It all stinks.

It seems that JP Morgan is trying to flex its too-big-to-fail muscles against the bitcoin industry as it becomes more apparent that bitcoin serves as a legitimate threat to the establishment and its parasitic business practices. This is evident by their treatment of MSTR and Jack Mallers in recent months.

For those who are unaware, apparently on July 7th JP Morgan raised the margin requirements for customers using MSTR as collateral for loans issued through the bank from 50% to 95%. This has been confirmed by JP Morgan customers who had margin loans out at the time and were forced to scramble as a result. By raising the collateral requirements for this specific loan with an MSTR backing, JP Morgan forced many of their customers offsides and incited a sell off of the stock.

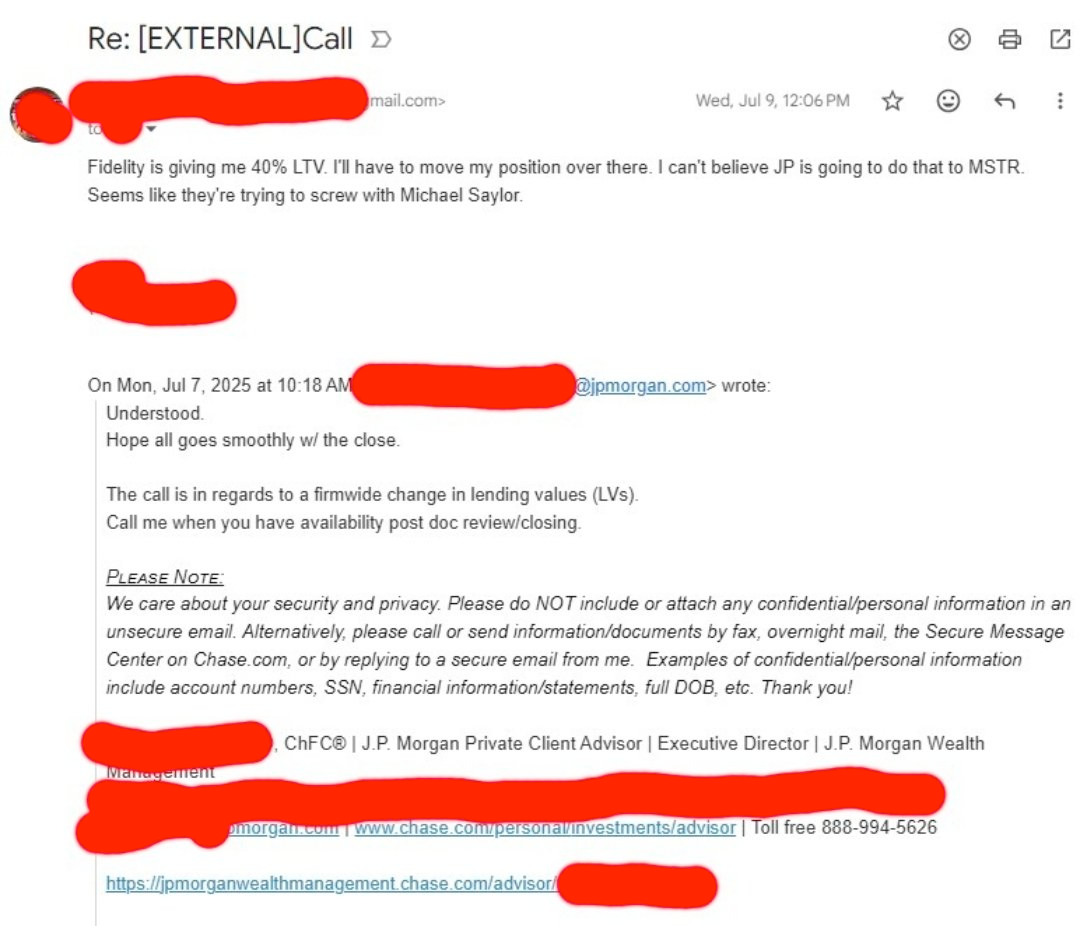

According to the JP Morgan Private Client Advisor in this email exchange, the reason for doing this is "in regards to a firmwide change in lending values (LVs)." I've heard independently from a JP Morgan private client that his advisor told him it was because of the volatility risk that Strategy represents. Which is odd because MSTR was a top five traded equity by volume at the beginning of the year, it is extremely liquid and its main reserve asset was bitcoin, which was at an all time high at the time of the margin requirement change and was up more than 10x from when Strategy started accumulating it.

