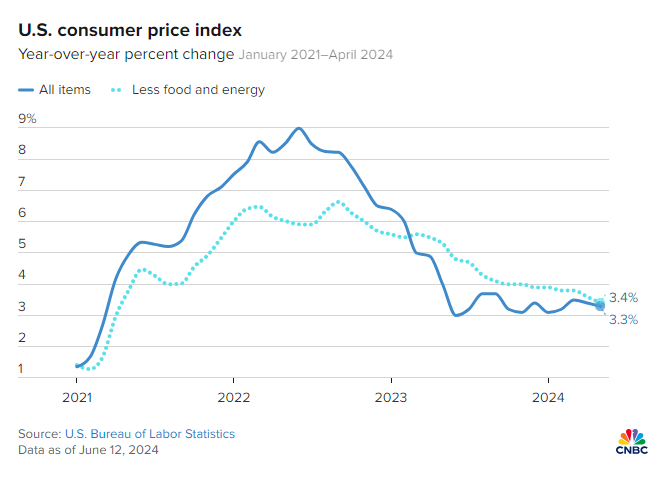

The latest Consumer Price Index data shows a 3.3% year-over-year rise in consumer prices for May, indicating a slight slowdown in inflation.

The Consumer Price Index (CPI) data for May, as reported by CNBC, indicates a slowing in inflation with consumer prices increasing by 3.3% from a year ago, which was 0.1 percentage point below market expectations. The month-over-month CPI was flat at zero percent, suggesting a halt in price increases. Core CPI, which excludes volatile food and energy prices and is closely watched by the Federal Reserve, increased by 0.2% for the month and 3.4% year-over-year, also below the expected 0.3% and 3.5%, respectively.

The lower-than-anticipated inflation figures have led to a positive response in the stock market, particularly the Nasdaq, as investors anticipate the possibility of the Federal Reserve reducing interest rates. Energy prices, which dropped by 2%, played a significant role in the subdued inflation report. Housing inflation remains stubbornly high but is decreasing slowly. According to Mark Zandi, the chief economist at Moody's, the report supports the disinflationary narrative that inflation is nearing containment.

The Biden administration's efforts to lower gas prices, which directly influence public perception of the economy, may provide the Federal Reserve with more leeway to adjust rates. The report reflects a trend of decreasing price increases rather than a decline in absolute price levels compared to 2019. Disinflation is evident, although prices for some services, such as handyman costs, have risen sharply in recent years.

The CPI's breakdown reveals that while the overall year-over-year rate is 3.3%, individual categories exhibit higher rates, suggesting a complex calculation process for the index. The recent decrease in gasoline prices, despite the upcoming driving season, raises questions about aggregate demand and its potential implications for the economy and the Federal Reserve's policy response.

The unchanged month-over-month CPI reading and the slight annual increase in core CPI, alongside the persistent housing costs, indicate a complex environment for monetary policy adjustments.

Bond yields have responded to the CPI data with a significant decrease, while gold and Bitcoin prices have increased, reflecting market sentiment. The Nasdaq's performance, reaching 52-week highs, underscores the connection between inflation expectations and risk asset valuations.