Credit card and auto loan delinquency is getting crazy.

If one looks past the tweets proclaiming that we are in "THE BEST ECONOMY EVER" from our orange-tinged President which is oft parroted by the mainstream media and looks at some granular data, things aren't looking so well. Especially for those who are the most vulnerable in our country.

The charts above paint a pretty dark picture for subprime borrowers and the lenders they are borrowing from. As the price of the goods and services that the common man needs most continue to increase, he is being forced to overextend himself by going into debt. Borrowing from his future self to survive today. And as the trend of increasing prices continues, it is becoming increasingly hard to tread water. Let alone get ahead in any material fashion.

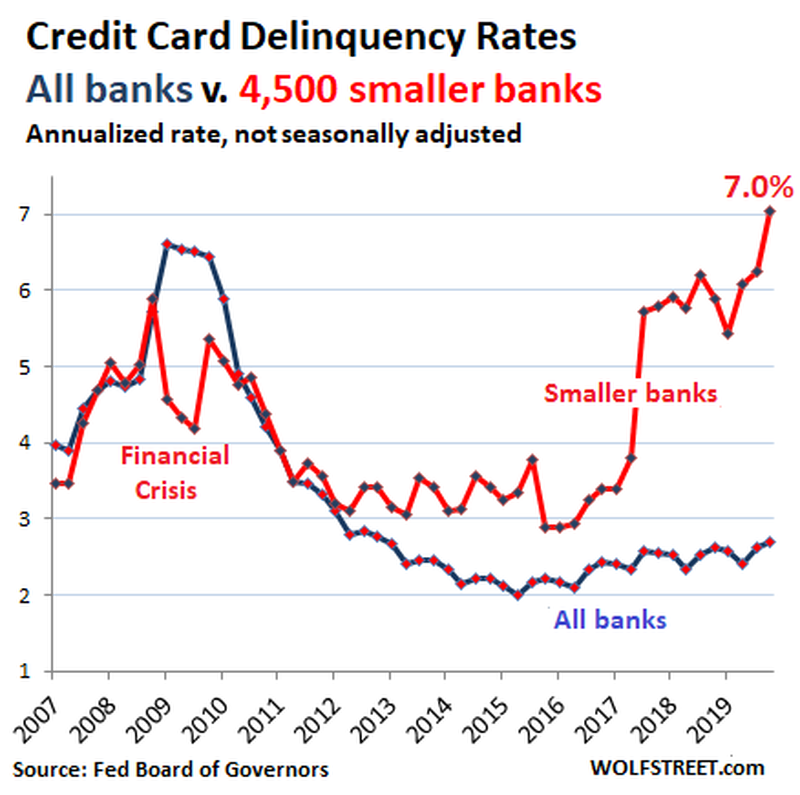

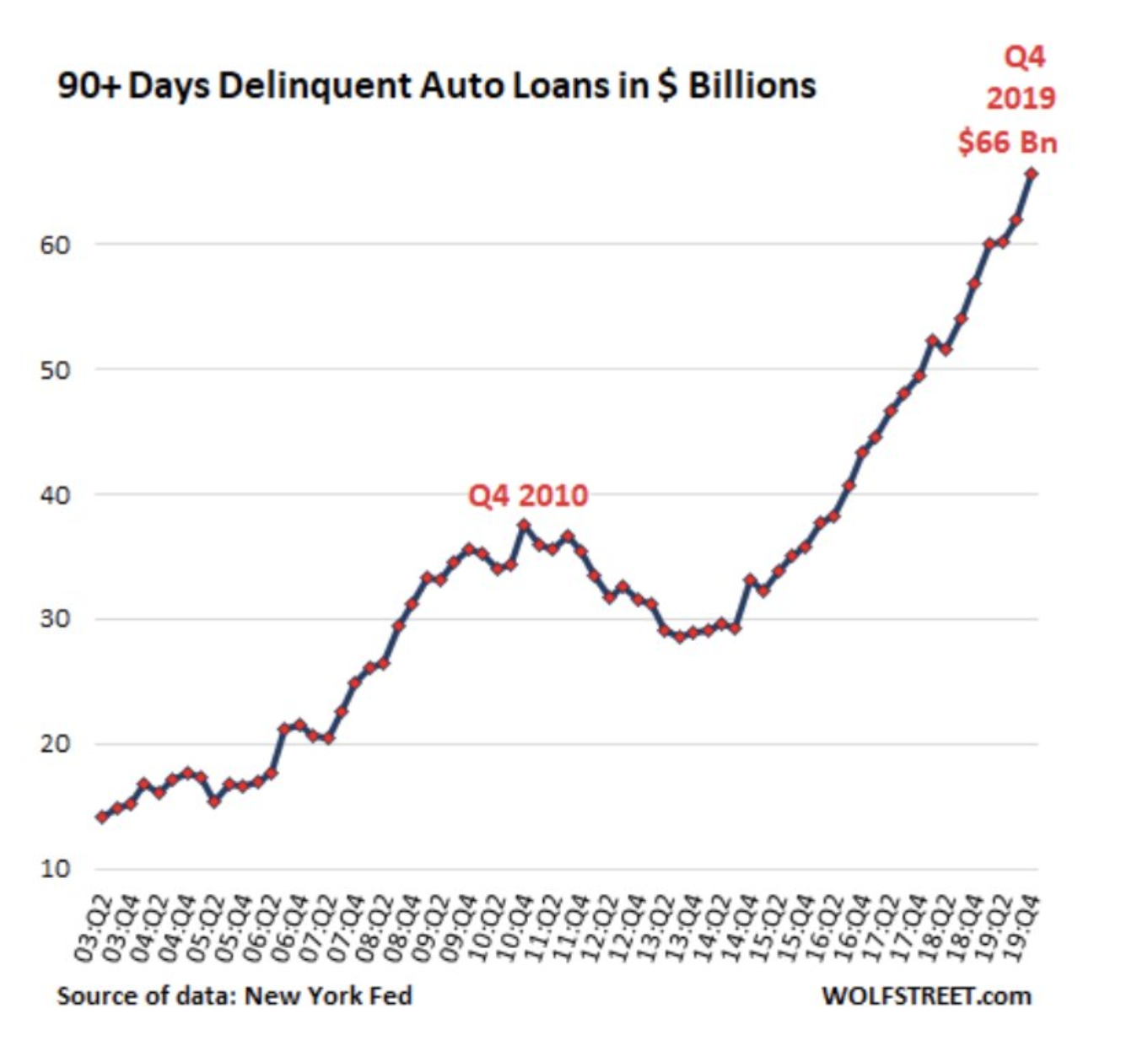

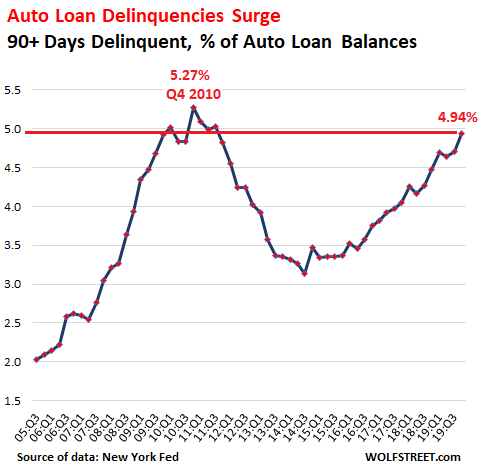

This is evidenced by the skyrocketing delinquency rates in credit cards issued by small banks and auto loan delinquency rates. The latter of which has reached parity with levels last observed during the Great Recession. If you freaks recall, the Great Recession was precipitated by a degradation of the subprime lending markets. This is not a good sign. Especially when one begins to factor in the economic slowdown that seems to be inevitable if fears of the Coronavirus continue to spread, causing more and more cities to quarantine their citizens.

