Japan's current economic predicament offers a valuable lesson on the limitations of central bank policies in the face of global economic shifts.

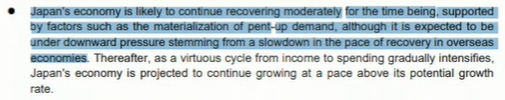

Japan's economic challenges present a stark warning to the global community. The Bank of Japan (BOJ) is navigating a complex landscape where inflation risks, once a primary concern, have receded amid a synchronized global downturn. This shift in economic climate has prompted a reassessment of monetary policy strategies.

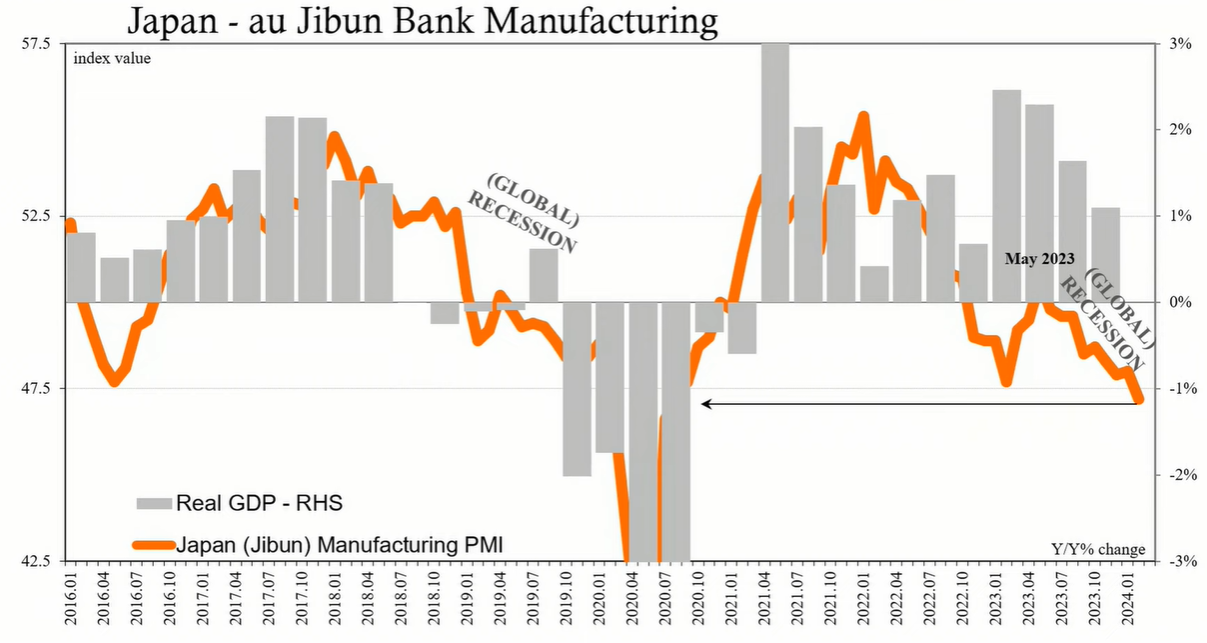

Despite the BOJ's continued warnings about inflation risks, these concerns have largely dissipated due to a synchronized global recession. Acknowledging the impact of a global slowdown, the BOJ maintains a cautious stance, with an optimistic outlook for a recovery driven by pent-up consumer demand, a hypothesis that remains unsupported by empirical evidence.

