Japan's significant shift from negative interest rates to a new monetary era dramatically impacts its traditionally savings-inclined citizens.

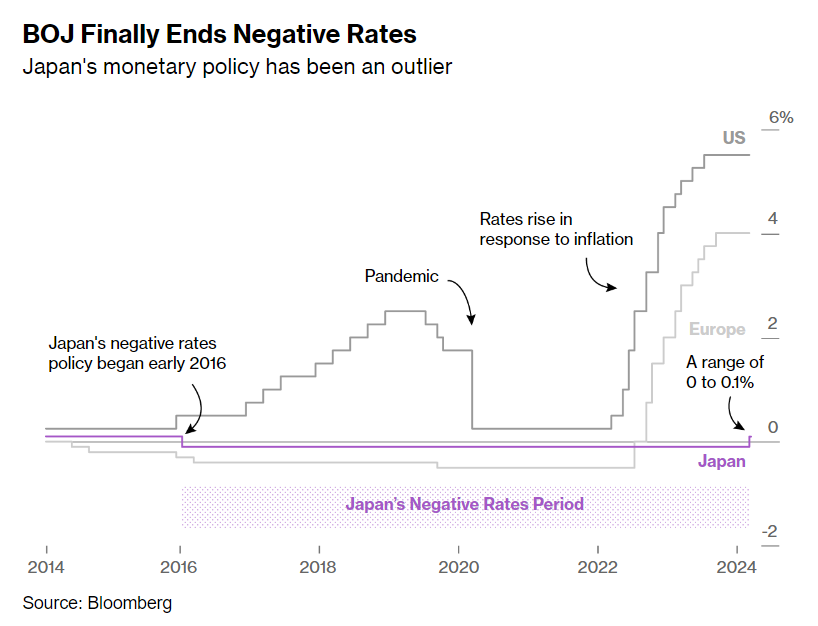

In a significant turn of events, Japan has ended its negative interest-rate policy, a move last seen in 2007, signaling a new economic era for the nation. The traditional Japanese retail investor was historically inclined towards savings rather than investments. However, the current economic landscape, characterized by inflation and the Bank of Japan's (BOJ) policy shift under Governor Kazuo Ueda, is prompting many to reconsider their financial strategy.

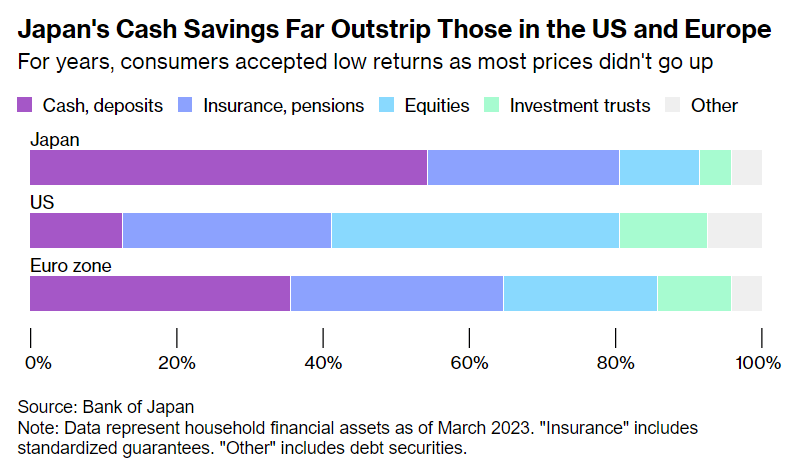

Japan, a country where cash and deposits traditionally dominated household assets, is seeing a paradigm shift as the BOJ declared an end to the world’s last negative interest-rate policy on Tuesday. For decades, Japanese residents have been molded by deflation, with expectations of steady prices, static salaries, and mortgages that would not become burdensome. This financial comfort is eroding as the country faces inflation levels that have consistently been at or above 2% since April 2022, prompting the central bank to adjust its policy with a new range set between 0% and 0.1%.

The stock market's recent peak and the largest wage rises in 33 years have injected a sense of optimism in international markets but have also spurred internal financial introspection among Japanese citizens. While the value of stocks and debt securities held by Japanese households saw a 27% increase last year, many locals are still grappling with pay raises that do not match the pace of inflation, affecting their livelihoods and casting doubt on the efficacy of Prime Minister Fumio Kishida's government.

Analysts like Takashi Shiozawa of MFS Inc. express concern over the potential negative psychological impact the policy change may have on consumers.

“For the BOJ, it might seem like just a 0.1 percentage point move to remove negative interest rates, but in terms of the average consumer, there’s a possibility that the negative psychological impact will be many times greater than that.” - Takashi Shiozawa

For households, the new rates present a double-edged sword: savings will benefit from higher deposit rates, but personal loans, especially home mortgages which are largely on floating rates, will become more expensive. Major banks have already announced an increase in deposit rates, leaving mortgage rates unchanged for the time being.

Seiya Kibushi, a 24-year-old recent graduate, acknowledges that the BOJ's policy shift could affect his student debt repayment plans. Similarly, individuals like Yasufumi Ishii, a 50-year-old employee at a cosmetics company, are considering property investments as a hedge against inflation.

The BOJ's decision closes a chapter of unconventional monetary policy that saw Japan's central bank become the largest owner of domestic stocks. This policy was a response to deflationary pressures that have long characterized the Japanese economy. As Japan aligns with global financial trends, the shift away from negative rates may strengthen the yen, potentially easing import costs but also affecting tourism and exports.

Jeff Young, the founder of DeepMacro, stresses the importance of reevaluating financial strategies in light of rising rates. The change in policy also highlights the need for financial education, as exemplified by Hu Shenqiang, who is investing in an MBA to enhance his financial acumen.

In conclusion, Japan's move away from negative interest rates marks a significant transition that is prompting Japanese citizens to reassess their financial positions. While this may foster a more investment-oriented mindset, it also brings challenges, particularly for those whose income growth fails to outpace inflation. The country's economic future hinges on how individuals and policymakers navigate this new financial landscape.

Originally reported by Bloomberg