Those abroad should heed the warning.

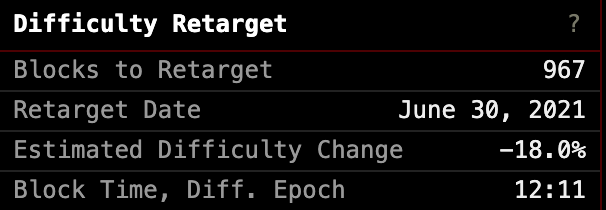

As I'm sure most of you freaks are aware of by now, there is a great bitcoin mining migration under way as the powers that Xi in China have decided to - what seems to be for real this time - officially ban the activity across many provinces. The pace of block production since the last difficulty adjustment seems to confirm that a significant amount of hashrate has left the network.

It’s really a shame, but not surprising, to see this happen to a cohort of bitcoiners who have proven to be some of the most ruthlessly competitive in the industry over time.

— Marty Bent (@MartyBent) June 19, 2021

When push comes to shove Bitcoin mining on grid will be vilified.

— Marty Bent (@MartyBent) June 19, 2021

On top of this, BITMAIN hosted an event over the weekend with VIP clients during which participants discussed hosting opportunities in the West. Particularly the US.

The hopium in Chengdu was real last night. Can’t wait to see how all this shakes out over the course of the next 6–12 months#bitcoin mining pic.twitter.com/vl25YaWKXo

— Kevin Zhang (@SinoCrypto) June 19, 2021

If you squint hard enough at the above picture, you'll see that there appears to be ~10 gigawatts worth of capacity in the US available by the end of 2022. I'd be very surprised to find this to be the case. On top of this, as I articulate in the thread above, it is imperative that the market takes the political risk of mining on-grid more seriously moving forward. There seem to be many factors driving this decision from the CCP. One of these factors being that as China's grid systems become more mature and interconnected, miners are increasingly competing with consumer electricity use. Push has come to shove and the CCP has decided it doesn't want this type of competition on its grids at the scale miners have achieved.

Many are speculating that many of Chinese miners are going to find homes across the US, particularly Texas. I would caution those in the North American mining industry to be wary of the political risks that will come with this amount of hashrate flooding the grids at once. Particularly in Texas, where ERCOT is currently asking individuals to curb their electricity use due to the inability of the grid to meet peak demand as Summer heats up. It seems a bit wishful to think the Texas grid can take on this type of mining load without any political backlash unless ERCOT gets its shit together in relatively quick order. I hope I'm wrong. I love all my Texas Bitcoin mining brothers and sisters, but this potential conflict seems very obvious at the moment.

With that in mind, I think the great migration is going to take longer than many expect at the moment and there will be bumps along the way. There are too many unknowns at play at the moment and the Chinese and Western mining markets are still feeling each other out. On top of this, a lot of the promised capacity still needs to be built out, which takes a considerable amount of time.

As a result, I believe we can expect a glut of ASICs on the market at some point over the next 18-months that should drive prices lower.

Regardless of whether I'm right or wrong here, I feel for the Chinese miners who have been forced into this scramble mode. The Chinese mining community has been arguably the most ruthlessly competitive facet of the Bitcoin network throughout its first twelve and a half years of existence. It's a real shame all of their hard work is being blown up with the stroke of a pen.

We'll keep you freaks updated as this situation unfolds.

Final thought...

It's a two shower type of day.