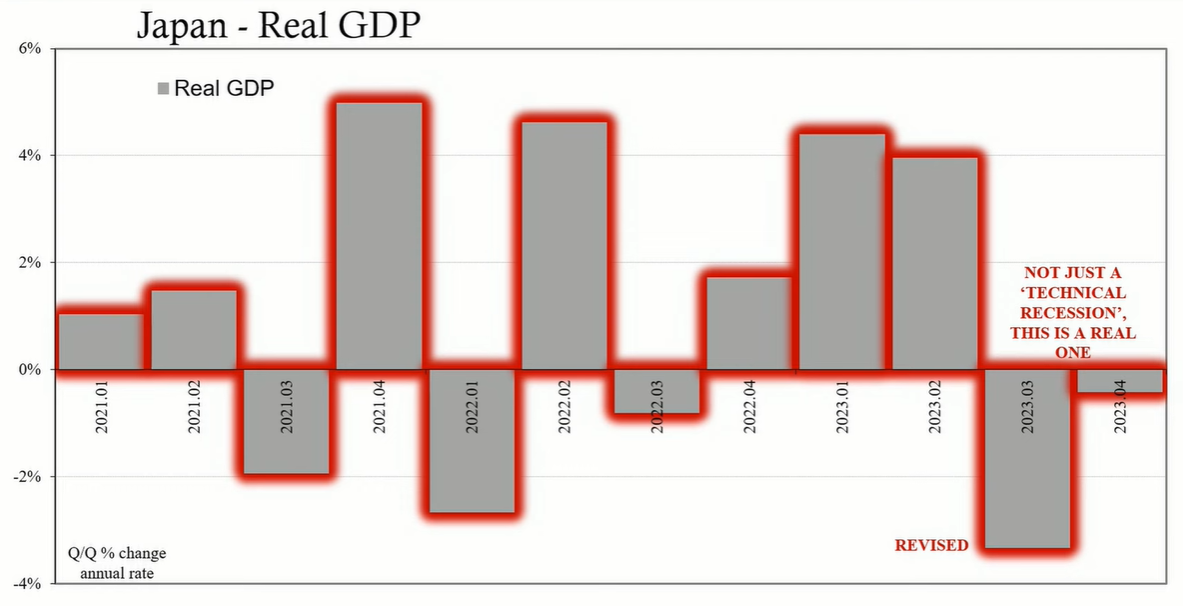

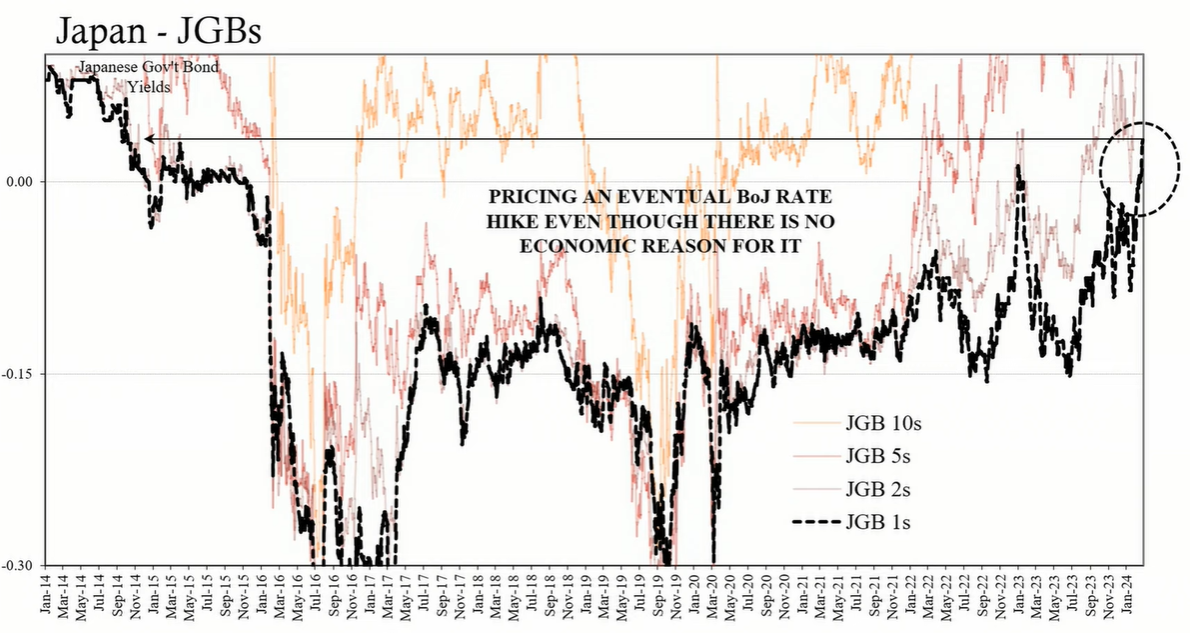

The BOJ's insistence on potential rate hikes raises questions about the necessity and effectiveness of such measures. With Japan's economy in a recession and high prices triggering market corrections, the rationale for increased rates appears unsubstantiated. This situation exemplifies the broader skepticism about the real impact of central bank policies on inflation and economic performance.

The BOJ's projections for Japan's economy suggest a recovery above the potential growth rate, fueled by a supposed increase in consumer spending. However, historical data shows that Japanese consumer spending has been consistently weak for decades, casting doubt on the anticipated surge in demand.

The BOJ acknowledges the uncertainties surrounding Japan's economic activity and prices, particularly in relation to overseas developments, commodity prices, and domestic wage and price-setting behaviors. These factors, coupled with financial and foreign exchange market dynamics, present a complex environment for monetary policy considerations.

