The sharp decline of the Japanese yen, falling below 157 against the dollar, has ignited global market fears and spotlighted the limited impact of Japanese officials' interventions.

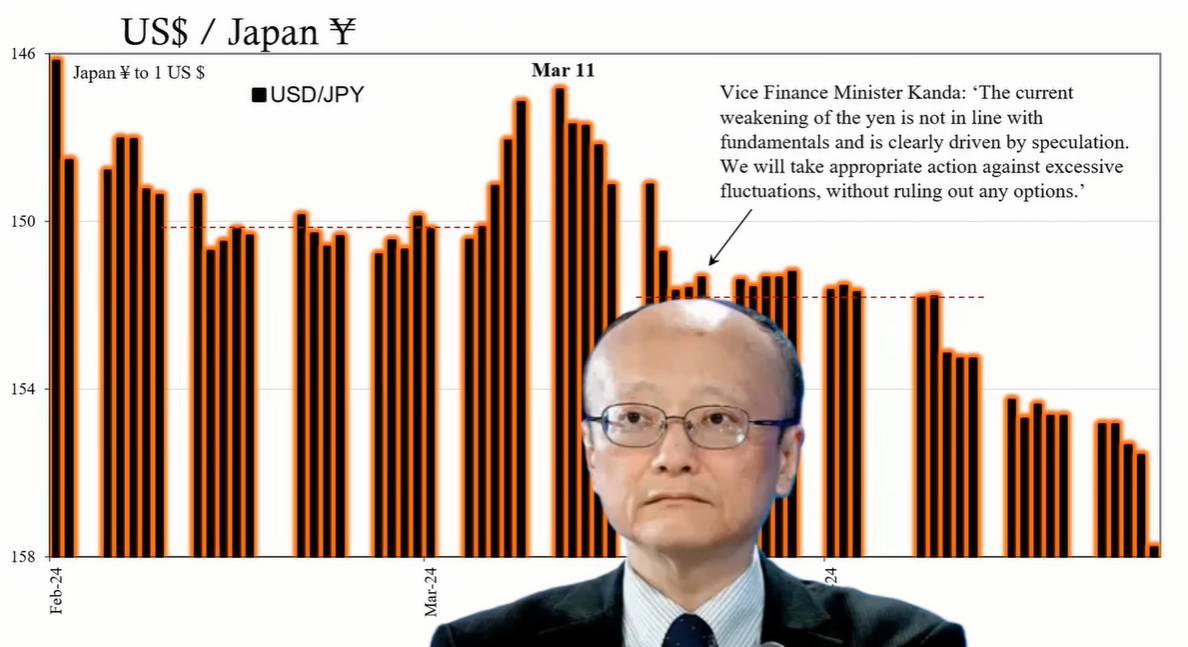

Recent trends have shown a significant decline in the value of Japan's yen, reaching levels below 157 against the dollar, a marked drop from approximately 152 a month prior. Despite verbal interventions by Japanese officials promising to stem the fall, the yen has continued its descent, raising questions about the effectiveness of government action in currency markets.

Japanese authorities have refrained from intervening directly in the currency market. This inaction might be interpreted as a strategic choice to avoid confirming their inability to influence the market after previous interventions have failed to yield the desired results. History suggests that market forces, rather than government actions, are the primary drivers of currency values.

