This is an awesome statistic.

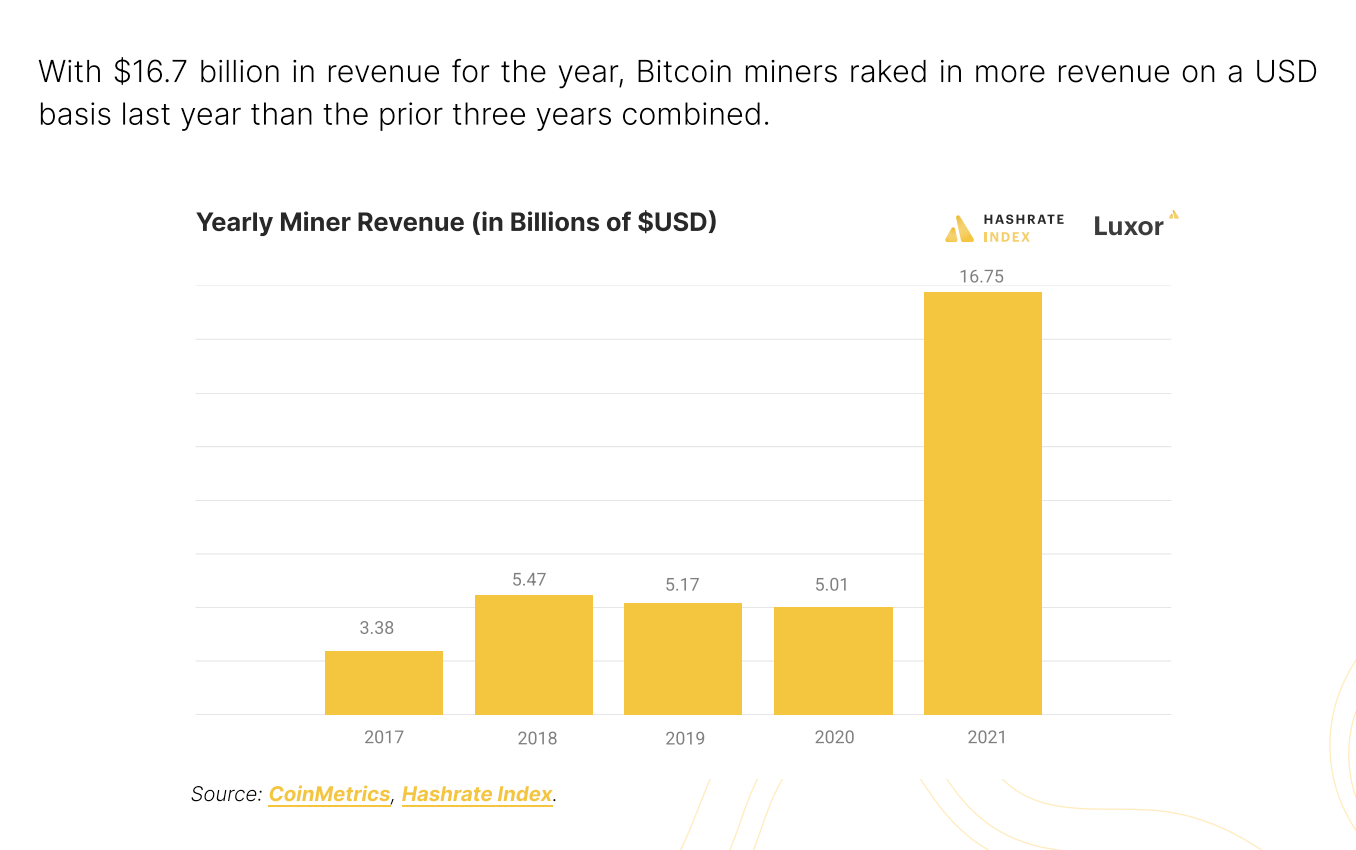

Here's a pretty startling stat from the mining world highlighted by the Hashrate Index team; bitcoin miners produced more USD revenue in 2021 than they did in 2018, 2019, and 2020 combined. Obviously, the price of bitcoin reaching new all time highs and remaining at a historically elevated level helped drive revenues. But you should be reminded that the block subsidy in 2021 (and 7-monhts in 2020) was (and still remains today) 625M satoshis (sats) compared to 1.25B sats in 2018, 2019 and a solid portion of 2020. This is a great stat to see if the dwindling block subsidy getting cut in half every four years causes you worry.

Many think the subsidy dwindling toward zero sats per block puts the future security of the network at risk because miners would have little incentive to mine if they aren't appropriately compensated for their work. However, as we can see from the chart above, due to an increase in demand for sats driving up the price of sats as measured in dollars, the increased value of the sats in the block subsidy are more than compensating for reduction of overall sats in the subsidy. The purchasing power of sats has increased materially over the last two years, which is keeping miners incentivized to keep plugging in machines to continue appending the ledger. 2021 revenue as measured in dollars was more than 3x the revenue produced in 2018, which was the best year in mining pre-2021.

If the price of sats as measured in dollars continues to increase as well as outperform the real rate of inflation, humanity can rest easy knowing that miners should be sufficiently incentivized to provide their services for the foreseeable future. If operators keep working tirelessly to drive down their initial capital expenditure and ongoing operational expenses to mine as profitably as possible we should see very profitable businesses continue to emerge. On top of this, as bitcoin adoption continues to increase, the demand for blockspace should increase with it bringing a more robust fee market that should create an even better incentive for miners to continue their operations.

This is a very bullish and not-well-understood fundamental metric that many are overlooking at the moment in your Uncle Marty's humble opinion.

I highly recommend you freaks check out the rest of the Hashrate Index report. Colin Harper and Ethan Vera did an incredible job of laying out the developments in the mining industry throughout 2021.

Final thought...

I need to be better at setting my alarm clock when I need it.

Enjoy your weekend, freaks.