To make matters worse, there are reports that when JP Morgan increased the collateral requirement to obscene levels, customers who tried to have their shares transferred to other prime brokers with more sensible collateral requirements (cited in the email above), Jeffrey Epstein's bank was incredibly slow to accommodate the transfer. Someone I spoke with this morning said it took nine days to transfer 2,500 shares when he had requested to transfer a position of 50,ooo shares. Ultimately, it took months to move the whole position. This is causing many to believe that JP Morgan was either lending those shares out to short sellers to hammer the stock or was short MSTR itself.

Now, I don't think it's possible to determine if JP Morgan had a massive short on itself and was attempting to intentionally screw its clients over while massively benefiting from a trade, but, at the very least, the inability to deliver a relatively small slug of shares is quite perplexing and would lead me to believe that they were, at the very least, rehypothecating MSTR shares to short sellers. Maybe there will be some public filings in the future that disclose a trade. If I were to guess, they're most likely lending them out to short sellers who are aligned with JP Morgan in their disdain for bitcoin and anything associated with it. This is all made particularly interesting when you consider the fact that Strategy started offering yield-bearing credit instruments for the first time throughout the year, which directly compete with JP Morgan's credit products.

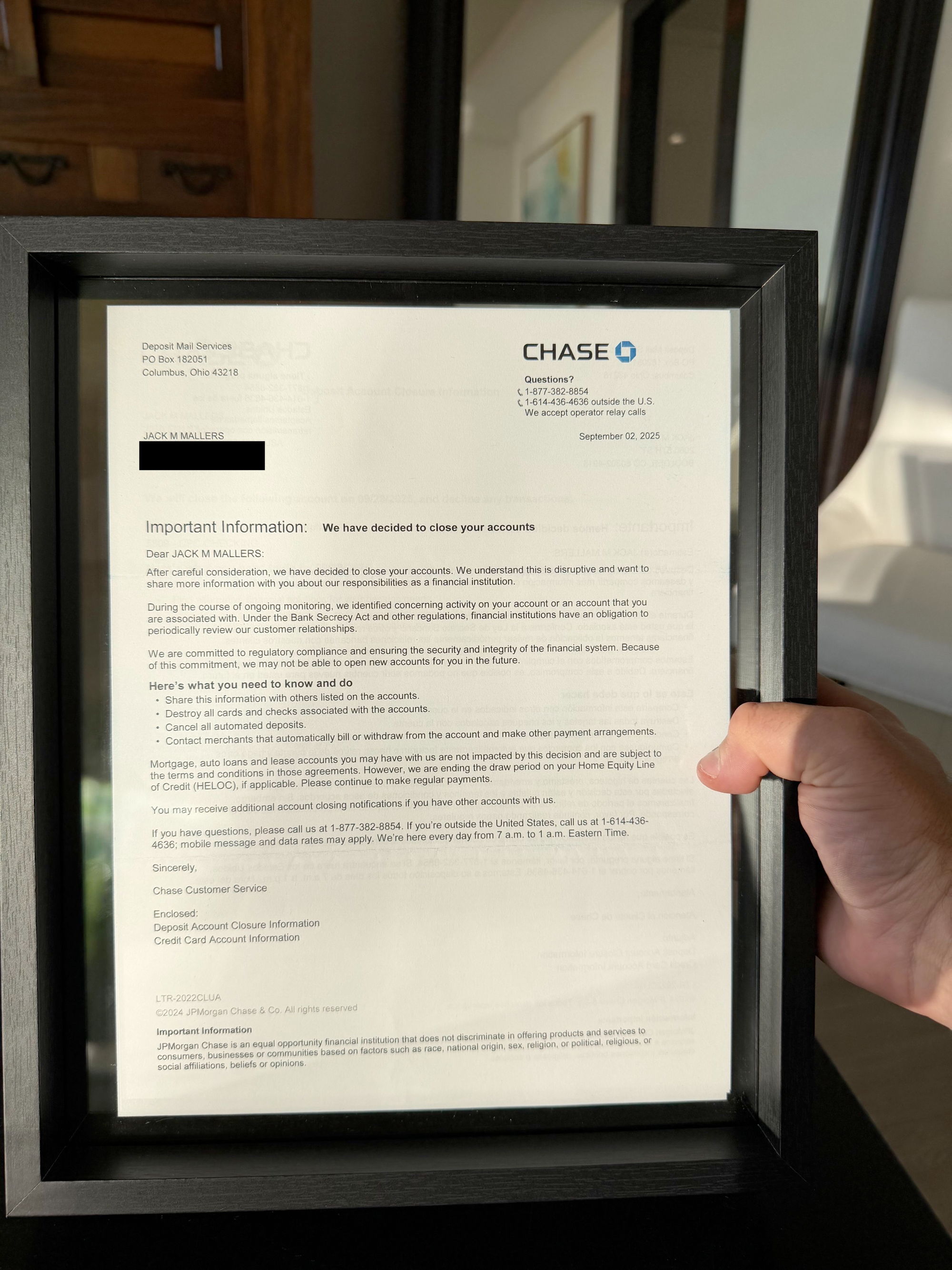

We were also made aware this week that Jeffrey Epstein's bank shut down the personal bank account of Strike CEO Jack Mallers without cause.

All of this tells me that JP Morgan has a serious problem with bitcoin and those building businesses on and around the protocol and they see their position as a too-big-to-fail as a way to try to put their thumb on the scale and move things in a certain direction. The core of the thesis is, just that, a thesis right now, but many of the small details are true and verifiable. They increased margin requirements to truly insane levels out of the blue, they couldn't deliver a relatively small amount of shares in a timely manner, and they have closed the personal bank account of one of the most prominent and successful bitcoin advocates on the planet.

Jamie Dimon and crew seem to be threatened and are acting accordingly. One thing is certain, they should feel threatened.

