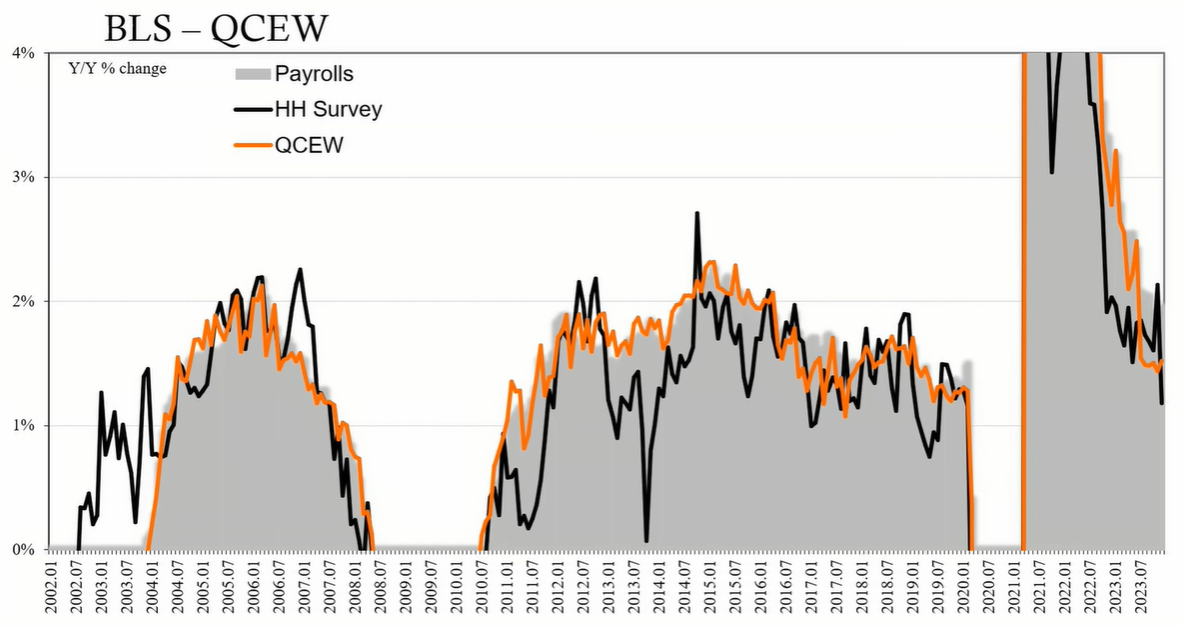

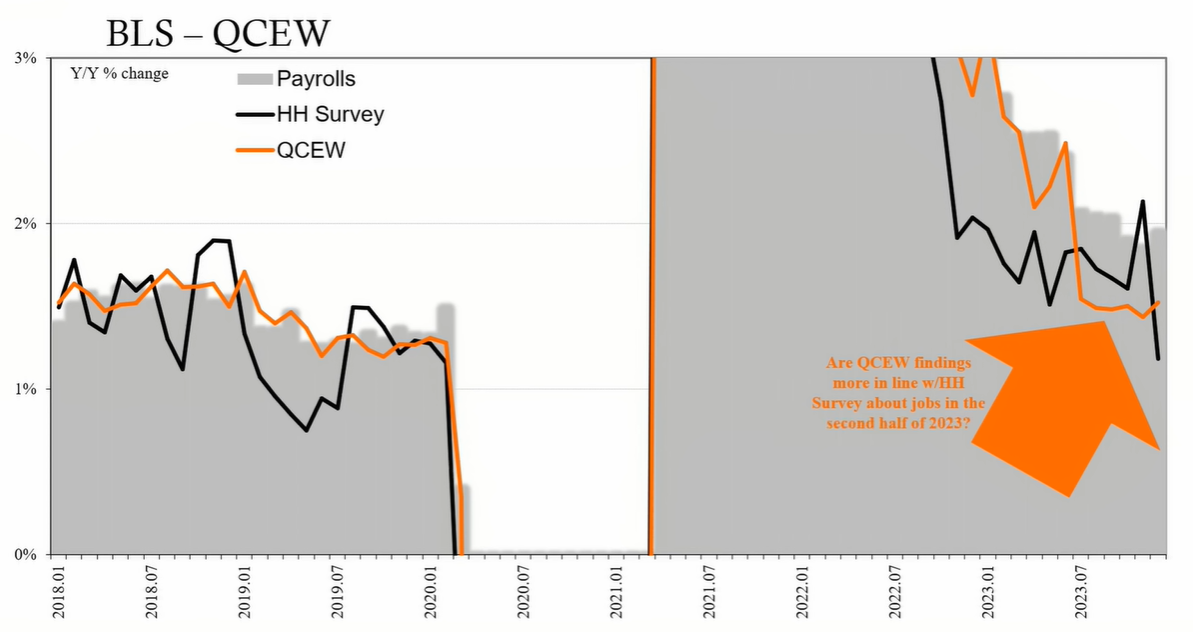

The QCEW report for December 2023 indicates a 1.5% increase in employment, which is significantly less than the 1.95% reported by the establishment survey. This suggests that the labor market may have been weaker last year than previously thought, particularly in the second half of the year.

Future labor market trends may include declining jobs in cyclical sectors like manufacturing, trade, and construction. Additionally, market signals such as dropping treasury yields and oil prices suggest the reemergence of economic weakness after a temporary rebound earlier in the year.

The labor market is exhibiting signs of weakness across various sectors, contradicting the optimistic economic narrative. As policymakers and markets adjust to these indicators, the focus remains on the potential depth and duration of the emerging recession. Key metrics to watch include construction job trends, cyclical sector employment, and consumer spending power, all of which will shape the economic outlook for the remainder of the year.