I highly recommend you check out this piece.

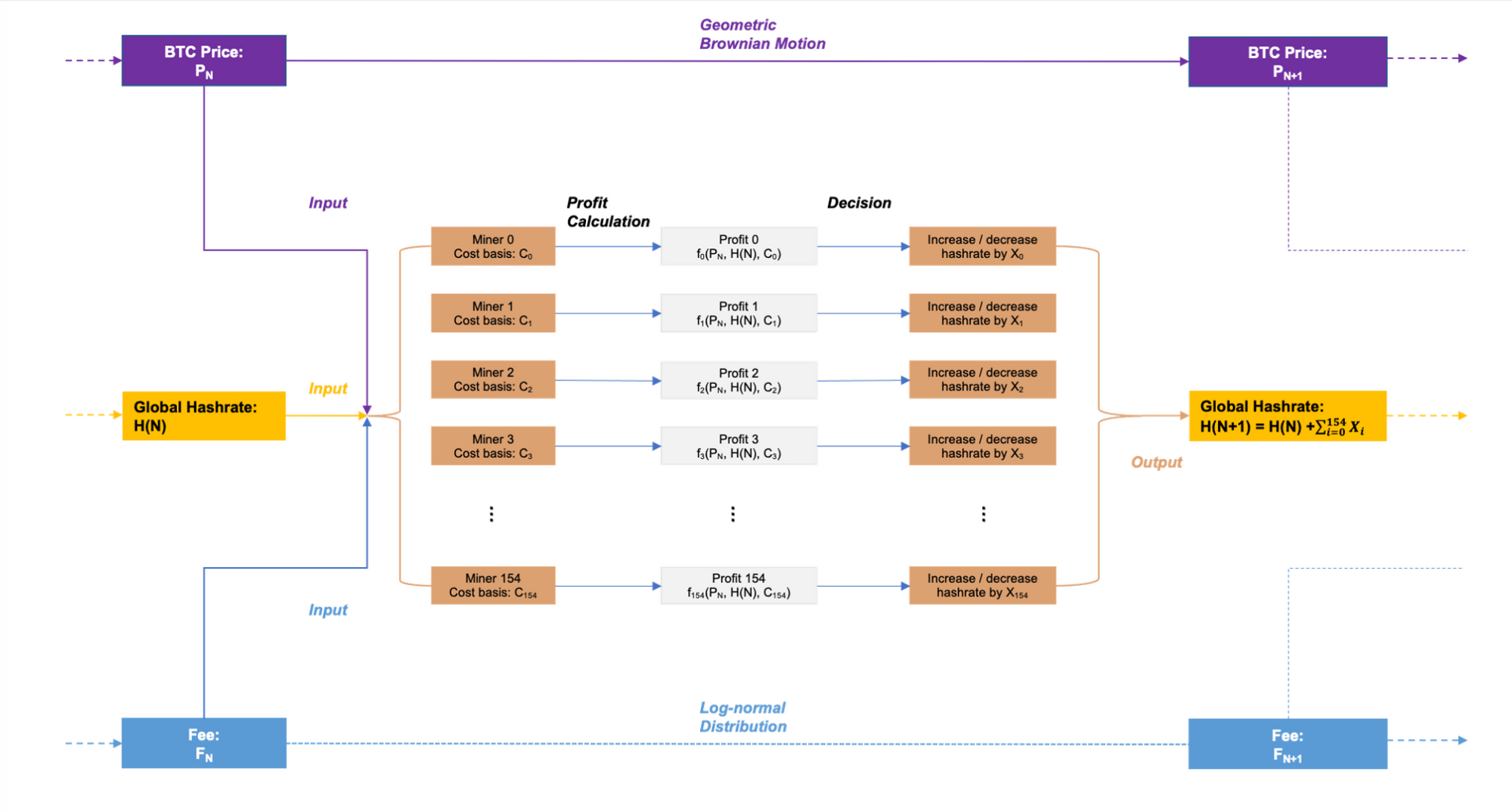

Leo Zhang and Jack Koehler of Anicca Research are back with Part II of their The Intelligent Bitcoin Miner series. For this installment the two have teamed up with Karim Helmy from Galaxy Digital to produce a model that can help miners, and interested observers, attempt to illustrate different potential profitability scenarios. Their open-source model takes miner model, initial investment, and electricity costs and runs them through different bitcoin price and hashrate scenarios for two inventory management strategies; mine and sell every sat, and mine and sell enough sats to cover operation expenses.

If you're interested in learning more about the variables that go into running a mining operation and, more importantly, how to run an operation as profitably as possible, I highly recommend you check out this piece. As the trio explains in the article, these models are just that, models. They are forward looking and not indicative of what will play out, but they can certainly help miners develop strategies to reduce balance sheet risks as they continue to mine.

With that being said, if you want to get an idea of the different revenue scenarios that could play out during a bull market, during a relatively flat market, and during a bear market with different mining models and electricity costs, this piece has some very intriguing models.

I've said it once, but I'll say it again, Leo and the Anicca research team are putting out some of the highest quality content in the mining space.

Final thought...

Been significantly stepping my walking game up during the day. Need to walk more.