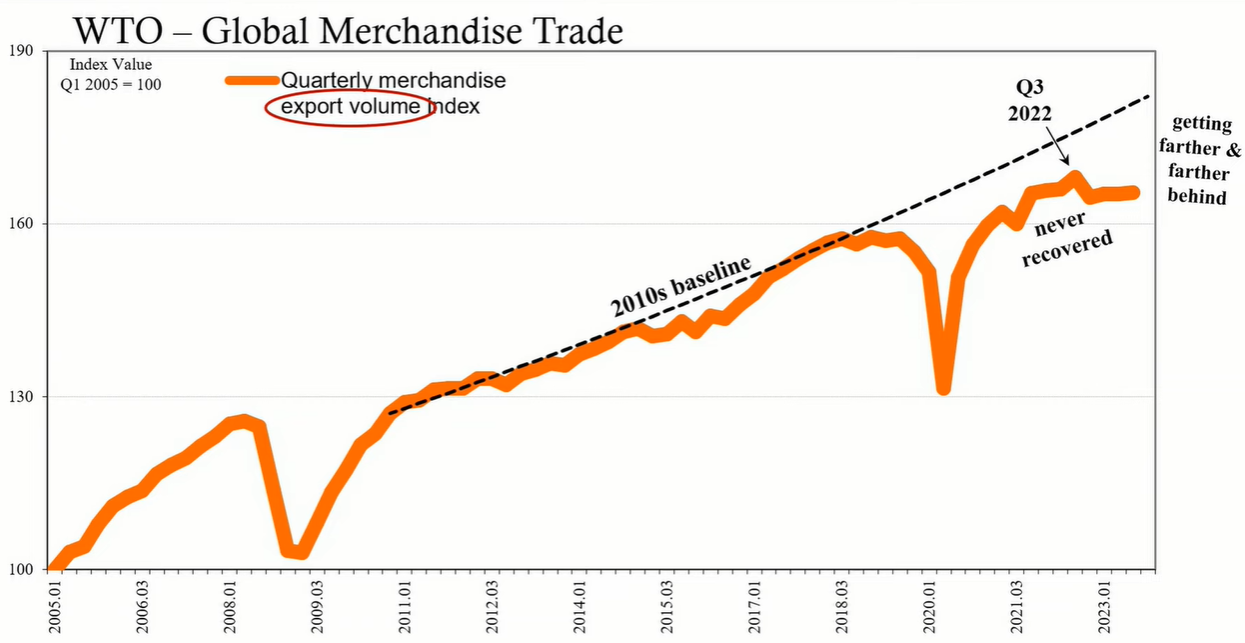

Recent consumer price index (CPI) data from Japan indicates a trend toward disinflation, with the core CPI (excluding fresh food) exhibiting minimal growth. Despite this, the BOJ maintains a target CPI rate above 2% through fiscal 2024, a goal that seems increasingly unrealistic in light of current trends.

The Japanese government's fuel price subsidy program, aimed at mitigating energy cost impacts on consumers, has been extended multiple times, reflecting a sustained effort to control inflationary pressures. However, the overall CPI movement suggests that these efforts may not be aligning with broader economic realities.

