It's been real slow around these parts outside of the Attorneys General report that dropped earlier this week, a Japanese exchange getting hacked, and the volatile intraday price action in Bitcoin yesterday that had some people screaming "MANIPULATION", so I figured I'd wander off the beaten path and talk about lessons we can glean from the Lehman collapse and subsequent recession. As you can see from the snippet above taken from this great piece on Zerohedge, some eerily similar themes played out in the bubble fueled by mortgage-backed securities and the one we witnessed last year fueled by ICOs and other affinity scams.

The main similarity being the presence of "experts" who proclaimed to retail investors and the masses at large that these new forms of organizing and raising funds (ICOs) were as revolutionary as the Internet itself. What we came to find is that these vehicles were great for transferring money from the pockets of retail investors to the organizers of the ICOs and the lucky investors who were able to get into presales due to cronyism and proximity to "deal flow", an overwhelming majority of which have produced nothing of value to society other than a lesson that now will stand in the annals of history next to bubbles like the one that led to Lehman's collapse.

If we take any lessons away from these two examples of exuberance and subsequent disaster for retail investors, it's that we should not trust "experts", especially in this industry since they DO NOT EXIST. If anyone is telling you that they have solved a decades-long economic, technological or social problem and the solution includes an ICO and a blockchain, you should be immediately skeptical. If someone tells you that the music isn't stopping because of the pending "flood of institutional investors" is about to run onto the field from the sidelines (I was guilty of this at one point, but have since wised up to the fact that this is a bad meme), you should look at them with a bit of skepticism. This, obviously, did not happen.

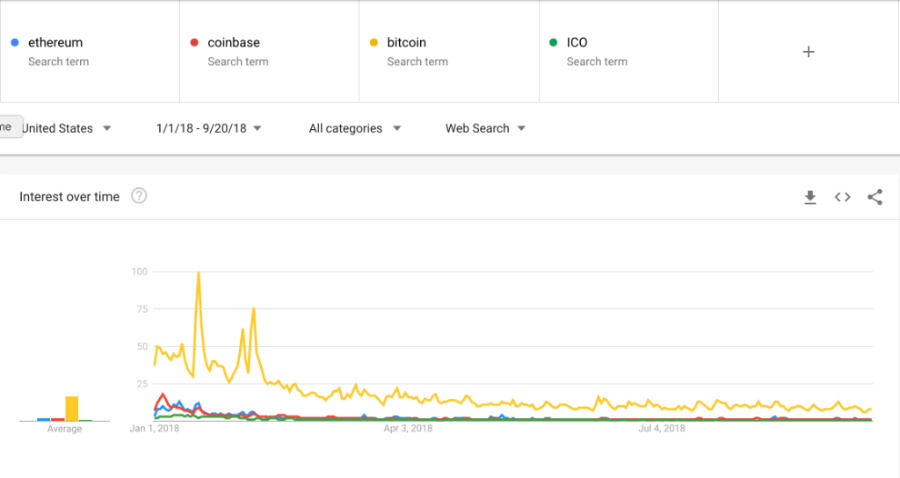

As we can see from the Google Trends chart above, retail and institutional investors alike have lost a considerable amount of interest in Bitcoin and cryptocurrencies in general. I bet this is because of how ridiculous the hype and promises were during last year's mania coupled with the lack of results and actual working products this year. All hump and no red rocket. This disinterest will probably continue until people begin to see the true value of the only thing that actually works as marketed in this space, Bitcoin. Once Bitcoin becomes a go-to tool (among many) for people struggling in emerging markets with weak currencies or oligarchs looking to preserve wealth and avoid capital controls, I believe we'll see interest piqued again. Until then, enjoy the doldrums of the bear market.

Final thought...

One time, while on a family skiing trip, we were on the last run of the trip and my brother my cousin and I were shredding our favorite trail with a jump at the end. My brother and I nailed the jump and waited for my cousin at the base to watch him get some big air. Unfortunately, a ski instructor corralled a school of ten 8-12 year olds to the base of the jump unbeknownst to my cousin and he launched directly into them. Pure chaos.

My brother and I pissed ourselves from laughing so hard.