This is a great read.

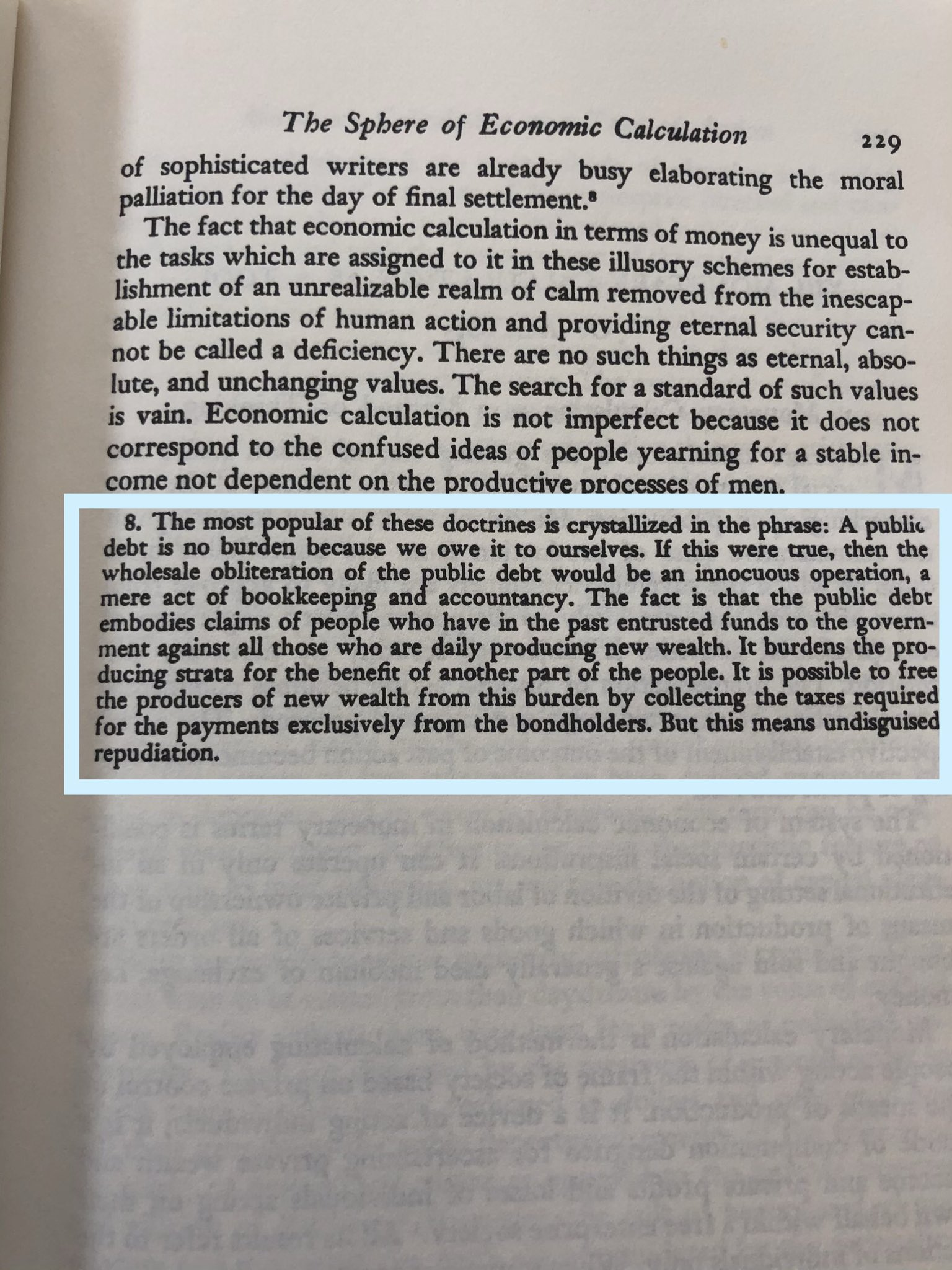

I've (finally) been making my way through Ludwig von Mises' Human Action. I've been exposed to Mises' ideas, essays and books via Mises.org for many years now, but never got around to diving into Human Action. Over the weekend I read a few chapters with my morning coffee and came to this footnote that succinctly debunks the terrible notion that public debt isn't a problem because it is money we owe ourselves.

This line of thinking has always driven me crazy simply because of the mere fact that actions have consequences. Hand waving about public debt and writing it off as inconsequential does not make any sense to any self respecting human. In the six sentence footnote above Mises handily debunks this terrible line of thinking. And I am using today's issue to spread the message to you freaks.

"We owe it to ourselves" is one of the most destructive thoughts to ever enter the economic mainstream. This line of thinking completely ignores the concept of individuals. An individual with unique circumstances, income, time preference and personal debt levels. What "we" really describes is those at the helm of the political and banking system at any given point in time. And they are using the mythical we as a scapegoat so that they can paper over systemic problems without having to make necessary but politically unpopular policy changes. This continual scapegoating and normalization of this line of thinking has put us in a very precarious situation.

The US economy is quickly turning into a Banana Republic completely dependent on the Federal Reserve intervening in markets. Their intervention has gotten to the point where they are the only game in town. Actual value creation and productivity from businesses does not matter any more. The only thing that matters is whether or not the Fed is printing money (i.e., inciting the creation of public debt via treasury issuance) and how much of it. "Value" now flows from the ether of the Fed's servers to the stock market. The structural stability and cash flows of the companies that make up the stock market matter very little in this type of environment.

The Fed is doing such a great job of distorting markets it has totally priced out both Warren Buffett & Stanley Druckenmiller. These guys used to rely on value to invest. There can be no value when the Fed provides a neverending bid. The Fed literally just ended value investing.

— Quoth the Raven (@QTRResearch) June 8, 2020

Be careful out there freaks. There are many men out there who will parrot the "debt is money WE owe OURSELVES" without acknowledging that "WE" isn't a static entity, but a collection of individuals at different points in their lives, with different income levels, education levels, balance sheets, time preferences and personal beliefs. Thinking that all of the individuals that make up the mythical "we" align perfectly in all of these areas is legitimately stupid and arguably malicious.

This type of thinking devalues individual sovereignty and completely distorts markets and the pricing of goods within them. This distortion benefits very few individuals. Those who hold the financial assets being distorted. These polices are producing a gorge between the rich and the poor at the moment in our country. Saying that creating public debt via treasury issuance incentivized by QE has no effect on markets because the Fed's purchasing policies "net to zero" completely neglects - again, arguably maliciously - what actually happens during this process. These actions most certainly do not "net to zero". The Fed buys the treasuries (along with other assets) with newly printed money from its servers and gives that to banks and other institutions who take that newly printed money and lever it up in markets. Causing a positive EV for those on the opposite side of these transactions with the Fed.

This process hurts American citizens in two ways. As described above, it creates a transfer of wealth from taxpayers to the owners of financial assets. And to pour salt in the wound, it increases their eventual tax burden when there is an inevitable shortfall on the public debt accrued during this process. It's completely fucked up and it needs to stop. Anyone championing these policies are either woefully ignorant or overtly malicious.

Fix the money, fix the world.

Final thought...

I already want to have another child.