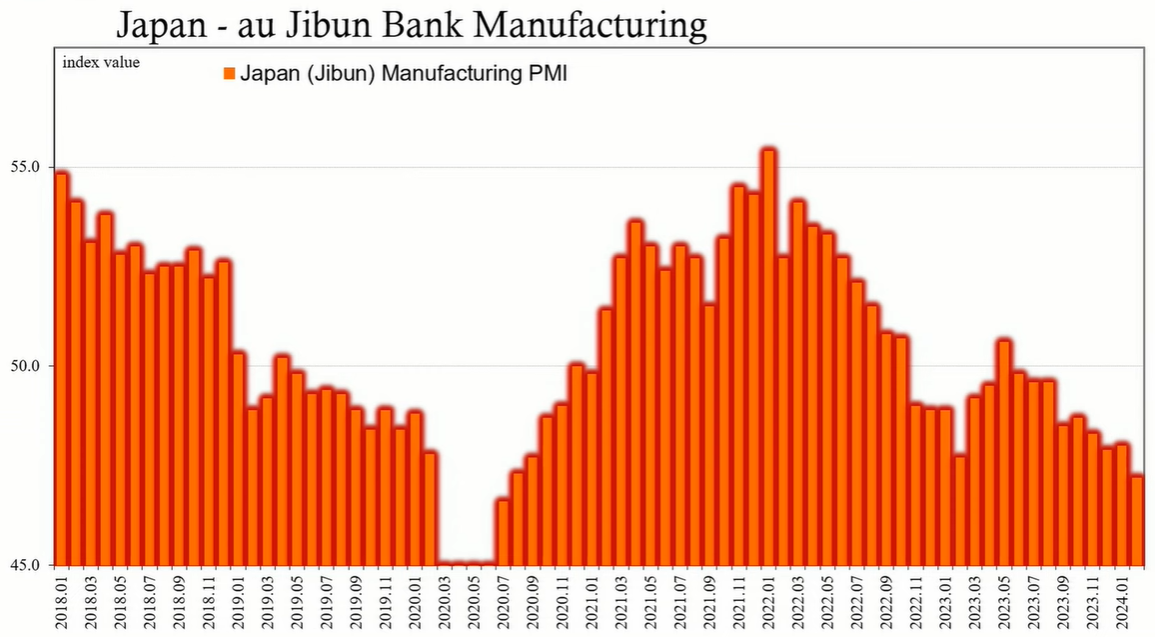

Japan's economy shows signs of recession, with household incomes in decline and spending trending downward. This contraction, alongside disinflationary pressures, undermines the argument for imminent rate hikes. The PMI data likewise indicates an economic slowdown, reinforcing the recessionary narrative.

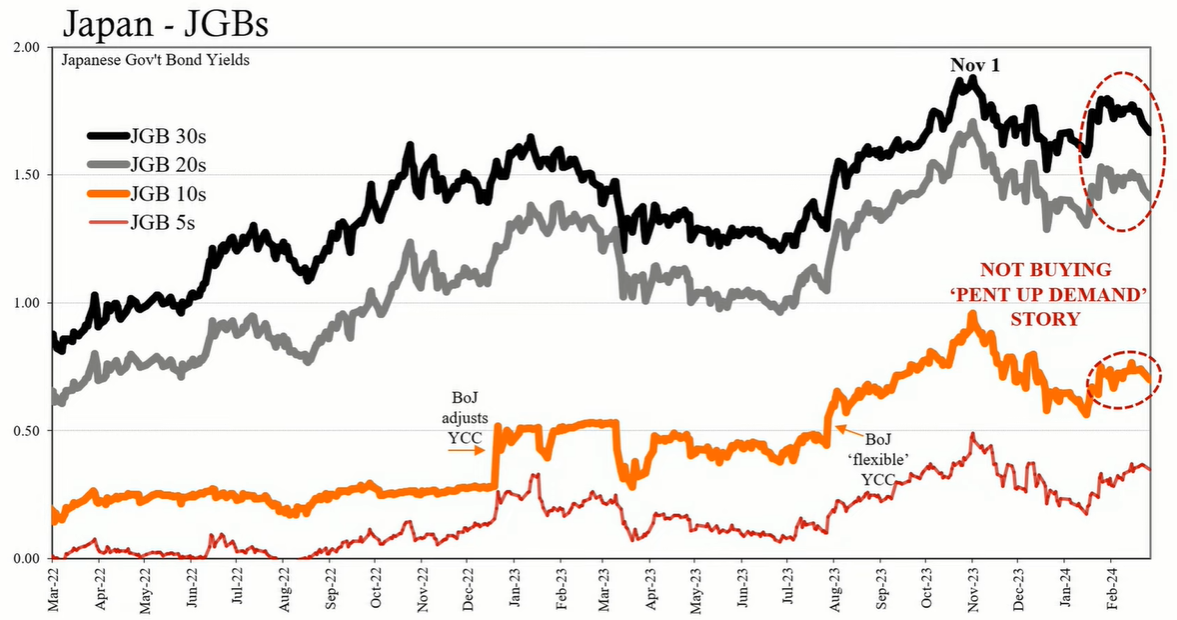

The divergence between long-term and short-term Japanese government bond (JGB) yields highlights market expectations of potential BOJ rate hikes, despite the absence of a compelling economic case. This dissonance suggests that central bank actions may be more politically motivated than economically justified.

A review of Japan's CPI history since the BOJ's introduction of its price target in 2013 reveals a consistent failure to achieve the set goals. This track record casts doubt on the influence of central bank initiatives on actual price levels and economic outcomes.

Japan's situation serves as a critical example of the limitations of central bank policies in the face of global economic forces. The country's experience demonstrates that high prices can lead to recession as a corrective mechanism, and that the roots of inflation and recession are often globally synchronized, transcending national monetary policy actions. As Japan and other nations grapple with the aftermath of supply shocks and economic contractions, it becomes clear that understanding global dynamics is essential for accurate economic forecasting and policy formulation.