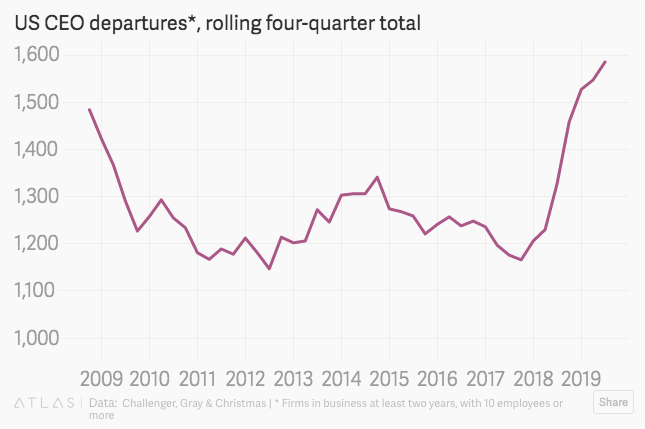

The degradation of subprime loans is not the only warning alarm going off at the moment. The individuals in charge of the companies that make the economy go round are jumping ship:

It seems as though those with the most intimate knowledge of the state of the economy are jumping ship as shit hit the fan. As I said on Twitter earlier this morning, this trend is poetic and emblematic of our high velocity trash economy. Those at the top don't care about the true vitality of their companies. How could they when their incentives are skewed towards the short-term? Chasing quarterly earnings reports and grooming stock prices via buybacks is the norm. The "leaders" at the top of companies only care about optics. If all that matters is creating a mirage of success, it's not surprising to see the people who have benefited most from the Fed's propping up of the markets begin to bail when that mirage begins to fizzle and reveal that what people thought was a "strong economy" is actually a barren wasteland.

All of this has been enabled by financial engineering. Lowering the barrier of entry to credit for the sake of economic growth. Allowing massive buybacks so CEOs can make it seem like their companies are doing better than they actually are. Printing money and lowering interest rates to keep failing companies afloat instead of culling the herd.

This is all so fucked.

Final thought...

Mama, I want to go surfing.