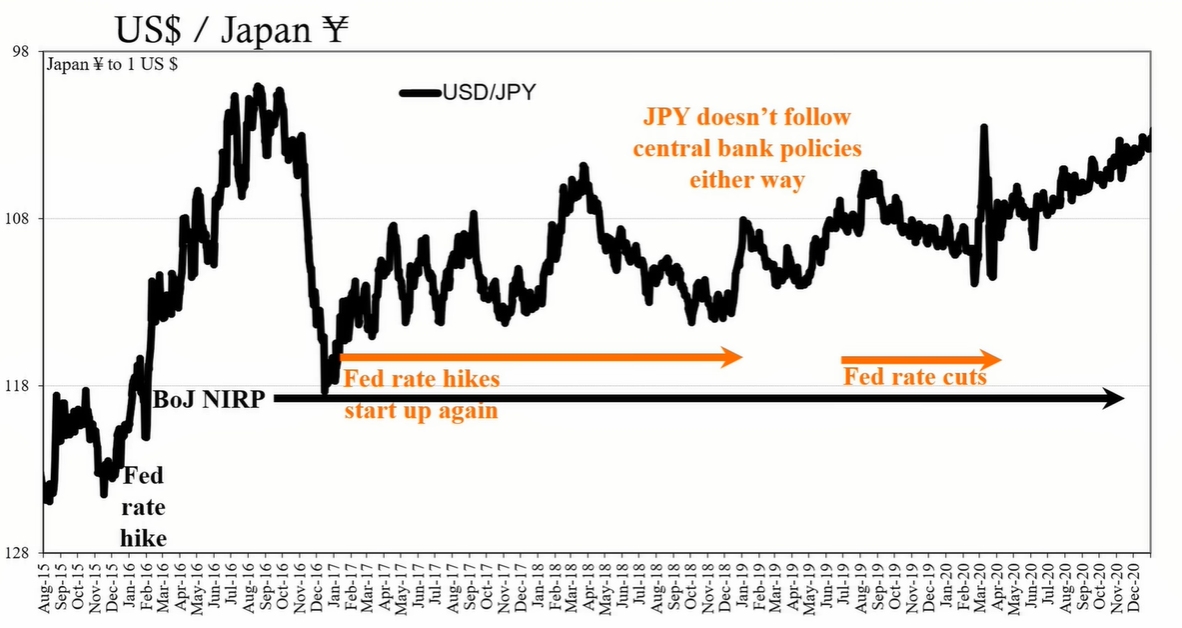

There is a widespread belief that central bank policies and interest rate differentials between countries are the main factors influencing currency movements. While the Federal Reserve's rate hikes and the Bank of Japan's (BoJ's) persistent low rates seem to justify the yen's decline, historical data often contradicts this correlation. For instance, despite the BoJ's negative interest rate policy and the Fed's rate hikes from 2016 to 2019, the yen did not depreciate as expected, calling into question the simplicity of the interest rate differential explanation.

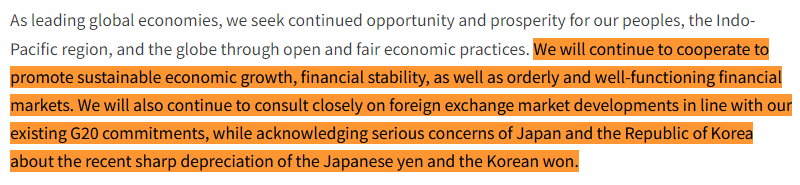

The slide of the yen, along with other Asian currencies, has prompted concerns from governments worldwide. A joint statement by Japan, Korea, and the United States underscored the commitment to sustainable economic growth and financial stability, highlighting the potential destabilizing effects of such currency movements.

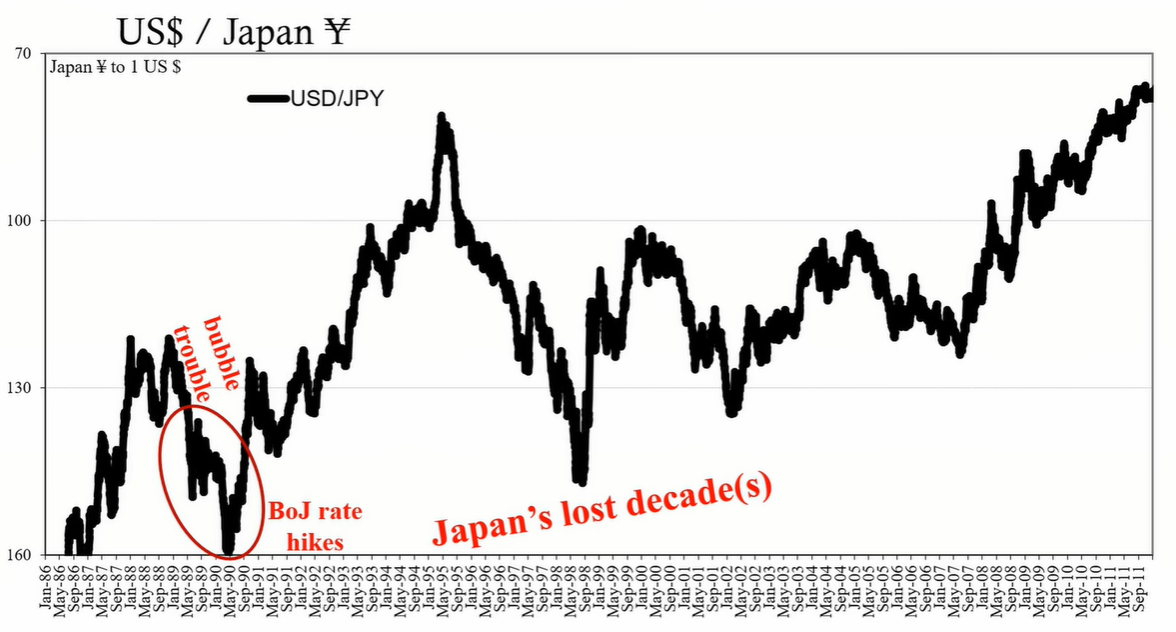

Analyzing currency trends over the last several decades reveals a more complex relationship between currencies and global economic conditions. The yen's strength in the 1980s and 1990s often coincided with periods of global prosperity, while its weakness was linked to times of economic distress, such as the Asian financial crisis in the late 1990s. These patterns suggest that currencies are influenced by broader financial dynamics rather than just central bank policies.

The eurodollar system, which encompasses global dollar-based financial transactions, appears to play a significant role in dictating currency values. Disruptions in this system often lead to currency fluctuations, as evidenced by the yen's behavior during various global economic events.

The yen's current decline began before aggressive rate hikes by the Fed, indicating that factors beyond interest rate differentials are at play. The trajectory of the yen and similar currencies may signal global risk aversion and concerns about the long-term impact of the pandemic and supply chain disruptions. The yen's movements serve as a barometer for global financial stability and economic health, with its decline pointing to underlying challenges in the international financial system.

The depreciation of Japan's yen is not simply a matter of central bank policies or interest rate differentials but is tied to the complex dynamics of the eurodollar system and global economic sentiment. As the yen continues its descent, it sends a cautionary signal about the state of financial stability and the potential for future economic disruptions.