Check out this chart.

On September 18th of this year we covered the emergency repo operations that the Federal Reserve had to execute in the wake of an apparent liquidity crunch. Since then, we have learned that JP Morgan embarked on a massive portfolio restructuring this year. Rotating out of a massive cash position into long-term bonds. The scale of which was "mind-boggling" according to some institutional investors who have an intimate understanding of money markets. This tectonic rotation out of cash and into longer-term securities is what a lot of people are surmising is the impetus for the liquidity crunch that is forcing the Fed to purchase debt from cash-strapped financial institutions. The question that has been on everyone's mind is, "who the hell needs the liquidity?"

Well, late last night Zerohedge dropped a piece covering comments from the Bank of International Settlements (BIS) that seem to have identified the institutions in need of liquidity, hedge funds looking to lever up. And their need for liquidity was so dire that those in charge of the very top of the international banking cabal pyramid are going as far as to say that "the Fed was facing multiple LTCMs". For those of you freaks who are unaware of what an LTCM is, it's a reference to the blow up of Long Term Capital Management, an infamous hedge fund founded by academics that levered up like crazy and blew up in spectacular fashion in the late 90s. It is a case study in how quickly things can unravel, even for those who are deemed the smartest in the room.

So apparently, (according to the BIS mind you) in early September there were a number of hedge funds scrambling for liquidity lest they blow up in spectacular fashion. A startling admission coming from an entity with extremely strong incentives to make it seem like everything is okay. Though, is this really surprising considering the BIS's recent capitulation that they will have to compete with cryptocurrencies?

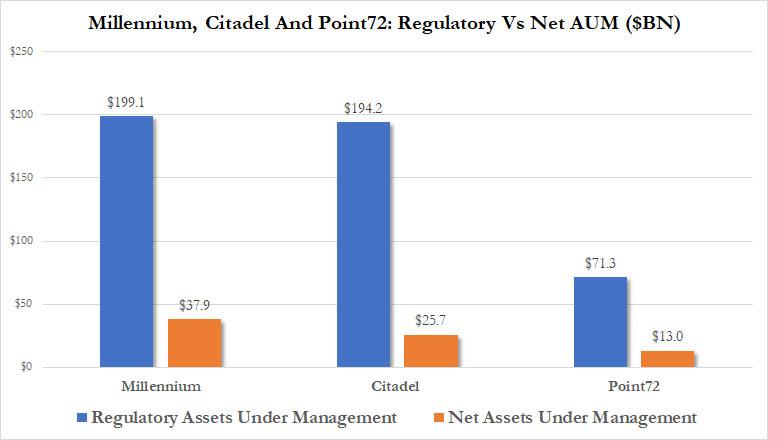

Look at that chart above. Millennium is 5.25x levered, Citadel is 7.55x levered and Point72 5.48x levered at the moment. If I understand the situation correctly, the funds above and others like them would usually tap the shoulder of JP Morgan to help fund their levered exposure, but due to JP Morgan's balance sheet restructuring this year out of cash that avenue for liquidity isn't available anymore. Thus, these hedge funds are being forced to approach the lender of last resort for the needed liquidity to either maintain the leverage they need to produce sufficient returns, or worse, as the BIS is alluding may be the case, to prevent themselves from being margin called on their leveraged trades. This is not an ideal situation we find ourselves in, freaks.

Think about how far away the Fed has gotten from its original mandate. The Fed was originally forced upon us under the guise that it would only intervene to lend to the banking system when the economy needed to be stoked. Fast forward 106-years and the Fed is buying toxic assets, monetizing the debt it's creating, and acting as lender of last resort to... levered up hedge funds. Do the people who have been saying that the Fed is propping up markets really sound that crazy anymore?

This is not going to end well. And JP Morgan knows it! This year's balance sheet restructuring out of cash and into long-term securities is looking more and more like a "get out first" move by Jamie Dimon and crew. Like I said on Saturday, put your helmets on freaks. 2020 is gearing up to be a crazy year on all fronts.

Thank Satoshi we have Bitcoin running in parallel to this shit show.

Final thought...

Loving the Sixers chemistry this last week.