The artificial intelligence revolution has fundamentally altered how we think about time and investment cycles. Jordi Visser made a compelling observation about this phenomenon, noting that the pace of technological advancement has compressed dramatically. What once took months now happens in days, and what used to span decades now occurs within a single year. This acceleration creates unprecedented challenges for investors and companies making capital allocation decisions.

"A day is like what used to be a month and a year is what used to be a decade." - Jordi Visser

This time compression presents serious risks for companies pursuing debt-financed infrastructure buildouts in the AI space. Visser argued that businesses taking on long-term debt obligations to fund AI infrastructure may find themselves in precarious positions as better, faster, and cheaper solutions can emerge within just 1-2 years. The traditional investment timeline that allowed companies to generate returns over extended periods no longer applies in this rapidly evolving landscape, making strategic planning more challenging than ever.

Check out the full podcast here for more on venture capital strategies, market timing dynamics, and technological disruption patterns.

Bitcoin Selloff Driven by US Session

US Banks Face $337 Billion Losses

Bitcoin Hits $89,000 Versus Last Week

Eric Trump Unveils Texas Bitcoin Mine

MSCI Pressures Bitcoin Treasury Companies

Andreas Antonopoulos Addresses Bitcoin Spam

Created by Carl Dong (former Bitcoin Core contributor), unlike other VPNs, it can’t log your activity by design, delivering verifiable privacy you can trust.

Outsmarts internet censorship: works even on the most restrictive Wi-Fi networks where other VPNs fail. Pay with bitcoin over Lightning: better privacy and low fees. No email required: accounts are generated like bitcoin wallets. No trade-offs: browse freely with fast, reliable speeds.

Exclusive Deal for TFTC Listeners: Sign up at obscura.net and use code TFTC25 for 25% off your first 12 months.

Now available on macOS, iOS, and WireGuard, with more platforms coming soon — so your privacy travels with you wherever you go.

SLNT's patented Faraday backpacks, sleeves, and dry bags secure your hardware wallet or electronics against hackers and solar flares.

Block WiFi, GPS, RFID, and EMPs with our MIL-STD compliant tech. Made in the USA, trusted by 8 military contracts. Protect your wealth, stay untraceable.

Add Faraday protection to your stack here: https://slnt.com/tftc & use code TFTC for 15% off

Ten31, the largest bitcoin-focused investor, has deployed $200M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Runny noses are annoying.

Download our free browser extension, Opportunity Cost:

https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

|

|